You're standing at the counter, or maybe sitting at your desk, and you realize you haven't touched a pen to paper for a financial transaction in months. Years, maybe. Then it happens. You need to pay a contractor, or your landlord specifically requests a physical document because they're old-school. Suddenly, the pressure is on. How do you fill out a cheque without looking like you've never seen one before? It feels like a relic of the past, but getting it wrong isn't just embarrassing—it can lead to bounced payments, fraud, or your bank just flat-out rejecting the deposit.

It's actually a pretty precise bit of business. Banks use Automated Clearing House (ACH) systems and Optical Character Recognition (OCR) to read these things. If your handwriting looks like a doctor's prescription or you put the decimal in the wrong spot, the machine throws a fit. Let's get into the weeds of how this actually works so you don't lose money.

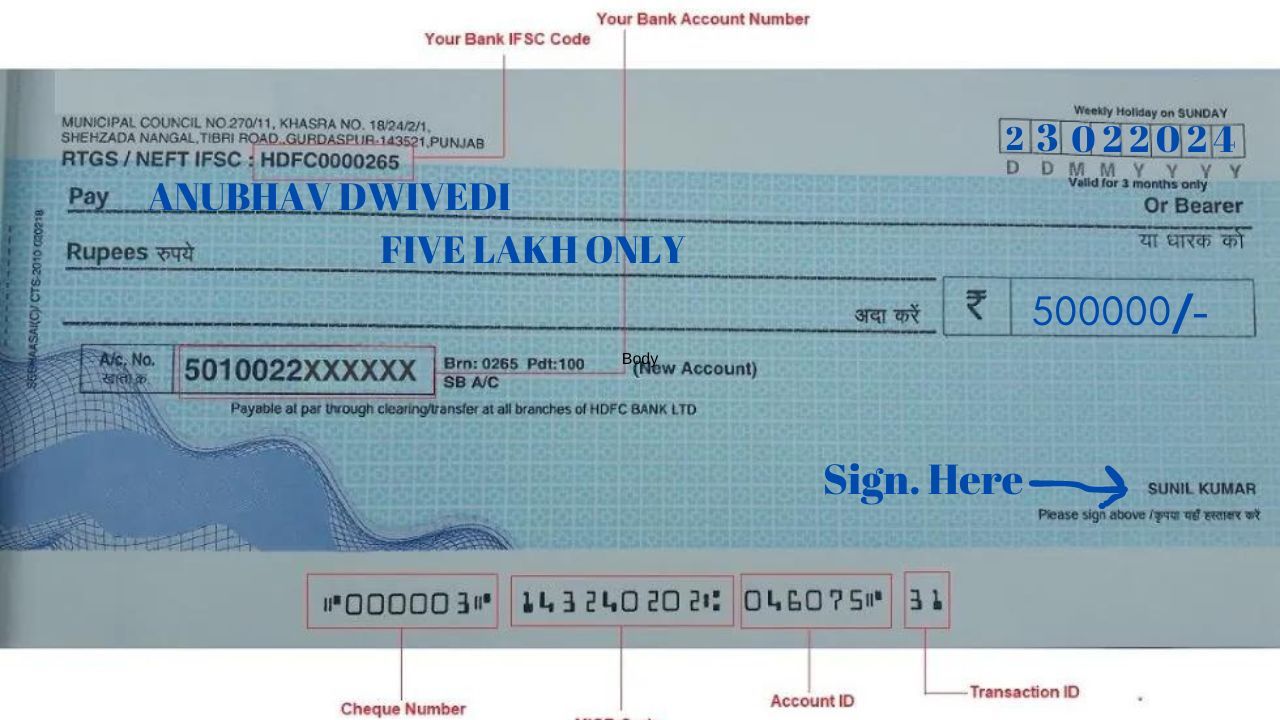

The Basic Anatomy of the Slip

First off, look at the top right corner. That's where the date goes. It sounds simple, but people mess this up constantly. You’ve got to decide if you’re dating it for today or "post-dating" it. Post-dating is when you write a future date so the person can't cash it until then. Honestly, though? Most banks don't even look at the date anymore unless it’s months old. They just scan the numbers. Still, for your own records, use the current date in a clear format like MM/DD/YYYY.

Next is that line that says "Pay to the Order of." This is vital. Write the name of the person or the business exactly as they want it. If you're paying "John Smith" but his bank account is under "John A. Smith," it might cause a hiccup. If you aren't sure, ask. Don't just guess.

Then there's the little box with the currency symbol. This is for the numerical amount. Write it clearly. $1,250.50. Make sure the numbers are snug against the dollar sign so nobody can sneak an extra digit in there. That's an old fraud trick, but it still happens.

💡 You might also like: The Insignia de Uñas y Suelos Problem: Why Your Construction Standards Might Be Failing

The Word Line: Where People Trip Up

Right below the "Pay to" line is a long blank space. This is where you write the amount in words. This is legally the most important part of the cheque. If the numbers in the box say $100 but the words say "One Thousand Dollars," the bank is technically supposed to go with the words.

Write it out: One thousand two hundred fifty and 50/100.

See that fraction at the end? That’s the standard way to handle cents. If there are no cents, write "no/100" or "00/100." Then, draw a thick line through the rest of the empty space to the end of the line. Why? To stop anyone from adding "and ninety-nine cents" to your payment. It’s a simple security measure that takes two seconds.

Security and the Bottom Row

At the very bottom, you’ll see a string of weird-looking numbers. Those are printed in magnetic ink. That's the MICR line (Magnetic Ink Character Recognition). The first set is your routing number—it identifies your bank. The second set is your account number. The third is usually the cheque number. Don't write over these. If you smudge them or scribble near them, the bank's scanner will reject the cheque, and you'll be stuck doing it all over again.

The Memo Line: Your Best Friend for Taxes

The memo line in the bottom left is optional, but you'd be crazy not to use it. If you're paying rent, write "January Rent." If it's for a plumbing repair, write "Invoice #456." This isn't for the bank; it's for you and the person receiving the money. When you're looking at your bank statement six months from now and see a random withdrawal, that memo line (which usually gets scanned and saved) will save your life during an audit or a dispute.

The Signature: The Final Seal

Don't sign the thing until everything else is filled out. Seriously. A signed blank cheque is basically a "steal my money" flyer if you drop it. Sign it exactly how you signed your signature card when you opened the account. If you’ve started using a simplified "squiggle" over the years but your official bank signature is full cursive, try to match the official one. If the signatures don't match, some high-security fraud systems might flag the transaction.

✨ Don't miss: Why your 401 k growth calculator is probably lying to you (and how to fix it)

Common Pitfalls to Avoid

- Using a Pencil: Never do this. Ever. It can be erased and changed. Use a blue or black pen.

- Leaving Gaps: As mentioned, keep your writing tight. Don't leave big spaces between words or numbers where a "1" could become a "9."

- The "Cash" Mistake: You can write "Cash" in the "Pay to" line if you want to withdraw money yourself, but be careful. If you lose that cheque, anyone who finds it can cash it. It's much safer to write your own name.

- Scribbling Out Mistakes: If you mess up, don't just cross it out and initial it. Most banks are twitchy about altered cheques now. It's better to write "VOID" in big letters across the cheque, rip it up, and start fresh with a new one.

Why Does Anyone Still Use Cheques?

It seems archaic. We have Venmo, Zelle, and wire transfers. But in the world of business, cheques provide a "paper trail" that digital apps sometimes lack. When a cheque is cashed, your bank keeps a digital image of the front and back. That back side shows the endorsement—proof that the person you intended to pay actually received the money.

Small businesses often prefer them because they avoid the 3% processing fees charged by credit card companies. If you're paying a $5,000 bill, that's $150 saved just by using paper. It's a significant amount of money over a fiscal year.

Dealing with "Stale-Dated" Cheques

What happens if you find a cheque in a drawer from six months ago? Most banks consider a cheque "stale" after six months. They aren't legally required to honor it after that point. If you’re the one writing the cheque, keep an eye on your balance. If the person doesn't cash it for months, that money is still "gone" from your budget, even if it's still in your account.

Practical Steps for Moving Forward

- Check your balance first. It sounds obvious, but "bouncing" a cheque (writing one for more than you have) can result in hefty NSF (Non-Sufficient Funds) fees from both your bank and the person you're paying.

- Use a dedicated pen. Keep a high-quality gel pen or ballpoint in your bag or desk specifically for financial documents to ensure the ink is bold and permanent.

- Track it in a register. Whether it's the little paper booklet that comes with your cheques or an Excel sheet, record the cheque number, date, amount, and recipient immediately.

- Confirm the recipient's name. Double-check if a business requires their full legal name or a "Doing Business As" (DBA) name to ensure the deposit goes through smoothly.

- Secure your chequebook. Treat it like cash. Store it in a locked drawer or a safe place at home, never in your car or an unlocked bag.