Checking the ticker for Tesla (TSLA) these days is kinda like watching a high-stakes poker game where half the players are betting on a tech revolution and the other half are convinced the house is about to fold. If you’re looking for a quick answer on how much are tesla stocks worth, as of mid-January 2026, the stock has been hovering around the $437 to $440 mark.

It’s a weird spot to be in.

On one hand, the company is worth roughly $1.4 trillion. That’s "trillion" with a T. On the other hand, the stock has been a bit of a roller coaster lately, pulling back from those late-December highs that almost touched $500. Honestly, trying to pin down a "fair" value for Tesla is basically impossible because nobody can agree on what the company actually is. Are they a car company? An AI powerhouse? A robotics firm? Your answer to that usually dictates whether you think $440 is a bargain or a total bubble.

The Reality of the Current Stock Price

To understand the current valuation, you have to look at the momentum. Coming out of 2025, Tesla actually underperformed the broader market, gaining about 11% while the Nasdaq and S&P 500 were busy doing laps around it. It’s a bit of a reality check for the "Tesla always goes to the moon" crowd.

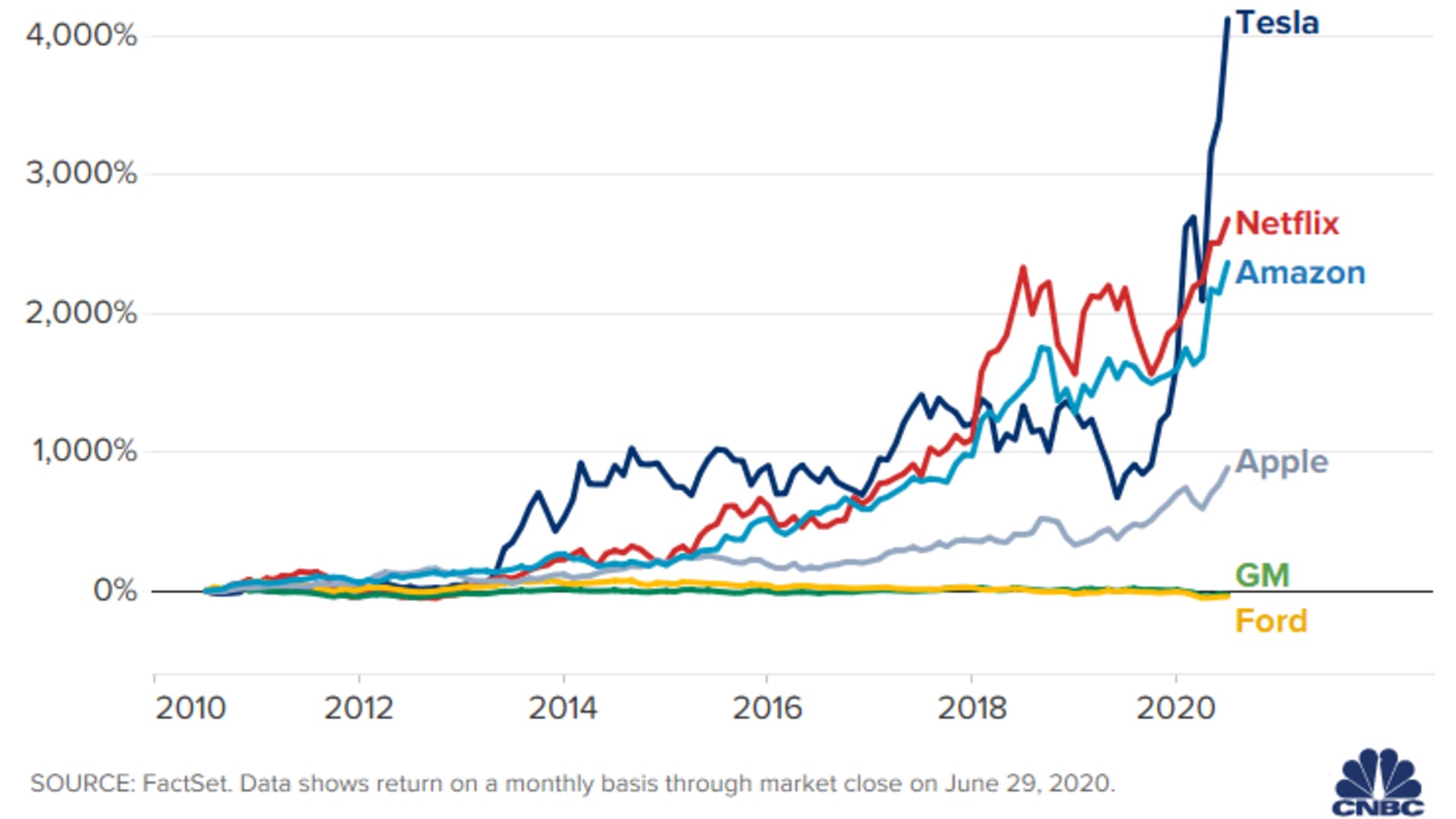

Investors are currently staring down a P/E (price-to-earnings) ratio of about 292. For context, a "normal" profitable car company like Ford or GM usually trades at a P/E around 8 or 9. Tesla is trading like a software company that’s about to discover the secret to eternal life.

Right now, the stock is sitting just below some key technical levels. It's under its 10-day and 50-day moving averages, which is a nerdier way of saying the short-term trend is looking a little tired. Traders are watching the $415 to $420 range as a safety net. If it falls through that, things could get messy. But if it stays above, the bulls are still in the driver's seat for the rest of 2026.

Why the Market is Freaking Out (and Cheering) at the Same Time

The big drama right now is the "Great Disconnect."

🔗 Read more: Why Refinance Home Mortgage Rates Are Driving Everyone Crazy Right Now

Tesla just missed its 2025 delivery estimates. That’s usually a death sentence for a growth stock. But here we are, with a trillion-dollar market cap. Why? Because Elon Musk is a master at moving the goalposts. Whenever the car business looks a little sluggish—thanks to high interest rates or the fact that everyone in China is buying a BYD instead—Musk starts talking about the "AI Chapter."

The Robotaxi and Cybercab Gamble

The reason how much are tesla stocks worth stays so high is the promise of the Cybercab. Production is supposed to start in April 2026. No steering wheel. No pedals. If that actually happens and works, the current stock price will look like a typo. If it gets delayed another two years? That $440 price tag starts to look very heavy.

Optimus and the $20 Trillion Dream

Then there’s Optimus. Musk has been out here saying the humanoid robot could eventually make Tesla worth "18 Nvidias." It’s a wild claim. But some analysts, like Dan Ives at Wedbush, are drinking the Kool-Aid. He’s got a price target of $600 and thinks the market cap could hit $2 trillion by the end of 2026.

On the flip side, you have the bears like GLJ Research who are screaming that the stock is fundamentally worth $25. Yeah, you read 그 right. Twenty-five dollars. They look at the declining margins and the fact that Tesla is having to cut prices to sell cars and they see a disaster waiting to happen.

📖 Related: En cuánto está el dólar en pesos mexicanos: lo que realmente mueve tu bolsillo hoy

Key Numbers to Keep in Your Pocket

If you’re trying to decide if you should buy, sell, or just watch the chaos from the sidelines, here’s a look at what the pros are tracking:

- Market Cap: ~$1.4T to $1.5T.

- 52-Week High: $498.82.

- 52-Week Low: $214.25.

- The "Safety" Zone: Many analysts see $425 as a neutral "fair value" based on today's math.

- Earnings Date: Keep your eyes peeled for January 28, 2026. That’s when the next big batch of data drops.

What Most People Get Wrong About Tesla's Value

A lot of folks think Tesla’s value is tied solely to how many Model 3s and Model Ys they see on the road. It’s not. Not anymore.

The stock price is currently a "call option" on the future of AI. If you buy Tesla today, you aren't just buying a car company. You are betting that they will solve Full Self-Driving (FSD) in a way that generates billions in pure-profit software subscriptions. Musk recently shifted FSD to a subscription-only model, which tells you exactly where he thinks the money is.

But there’s a risk. Competition is fierce. Lucid, NIO, and even legacy giants like Ford are clawing for every bit of market share. In 2025, Tesla's core business—selling cars—actually saw its first real decline in volume growth for some segments. That’s why the "AI narrative" has to work. The stock is essentially being held up by the hope that the robots are coming to save the day.

Actionable Insights for Your Portfolio

So, where does this leave you?

If you're wondering how much are tesla stocks worth to you, it depends on your timeline.

- For the Swing Trader: Watch the $415 support level. If it breaks, there’s a gap down to $360 that might need filling. If it holds, a run back toward $480 is definitely on the table as we approach the January 28 earnings call.

- For the Long-Term Believer: You have to ignore the noise. Tesla is a volatile beast. If you believe in the Cybercab and the Energy segment (which is actually growing quite fast), pullbacks like the one we're seeing now are usually seen as "discount" entries.

- For the Skeptic: The P/E of 290 is your best friend. It is incredibly difficult to justify that valuation if revenue growth doesn't accelerate significantly in 2026.

Basically, the stock is in a "prove it" phase. The next few months—specifically the April Cybercab launch—will tell us if this $1.4 trillion valuation is a solid floor or a glass ceiling.

Before you make a move, take a look at your own risk tolerance. Tesla isn't a "set it and forget it" stock like a boring utility company. It’s a tech-heavy, ego-driven, high-beta bet on the future. Make sure you're okay with 20% swings in either direction before you dive in.

Next Steps to Take:

- Monitor the RSI: Check the Relative Strength Index for TSLA. It's currently around 41, which means it’s not quite "oversold" yet, but it's getting there.

- Mark Your Calendar: Set an alert for the January 28 earnings report. This will be the first real look at how much the late-2025 price cuts hurt (or helped) the bottom line.

- Watch the Macro: Keep an eye on the Fed. Tesla is highly sensitive to interest rates because most people still need a loan to buy a car, even a Cybercab.