Timing is everything. You've probably heard that a thousand times in movies or from that one uncle who swears he almost bought Apple in the nineties. But when you're actually sitting at your desk, finger hovering over the "buy" button, the question of how long is the stock market open becomes a lot more than just a trivia fact. It’s the difference between catching a price swing and watching your order sit in limbo while the world moves on without you.

Most people think the answer is a simple six-and-a-half-hour window. They aren't exactly wrong, but they are missing the chaos that happens when the "closed" sign is still hanging on the door.

The New York Stock Exchange (NYSE) and the Nasdaq—the two big titans of American finance—officially ring the bell at 9:30 AM Eastern Time. They shut things down at 4:00 PM. That’s the "core" session. It’s when the liquidity is highest, the spreads are tightest, and the volume is screaming. If you’re a casual investor, this is your playground. But honestly? The market never really sleeps. It just changes its clothes.

The Secret Hours: Pre-Market and After-Hours Trading

If you think the action stops because the bell rang, you’re in for a surprise. Professional traders and institutional giants are busy way before you’ve had your first coffee.

Pre-market trading in the U.S. can start as early as 4:00 AM ET, though most of the real movement begins around 8:00 AM. Why does this matter? Well, companies love to drop their biggest news—earnings reports, CEO resignations, massive mergers—either right before the sun comes up or right after the market closes at 4:00 PM.

This brings us to "After-Hours." This session typically runs from 4:00 PM to 8:00 PM ET.

Here is the kicker: trading during these "extended hours" is a different beast entirely. It’s thinner. There are fewer people buying and selling. That means if you try to sell a stock at 6:00 PM, you might get a price that’s way lower than what you saw at 3:59 PM. It’s volatile. It’s risky. It’s basically the Wild West of finance. Most retail brokers like Robinhood, Fidelity, or Charles Schwab allow you to participate in these sessions, but they usually make you check a box saying you understand you might get punched in the gut by price swings.

✨ Don't miss: Charles Schwab Insider Selling: What Most People Get Wrong

Weekend Warriors and the Holiday Gap

The market loves a break. It’s closed on Saturdays and Sundays. Period. No exceptions.

If a global crisis happens on a Saturday afternoon, you’re stuck watching the news and waiting for Sunday night (when futures start trading) or Monday morning to do anything about it. It’s a helpless feeling, but it’s part of the game.

Then there are the holidays. The NYSE and Nasdaq follow a specific schedule that includes:

- New Year’s Day

- Martin Luther King, Jr. Day

- Washington's Birthday (Presidents' Day)

- Good Friday

- Memorial Day

- Juneteenth National Independence Day

- Independence Day

- Labor Day

- Thanksgiving Day (The market usually closes early the next day, at 1:00 PM)

- Christmas Day

Keep in mind, if a holiday falls on a Saturday, the market usually closes on the preceding Friday. If it’s a Sunday, it stays closed on the following Monday. It’s a weird bit of calendar math that catches people off guard every single year.

Global Markets: When the Sun Sets in New York

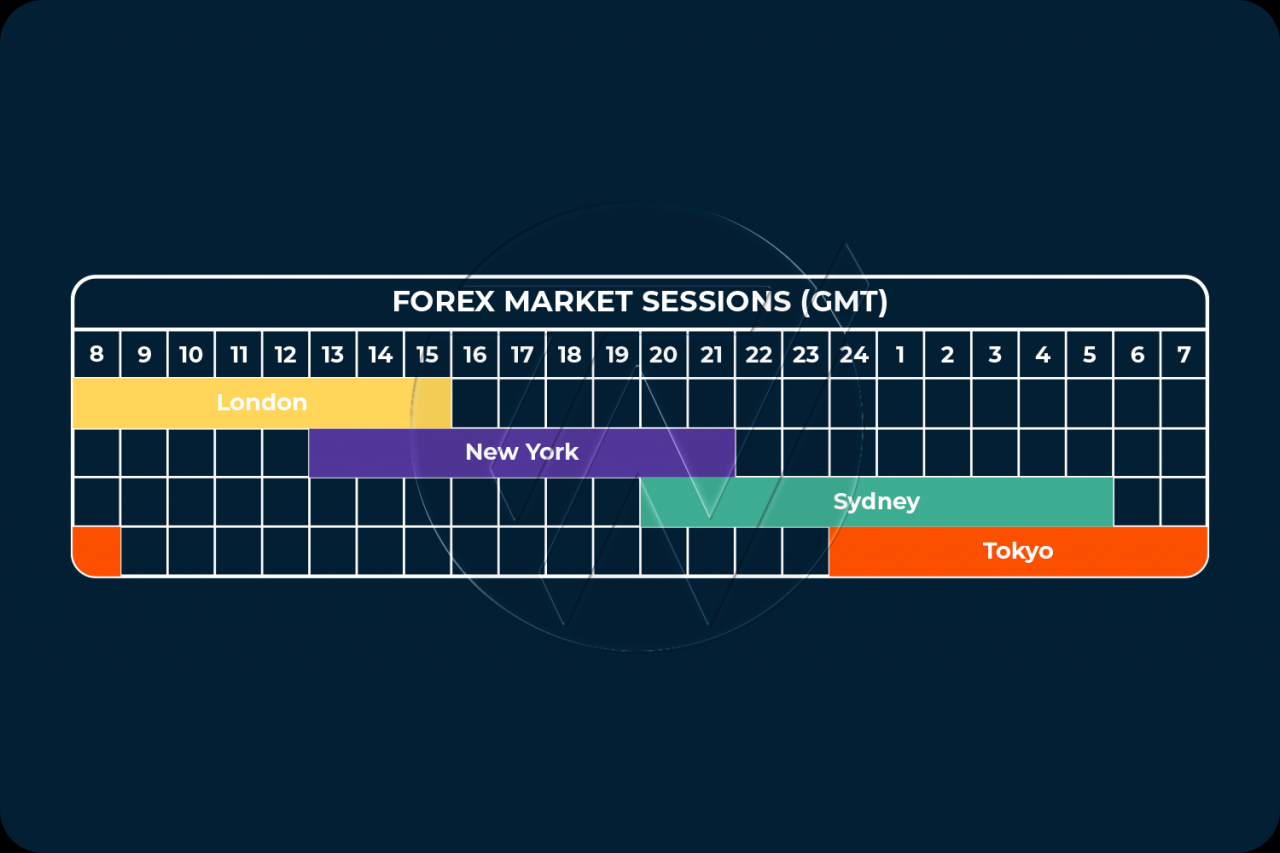

The world is round. Markets in London, Tokyo, and Hong Kong don't care about Eastern Standard Time. When you’re asking how long is the stock market open, you have to specify which market.

👉 See also: Ashley Buchanan Leaving Michaels: What Really Happened Behind the Scenes

London (LSE) usually runs from 8:00 AM to 4:30 PM local time. Tokyo (TSE) does a split shift, closing for lunch—literally—from 11:30 AM to 12:30 PM. It’s a very civilized way to trade, if you think about it.

If you’re a global investor, you’re essentially chasing the sun. As New York winds down, the Asian markets are just starting to stretch their legs. This creates a 24-hour cycle of information. If a tech giant in Taiwan has a bad manufacturing report at midnight your time, you’ll see that reflected in the U.S. pre-market hours long before the 9:30 AM bell rings.

The "Flash" Moments and Circuit Breakers

Sometimes the market is "open," but it’s not really moving. Or it’s moving too fast.

The SEC has these things called "circuit breakers." Think of them as the market's emergency brake. If the S&P 500 drops 7% in a single day, trading pauses for 15 minutes. It’s meant to stop panic selling. If it drops 13%, it pauses again. If it hits 20%? They pull the plug and send everyone home for the day.

These rules were put in place after the "Black Monday" crash of 1987 and refined after the 2010 "Flash Crash." It’s a reminder that even though the schedule says the market is open until 4:00 PM, the "market" is a living, breathing, and sometimes panicking entity that can stop whenever it gets too overwhelmed.

Why 9:30 AM and 4:00 PM Are "Danger Zones"

The first and last 30 minutes of the core trading session are absolute mayhem.

Traders call the opening bell "amateur hour," though that’s a bit of an insult to the pros who make a killing there. All the news that happened overnight gets baked into the price in a matter of seconds. Orders that were placed at 2:00 AM are suddenly executing all at once. The price of a stock can jump 5% and drop 6% before you’ve even finished your toast.

Then there’s the "Closing Cross." At 4:00 PM, there is a massive rush to finalize prices for the day. Institutional investors—the pension funds and big banks—often wait until the very last minute to execute huge trades to ensure they get the "closing price" for their records.

If you’re just starting out, honestly, maybe wait until 10:30 AM. Let the dust settle. See where the trend is actually going instead of guessing in the dark.

Putting It All Into Practice

Knowing how long is the stock market open isn't just about reading a clock. It's about strategy.

If you're a long-term investor, the specific minute you buy doesn't matter much. You’re looking at years, not hours. But if you're trying to manage risk or capitalize on a specific event, you need to live by the exchange's schedule.

Check your brokerage's specific rules on extended-hours trading. Some require you to use "Limit Orders" only—meaning you set a specific price you're willing to pay—rather than "Market Orders," which just take whatever price is available. This is a safety net. Use it.

Sync your calendar with the NYSE holiday schedule. There is nothing worse than planning a big trade on a Monday morning only to realize it's a bank holiday and the markets are dead.

Watch the "Futures" markets on Sunday night. Around 6:00 PM ET, S&P 500 and Nasdaq futures start trading. This is the first real look at how the market is reacting to the weekend's news. It’s the "weather report" for Monday morning. If futures are deep in the red on Sunday night, you know Monday at 9:30 AM is going to be a bumpy ride.

👉 See also: The Shoreham Nuclear Power Plant Disaster: Why a $6 Billion Project Never Produced a Watt of Power

Stay sharp. The clock is always ticking, even when the floor is quiet.

Actionable Next Steps:

- Audit your brokerage account settings: Log in and see if you have "Extended Hours" trading enabled. Most major brokers require a separate agreement or a simple toggle in the settings. Knowing you have the option is better than scrambling to find it during a market-moving event.

- Set a "Sunday Night" alarm: Check the U.S. Futures around 7:00 PM ET every Sunday. This 5-minute habit gives you a massive psychological head start on the trading week by showing you the market's "mood" before the Monday morning rush.

- Download a market holiday calendar: Add the 2026 NYSE holiday dates to your personal Google or Outlook calendar right now so you aren't caught off guard by mid-week closures.

- Practice with Limit Orders: Next time you trade during the core session, use a limit order instead of a market order. It gets you used to the discipline required for trading in the more volatile pre-market and after-hours windows where market orders are often disallowed or dangerous.