Ever walk through a small town and wonder how three different banks can survive on the same four-way intersection? It feels like they're everywhere. But honestly, if you look at the raw data, the "corner bank" is becoming a rare species.

So, how many banks are in the US exactly?

As of the latest reports from the Federal Deposit Insurance Corporation (FDIC) for early 2026, there are 4,348 FDIC-insured institutions operating in the United States.

That number might sound huge. You've got options, right? Well, yes and no. To put it in perspective, back in the late 1980s, there were over 14,000 banks. We’ve lost nearly 10,000 institutions in less than 40 years.

💡 You might also like: Les Schwab Fountain Co: What Most People Get Wrong About This Tire Giant

It’s a massive shift. Basically, the "mom and pop" of the financial world is being swallowed by the "big box stores" of Wall Street.

Why the Number of Banks Keeps Shrinking

Most people think banks close because they're failing. That's rarely the case lately.

The real culprit? Consolidation.

During the third quarter of 2025 alone, the total number of insured institutions dropped by 42. Some were sold to uninsured entities, but 38 of those were simply mergers. Banks are pairing up like it's a speed-dating event.

Small community banks are finding it harder to keep up with the tech requirements of 2026. If you're a tiny bank in rural Iowa, building a world-class mobile app that rivals JPMorgan Chase is expensive. Super expensive.

The Cost of Innovation

It’s not just the apps. It’s the security. Cyber threats have become so sophisticated that smaller players are often choosing to merge just to stay under the protective wing of a larger firm’s IT budget.

Then there’s the "succession problem."

A lot of community banks were started by families decades ago. Now, the leadership teams are hitting retirement age, and there isn't always a younger generation ready to take over the ledger. Selling to a regional neighbor becomes the easiest exit strategy.

🔗 Read more: US Dollar to Libyan Dinar: Why the "Official" Rate Isn't the Whole Story

The Giants vs. The Rest

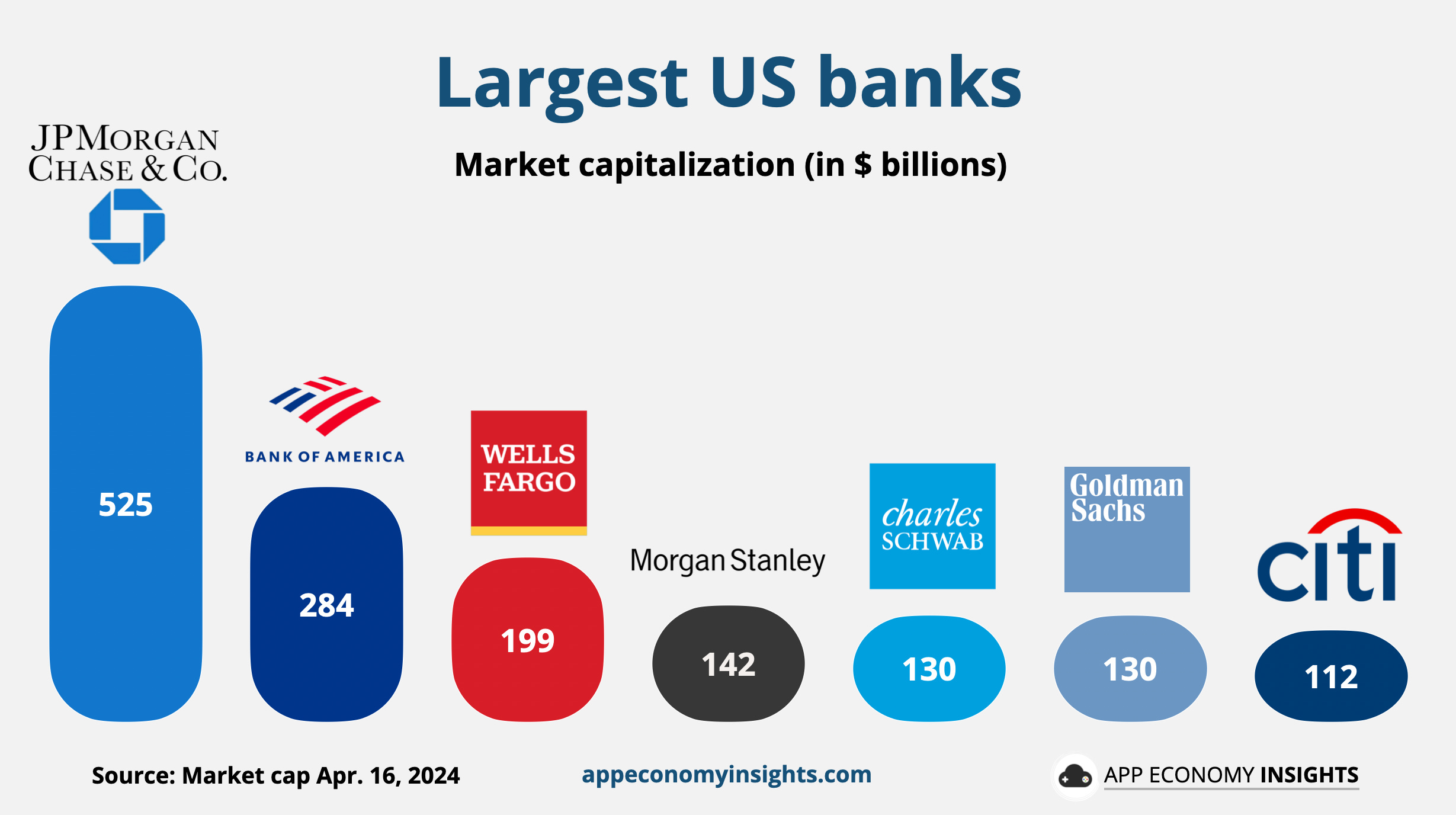

When we talk about how many banks are in the US, we have to acknowledge that the "Big Four" are in a league of their own.

JPMorgan Chase is sitting on over $4.1 trillion in assets. To give you an idea of how much that is, the second-place player, Bank of America, has around $3.2 trillion.

The gap is widening.

- JPMorgan Chase: $4.14 trillion

- Bank of America: $3.26 trillion

- Citigroup: $2.41 trillion

- Wells Fargo: $1.94 trillion

These four banks hold a staggering amount of the country's total wealth. Meanwhile, the FDIC identifies about 3,953 of the remaining institutions as "community banks."

These are the guys who actually know your name when you walk in. They’re the ones lending to the local hardware store or the new bakery down the street. While the big guys handle the global markets, these community banks are the ones actually keeping local economies breathing.

What About Credit Unions?

This is where the math gets tricky. People often use "bank" and "credit union" interchangeably, but they aren't the same.

If you're looking for a place to put your money, you've actually got more choices than just the 4,348 banks. There are roughly 4,411 credit unions in the US as of mid-2025.

Combined, that’s nearly 9,000 different places to open a checking account.

The main difference? Banks are for-profit and owned by shareholders. Credit unions are non-profits owned by their members. You’ll often see better interest rates at credit unions, but their tech might feel a little "retro" compared to a massive national bank.

The State of Banking in 2026

If you live in Texas, you're spoiled for choice. Texas consistently leads the pack with nearly 380 independent banks headquartered there. Illinois and Minnesota aren't far behind.

But if you’re in Alaska? You’ve only got about 5 local banks to choose from.

Geography matters. In many "banking deserts," the physical branch is disappearing entirely, replaced by digital-only neo-banks. These companies—think Chime or Ally—often don't have their own bank charters. Instead, they partner with an existing FDIC-insured bank to hold your money.

🔗 Read more: NYC Lord and Taylor: What Really Happened to America's Oldest Department Store

This creates a weird "masking" effect. You might think you're banking with a new startup, but your money is actually sitting in a 50-year-old institution in South Dakota or Utah.

Is This Consolidation Bad for You?

Sorta. It depends on what you value.

More consolidation usually means:

- Better Tech: Larger banks have the cash to build seamless, AI-driven apps.

- Less Choice: When your local bank gets bought, your fees might go up, or that "personal touch" might vanish.

- Stability: Larger institutions are generally more resilient to localized economic shocks, though we all remember 2008.

Honestly, the "too big to fail" era is just getting bigger. As we move through 2026, the trend of about 4% to 5% of banks disappearing every year via mergers seems likely to continue.

How to Choose Where to Put Your Money

Don't just look at the sign on the door. Look at the "under the hood" stats.

- Check the FDIC Status: Always ensure the institution is insured. This protects your first $250,000 if the bank goes belly-up.

- Look at Asset Size: If you want a bank that can handle complex international wires, go big. If you want a mortgage officer who understands why your business had a slow month in July, go local.

- Review the Tech: If you haven't stepped inside a physical bank in three years, the number of branches doesn't matter. Focus on the app's ratings.

The number of banks in the US might be falling, but the competition for your deposits is fiercer than ever. Whether it’s one of the 4,348 banks or the 4,400+ credit unions, you still have the leverage.

Next Steps for Your Finances:

First, verify your current bank's health by searching for their "Tier 1 Capital Ratio"—anything over 8% is generally considered strong. Next, compare your current savings APY against a "neo-bank" or a credit union; if you're earning less than 4% in the current 2026 environment, you're essentially giving the bank a free loan. Finally, if you value local service, check the "FDIC BankFind" tool to see which community banks are actually headquartered in your zip code rather than just renting a storefront.