Let’s be honest. Nobody actually wants to spend their Saturday morning on hold with an insurance giant. You probably found a better rate with Progressive or State Farm, or maybe you sold your car and just don't need the coverage anymore. Whatever the reason, figuring out how do i cancel geico policy shouldn't feel like a legal deposition. It’s actually pretty straightforward, though Geico makes you jump through a few more hoops than some of the newer "insurtech" companies that let you quit with a single tap on an app.

Insurance companies hate losing customers. It's called "churn" in the industry, and they fight it tooth and nail. Because of that, Geico hasn't exactly made it a one-click process to walk away. You can’t just ghost them. If you stop paying your premiums without officially canceling, they’ll eventually terminate your policy for non-payment, which sounds fine until you realize it absolutely trashes your insurance score and makes your future premiums skyrocket. Don't do that.

The Phone Call You Can’t Really Avoid

Despite what some outdated blogs might tell you, you generally can’t cancel a Geico auto policy via their mobile app or by sending a DM on X (formerly Twitter). They want you on the phone. Why? Because their agents are trained in "retention." They want to offer you a discount or a "re-rate" the second you say you're leaving.

💡 You might also like: Why the Power of Social Media Marketing is Actually Getting Harder (and Better)

To get it done, you need to call (800) 841-1589.

Prepare yourself. You’ll talk to an automated system first. Just keep saying "cancel policy" until a human picks up. Once you get a representative, stay firm. You don't owe them an explanation, though they will definitely ask for one. If you’ve already signed with another carrier, just tell them that. It stops the sales pitch in its tracks because, legally, they can't really argue with a policy that's already in force elsewhere.

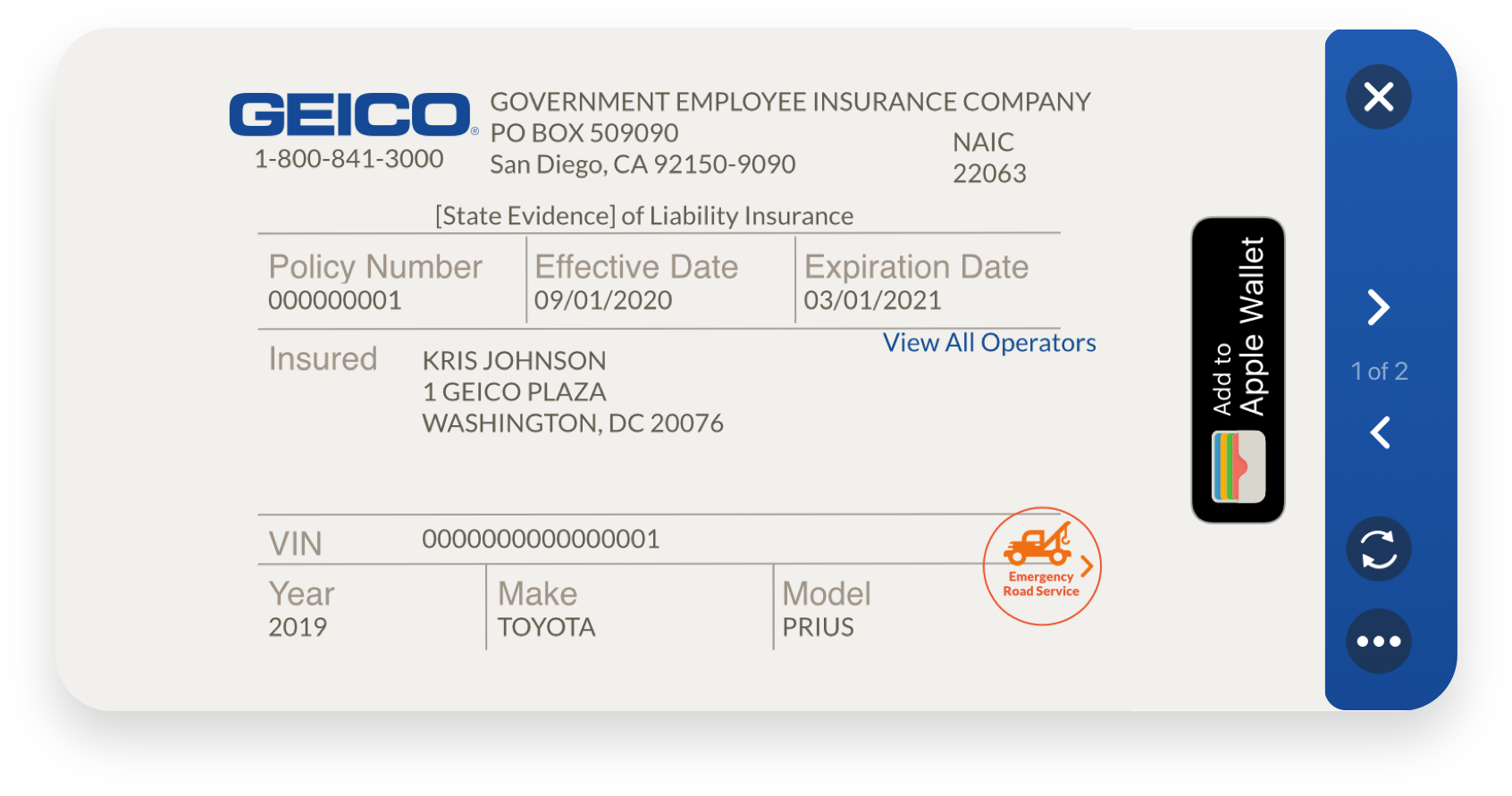

Make sure you have your policy number ready. It's on your digital ID card in the app. Also, have the specific date you want the coverage to end. If you sold your car on Tuesday, don't pay for Wednesday.

What About Mailing a Letter?

Yes, you can technically do this, but it’s slow. If you’re a fan of the old-school way, you can mail a written notice to their headquarters or a regional office. You’ll need to include your name, policy number, the date you want it to end, and your signature. Honestly, it's a hassle. Unless you’re dealing with a complex estate issue or a legal dispute where you need a paper trail via certified mail, just use the phone. It’s faster.

Timing Is Everything: The "Gap" Trap

Here is the thing most people mess up. If you are switching carriers, do not cancel your Geico policy until your new policy is active. Even a 24-hour lapse in coverage is a massive red flag for insurance algorithms. In the eyes of the industry, a lapse makes you "high risk." If you have a one-day gap today, your rates five years from now could still be higher because of it. It sounds ridiculous, but that’s how the data models at places like LexisNexis—which feeds info to all these insurers—actually work.

Check your new declarations page. If it says your new coverage starts at 12:01 AM on the 15th, set your Geico cancellation for that same day.

Refunds and the "Short Rate" Myth

Geico is generally pretty fair about unearned premiums. If you paid for six months upfront and cancel after two, they owe you money. This is called a pro-rata refund. Usually, they send it back to the original payment method, or they’ll mail a check to the address on file.

Wait. Watch out for the "short rate" cancellation fee. While Geico doesn't charge a flat "cancellation fee" in most states, some state laws allow insurers to keep a small percentage (often 10%) of the remaining premium if you cancel mid-term. This isn't a Geico rule so much as a state Department of Insurance rule. If you live in a state like Georgia or North Carolina, it’s worth asking the agent, "Will I be short-rated for canceling today?"

State-Specific Weirdness You Need to Know

Insurance is regulated by states, not the feds. This means how do i cancel geico policy in California looks a bit different than in New York.

In some states, Geico is legally required to notify the DMV the second your policy drops. If you haven't registered a new policy or turned in your license plates, the state might suspend your registration or fine you. This is a huge deal in New York and Florida. In NY, for example, you must turn in your plates before you cancel the insurance, or you'll face a daily fine and a suspended license.

👉 See also: The Truth About US Debt Under Presidents and Why It Never Seems to Shrink

Don't assume the insurance agent knows your specific DMV requirements. They might, but they aren't DMV employees. Always check your state's DMV website if you are getting rid of the car entirely.

Why "Pausing" Might Be Better Than Canceling

If you’re canceling because you’re going away for a few months—maybe for military deployment or a long international trip—ask about "storage coverage" or "suspension of coverage."

When you cancel entirely, you lose any "continuous coverage" discounts you've spent years building up. If you put the car in storage and drop everything except comprehensive (which protects against fire and theft), you keep your loyalty status. It usually costs pennies compared to a full policy. This is a pro move that saves you hundreds when you get back on the road.

Verification Is Your Safety Net

Once the call is over, don't just hang up and forget about it.

🔗 Read more: CHF Currency to Euro: Why the Swiss Franc is Still Smashing Expectations in 2026

- Ask for a cancellation confirmation number.

- Request an email confirmation immediately.

- Check your bank account. Geico uses "AutoPay" for almost everyone. Sometimes the cancellation doesn't process before the next scheduled draft. If they take money out after you canceled, you’ll get it back, but it can take 10 business days. Better to stop it at the source.

Moving Forward With Your New Coverage

Navigating the exit from a major carrier is about being firm and organized. The "human" element of the call is the biggest hurdle. Agents have scripts. They might say, "But your rate is already so low!" or "Are you sure the other company has the same bodily injury limits?"

Trust your own research. If you've done the math and another company wins, stick to the plan.

Actionable Next Steps

- Confirm your new start date: Verify your new insurance is active and you have the digital ID cards saved to your phone before making any calls.

- Locate your policy number: Open the Geico app or find a recent bill so you don't have to hunt for it while on hold.

- Call (800) 841-1589: Do this during business hours for the fastest service, though they take cancellation calls 24/7.

- Turn in your plates (if applicable): If you are selling the vehicle and live in a strict state like New York or Maryland, visit the DMV website to see if plates must be surrendered first.

- Monitor your bank statement: Ensure no further "AutoPay" withdrawals occur and look for your pro-rated refund check within two weeks.