Look. Everyone wants free money. When you see an ad promising a Chase direct deposit bonus worth $200, $300, or even $900, it feels like a no-brainer. But if you’ve ever hung out on Reddit’s r/banking or r/churning, you know the "simple" process of opening an account and getting paid is actually a minefield of fine print. People get denied. They miss the window. They realize, too late, that their "direct deposit" didn't actually count as one.

Chase is the biggest bank in the country. They don't give away cash because they're nice; they do it because they want your primary financial relationship. If you're going to take their money, you have to play the game by their specific rules. Honestly, it’s not even that hard once you stop skim-reading the terms and conditions.

What Is the Chase Direct Deposit Bonus Anyway?

Usually, Chase offers a cash incentive for new customers to open a Chase Total Checking® account. Sometimes there are offers for the Secure Banking or Premier Plus tiers, but Total Checking is the bread and butter. You open the account, you move your paycheck over, and a few weeks later, a credit appears in your balance.

The amount fluctuates. During most of the year, $200 or $300 is the standard. However, during "high season" for bank marketing—usually around the start of a new quarter—you’ll see "stacked" offers. These might give you $300 for checking and $200 for savings, plus a $400 kicker if you do both. That’s $900. Total. Just for switching banks.

But here is the catch. You can't just be a "new" customer in the sense that you don't have an account today. Chase defines a "new" customer as someone who hasn't had an open account in the last 90 days and hasn't received a checking boneus in the last two years. If you closed a Chase account last month and try to hop back in for the bonus, you're going to be disappointed. They track this by your Social Security number with surgical precision.

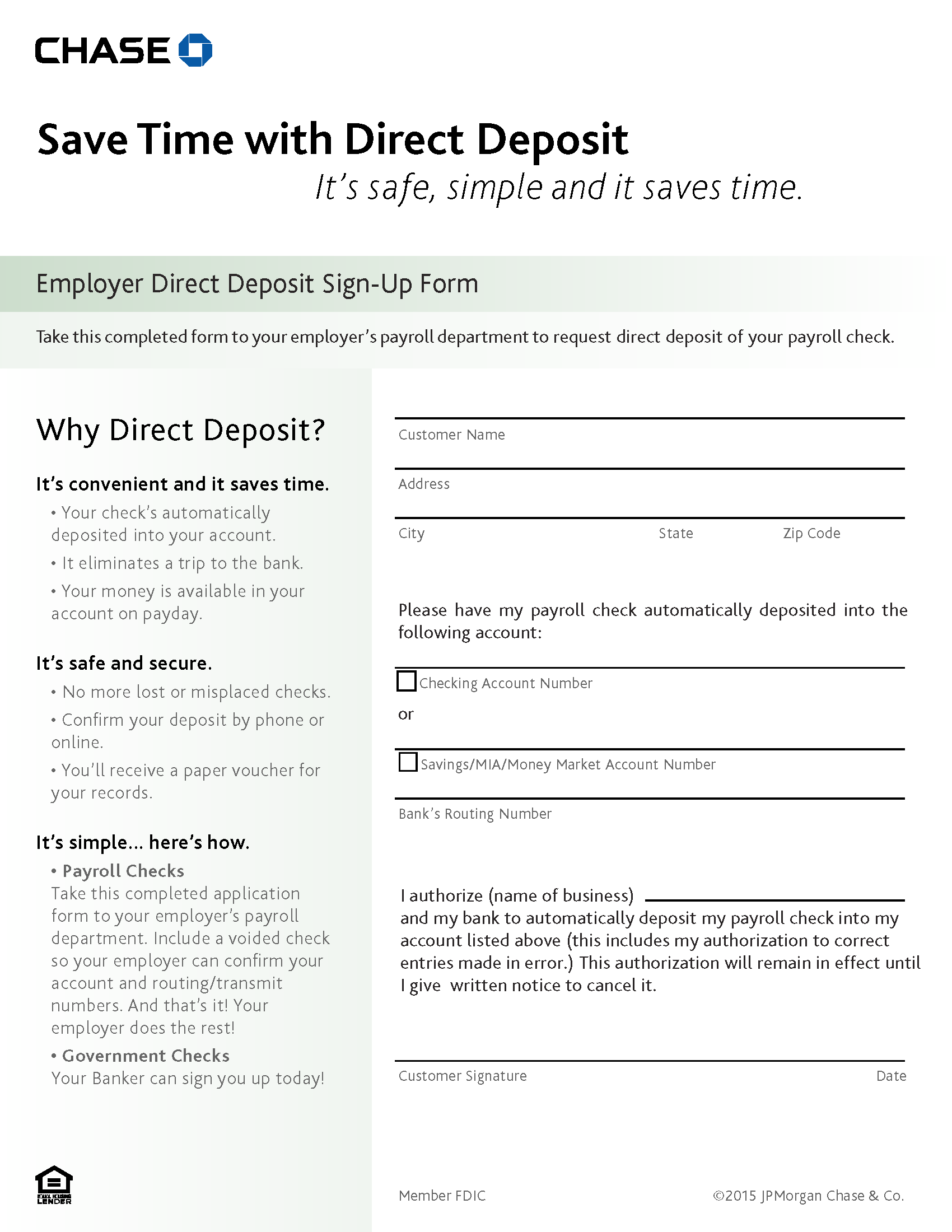

The Definition of a "Qualifying" Direct Deposit

This is where 80% of people fail. You can't just Zelle yourself $500 from your Wells Fargo account and call it a day. Chase is looking for an Automated Clearing House (ACH) transfer. Specifically, it needs to be an electronic deposit of your paycheck, pension, or government benefits (like Social Security) from your employer or the government.

Standard peer-to-peer transfers? No.

Moving money from your brokerage account? Usually no.

Depositing a check at the ATM? Definitely no.

Some people try to "game" this by using ACH transfers from other banks. While some "push" transfers from institutions like Capital One or Alliant have historically triggered the bonus, Chase has become much better at filtering these out. If the transaction description doesn't look like a payroll deposit, the system might ignore it. If you want the money without the stress, just use your actual workplace payroll portal.

The 90-Day Clawback Reality

Banks hate "hit and run" customers. If you get your Chase direct deposit bonus and immediately close the account, Chase will likely take the money back. Their standard terms usually state that the account must remain open for at least six months. If you close it before that 180-day mark, they reserve the right to deduct the bonus amount from your closing balance.

🔗 Read more: Nancy Pelosi Net Worth: Why the Numbers Keep Changing in 2026

Think about it from their perspective. They are paying $300 to acquire you. If you leave in three months, they lost money. They aren't a charity.

Also, keep an eye on the monthly fees. The Total Checking account has a $12 monthly service fee. You can waive this easily if you keep a $1,500 daily balance or have $500 in total monthly direct deposits. If you stop your direct deposit after the bonus hits, and your balance drops to zero, those $12 fees will eat your "free" money alive. By the time the six months are up, your $300 bonus might only be $228.

Why Your Application Might Get Denied

Not everyone gets approved for a Chase account. It’s a common misconception that banks only check your credit score. While they might do a "soft pull" on your credit (which doesn't hurt your score), they primarily use ChexSystems.

ChexSystems is like a credit bureau, but specifically for bank accounts. It tracks:

- Unpaid overdraft fees at other banks.

- Accounts closed for "cause" (fraud or suspicious activity).

- How many bank accounts you've tried to open recently.

If you’ve been "bank hopping" too much lately to grab every bonus in sight, Chase might flag you as a risk. They want loyal customers, not professional bonus hunters. If you have a "frozen" ChexSystems report, you'll need to thaw it before applying, or the automated system will spit out a rejection instantly.

🔗 Read more: Cracker Barrel New Logo: What Really Happened with the Old Timer

Step-by-Step: How to Execute This Properly

- Find the right link. Never just go to Chase.com and open an account. You need the specific coupon code. Search for the current public offer or check sites like Doctor of Credit, which track these daily.

- Apply online or in-branch. If you apply online, take a screenshot of the offer page. Seriously. If the bonus doesn't post, you want proof of the terms you agreed to.

- Fund the account. You usually need to put at least a small amount in to get started.

- Switch your payroll. Go to your HR portal at work. Set up a partial direct deposit if you don't want to move your whole check. Even $500 is usually enough to trigger the bonus and waive the fee.

- Wait. The bonus typically lands within 15 days of the qualifying deposit hitting your account, though the official terms say it can take up to 15 business days.

Is the Bonus Taxable?

Yes. This isn't a "gift." It's considered interest income. Come January of next year, Chase will send you a 1099-INT form. You will have to report that $300 (or whatever the amount was) as income on your tax return. If you're in a high tax bracket, you might only see about $200 of that bonus after Uncle Sam takes his cut. It’s still free money, but it’s not "tax-free" money.

Surprising Details Most People Miss

One thing people rarely talk about is the "Old Account" ghost. If you had an account with Chase ten years ago and it ended on bad terms—maybe a forgotten $20 overdraft—that record is still in their internal system. Even if it's off your ChexSystems report, Chase has a long memory. They might let you open the account, but they might freeze it three days later once the "back office" does a manual sweep.

Also, the "Direct Deposit" doesn't have to be one single check. It's usually a cumulative amount within a certain timeframe (often 90 days from account opening). However, verify the specific wording of your offer. Some "Premier" offers require a massive $10,000+ deposit, which is a different beast entirely.

What to Do If the Bonus Doesn't Show Up

If it’s been 20 days and you see nothing, don't panic. First, check your "Statements and Documents" tab in the Chase app. Look for a PDF of the original offer.

Then, use the Secure Message Center. Don't call the general customer service line first; the people on the phone are often reading from the same screens you see. A secure message creates a paper trail. Use phrases like, "I opened this account under offer code [XYZ] and completed my qualifying direct deposit of $[Amount] on [Date]. Please investigate why the promotional credit has not posted."

Most of the time, it's a simple glitch or your employer's payroll was coded as a "Standard Transfer" instead of "Payroll." If you can prove it's a paycheck, Chase is usually pretty good about manually pushing the bonus through.

Next Steps for Your Money

First, verify your eligibility by checking if you've received a Chase bonus in the last 24 months. If you’re clear, grab a screenshot of the current highest offer—don't settle for the $200 if a $300 version is available. Once you open the account, immediately set up a calendar alert for 181 days in the future. This ensures you don't close the account too early and trigger a clawback. Finally, confirm with your HR department how long it takes for a direct deposit change to take effect so you don't miss the 90-day qualification window.