Everyone is staring at the Federal Reserve like it’s a crystal ball. If you’ve got a mortgage, a car loan, or a business line of credit, you’re probably asking the same thing: how low will interest rates go before the music stops?

Honestly, the answer isn’t as simple as a single number.

🔗 Read more: Kuwait Currency to Indian RS: Why the Rate is Sky-High Right Now

We aren't going back to the "free money" era of 2020. That was a freak accident of history. If you're waiting for 2.5% mortgage rates to return, you might be waiting until the next global catastrophe, and nobody wants that. The reality is that Jerome Powell and the rest of the Fed governors are trying to find something called "the neutral rate." It’s that magical, invisible point where the economy isn't being choked out but it isn't overcooking into a pile of inflation either.

The Myth of the Zero-Bound

Remember 2010 through 2021? We lived in a weird bubble. Interest rates were effectively zero for so long that we forgot what a "normal" economy felt like.

Most economists, including people like Jan Hatzius at Goldman Sachs or the team over at BlackRock, are now signaling that the floor is much higher than it used to be. We’re looking at a structural shift. Why? Because the world is different now. We have higher government debt, a massive push for green energy investment, and a "near-shoring" of manufacturing that keeps prices—and therefore rates—stickier than they were in the era of cheap globalization.

So, when we talk about how low will interest rates go, we have to talk about the Federal Funds Rate.

Current projections from the Fed’s own "dot plot" suggest a landing zone. Most experts believe the terminal rate—the place where the Fed stops cutting—will land somewhere between 3.0% and 3.5%. If you think about it, that’s actually quite high compared to the last decade. But it’s lower than the 5.25%+ peaks we saw recently.

It’s a middle ground.

What This Means for Your Mortgage and Your Wallet

Mortgage rates don't move in a perfect 1:1 ratio with the Fed. They follow the 10-year Treasury yield.

👉 See also: Liquor King Check Cashing: What Most People Get Wrong About Using Convenience Stores for Money Services

If the 10-year Treasury yield stays stubborn because investors are worried about government spending, mortgage rates might stay in the 5.5% to 6.5% range even if the Fed cuts aggressively. It's frustrating. You see the headlines saying "Fed Cuts Rates," but then you call your loan officer and the quote hasn't budged.

That's the "term premium" at work.

Investors want to be paid more to hold long-term debt when the future is uncertain. Right now, the future is basically a giant question mark.

Why the "2% Inflation Target" is the Real Boss

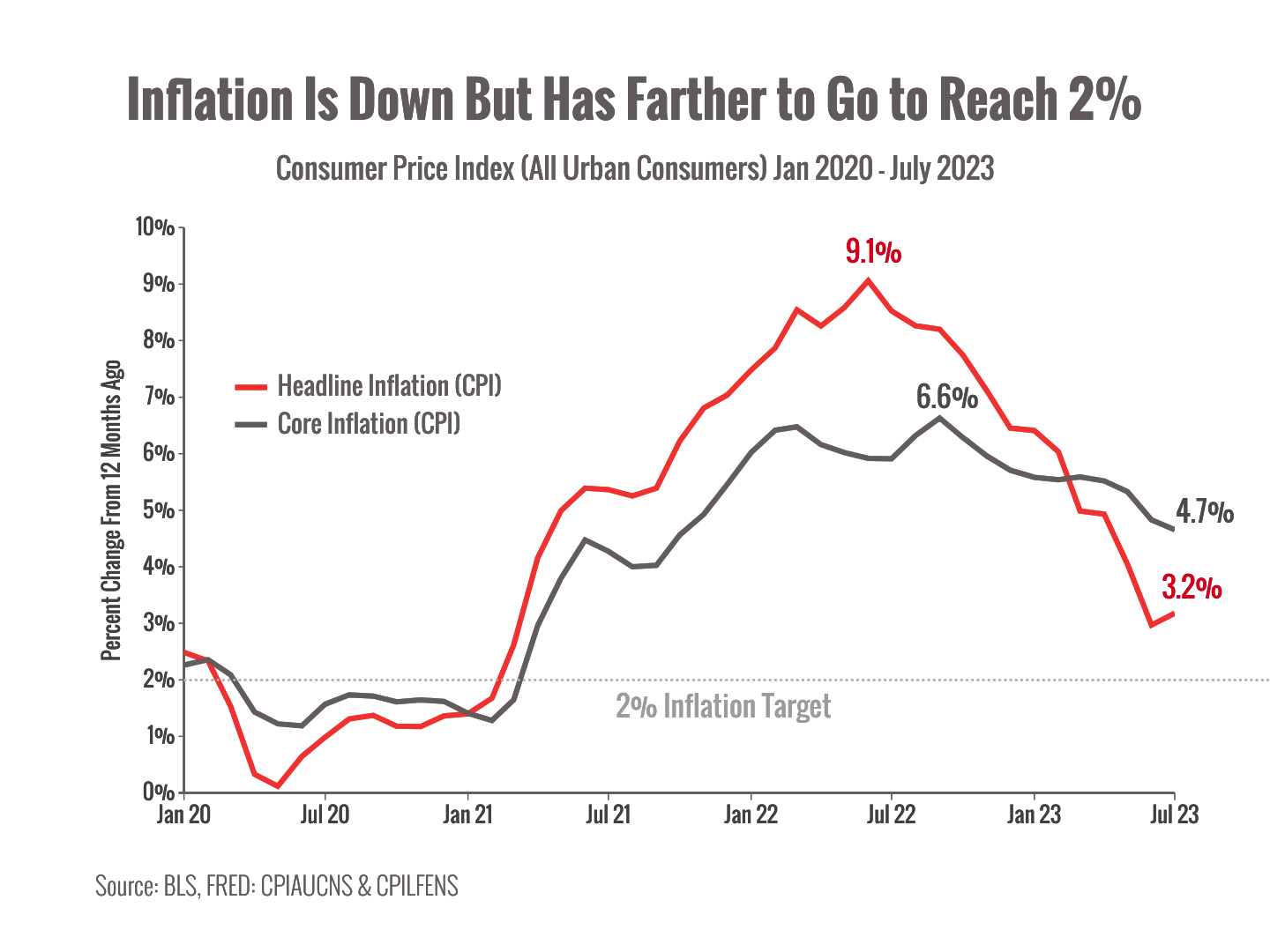

The Fed is obsessed with 2%. It’s their North Star.

If inflation stays at 2.5% or 2.7%, they won't feel the need to drop rates into the basement. They’ll just sit there. This is what some people call "higher for longer," though that's become a bit of a cliché. A better way to put it is "higher until something breaks."

- Labor market cooling? They cut.

- Stock market crash? They cut.

- Inflation stays sticky? They hold.

It’s a balancing act. If they cut too fast, they risk a 1970s-style rebound where inflation comes roaring back and they have to hike even harder. Nobody at the Eccles Building wants that on their legacy.

Historical Context: Are We Actually in a High-Rate Environment?

If you talk to someone who bought a house in 1982, they’ll laugh at you.

Back then, mortgage rates hit 18%.

We’ve been spoiled. For the 30 years prior to the pandemic, the trend was a long, slow slide downward. That's over. Demographic shifts—like the Baby Boomers retiring and spending their savings—mean there is less "supply" of capital to lend out. When supply goes down and demand stays up, the price (the interest rate) goes up.

When asking how low will interest rates go, you have to realize we are likely in a new "upcycle" that could last twenty years.

The Corporate Debt Cliff

There’s a massive amount of corporate debt that needs to be refinanced in 2025 and 2026. This is the "wall." Small businesses that took out loans at 4% are suddenly looking at 8% or 9%. This pressure is exactly why the Fed has to lower rates eventually. They don't want a wave of bankruptcies.

However, they also don't want to bail out everyone. They want "creative destruction."

It’s a cold way of saying they are fine with some companies failing as long as the whole system stays upright.

Actionable Steps for a Changing Rate Environment

You can't control the Fed, but you can control your exposure. Waiting for the "perfect" bottom is usually a losing game because by the time the bottom is clear, the market has already priced it in.

1. Re-evaluate your "Wait and See" strategy.

If you are sitting on the sidelines of the housing market waiting for 4% rates, you might be waiting years while home prices continue to climb due to low inventory. Sometimes a 6% rate on a cheaper house is better than a 4% rate on a house that has appreciated another 20%.

2. Focus on the spread, not just the headline rate.

For business owners, look at your debt-to-income ratio. If the Fed settles at 3.5%, can your business thrive? If not, you need to restructure your operations now rather than hoping for a 0% savior that isn't coming.

3. Lock in high-yield savings while you can.

As the Fed drops rates, your "easy" 5% return in a savings account or CD is going to vanish. If you have cash sitting around, locking in a multi-year CD now might be the smartest move you make this year.

4. Watch the 10-Year Treasury.

Don't just watch the news for Fed meetings. Watch the bond market. If you see the 10-year yield dropping, that’s your signal that mortgage rates are about to follow.

5. Diversify away from rate-sensitive assets.

If your entire portfolio depends on low rates (like speculative tech stocks or certain REITs), you're at risk. The "New Normal" favors companies with actual cash flow and low debt.

The bottom line is that the floor is higher than it used to be. We are transitioning from an era of "capital abundance" to "capital scarcity." It sounds scary, but it’s actually a healthier way for an economy to run. It rewards savers and forces companies to be efficient. While the answer to how low will interest rates go is likely "not as low as you hope," the stability that comes with a 3% neutral rate is far better than the wild volatility of the last four years.

Keep your eye on the labor market data. If unemployment starts ticking up toward 5%, the Fed will move faster. If it stays at 4%, they'll take their sweet time. Either way, the days of near-zero are firmly in the rearview mirror.