You remember when IBM was just that "dinosaur" company your dad worked for? The one that made those clunky ThinkPads and then sort of faded into the background while Apple and Google took over the world? Well, something weird happened while we weren't looking. IBM—or International Business Machines if you’re being formal—has staged one of the most aggressive comebacks in tech history.

As of mid-January 2026, IBM is worth approximately $283 billion in terms of market capitalization.

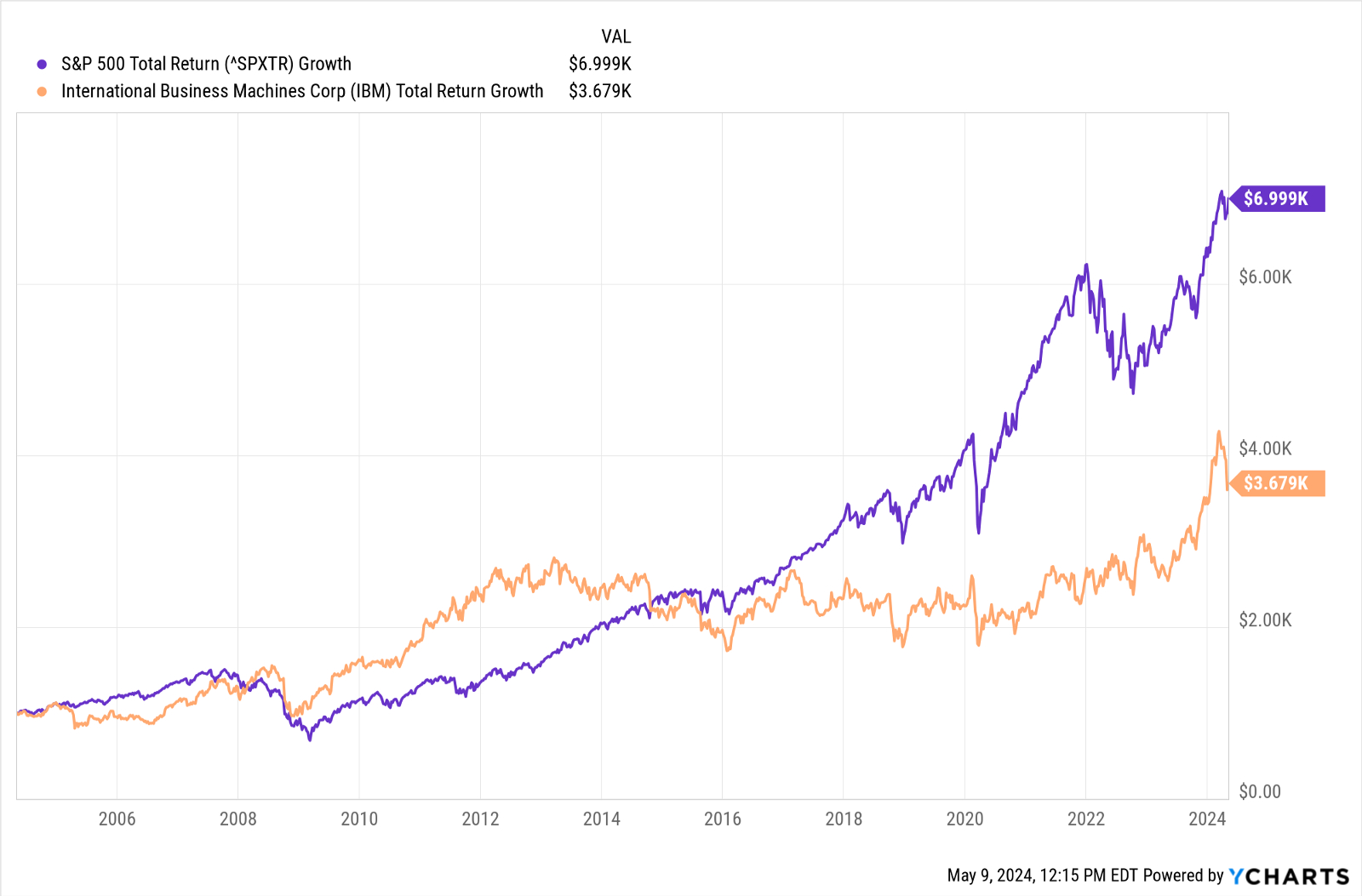

That’s a massive number, especially considering that just a couple of years ago, people were practically writing the company’s obituary. Its stock price is hovering around $303 to $305 per share, which is flirting with all-time highs. It’s a complete 180-degree turn from the decade of stagnation that defined the 2010s. Honestly, if you’d told a Wall Street analyst in 2018 that IBM would be a darling of the AI era, they probably would have laughed you out of the room.

✨ Don't miss: Is There a PNC Bank in Atlantic City? What Most People Get Wrong

The Real Math: Breaking Down the $283 Billion Tag

When people ask "how much is IBM worth," they usually mean the market cap—the total value of all its shares. But that's kinda like looking at the price of a house without checking the mortgage or the cash in the basement.

To get the full picture, we have to look at the Enterprise Value (EV). For IBM, the EV is actually higher than the market cap, sitting closer to $329 billion. Why the gap? Because IBM carries a fair amount of debt—about $66 billion—balanced against roughly $14 billion in cash.

- Market Cap: ~$283.4 Billion

- Enterprise Value: ~$329.2 Billion

- Share Price: ~$303.16

- Annual Revenue (TTM): ~$65.4 Billion

You've got to realize that IBM isn't just one thing anymore. It’s a three-headed beast: Software, Consulting, and Infrastructure. The software side is the real money-maker now. We’re talking about profit margins that make the old hardware days look like a lemonade stand. Software alone grew about 10% in late 2025, and that’s where the "worth" is really coming from.

Why the Valuation is Spiking Right Now

It’s basically all about AI. But not the "write me a poem about a cat" kind of AI. IBM has leaned hard into what they call "Agentic AI" and "Sovereign AI."

While everyone else was focused on chatbots, IBM’s CEO Arvind Krishna doubled down on watsonx. This is the platform that big banks and government agencies use because they don't want their data leaking into a public model. By early 2026, IBM’s generative AI "book of business"—which is essentially their backlog of signed contracts—hit over $9.5 billion.

That’s not just hype; that’s actual, spendable cash.

Then there’s the mainframe. You’d think the mainframe would be dead by now, right? Nope. The z17 series, which is set to launch later this year, is basically a supercomputer designed specifically to run AI models locally. Big corporations are terrified of sending their secret sauce to the cloud, so they’re buying these massive machines to keep everything in-house. This "Infrastructure" segment spiked 17% recently, which is insane for a business that’s over a century old.

The Red Hat Factor

You can't talk about IBM's value without mentioning the $34 billion they spent on Red Hat back in 2019. At the time, everyone thought they overpaid. They didn't. Red Hat is the glue that allows IBM to sell "hybrid cloud" services. Basically, it lets companies run their apps anywhere—on Amazon's servers, Microsoft's servers, or their own private basement servers. Without Red Hat, IBM’s current valuation would probably be half of what it is today.

Is IBM Overvalued at $283 Billion?

This is where it gets tricky. If you look at the Price-to-Earnings (P/E) ratio, IBM is trading at around 35x.

For comparison, that’s higher than the IT industry average of about 29x. Some analysts, like the folks at Goldman Sachs, have a "Buy" rating with a price target of $350, suggesting the company still has room to grow. They’re projecting that IBM will generate more than $15 billion in free cash flow in 2026.

On the flip side, some more cautious observers (the "bears") argue that the stock is slightly overvalued. Simply Wall St, for example, puts the "fair value" closer to $277 per share. They worry that if the AI hype cools down even a little bit, IBM’s stock could take a hit because it’s priced for near-perfection right now.

Comparisons at a Glance:

- IBM: $283B Market Cap | 35.1x P/E

- Accenture: $170B Market Cap | 22.4x P/E

- Oracle: $575B Market Cap | 27.5x P/E

IBM is actually "pricier" than Accenture right now relative to its earnings. That tells you that investors aren't just buying a steady dividend payer anymore; they’re betting on IBM as a high-growth tech leader.

The Quantum Wildcard

There is one more thing that could make that $283 billion look like pocket change in five years: Quantum Computing.

🔗 Read more: NT Taiwan to USD: Why the Exchange Rate is Acting So Weird Lately

IBM is currently the leader in this space. They’ve partnered with AMD to bridge traditional supercomputing with quantum chips. Right now, quantum doesn't make much money. It's mostly research. But if IBM manages to build a "fault-tolerant" quantum computer by their 2029 goal, they could own the foundation of the next century of computing.

It’s a moonshot. But it’s a moonshot that is already baked into the current valuation to some degree.

How to Gauge IBM’s Worth for Yourself

If you're trying to figure out if this company is actually worth the price of admission, stop looking at the stock ticker for a second. Look at these three things instead:

- Free Cash Flow (FCF): IBM is a cash machine. They use this money to pay dividends (currently yielding around 2-3%) and to buy other companies. If FCF stays above $14-$15 billion, they are healthy.

- The AI Backlog: Watch that $9.5 billion GenAI number. If it keeps growing every quarter, the "growth" story is real.

- The z17 Mainframe Cycle: When IBM releases a new mainframe, they usually get a huge bump in revenue. The late 2026 launch will be a massive "make or break" moment for their infrastructure division.

IBM has spent the last five years cleaning up its balance sheet and spinning off its slower-moving parts (like Kyndryl). What’s left is a leaner, much more profitable version of "Big Blue." Whether it's worth $283 billion or $350 billion depends entirely on whether you believe AI belongs in the hands of the public or in the highly regulated, hyper-secure world where IBM lives.

Next Steps for Tracking IBM's Value:

Check the upcoming Q4 2025 earnings report on January 28, 2026. This will be the definitive moment where we see if the $15 billion cash flow projection is actually on track. Specifically, look for the "Software" revenue growth percentage—if it's below 8%, the market might rethink that $300+ stock price. If it's over 10%, $350 might be closer than we think.