Checking the exchange rate used to be a once-a-month thing for most people in Accra or Kumasi. Now? It’s a daily ritual. If you’re asking how much is 1 dollar in ghana currency right now, you aren't just looking for a number. You’re looking for a strategy.

As of January 14, 2026, the official exchange rate for 1 US Dollar is approximately 10.75 Ghana Cedis.

But wait. If you walk into a forex bureau in Osu or try to trade on the street, you’re going to see a different story. The "official" rate is basically a polite suggestion from the Bank of Ghana. The real-world rate—the one that actually affects the price of your fuel, your imported spare parts, and that iPhone you’ve been eyeing—is often a bit higher, sometimes touching 11.20 GH₵ depending on who you’re talking to.

Why the Cedi is Doing This Right Now

Honestly, the Cedi has been on a wild ride. Just a year ago, everyone was panicking. Inflation was hitting 23%, and it felt like the currency was in a freefall. Fast forward to early 2026, and things have... calmed down? Kinda.

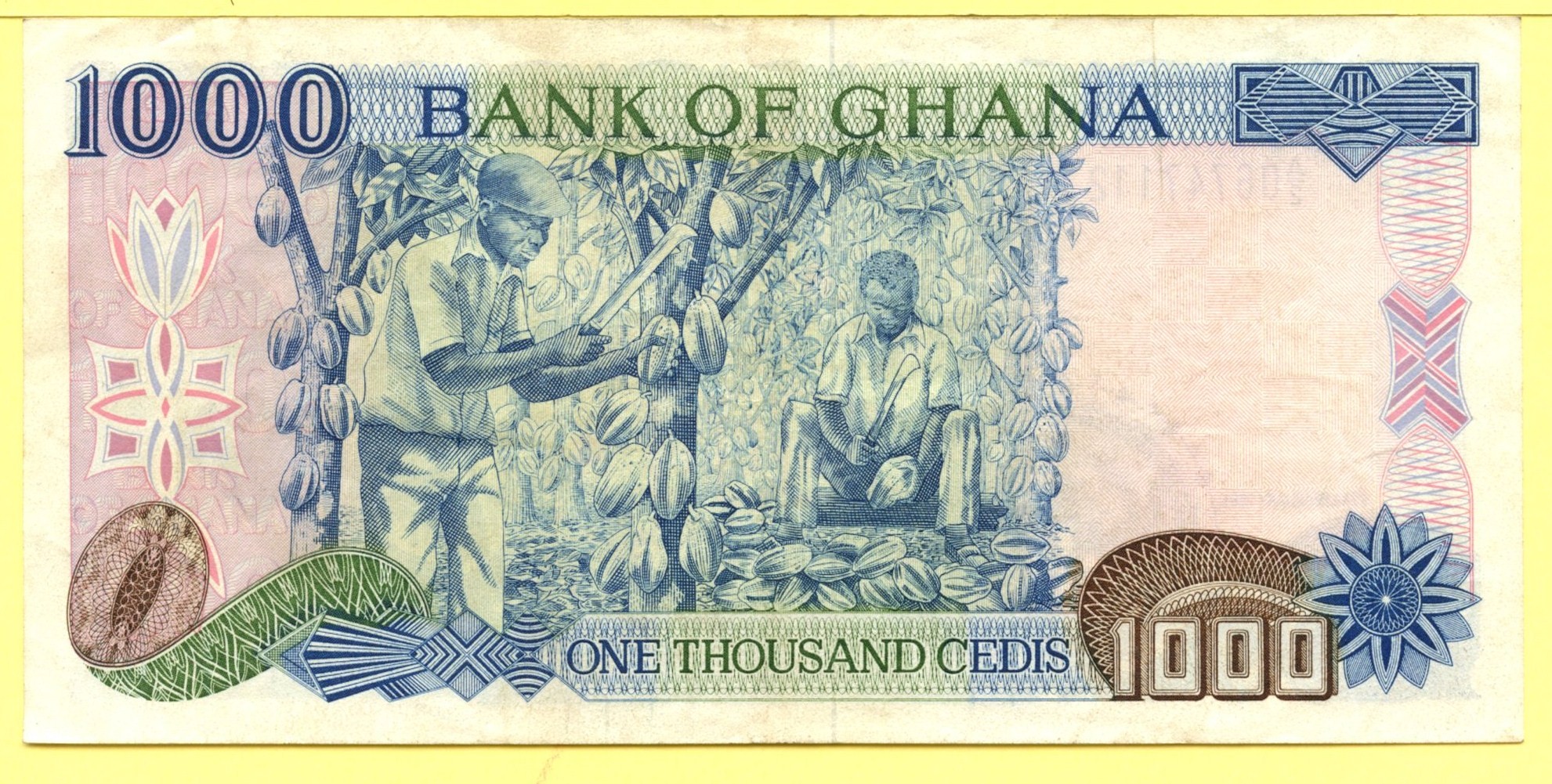

Ghana’s inflation actually dropped to 5.4% in December 2025, which is a massive win for the Bank of Ghana. They’ve been working overtime to stabilize things. High gold prices and a steady flow of cocoa exports have helped the central bank build up a "war chest" of reserves. When the Bank of Ghana has dollars in the vault, they can step in and stop the Cedi from crashing when everyone starts buying greenbacks at the end of the month.

But don't get it twisted. Even with "low" inflation, prices haven't actually gone back down. They’re just rising slower. A bag of cement or a gallon of oil is still expensive. The exchange rate is the heartbeat of the Ghanaian economy because we import almost everything. From the rice on your plate to the fuel in your tank, the dollar dictates the cost of living.

The Bureau vs. The Bank: The Price Gap

You've probably noticed that Google says one thing, but the guy at the counter says another. This isn't a scam; it's just the market.

Commercial banks like GCB or Standard Chartered usually stay close to the official rate, but they often have "limitations" on how many dollars they can actually sell you. If you need 20,000 USD for a business shipment, they might tell you to wait. That’s where the forex bureaus come in. They have the cash, but they charge a premium for the convenience.

In early 2026, the gap between the official rate and the bureau rate has narrowed significantly—down to about 3% or 4%. Back in the "bad days" of 2023 and 2024, that gap was a canyon. The narrowing of this gap is actually a huge sign of economic health. It means people aren't as desperate to dump their Cedis anymore.

What Really Drives the Exchange Rate in 2026

It isn't just "politics." It’s math.

- Cocoa and Gold: Ghana is a commodity powerhouse. When gold prices stay high (as they have recently), the Cedi gets a boost.

- The IMF Factor: Ghana is still under the watchful eye of the IMF. The 2026 budget targets a primary surplus of 1.5% of GDP. Basically, the government is trying to prove it can spend responsibly. Investors love this.

- Import Demand: Whenever there’s a big holiday or the start of a school term, businesses need dollars to restock. That’s when you’ll see the Cedi weaken slightly.

- Sentiment: This is the "vibe" check. If people think the Cedi will fall, they buy dollars. The act of buying those dollars actually causes the Cedi to fall. It’s a self-fulfilling prophecy.

The Reality of "Single-Digit" Inflation

Government officials love talking about the 8% inflation target. And sure, on paper, hitting 5.4% is impressive. But if you’re a trader at Makola Market, those numbers feel like a different language.

Specific items are still surging. In the last year, ginger prices went up 76%. Charcoal is up nearly 67%. While the exchange rate of 1 dollar in ghana currency has stayed relatively stable around the 10.75 mark, the cost of specific local goods is still volatile. This is the paradox of the 2026 economy: the currency is stable, but the kitchen table is still expensive.

Practical Advice for Handling Your Money

If you’re receiving remittances from the US or trying to save for a big purchase, timing is everything.

For Remittance Receivers: If you're getting money from family abroad via apps like Remitly, TapTap Send, or WorldRemit, check the "hidden" exchange rate. These apps often give a slightly lower rate than the interbank rate to cover their fees. Sometimes it's better to receive the money in USD (if you have a domiciliary account) and change it yourself at a bureau when the rate spikes.

👉 See also: Why is Costco Stock Down: What Most People Get Wrong

For Business Owners: Don't wait until the last minute to buy your forex. The Cedi tends to fluctuate at the end of each quarter. If the rate is sitting comfortably at 10.75, and you know you have an invoice due in March, buying now might save you a headache later.

Looking Ahead: Will it hit 12?

There’s always talk about the "dreaded 12." Will 1 dollar ever cost 12 Ghana Cedis?

Analysts at places like Fitch Solutions and local experts in Accra think the Cedi will stay within a range of 10.50 to 11.50 for most of 2026. Unless there’s a massive global shock—like another pandemic or a collapse in gold prices—the extreme volatility of the past seems to be over. The Bank of Ghana has been more aggressive with interest rates, currently holding at around 21.5% to keep the Cedi attractive to investors.

It’s a tough balance. High interest rates make the currency strong, but they make it almost impossible for local businesses to take out loans. It’s a "pick your poison" situation.

🔗 Read more: MSTY Stock Dividend History: What Most People Get Wrong About These Massive Payouts

Actionable Steps for Today

- Check the mid-market rate: Use a reliable financial site to see the "pure" value before you go to a bureau.

- Compare 3 bureaus: Rates in East Legon are often different from rates in Central Accra. A 10-minute drive can save you a few hundred Cedis on a large transaction.

- Keep an eye on the news: Watch for Bank of Ghana Monetary Policy Committee (MPC) announcements. If they cut interest rates too fast, the Cedi might start to slip again.

- Use Cedi-denominated investments: With inflation down to 5% and treasury bills still offering decent returns, it might actually be a good time to keep some money in local currency instead of hoarding dollars under a mattress.

The exchange rate is more than just a number on a screen. It’s a reflection of how the world views Ghana’s future. For now, that view is cautiously optimistic.

Stay updated by checking the Bank of Ghana’s daily bulletin for the most accurate official figures, and always verify with your local bank before committing to a large transfer. Knowing the current rate for 1 dollar in ghana currency is your best defense against market volatility.