You'd think that with billions of barrels of oil pumping out of the Atlantic, the Guyanese currency would be skyrocketing. But if you’re trying to swap guyana dollar to american dollar right now, you’ve likely noticed a weird gap between what Google tells you and what the guy at the cambio is actually charging. It's frustrating. Honestly, it's kinda confusing too.

The official numbers look stable, but the "street" reality is a whole different beast.

📖 Related: How the Kia Plant West Point Ga Actually Changed the South

The Numbers Game: What 1 USD Gets You

Right now, the Bank of Guyana has the official "mid-rate" sitting around $208.50 GYD to $1 USD. If you look at the big commercial banks like Republic Bank or GBTI, they usually "sell" US dollars to you at about $210.45 and "buy" them from you at $207.98.

But here's the kicker.

Try walking into a bank in Georgetown and asking for $5,000 USD. You’ll probably be met with a polite "we're out" or told to wait two weeks. Because of this "scarcity," the actual rate most people pay at private cambios or for business transactions often hits **$215, $220, or even $230**.

Why the gap? Basically, Guyana’s economy is growing at a record-breaking 20% to 30% per year, but most of that wealth is tied up in oil infrastructure. The average person still needs greenbacks to buy imported cars, electronics, or to travel. The demand is just way higher than the supply of actual physical cash in the vaults.

Why the Guyana Dollar Isn't "Winning" Yet

You’ve seen the headlines. Guyana is the fastest-growing economy in the world. So why isn't the Guyana dollar getting stronger against the American dollar?

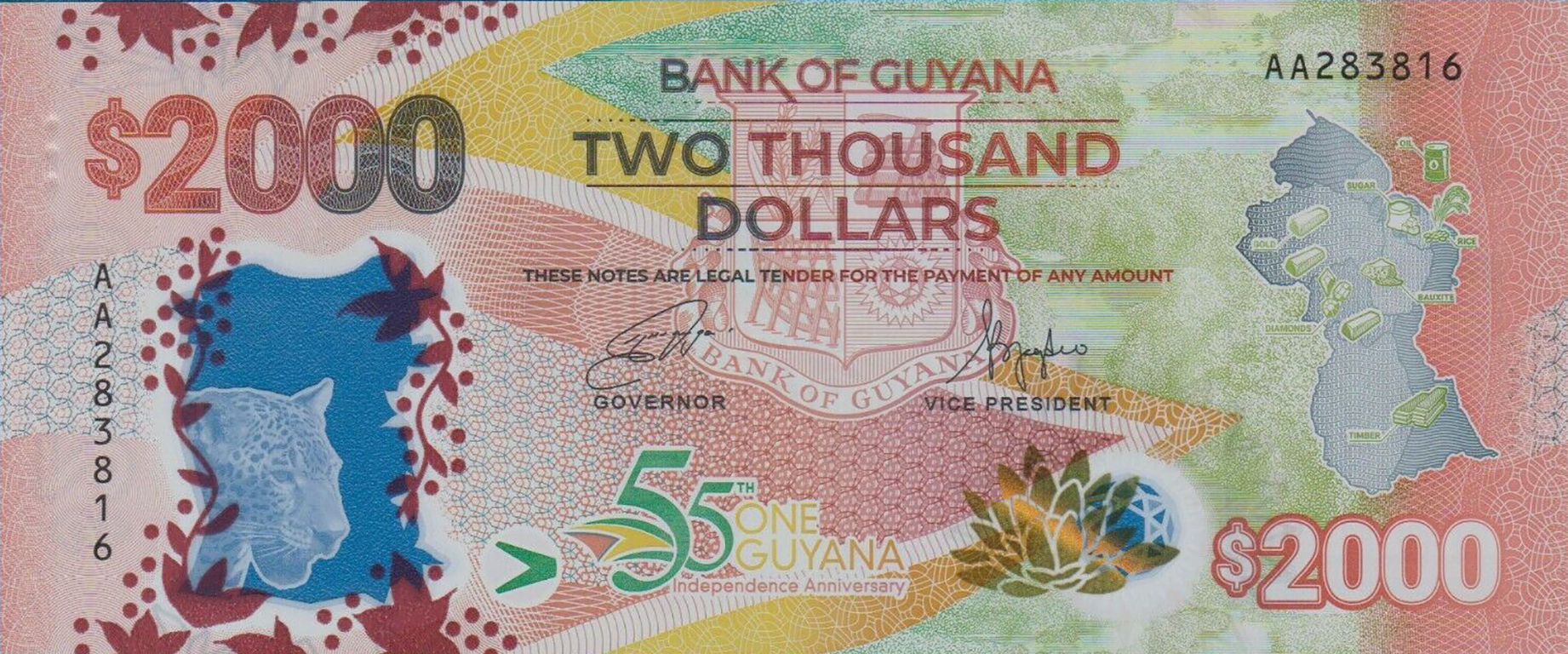

- The Dutch Disease Worry: If the GYD gets too strong, it kills other exports like sugar, rice, and gold. The government actually works hard to keep the rate stable (around 208-210) so local farmers don't get priced out of the global market.

- Import Dependency: Guyana imports almost everything. From the iPhone in your pocket to the flour in your roti, it’s all paid for in US dollars. Every time a Guyanese business buys stock from abroad, they dump GYD and hunt for USD, keeping the pressure on.

- The 2026 Oil Factor: We’re currently seeing production from fields like Liza 1, Liza 2, Payara, and Yellowtail. While the revenue is massive—projected to exceed $5 billion—a lot of it goes straight into the Natural Resource Fund (NRF). It’s not just sitting in a local bank account ready to be swapped.

Getting Your Money’s Worth: Real World Tips

If you're a traveler or a business owner, you've gotta be smart about how you handle the guyana dollar to american dollar swap. Don't just settle for the first rate you see.

Skip the Airport Cambios

Seriously. The rates at Cheddi Jagan International (CJIA) are notoriously bad. You’ll lose significantly more on the spread there than you would at a cambio in the city center.

The "Cash is King" Rule

In Guyana, physical USD cash is a hot commodity. If you have crisp, new $100 bills (the "blue" ones), you can often negotiate a better rate at private cambios. Avoid old, torn, or marked bills—many places simply won't take them or will charge you a "penalty" rate.

Use Your Card, But Be Careful

Using a US-issued Visa or Mastercard at a Guyanese supermarket usually gets you a decent rate, often close to the official 208:1. However, check your bank's foreign transaction fees. If your bank charges 3%, you’ve just wiped out any gain you made on the exchange rate.

The 2026 Outlook

Things are shifting. President Irfaan Ali recently announced that the Central Bank will no longer be "passive." This means more intervention to stop "speculation" by banks. If you're holding a lot of Guyana dollars, keep an eye on the new rules for oil companies. Starting late last year, many are now required to keep local bank accounts for their foreign earnings, which should—in theory—put more US dollars back into the local system.

But for now? Expect the squeeze to continue.

The gap between the "official" $208 and the "street" $218 is the price of doing business in a boomtown.

👉 See also: The Truth About the $5,000 Tax Credit 2025: What You Actually Need to Know

Actionable Steps for Exchange

- Check the Bank of Guyana Daily: Use their website to find the baseline so you know when a private cambio is ripping you off.

- Request a "Business Rate": If you are exchanging more than $2,000 USD, don't accept the posted rate. Ask for the manager and see if they can shave a few points off.

- Keep Small Change: If you're visiting, carry small USD bills ($1, $5, $10). Most local shops in Georgetown will accept them at a flat rate of $200 GYD to $1 USD for convenience, which is easy math and usually fair for small buys.

- Monitor the NRF Withdrawals: Every time the government makes a large withdrawal from the Natural Resource Fund to pay for the national budget, it injects liquidity into the market. That's usually the best time to find USD at the banks.

The reality of the guyana dollar to american dollar exchange is that it's a managed system. It’s not a free-floating market like the Euro or the Yen. Understanding that the government wants it to stay right where it is—around 210—is the first step to managing your money effectively in the land of many waters.