You've probably seen your neighbor bragging about a five-grand windfall or your coworker grumbling because they owe the IRS a hundred bucks. It’s a weird annual ritual. We all sit around wondering how much tax refund should I get while staring at a screen full of numbers that seem like they were written in ancient Greek.

Here is the truth: a huge refund is actually kind of a failure.

Think about it. You’re essentially giving the government an interest-free loan for twelve months. They take your money, hold onto it, and then give it back later without adding a single cent of interest. It feels like a "bonus," but it’s just your own paycheck returning home after a long, pointless vacation in Washington D.C. Most financial planners, like those you’ll find quoted in the Wall Street Journal or Forbes, will tell you that the "perfect" refund is zero. You want to break even. But let’s be real—most of us use that refund as a forced savings account.

The Average Numbers for 2026

If you’re looking for a benchmark, the IRS data usually tells a consistent story. In recent filing seasons, the average refund has hovered somewhere between $2,800 and $3,200. Does that mean you should expect three grand? Not necessarily. Your specific number depends on a chaotic mix of your income bracket, how many kids you have running around, and whether you decided to sell that crypto back in July.

The 2025 tax year (which we are filing for now in early 2026) saw some subtle shifts in standard deductions. For single filers, that amount jumped to $15,000. If you’re married filing jointly, you’re looking at $30,000. These aren't just dry numbers; they are the "floor" of your tax-free income. If you earned less than that, you basically shouldn't owe federal income tax at all, though you’re still on the hook for Social Security and Medicare.

📖 Related: Gary Howe Bank of America: What Really Happened Behind the Headlines

Why Your Refund Varies So Much

It’s all about the W-4. You remember that form? The one you filled out in a HR office five years ago and haven't touched since? That single piece of paper dictates everything. If you claimed "0" or "1" back when the form used "allowances" (which they don't anymore, by the way), you might be over-withholding.

The Credits That Change the Game

Credits are the holy grail of tax season. Unlike deductions—which just lower the amount of income you’re taxed on—credits are a dollar-for-dollar reduction of your tax bill.

The Child Tax Credit is the big one. For 2025/2026, the credit remains at $2,000 per qualifying child. However, only a portion of that ($1,700) is usually refundable. This means if you owe zero in taxes, the government will actually send you a check for that refundable portion. It’s one of the few ways to get back more money than you actually paid in.

Then there’s the Earned Income Tax Credit (EITC). This is specifically for low-to-moderate-income working individuals and couples, particularly those with children. If you’re a single filer with three kids and earned under $60,000, you could see a massive boost to your refund, sometimes upwards of $7,000. It’s meant to be a safety net, but the rules are notoriously complex. One tiny typo on your filing can trigger an audit or a long delay.

The Impact of Side Hustles

In 2026, almost everyone has some kind of secondary income. Maybe you’re driving for a delivery app or selling vintage clothes on Depop. This is where people get crushed. If you’re an independent contractor (1099), nobody is withholding taxes for you.

I’ve seen people expect a $2,000 refund because of their "day job" only to realize their side hustle wiped it out. You owe about 15.3% in self-employment tax on those earnings. That covers the employer and employee portions of Social Security and Medicare. If you didn't pay quarterly estimated taxes, don't be shocked if your "refund" turns into a bill. It’s a brutal realization.

Misconceptions About Tax Brackets

"I don't want a raise because it'll put me in a higher tax bracket and I'll take home less money."

I hear this constantly. It’s flat-out wrong.

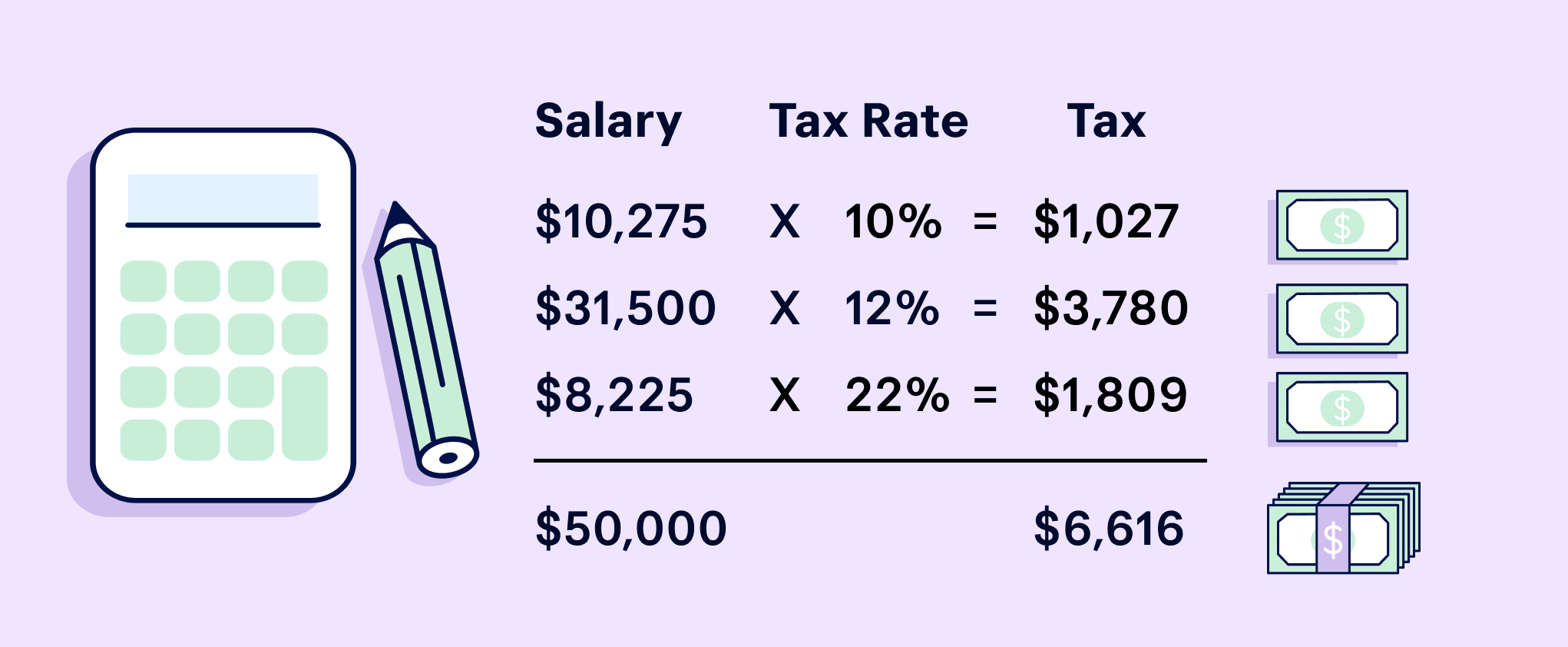

We use a progressive tax system. If you move from the 12% bracket to the 22% bracket, only the money inside that new bracket is taxed at the higher rate. You never end up with less total money because you earned more. However, moving into a higher bracket can affect your eligibility for certain phase-out credits, which is where the confusion usually starts.

How to Calculate Your "Real" Expected Refund

Stop guessing. If you want to know how much tax refund should I get, you need to look at your last paystub of the year.

✨ Don't miss: Egyptian Pound to American Dollar: Why the Rates Are Moving Now

- Look at your "Federal Tax Withheld" YTD (Year-to-Date).

- Look at your "Adjusted Gross Income."

- Subtract your standard deduction ($15,000 for singles, $30,000 for couples).

- Apply the tax rates (10%, 12%, 22%, etc.) to the remaining amount.

- Subtract your credits (Child Tax Credit, etc.).

If the number in Step 4/5 is lower than the number in Step 1, you’re getting a refund. If it’s higher, you’re writing a check. It’s basic math, but the tax code hides it behind five hundred pages of jargon.

What to Do If Your Refund Is Huge

If you get back $5,000, celebrate for a second, then get to work. You are overpaying the IRS by about $416 every single month. That is money that could be sitting in a High-Yield Savings Account (HYSA) earning 4% or 5% interest (depending on the 2026 market rates).

Go to your payroll department. Ask for a new W-4. Use the IRS Tax Withholding Estimator tool—it’s actually one of the few government websites that doesn't feel like it was designed in 1995. Adjust your withholding so your paycheck is bigger every month and your refund is smaller in April. You’ll have better cash flow, and you won't be begging the government to give your own money back to you.

Actionable Steps for This Tax Season

- Gather the 1099-K forms. The IRS has been back and forth on the $600 threshold for third-party payment processors like Venmo and PayPal. In 2026, ensure you have these documents ready if you sold goods or services.

- Check your HSA and 401(k) contributions. You have until the filing deadline (usually April 15) to contribute to a traditional IRA or an HSA to lower your 2025 taxable income. This is a last-minute lever you can pull to increase your refund.

- Verify your bank info. A huge percentage of "missing" refunds are just people who typed their routing number wrong. Double-check it. Triple-check it.

- Look for State-specific credits. Many states, like California or New York, have their own versions of the Earned Income Tax Credit or renter's credits that can add several hundred dollars to your total take-home.

- Don't ignore the "Quality" of the filer. If your tax situation involves rental properties, K-1s from a business, or complex stock options, don't use the cheapest software. An Enrolled Agent (EA) or a CPA can often find enough deductions to pay for their own fee.

The goal isn't just to get a big check. The goal is to understand your financial flow so you aren't surprised when the deadline hits. Whether you owe or you're owed, knowing the "why" behind the number is the only way to stay in control of your bank account.