Markets are messy. Honestly, if you looked at your screen this morning, you probably saw a sea of red and thought the gold and silver rally was finally over. It's not.

Basically, what we’re seeing right now is a classic "breather" in a market that has been running a sprint for twelve months straight. People get spooked when they see gold and silver prices per ounce today dip even slightly, but the reality is much more nuanced than a simple "buy" or "sell" signal.

The numbers you actually came for

Let's get the raw data out of the way first. As of Thursday, January 15, 2026, the spot price for gold is hovering around $4,612 per ounce. That’s down about $15 to $20 from yesterday’s highs, depending on which exchange you're tracking.

Silver is a different beast entirely. It’s sitting near $91.10 per ounce today. It took a harder hit than gold, dropping nearly 2% in the last 24 hours.

You’ve got to remember that silver gained something like 148% in 2025. A two-dollar drop on a Thursday morning in January 2026 isn't a crash; it's a rounding error for the big institutional desks.

Why everything feels so volatile right now

You’ve probably heard the talking heads on financial news blaming "profit-taking." While that's partially true—traders love to lock in gains after a massive run—the real story is deeper.

There is an unprecedented crisis of confidence happening at the Federal Reserve. Earlier this week, news broke about a criminal investigation into Chair Jerome Powell's independence. That sent gold into a "price discovery" phase where nobody really knows where the ceiling is.

Wait, what does that mean?

Basically, when a market hits an all-time high, there are no historical "resistance" levels. We are in uncharted territory. Analysts like Prithviraj Kothari at RiddiSiddhi Bullions are watching $4,750 as the next big hurdle for gold. If we break that, $5,000 is the psychological magnet everyone is talking about.

🔗 Read more: 45 Euro to USD: Why Your Exchange Rate Isn't What You See Online

Silver is the real wild card

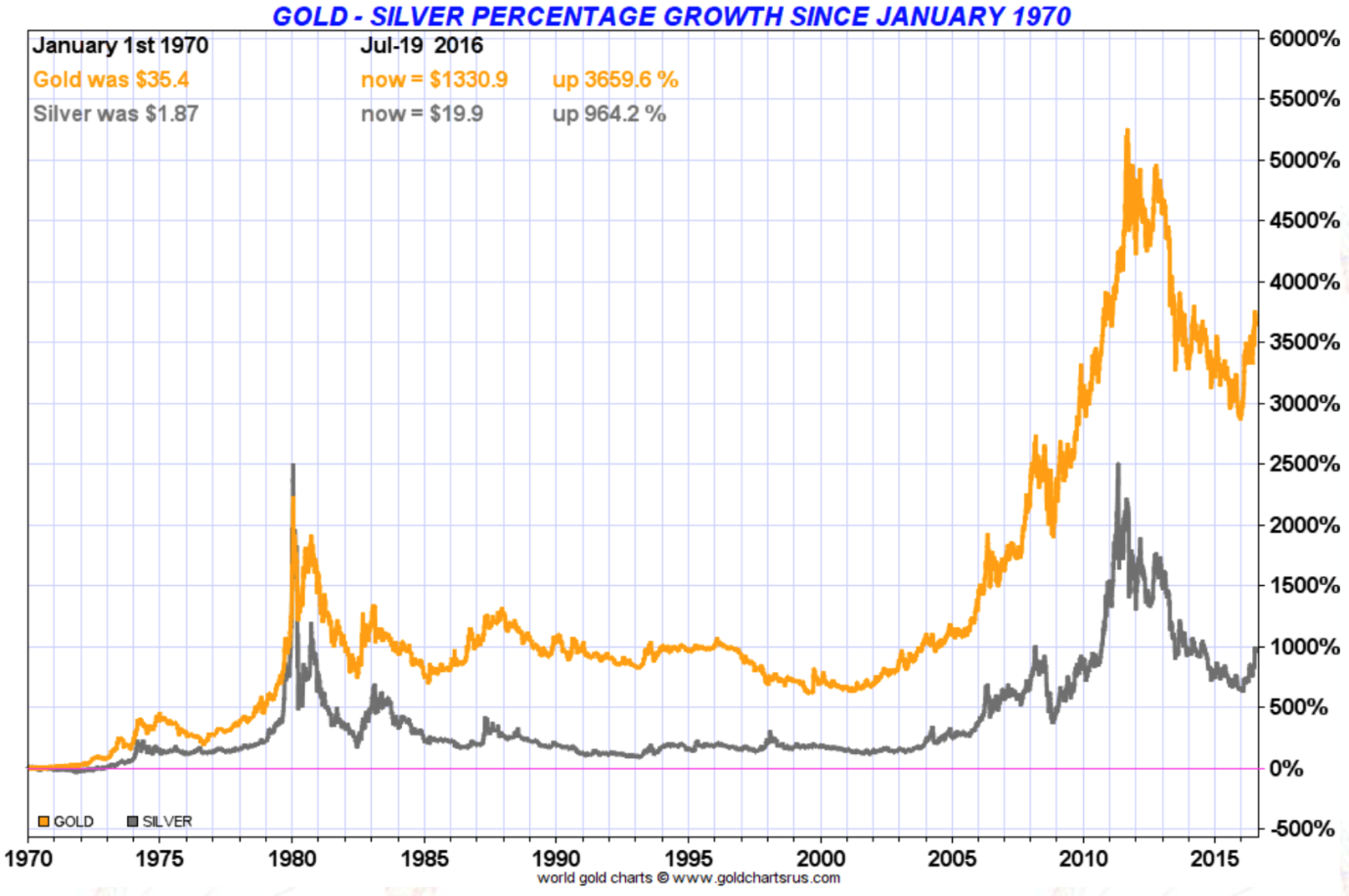

Silver is doing things it hasn't done since the late 70s. The gold-to-silver ratio—a metric nerds like me obsess over—has collapsed from over 100:1 last year to around 57:1 today.

Silver is outperforming gold by a massive margin.

Why? It’s the "Green Squeeze." China just limited exports of refined silver, claiming national security interests. Considering they control about 65% of the global trade, that's like a cardiac arrest for the solar panel and EV battery supply chains. Elon Musk even hopped on X to complain about it, which usually adds a few dollars to the price just by itself.

The "Everything Bubble" vs. The Productivity Pivot

There’s a really interesting argument floating around the trading floors right now. Some guys, like Akshat Shrivastava, are suggesting that gold and silver might have actually peaked.

I know, I know. It sounds crazy when gold is at $4,600.

💡 You might also like: Inox Wind Limited Share Price: Why Everyone is Watching This Stock in 2026

But his logic is that if the massive spending on AI infrastructure finally starts showing real-world productivity gains, it could be deflationary. If things get cheaper because robots and software are doing the heavy lifting, the "inflation hedge" argument for gold starts to look a bit shaky.

I'm not saying I agree, but it's a viewpoint you won't hear from the "gold bugs" who think $10,000 is a guarantee.

What should you actually do?

If you're holding physical metal, don't panic-sell because of a 1% dip. These markets are driven by debt and geopolitics. With US debt levels where they are in 2026, the fundamental reason to own "real" assets hasn't changed.

Watch the $4,580 level for gold.

📖 Related: Koninklijke Philips Electronics Stock: Why Most Investors Are Looking at the Wrong Numbers

If we close below that for two days straight, we might see a deeper correction down to the $4,300 range. For silver, as long as it stays above $88, the path to $100 looks incredibly clear for the first quarter of the year.

Next steps for you:

Check the "bid-ask spread" at your local coin shop before buying more today. With this much volatility, some dealers are jacking up premiums to 10% or 15% above spot. If you can't get silver for less than $5 over spot, you're probably better off waiting for the mid-month settlement period when things usually calm down. Focus on tracking the 50-day moving average rather than the minute-by-minute charts if you want to keep your sanity.