You’ve probably heard the horror stories. A friend of a friend moves to the suburbs of New Jersey or a leafy street in Illinois, only to find out their monthly tax bill is basically a second mortgage. It’s a gut-punch.

Honestly, when we talk about the highest property tax in usa, most people just look at a percentage and panic. But that's not the whole story. If you’re looking at a 2.3% rate in a town where houses cost $200,000, you’re often paying way less than a 0.5% rate in a Silicon Valley zip code where the "starter homes" are $3 million.

🔗 Read more: Chariot Mining Stock Symbol: What Most People Get Wrong

Context matters. Numbers lie if you don't know how to read them.

The Usual Suspects: Why New Jersey and Illinois Lead the Pack

New Jersey is consistently the heavyweight champion of this list. It’s almost impressive how they keep the title year after year. For 2025 and heading into 2026, the average property tax bill in the Garden State officially cleared the $10,000 mark for the first time. That’s an average. In places like Millburn or Tenafly, you’re looking at $20,000 or $30,000 easily.

Why? Because New Jersey loves local control.

Every tiny town has its own police department, its own school district, its own fleet of snowplows. It’s inefficient as hell, but residents generally fight to keep their local identity. You pay for that.

Then there’s Illinois. Specifically, the "collar counties" around Chicago. Illinois has more units of local government—nearly 7,000—than any other state in the country. From mosquito abatement districts to forest preserves, everyone wants a slice of your home value. In 2026, projections show gross property tax levies in states like Wisconsin and Illinois rising because school districts are hitting a wall with state aid.

The Breakdown by State (2025-2026 Estimates)

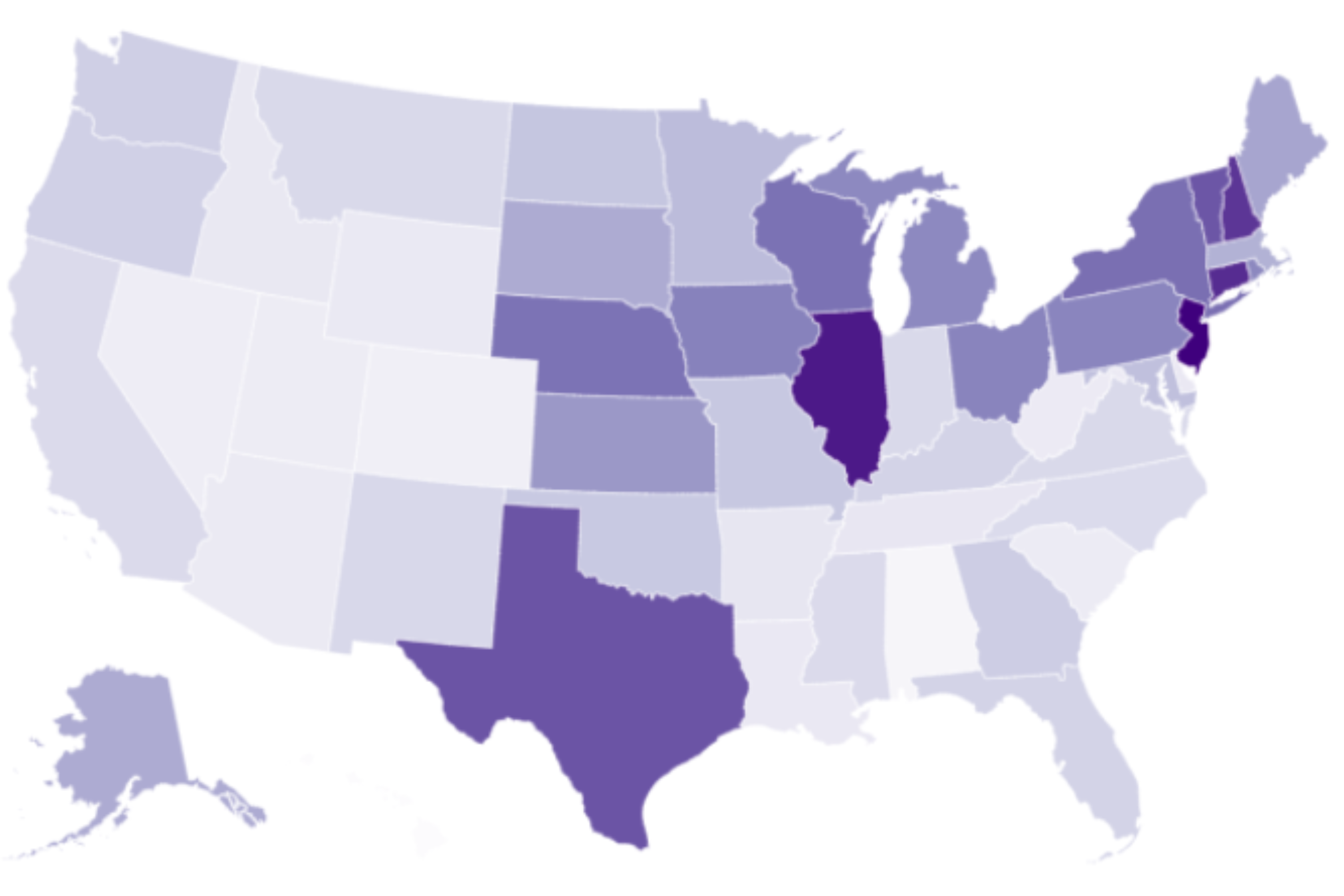

If we look at effective tax rates—which is basically the tax paid divided by the home value—the rankings usually shake out like this:

- New Jersey: Roughly 2.23%. High home values + high rates = a very empty wallet.

- Illinois: Around 2.08%. In some counties like Kendall or DeKalb, it’s even higher.

- Connecticut: Sitting at 1.79%. It's the price of being in the "commuter belt."

- New Hampshire: 1.61%. This one is tricky. They have no sales or income tax, so the property tax has to do all the heavy lifting for the state budget.

- Vermont: Approximately 1.56%. Beautiful leaves, expensive dirt.

The County-Level Shockers

Sometimes the state average masks the real "tax hells." According to recent 2025 data analysis from Construction Coverage and the U.S. Census Bureau, Salem County in New Jersey and Monroe County in New York are absolute outliers, with effective rates often north of 2.3%.

In Monroe County (think Rochester, NY), the rates are high because home values haven't kept pace with the cost of public services. When the denominator (home value) stays low but the numerator (the city budget) goes up, that percentage gets scary fast.

Then you have Detroit.

Detroit technically has one of the highest effective property tax rates in the entire country—over 3% for some homesteads. But because a home might only be worth $60,000, the actual dollar amount is lower than a condo in Manhattan. This is the paradox of the highest property tax in usa. High rates don't always mean high bills, but they definitely hurt your ability to build equity.

What Most People Get Wrong About "Tax Free" States

Texas is the classic example here. Everyone wants to move to Texas because there’s no state income tax. "It's a bargain!" they say.

Until they get the tax bill.

Texas has some of the highest property tax rates in the country, often hovering around 1.6% to 1.8% depending on the school district and MUD (Municipal Utility District) taxes. If you buy a $500,000 home in a trendy Austin suburb, you might be paying $10,000 a year in taxes.

The government is going to get its money. It just chooses which pocket to pick. In Texas, they pick your "home" pocket. In California, they have Prop 13, which keeps property taxes low (roughly 0.7% to 0.8% effective), but they make up for it with some of the highest income tax brackets in the nation.

Can You Actually Fight This?

You aren't totally helpless. Most people just pay the bill and grumble, but the assessment—the value the city thinks your home is worth—isn't set in stone.

- Check your record card. Go to the assessor's office. You’d be surprised how many houses are listed as having a finished basement or four bedrooms when they really have three and a crawlspace.

- The "Comparable" Hunt. If your neighbor's identical house is assessed at $50,000 less than yours, you have a case.

- Deadlines. In New Jersey, the appeal deadline is typically April 1st. Miss it, and you're stuck for the year.

- Exemptions. Are you a senior? A veteran? Did you do a historical renovation? Many states have "homestead" exemptions that knock a few hundred (or thousand) off the bill, but you usually have to apply for them manually. They won't just give it to you.

The 2026 Outlook: Why Rates are Rising

We are seeing a trend in 2026 where school districts are losing the "COVID-era" federal funding that propped up their budgets for a few years. To keep the lights on and teachers paid, they are turning to the local levy.

In Wisconsin, for example, gross K-12 school property taxes are projected to jump by about 7.8% for the 2026 cycle. That’s the biggest spike since the early 90s. Even if your state legislature says they want "tax relief," the local school board usually has the final word on your bill.

Actionable Next Steps for Homeowners

- Audit your escrow: If your taxes went up, your mortgage company might not have adjusted your monthly payment yet. This leads to a "shortage" and a massive, painful bill at the end of the year. Call them and ask for a projection.

- Request your Property Card: Look for factual errors in your home’s description. It’s the easiest way to win an appeal.

- Research the "Mill Rate": Before moving, don't just look at the current tax bill. Look at the town's mill rate history. If it’s been climbing 5% every year for a decade, expect that trend to continue.

- Stay NJ & Senior Freeze: If you live in a high-tax state like NJ, check for programs like "Stay NJ" or the "Senior Freeze" which were expanded in the 2025-2026 budget cycles to help offset these record-breaking costs.