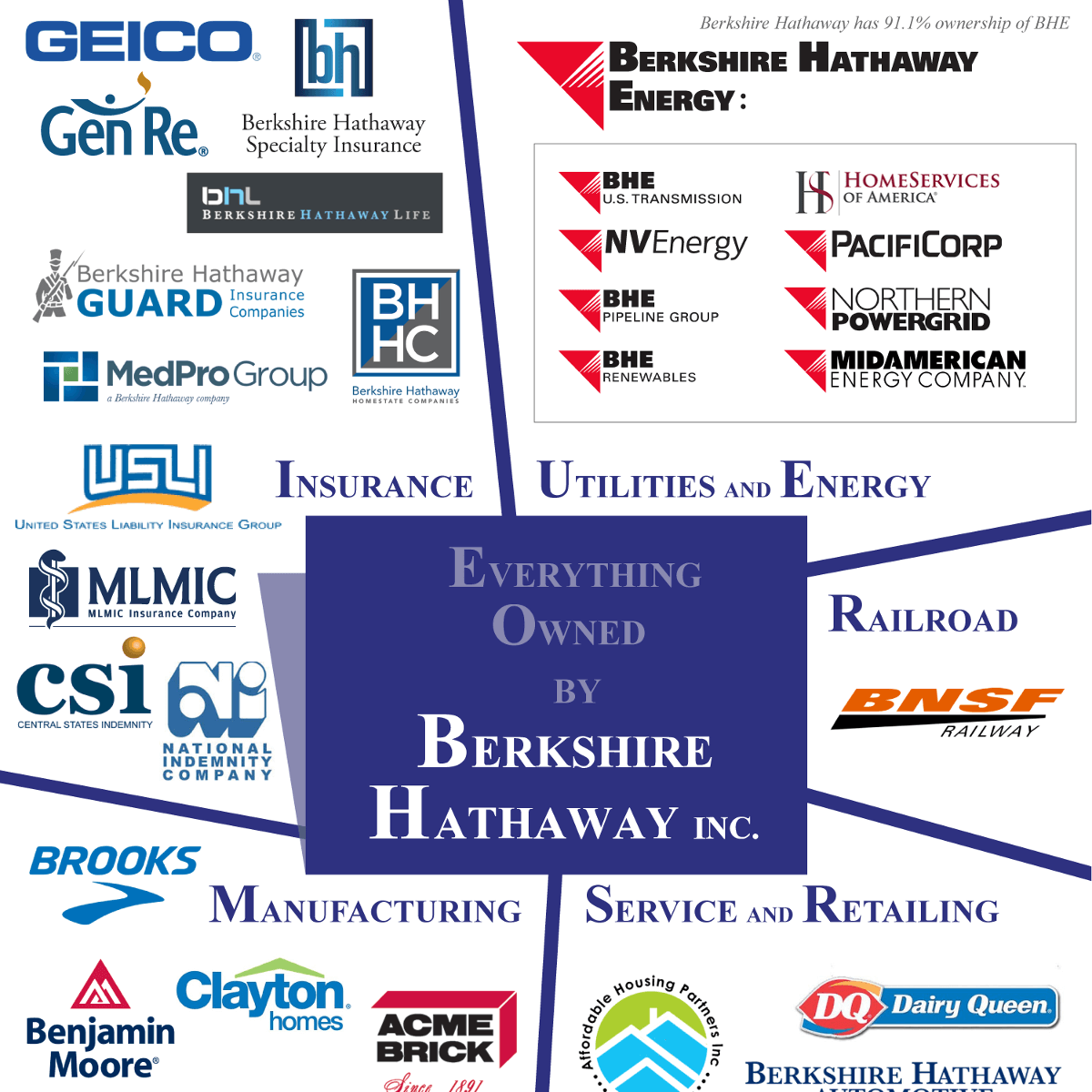

You probably know the gecko. That green, slightly posh lizard has been on your TV screen for decades, cracking jokes about 15 minutes and 15 percent. It’s iconic. But beneath the CGI and the clever marketing scripts lies the actual engine of the Berkshire Hathaway empire. When people talk about a company owned by Berkshire Hathaway, they usually mention Dairy Queen or maybe Fruit of the Loom. GEICO is different. It is the cornerstone.

Warren Buffett didn't just buy a car insurance company because he liked the ads. Honestly, the ads weren't even that good back in the 1950s when he first took a train down to Washington, D.C., to see what the fuss was about. He bought it because of "float."

Float is basically free money. Well, not free, but it's money that belongs to someone else—the policyholders—that GEICO gets to hold onto and invest until a claim needs to be paid. For a guy like Buffett, having billions of dollars in float is like having a superpower. It’s the secret sauce that allowed Berkshire to grow from a dying textile mill into a global behemoth.

Why GEICO Isn’t Just Another Insurance Firm

Most insurance companies are boring. They have agents in suits, mahogany desks, and high overhead. GEICO—the Government Employees Insurance Company—was born differently. It was founded in 1936 by Leo and Lillian Goodwin during the height of the Great Depression. That’s a gutsy time to start a business.

The Goodwins had a simple, almost radical idea: sell directly to the customer. By cutting out the middleman (the agents), they could offer lower prices. They initially targeted government employees and military officers because, frankly, those people were statistically less likely to get into car wrecks. They were "safe bets."

✨ Don't miss: US Mortgage Rate Today: Why They Just Dipped Below 6%

Fast forward to today, and that direct-to-consumer model is the industry standard. But GEICO did it first. Being a company owned by Berkshire Hathaway means GEICO doesn't have to worry about quarterly earnings calls with impatient Wall Street analysts. They can play the long game.

If GEICO needs to spend $2 billion on advertising this year to grab market share, they do it. If they need to take a hit on underwriting profits to keep their prices lower than Progressive’s, they can. That's the Berkshire advantage. It’s about being the low-cost provider, period.

The 1976 Near-Death Experience

People forget GEICO almost went bankrupt. In the mid-70s, the company lost its way. They expanded too fast, mispriced their risk, and were staring down the barrel of insolvency. The stock price plummeted from $61 to around $2.

This is where the lore of the company owned by Berkshire Hathaway really starts. Buffett didn't just see a failing company; he saw a brand with a massive competitive moat that had been temporarily mismanaged. He backed the truck up. He started buying shares when everyone else was running for the exits. He even met with Jack Byrne, the man brought in to save the company, and reportedly decided within minutes that Byrne was the right guy for the job.

By 1996, Berkshire bought the remaining 49% of GEICO that it didn't already own for $2.3 billion. Today, that investment is worth many, many times that amount.

The Brutal Reality of the Insurance Wars

It’s not all sunshine and lizards. The insurance business is a street fight. You’ve got Progressive, State Farm, and Allstate all throwing billions of dollars at the same problem: how to get you to switch.

🔗 Read more: Finding What Trade Is Right for Me Without Wasting Three Years

Progressive is actually the one GEICO looks at most nervously. Why? Because Progressive was faster to adopt "telematics"—those little plug-in devices or apps that track how hard you slam on your brakes. GEICO was a bit slow to the party on that one. They’ve been playing catch-up on data analytics for the last few years.

- The Loss Ratio: This is the percentage of premiums paid out in claims. If GEICO collects $100 and pays out $70 in repairs, the loss ratio is 70%.

- The Expense Ratio: This is what it costs to run the business (the gecko's salary, the office rent, the tech).

- Combined Ratio: Add those two together. If it's under 100%, they are making an "underwriting profit."

Lately, the combined ratio for almost every company owned by Berkshire Hathaway in the insurance space has been under pressure. Car parts are more expensive. Labor costs are up. Even the "fender benders" now involve replacing $3,000 sensors in a bumper. It’s a tough business to be in right now, but GEICO’s massive scale allows it to absorb shocks that would crush a smaller regional player.

Does Berkshire Actually "Run" GEICO?

Kinda, but not really. One of the most misunderstood things about any company owned by Berkshire Hathaway is how much control Omaha actually has. Buffett and his successors—like Greg Abel and Ajit Jain—don't tell GEICO what color to paint their offices or which TV spots to buy.

They practice radical decentralization. They hire the CEO, set the compensation, and then get out of the way. Todd Combs, who is one of Buffett’s investment managers, took the reins as CEO of GEICO a few years back. His job isn't to be an insurance guy; it's to be a "capital allocator." He’s there to make sure the tech stack is modernized and the float is being generated efficiently.

What Most People Miss About the "Berkshire System"

If you look at the 2024 or 2025 Berkshire shareholder letters, you'll see a recurring theme. The insurance operations are the heartbeat. Without GEICO, there is no BNSF Railway. Without the insurance float, Berkshire doesn't have the cash to buy huge stakes in Apple or Coca-Cola.

GEICO is basically a giant sponge that soaks up cash from millions of drivers every month. Berkshire then takes that sponge and squeezes it into other investments. It’s a virtuous cycle.

But there is a risk. If GEICO loses its price advantage, the sponge starts to dry up. If self-driving cars actually become a thing and accidents drop by 90%, the entire car insurance industry shrinks. Buffett has admitted this. He’s not blind to the fact that Tesla or Waymo could eventually disrupt his favorite business. But he’s also betting that human beings will keep bumping into things for a long time.

Actionable Insights for the Average Person

Understanding how a company owned by Berkshire Hathaway operates isn't just for investors. It tells you a lot about how the economy actually works. Here is what you should actually do with this information:

- Check your "Loyalty Tax": GEICO is a low-cost leader, but they aren't always the cheapest for everyone. Because they use direct marketing, they spend a lot to get you in the door. If you’ve been with them (or anyone) for five years, your rate has likely crept up. Shop around every 24 months.

- Look for the "Moat": When you’re looking at a business—whether to work there or invest—ask if it has a GEICO-style advantage. Is it the low-cost producer? Does it have a brand that people trust even if they don't love the product?

- Watch the Telematics Trend: If you’re a safe driver, opt into the tracking apps. GEICO and its competitors are increasingly using this data to punish bad drivers and reward good ones. If you don't use it, you might be subsidizing the person who texts while driving.

- Understand the Float: If you run a small business, look for ways to get paid upfront. Subscription models, retainers, and deposits all create a version of "float" that you can use to grow your business without taking on bank debt.

GEICO isn't just a gecko. It's a massive, data-driven, cash-generating machine that has survived depressions, inflation, and management crises. It remains the most important company owned by Berkshire Hathaway because it provides the fuel for everything else the Oracle of Omaha does.

The next time you see that lizard on TV, don't just think about the 15% you might save. Think about the billions of dollars flowing through Omaha, Nebraska, because a couple in 1936 decided that government employees were a safe bet for a car insurance policy.