You’re probably tired of hearing about the S&P 500. It's everywhere. Every financial news cycle, every TikTok "finfluencer," and basically every bored uncle at Thanksgiving mentions it. But honestly, most people just say the name without actually knowing how to get their money into it. They treat it like a club they aren't invited to.

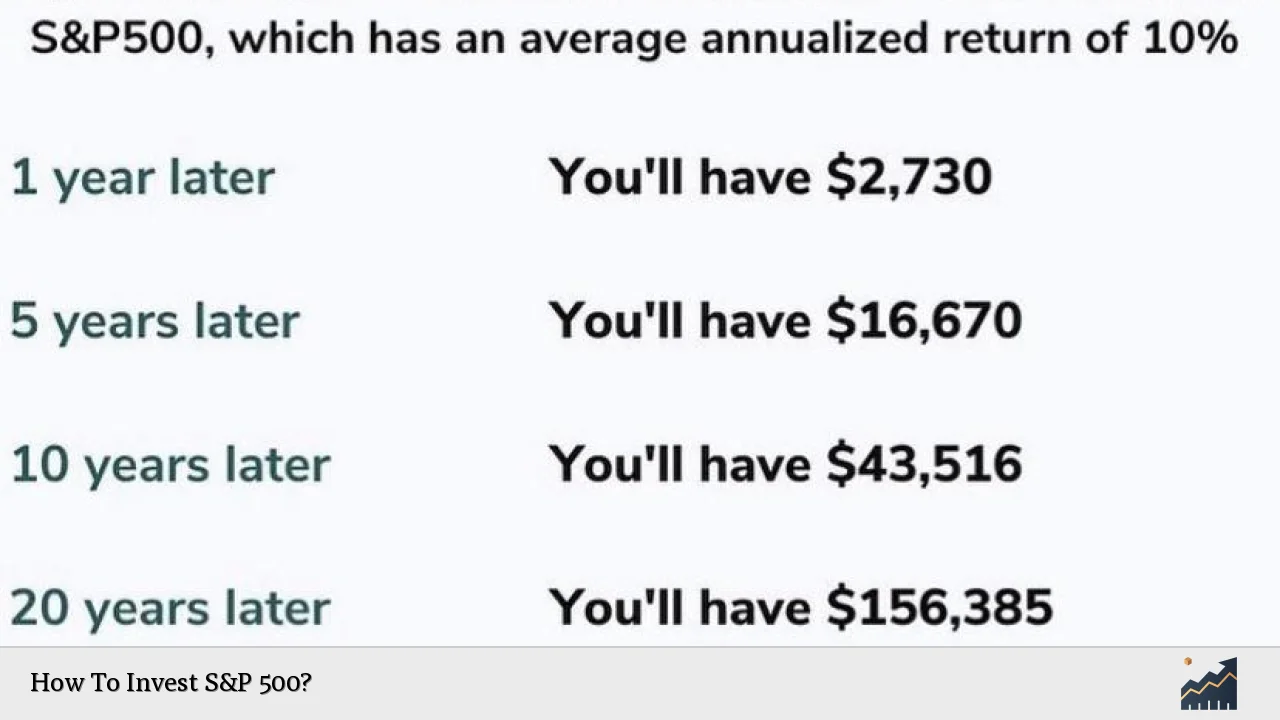

If you're asking how do i invest in the s&p 500, you’ve already won half the battle because you've stopped trying to pick "the next big thing" like a gambling addict. You’re looking for the boring, reliable, wealth-building machine that has averaged roughly 10% annual returns over the long haul.

It’s actually stupidly simple. You don't "buy" the S&P 500 directly—it's just a list of names, a scoreboard of the 500 largest publicly traded companies in the U.S. To actually own it, you buy a "wrapper" that holds those companies for you.

The Reality of the Index

Let’s get one thing straight: the S&P 500 isn't just 500 random companies. It’s a market-cap-weighted index. This means the big dogs like Apple, Microsoft, and Amazon carry way more weight than some struggling retail chain at spot 498. When you invest, you’re betting on the backbone of the American economy.

Some people think they need thousands of dollars to start. Nope. You can literally start with the price of a burrito if your brokerage allows fractional shares. You’re essentially buying a tiny slice of everything from tech giants to soda companies and oil refineries.

Step One: Picking Your "Bucket"

Before you can buy the index, you need an account. This is where most people get stuck in analysis paralysis. You have two main choices here: a standard brokerage account or a retirement account like a Roth IRA.

If you use a Roth IRA, your money grows tax-free. That is a massive deal. Imagine making $100,000 in profit over thirty years and telling the IRS they can’t touch a cent of it. That’s the power of the right bucket. If you just use a regular taxable brokerage account (think Robinhood, Fidelity, or Charles Schwab), you’ll owe capital gains taxes when you sell.

💡 You might also like: The PRL Data Breach Settlement: How to Actually Get Your Money

Choosing a broker is easy nowadays. Fidelity, Vanguard, and Schwab are the "Big Three." They’ve been around forever. They aren't going to vanish overnight. They also have the lowest fees in the game. Avoid any "wealth manager" who wants to charge you a 1% fee just to click a button for you. You can do this yourself in five minutes.

How Do I Invest in the S&P 500? Choosing Your Vehicle

Once your account is open and funded, you have to choose your "vehicle." This is usually either an ETF (Exchange-Traded Fund) or a Mutual Fund.

ETFs are great because they trade like stocks. You can buy them at 10:30 AM or 2:15 PM. The most famous one is SPY (SPDR S&P 500 ETF Trust). It’s the oldest, the biggest, and it’s what the pros use. But here’s a pro tip: if you’re a long-term buy-and-hold investor, VOO (Vanguard S&P 500 ETF) or IVV (iShares Core S&P 500 ETF) are actually slightly better because their expense ratios are lower.

Wait, what’s an expense ratio?

It’s the fee the fund takes to run the show. VOO has an expense ratio of 0.03%. That means for every $10,000 you invest, they only take $3 a year. That’s basically free. Some "actively managed" funds charge 1% or more. That sounds small, but over 30 years, that 1% can eat up a third of your total wealth. Seriously. Don't pay for someone's yacht when you can get the same results for the price of a cup of coffee.

The Mutual Fund Route

If you’re the type of person who wants to set up an automatic transfer every payday and never look at it again, an index mutual fund might be better.

Fidelity has one called FXAIX. Schwab has SWPPX.

The cool thing about mutual funds is you can often invest exact dollar amounts. If you have $57.42 left over after bills, you can put exactly $57.42 into FXAIX. With some ETFs, you might have to buy whole shares, though most modern brokers are moving away from that restriction.

📖 Related: What Does Someone Being DEI Mean? Why Everyone Is Talking About It Right Now

The Strategy: Don't Be a Hero

The biggest mistake people make once they figure out how do i invest in the s&p 500 is trying to time the market.

"Oh, the news says there's a recession coming, I'll wait to buy."

"The market is at an all-time high, I'll wait for a dip."

Stop. Just stop.

The math shows that "time in the market" beats "timing the market" almost every single time. Look at the data from JP Morgan Asset Management. If you missed just the 10 best days in the market over a 20-year period, your returns would be cut in half. Think about that. Ten days. You don't know when those days are coming. Usually, they happen right after a big crash when everyone is terrified.

The best way to do this is Dollar Cost Averaging (DCA). You put in $200 (or whatever you can afford) every single month, regardless of whether the market is up, down, or sideways. When the market is down, your $200 buys more shares. When it's up, it buys fewer. It averages out, and it keeps your emotions out of the driver's seat.

Why the S&P 500 Might Actually Suck for You

I know, I just spent a thousand words praising it. But context matters.

The S&P 500 is 100% stocks. If the market drops 30% tomorrow—which it does every decade or so—can you handle seeing your $10,000 turn into $7,000 without panicking and selling? If you sell during a crash, you lock in those losses.

Also, the S&P 500 is purely U.S.-based. While most of these companies do business globally, you’re missing out on emerging markets and small-cap companies that sometimes outperform the giants. Some investors prefer a "Total Stock Market" index like VTI, which includes the S&P 500 plus a few thousand smaller companies. It’s even more diversified, but honestly, the performance is almost identical because the S&P 500 is so massive it dominates the total market anyway.

The Step-by-Step Checklist

Let's cut through the noise. If you want to get this done today, here is the exact sequence.

- Open an account. Go to Fidelity, Vanguard, or Schwab. If you don't have a retirement plan at work, open a Roth IRA. If you do, or if you want the money before you’re 59.5 years old, open a regular brokerage account.

- Link your bank. Transfer some cash. Don't overthink the amount. Just get started.

- Search for the ticker symbol. Type in VOO, IVV, or FXAIX.

- Click Buy. Choose "Market Order" if the market is open, or "Limit Order" if you want to be precise.

- Set up Auto-Invest. This is the secret sauce. Set it to pull $X from your bank account every month and automatically buy more of that fund.

A Note on "The Lost Decade"

It’s worth noting that the S&P 500 isn't a magic money printer that works every single year. From 2000 to 2009, the index actually had a negative return. It’s called the "Lost Decade." If you started investing in 2000 and looked at your account in 2010, you would have been pretty annoyed.

But if you kept buying through those ten years, you would have been buying shares at a massive discount. When the market finally ripped higher in the 2010s, you would have become incredibly wealthy. You have to be willing to look at your account in the red and keep clicking "buy."

Actionable Insights for the Long Haul

Investing is 10% math and 90% temperament. You now know the mechanics of how do i invest in the s&p 500. You know which tickers to look for (VOO, IVV, SPY) and which brokers to use.

The real work starts when the headlines get scary. When the news says "The Dollar is Collapsing" or "The Stock Market is Doomed," that is usually the best time to stay the course.

- Check your expense ratios. Anything above 0.10% for an S&P 500 fund is a rip-off.

- Turn on DRIP (Dividend Reinvestment Plan). This automatically uses the dividends companies pay you to buy even more shares of the index. It creates a compounding snowball effect that is genuinely life-changing over 20 years.

- Ignore the "daily" price. The S&P 500 is a 10-year minimum commitment. If you need the money for a house down payment in two years, the stock market is a risky place to put it.

Start small, stay consistent, and let the 500 most profitable companies in the world do the heavy lifting for you. All you have to do is provide the capital and the patience.

Next Steps:

Go to a major brokerage site (Fidelity or Vanguard are the standard-bearers) and open a Roth IRA. Once funded, place your first trade for a low-cost ETF like VOO. Set your dividends to "reinvest" and schedule a recurring monthly transfer to ensure you are buying regardless of market volatility.