If you just typed "how much is a share of S&P 500" into a search bar, you're likely seeing a big, intimidating number around $6,958. That's the current level of the S&P 500 index as of January 2026. But here’s the kicker: you can't actually "buy" a share of the index itself.

It’s not a stock. It’s a list.

Think of the S&P 500 like a high-end menu at a restaurant. The "price" you see on the news is basically the total cost of the meal, but you don't buy the menu—you buy the food. In the investing world, that means you buy ETFs or mutual funds that mimic the index. And the best part? Those "shares" don't cost $7,000.

How Much is a Share of S&P 500 via ETFs?

Since you can't buy the index directly, you look for Exchange-Traded Funds (ETFs). These are products created by companies like Vanguard, BlackRock (iShares), and State Street (SPDR) that hold all 500 stocks for you.

Right now, the prices for these "shares" are all over the place, even though they all track the exact same thing. For example, as of mid-January 2026, a single share of VOO (Vanguard S&P 500 ETF) is trading around $638. Meanwhile, SPY (the SPDR S&P 500 ETF Trust) is hovering closer to $692.

Why the difference? It's just math.

Each fund uses a different "slice" size. If the S&P 500 were a giant pizza, VOO might be cut into 10 slices while SPY is cut into 9. The pizza is the same; the slices just weigh different amounts. Honestly, for a retail investor, the share price matters way less than the expense ratio, which is the fee the company charges you to manage the fund.

Vanguard’s VOO and iShares’ IVV are famous for being dirt cheap, charging around 0.03%. That means for every $10,000 you invest, you’re only paying $3 a year in fees. That’s basically free.

The Secret to Buying "Half" a Share

If $600+ still feels like too much to drop at once, don't sweat it. Most modern brokerages like Fidelity, Schwab, or Robinhood allow for fractional shares.

Basically, you can tell the app, "I have $50, give me $50 worth of the S&P 500." They’ll give you a tiny sliver—like 0.078 of a share. This is the ultimate "no excuses" way to start. You don't need to wait until you have thousands of dollars saved up. You just start.

Is 2026 a Weird Time to Buy?

Kinda. We’re currently seeing the S&P 500 hit record highs, recently crossing that 6,900 mark. Some analysts at Goldman Sachs are actually predicting the index could rally another 12% this year, potentially eyeing 7,500 or higher.

But there’s a flip side.

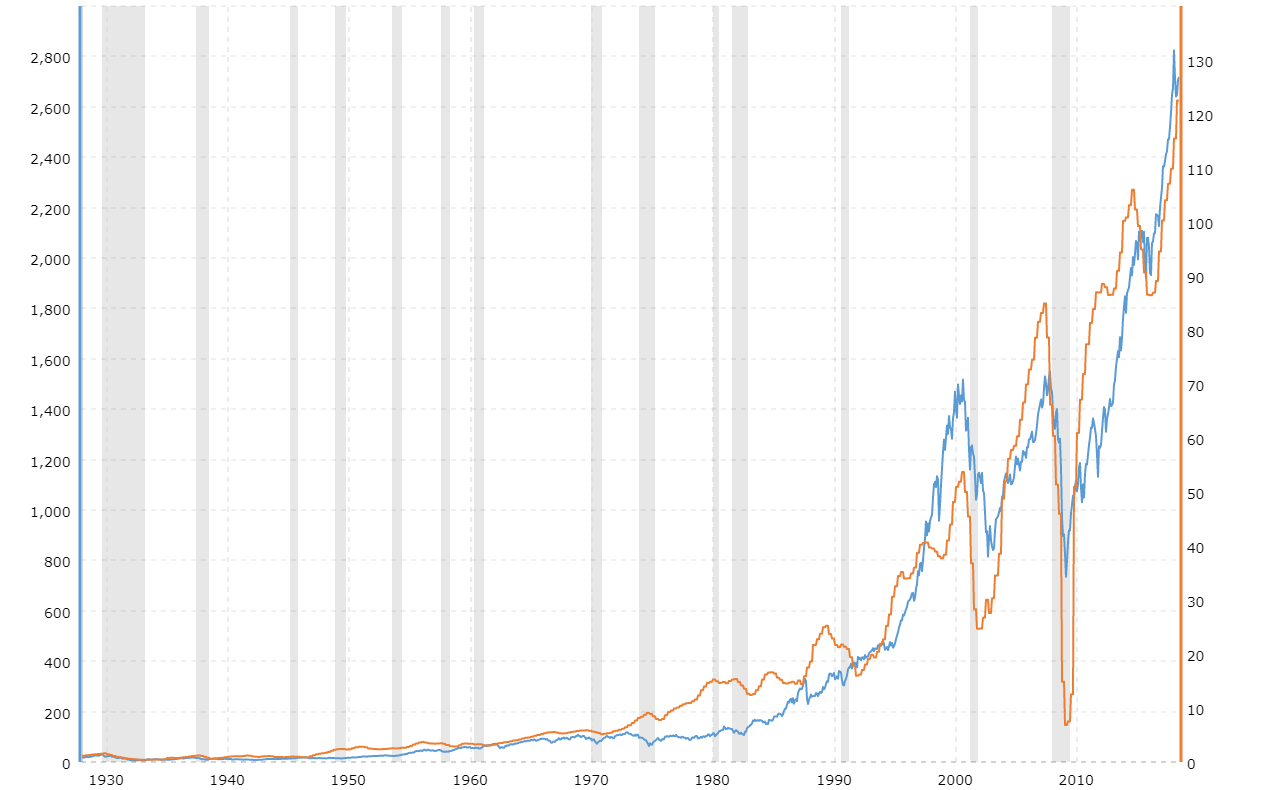

The Shiller PE Ratio (a fancy way of measuring if the market is "expensive") is currently sitting near 40. Historically, that’s really high. The last time it stayed this high for long was during the dot-com bubble. Does that mean a crash is coming tomorrow? Not necessarily. It just means the "price" of the S&P 500 is high relative to the actual earnings of the companies inside it.

Breaking Down the "Price" Logic

When you ask how much is a share of S&P 500, you're really asking about the value of the 500 largest US companies combined.

- The Index Value: This is the ~6,958 number. It’s a weighted average.

- The ETF Price: This is the ~$638 (for VOO) or ~$692 (for SPY). This is what you actually pay on an app.

- The Minimum Investment: This is often $1 if your broker supports fractional trading.

What Actually Moves the Price?

The S&P 500 isn't just a random number; it's heavily influenced by the "Magnificent Seven" and big tech. Since the index is market-cap weighted, companies like Apple, Microsoft, and Nvidia have a massive say in whether the price goes up or down.

📖 Related: Why 125 West 26th Street is the Chelsea Office Space Everyone is Chasing

If Nvidia has a bad day because of a shift in AI chip demand, the S&P 500 "share" price is going to feel it, even if 400 other smaller companies in the index had a great day. That's one of the few critiques of the index—it's become a bit top-heavy lately.

Actionable Steps to Get Started

If you're ready to move past just looking at the price and actually want to own a piece of it, here is how you do it effectively in 2026:

- Check your brokerage for "Fractional Shares": If they don't offer them, you'll need the full ~$640 to buy one share of VOO. If they do, you can start with $5.

- Look at the Ticker, Not the Price: Don't get distracted by SPY being $692 and VOO being $638. Look at the Expense Ratio. IVV and VOO are almost always the better long-term bets for regular people because they cost less to hold.

- Automate It: Set up a "recurring buy." This is the "secret sauce." If you buy a little bit every month, you don't have to worry if the price is $6,900 or $6,200. You're "dollar-cost averaging," which just means you're buying more when it's cheap and less when it's expensive.

- Use a Tax-Advantaged Account: If you’re doing this for retirement, buy your S&P 500 shares inside a Roth IRA. You won't pay a dime in taxes on the gains when you retire.

The S&P 500 has historically returned about 10% per year on average over many decades. It’s not a get-rich-quick scheme, but it’s arguably the most reliable wealth-builder in history. The best price for a share is usually the one you paid five years ago—the second best is whatever it's trading at today.