You’ve probably seen the headlines. Every year, like clockwork, major financial publications drop their "rich lists," and New York City is almost always sitting right at the top. But honestly, if you're trying to figure out exactly how many billionaires live in New York, the answer depends entirely on who you ask—and when you ask them.

As of early 2026, the data from the 2025 reporting cycle confirms that New York City has reclaimed its throne as the billionaire capital of the world. According to the most recent Forbes counts, there are 123 billionaires calling the five boroughs home. That is a massive jump from just a few years ago.

If you look at the Hurun Global Rich List, they actually peg the number even higher, at 129. Why the discrepancy? It usually comes down to how these organizations define "resident." Some billionaires have five houses. Is the guy with a penthouse on Billionaires’ Row and a "primary residence" in Florida still a New Yorker? Forbes usually says yes if that's where they spend the bulk of their business hours.

Why New York is Winning the Numbers Game

It’s not just about the prestige. It’s the infrastructure. Basically, if you are worth ten figures, New York isn't just a place to live; it's a massive, high-functioning machine designed to manage your money.

The city’s lead is what experts call "structural." You have the highest concentration of private equity firms, hedge funds, and investment banks on the planet. Out of the 123 billionaires identified by Forbes, a staggering 68 made their fortunes specifically in finance and investments. That is more than half.

Compare that to a place like San Francisco or Shenzhen. Those cities are tech-heavy. When the Nasdaq takes a nosedive, their billionaire counts often shrivel. New York is different because its wealth is diversified across finance, real estate, retail, and media. Even when one sector is hurting, the others usually pick up the slack.

The Rivals: NYC vs. The World

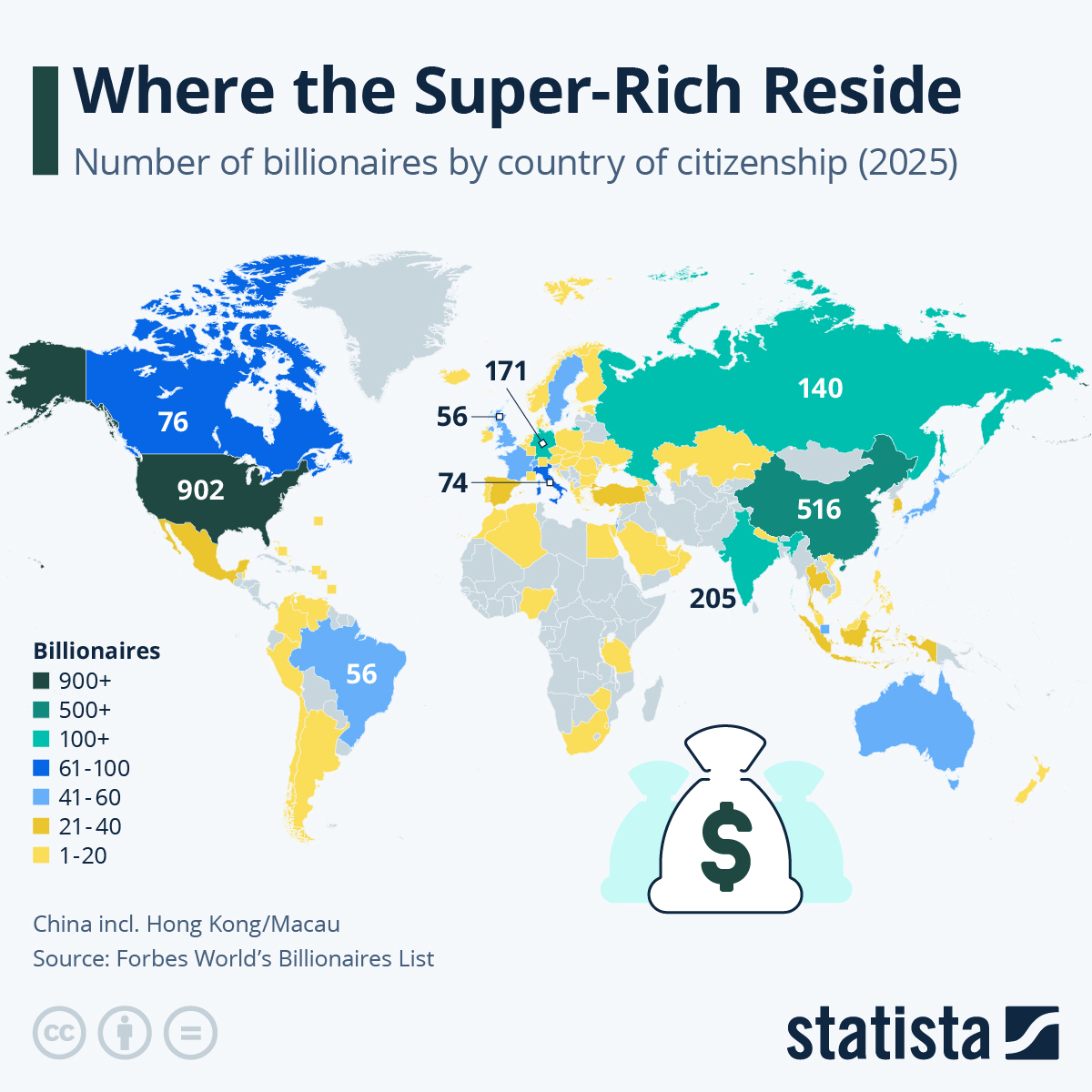

For a brief, stressful moment in 2021, Beijing actually overtook New York. People thought the era of American urban dominance was over. It wasn't. Since then, the Chinese tech crackdown and a shaky property market in Asia have seen Beijing’s numbers slide.

Here is how the 2026 landscape looks compared to other global hubs:

- New York City: 123 (Forbes) / 129 (Hurun)

- Hong Kong: 74

- Moscow: 73

- Mumbai: 69

- Beijing: 63

London is trailing further back with 62. It’s wild to think about, but New York has nearly double the billionaire population of London or Beijing right now.

The "Billionaires’ Row" Effect

You can’t talk about how many billionaires live in New York without talking about the skyline. Walk down 57th Street and look up. Those impossibly thin glass needles like 220 Central Park South and Central Park Tower aren't just apartments. They are vertical safe-deposit boxes.

Ken Griffin, the founder of Citadel, famously spent roughly $238 million on a multi-floor unit here. He’s one of the big names that keeps NYC at the top of the list. Then you have the "old guard" like Michael Bloomberg, who is worth over $105 billion and remains a fixture of the city's social and political fabric.

But it’s not all Manhattan. We are seeing a "Brooklyn-ization" of ultra-high-net-worth individuals. Places like Brooklyn Heights and Cobble Hill are seeing record-breaking townhouse sales. Even billionaires want a backyard sometimes, even if that backyard costs $30 million.

What Most People Get Wrong About the Count

Here’s the thing: the official count of 123 or 129 is almost certainly an underestimate.

Many ultra-wealthy individuals go to extreme lengths to stay off the radar. They use LLCs, trusts, and shell companies to buy property. If their name isn't on the deed and they don't run a public company, they might never show up on a Forbes or Bloomberg list.

Some researchers, like those at the Hurun Research Institute, suggest that for every "visible" billionaire, there might be another person with ten figures hiding in plain sight. This is especially true in New York, where "quiet luxury" isn't just a fashion trend—it's a privacy strategy.

The Impact of the "Great Wealth Transfer"

Something else is happening in 2026 that is inflating these numbers: inheritance. We are currently in the middle of the largest intergenerational wealth transfer in history.

✨ Don't miss: Lacks Rio Grande City: Why It Closed and What’s Happening Now

As the "Silent Generation" and older Boomers pass down assets, we are seeing a surge in "New York heirs." These are Millennials and Gen Xers who are inheriting billion-dollar portfolios and choosing to stay in the city rather than decamping to tax havens. They want the culture, the schools, and the networking that only NYC provides.

Is the Number Going to Keep Growing?

Probably. Despite the high taxes—New York has some of the highest personal income tax rates in the U.S.—the "network effect" is too strong to ignore.

Billionaires live here because other billionaires live here. It’s where the deals happen. If you're a billionaire in West Palm Beach, you're on vacation. If you're a billionaire in New York, you're at work.

What you can do with this information:

✨ Don't miss: Why 77 Beale St SF Is More Than Just a High-Rise Office

If you are tracking these trends for investment or real estate purposes, keep a close eye on the 13-person year-over-year increase New York just saw. It signals that the "flight from the city" narrative of the early 2020s is officially dead.

For those looking at the luxury market, focus on the "Centi-millionaire" bracket. While there are about 123 billionaires, there are over 800 people in NYC with more than $100 million. This is the group that actually drives the luxury economy, from high-end art auctions to the $10 million+ real estate market.

Watch for the next major data drop from Forbes in April to see if the 123 number holds or if the current market volatility has finally thinned the herd.