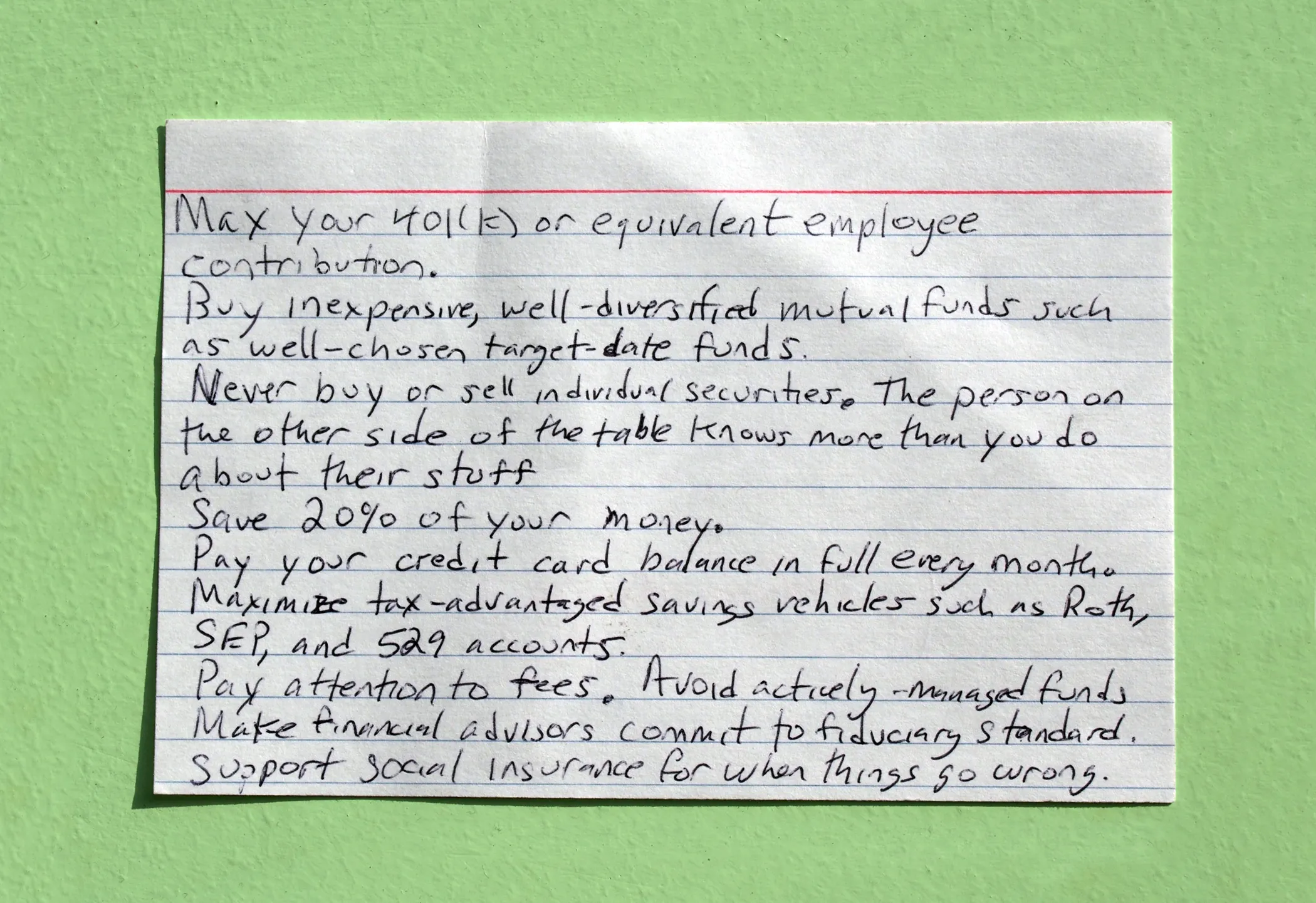

Back in 2013, Harold Pollack, a University of Chicago professor, made a bold claim during an interview. He said the only financial advice most people ever need could fit on a simple 4x6 index card. Then, he actually did it. He grabbed a card from his daughter's backpack, scribbled nine rules in blue ink, and posted a photo online. It went viral because it was the antithesis of the jargon-heavy, commission-driven nonsense usually pushed by "wealth gurus."

Honestly, the Harold Pollack index card is still the best BS-detector for your wallet in 2026.

What's actually on the card?

The original handwritten card was messy. It wasn't some polished marketing graphic. It was just a professor telling the truth. While he later co-authored a book with Helaine Olen called The Index Card to expand on these points, the core rules remained the same.

📖 Related: Adjustable Queen Size Bed: Why Most People Choose the Wrong One

Basically, it boils down to this:

- Max out your 401(k) or whatever employee contribution your job offers.

- Buy inexpensive, well-diversified mutual funds (like Vanguard Target 20xx funds).

- Never buy or sell individual securities. Seriously. The person on the other side of the table is almost certainly smarter than you are.

- Save 20% of your money. This is the big one that most people struggle with.

- Pay your credit card balance in full every month.

- Maximize tax-advantaged accounts like Roth IRAs, SEPs, and 529s for the kids.

- Watch those fees. Avoid actively managed funds like the plague.

- Make financial advisors commit to the fiduciary standard. If they won't sign a paper saying they'll put your interests first, walk away.

- Support the social safety net. Pollack added this because he believes we’re all one medical crisis away from needing help.

Why you should stop trying to beat the market

The most polarizing rule on the Harold Pollack index card is the ban on individual stocks. Everyone wants to be the genius who bought NVIDIA at $10 or Bitcoin at $1,000. It’s human nature to want to "win." But Pollack’s point is that the market is filled with professionals with PhDs and supercomputers. When you buy a single stock, you're betting against them.

You'll lose.

Maybe not today, but eventually. By sticking to index funds, you're basically saying, "I'll take the average growth of the whole economy." Over thirty years, that "average" is actually a massive win compared to the 90% of active traders who underperform the S&P 500. It's boring. It's unsexy. It works.

The 20% savings rule is a gut punch

Let’s be real. Saving 20% of your pretax income feels impossible for most of us. In the book version, Pollack and Olen loosened up a bit, suggesting a range of 10% to 20%. The goal isn't to hit 20% on day one; it's to build the habit.

You've gotta track your spending.

Most people have no clue where their money goes. They think it's the $5 latte, but it's usually the $800 car payment or the subscription services they haven't used since 2022. Pollack suggests tracking every single cent for three months. It’s painful. It’s annoying. But it’s the only way to see the "leakage" in your budget. Once you see it, you can't unsee it.

The Fiduciary Standard: The question they don't want you to ask

If you decide to hire a financial advisor, you need to ask one specific question: "Are you a fiduciary at all times?"

Most "advisors" are actually salespeople. They get commissions for putting you in expensive mutual funds that pay them a kickback. A fiduciary is legally required to put your interests ahead of their own. If they say "I follow a suitability standard," that's code for "I can sell you a crappy product as long as it isn't a total disaster."

Don't settle for "suitable."

Why the card still matters in 2026

The world has changed. We have AI-driven trading apps and a million "fin-fluencers" on TikTok telling you to buy weird crypto coins. The Harold Pollack index card is a stabilizer. It reminds you that the math of wealth hasn't actually changed in a hundred years.

Spend less than you earn.

Invest in the whole market.

Avoid high interest.

Don't pay for "magic" advice.

It’s not a get-rich-quick scheme. It’s a don’t-be-poor-later scheme.

Actionable Next Steps

If you want to implement the Pollack method today, do these three things:

- Check your 401(k) or 403(b). Are you contributing enough to get the full employer match? If not, you're literally turning down a 100% return on your money. Fix that before you finish your lunch.

- Audit your fees. Look at your investment accounts. If you see "expense ratios" higher than 0.20%, you're probably paying too much. Look for low-cost index funds or Target Date funds.

- The Fiduciary Test. If you have a money guy, call him. Ask if he's a fiduciary. If he stammers or gives a long-winded explanation that doesn't start with "Yes," start looking for a new advisor.

The beauty of the index card isn't that it's "easy"—it's that it's simple. Living it is the hard part, but at least now you have the map.

Practical Insight: Start by automating just 1% more of your income into savings this month. You won't feel the difference in your daily life, but your future self will thank you. Then, do it again in six months. Slow and steady is the only way this card actually works.