Wait. Let’s clear the air before we even look at a Texas tax refund estimator. Most people landing here are looking for a big check from the state government. I hate to be the bearer of bad news, but Texas is one of the few states that famously has no personal income tax. If you’re looking for a state-level income tax refund, you’re looking for a ghost. It doesn't exist.

However, that doesn't mean "Texas tax refunds" are a myth. It just means the money is hiding in different pockets—mostly property tax relief, franchise tax credits for business owners, or sales tax exemptions.

Why Everyone Gets Confused

Texas is weird. We love to brag about no income tax, but our property taxes are some of the highest in the country. Because of this, the term "refund" usually refers to federal returns or specific state-level rebates that target homeowners. If you use a generic Texas tax refund estimator online, it’s almost certainly calculating your Federal 1040 return based on the fact that you live in a state with no state-level withholding.

See, when you don't pay state income tax, your federal itemized deductions look different. You get to choose between deducting state income tax (which is zero here) or state sales tax. For most Texans, the sales tax deduction is a massive win. That’s where a real estimator earns its keep.

The Federal Connection

Most people searching for a Texas tax refund estimator are actually trying to figure out how much the IRS owes them. Since Texas doesn't take a cut of your paycheck, your take-home pay is higher than it would be in California or New York. But come April, you still have to settle up with Uncle Sam.

If you’re a W-2 employee in Austin or Dallas, your employer withholds federal taxes. If they withheld too much, you get a refund. Simple. But if you’re a 1099 contractor—and there are millions in the Lone Star State—you’re likely paying quarterly estimated taxes. An estimator for these folks isn't just a "fun tool" to see how much "bonus money" is coming; it’s a survival guide to ensure they don't get hit with underpayment penalties.

The IRS uses a progressive tax bracket system. For 2025 and 2026, those brackets have shifted slightly to account for inflation. If you made $60,000, you aren't taxed at one flat rate. You’re taxed in chunks. The first chunk at 10%, the next at 12%, and so on. A good Texas tax refund estimator should account for the Standard Deduction, which for 2026 has climbed again. If your tool is using 2023 numbers, it's garbage. Throw it away.

Property Tax: The Real Texas "Refund"

In 2023, Texas voters approved a massive $18 billion property tax cut. This is the closest thing most Texans will ever get to a "state refund." It didn't come as a check in the mail, though. It came as a reduction in the school district tax rate and an increase in the homestead exemption.

If you’re trying to estimate a refund on property taxes, you’re actually looking for a "tax protest" outcome. In counties like Harris, Travis, or Bexar, the appraisal districts (HCAD, TCAD) often overvalue homes. If you protest your appraisal and win, your "refund" is the lower tax bill you pay at the end of the year.

There are also specific programs like the Texas Property Tax Deferral for seniors or disabled veterans. For those individuals, an estimator helps determine how much of their tax burden can be pushed into the future or eliminated entirely. It's a different kind of math. It's heavier.

Businesses and the Franchise Tax

If you own a business in Texas, the "refund" conversation changes entirely. The Texas Franchise Tax is the primary way the state collects revenue from companies. However, many small businesses fall under the "no tax due" threshold.

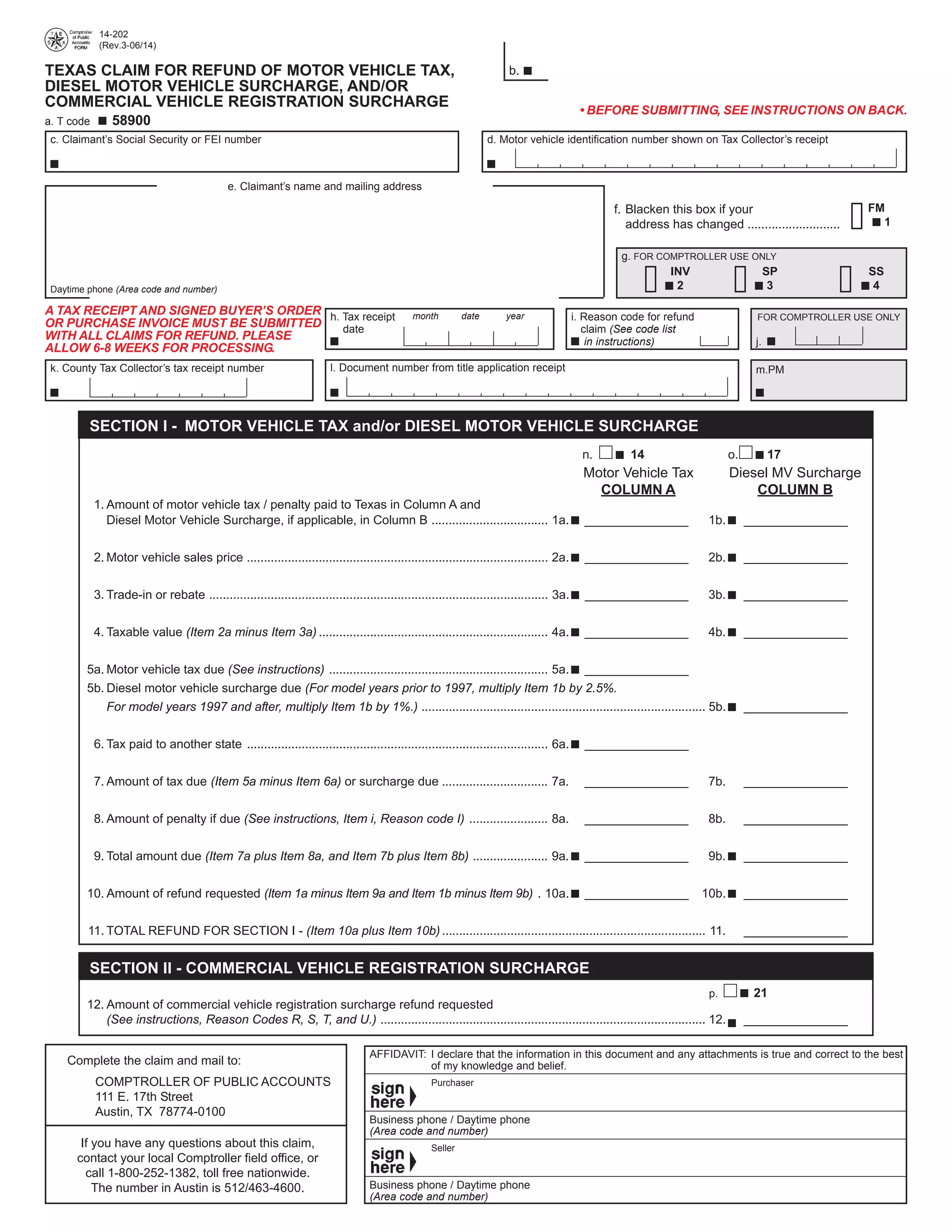

If you overpaid your franchise tax or qualify for research and development (R&D) credits, you can actually file for a refund with the Texas Comptroller of Public Accounts. Glenn Hegar, the current Comptroller, oversees this process. It is paperwork-intensive. You’ll need more than a simple web slider to figure this out; you’ll need a copy of your Form 05-163 and a lot of patience.

The Sales Tax Deduction Hack

This is the part most people miss. Because Texas doesn't have an income tax, the IRS allows you to deduct the sales tax you paid throughout the year on your federal return. You have two ways to do this:

🔗 Read more: Where Did Nike Start? The Real Story Behind Blue Ribbon Sports and the Waffle Iron

- The Easy Way: Use the IRS optional sales tax tables. It’s a flat amount based on your income and number of dependents.

- The Hard Way: Keep every single receipt for every single thing you bought in Texas all year.

If you bought a truck, a boat, or a massive amount of materials for a home renovation, the "Hard Way" might actually result in a much higher federal refund. A Texas tax refund estimator that includes a field for "major purchases" is worth its weight in gold.

Common Mistakes When Estimating

I see it every year. People get excited by a number on a screen and then reality hits.

First off, people forget about the "kiddie tax" or changes in the Child Tax Credit. If you're counting on the 2021-era expanded credits, stop. We’re back to the standard rules now.

Secondly, people ignore capital gains. If you sold some Bitcoin or a rental property in Fredericksburg, that profit is taxable at the federal level. Texas won't touch it, but the IRS sure will. If you don't input those gains into your Texas tax refund estimator, your "estimated refund" will be thousands of dollars off.

👉 See also: Walgreens Pharmacy Stock Ticker Symbol: Why You Can’t Find It Anymore

Lastly, there's the issue of residency. If you moved to Texas halfway through the year from a state like Illinois, you still owe Illinois taxes for the months you lived there. You can't just claim "Texas resident" for the whole year to skip out on your old state's bill. The states talk to each other. They will find you.

What to Look for in a Tool

Don't trust any tool that asks for your Social Security number right away. That's a scam. A legitimate estimator should only need:

- Gross Income

- Filing Status (Single, Married Filing Jointly, etc.)

- Number of Dependents

- Total Federal Tax Withheld (from your W-2)

- Significant Deductions (Mortgage interest, charitable giving)

If it’s a state-specific tool for property taxes, it should ask for your CAD (Central Appraisal District) account number or your property’s last appraised value.

The Bottom Line on Texas Taxes

Texas is a "low tax, high fee" state. We don't have the income tax, but we pay for it elsewhere. Your refund is almost always going to be a federal event.

Honestly, the best way to "estimate" your refund is to look at your last pay stub of the year. Look at the total federal tax withheld. If that number is higher than your projected tax liability (roughly 10-22% for most middle-class earners), you’re getting money back.

If you are self-employed, stop hoping for a refund. Focus on "owing zero." In the world of 1099 work, owing zero is the ultimate win. It means you managed your cash flow perfectly.

💡 You might also like: México y Corea del Sur: El eje inesperado que está moviendo al mundo

Practical Next Steps

- Check your last pay stub. Look at the "Federal Withholding" line. If it’s zero, you aren't getting a refund unless you qualify for refundable credits like the EITC.

- Gather big-ticket receipts. If you bought a vehicle in Texas this year, find the sales contract. The sales tax paid on that vehicle can be added to your federal deduction.

- Verify your Homestead Exemption. Go to your county’s appraisal district website. If you don't see "Homestead: Yes" on your primary residence, you are literally throwing money away. File the paperwork immediately; it's free.

- Use the IRS Interactive Tax Assistant. Instead of a random third-party Texas tax refund estimator, use the official IRS tools to check your eligibility for specific credits.

- Adjust your W-4. If your refund is massive (over $5,000), you're giving the government an interest-free loan. Change your withholding so you get that money in your paycheck every month instead.

Texas tax laws don't change as fast as federal ones, but the 2023 property tax overhaul is still rippling through the system. Stay on top of your local school district’s tax rate, as that is where the majority of your Texas tax "savings" will actually manifest.