You’re standing there with a paper check in your hand and the bank doors are locked. It’s 8:00 PM on a Tuesday. You need that money, or at least you need it sitting in your balance so you can pay rent. Can you actually cash a check at an ATM? The answer is usually yes, but it’s rarely as "instant" as hand-to-hand combat with a teller. Most people think they’re going to walk away with a pocket full of twenties immediately. Sometimes that happens. Often, it doesn't.

Banking has changed. Honestly, the days of those little paper envelopes are mostly gone. Modern machines—the ones Chase, Wells Fargo, and Bank of America have been rolling out—can read the check directly. They use Optical Character Recognition (OCR). It’s basically a scanner that looks at the MICR line (those weird numbers at the bottom) and figures out who is paying you and how much. But there are rules. If you don't know the rules, the machine might just spit your check back out, or worse, hold your funds in "limbo" for three business days while you stress about your electric bill.

Can You Really Cash a Check at an ATM for Immediate Cash?

Let's get real about "cashing" versus "depositing." When you cash a check at an ATM, you are asking the bank to trust that the piece of paper is real before they've actually cleared it with the other bank. Most ATMs will let you deposit a check, but getting the full amount in green bills right then and there is a different story.

Usually, banks have a "cutoff time." If you hit the machine at 11:00 PM, that deposit probably won't even start processing until the next morning.

Here is how it typically breaks down: your bank might give you the first $200 or $500 immediately. This is called "available funds." The rest stays behind a digital curtain until the check officially clears. If you're a long-time customer with a high balance, they might give you more. If you just opened the account last week? Good luck. They might hold the whole thing.

What You Need Before You Start

Don't just walk up to the machine and shove the paper in. You've got to prep. First, flip that check over. Sign the back. This is the "endorsement." If you want to be extra safe, write "For Deposit Only" under your signature along with your account number. This prevents someone else from cashing it if you happen to drop it in the parking lot.

You also need your debit card. You can't just talk to the machine. You need your PIN. It sounds obvious, but you’d be surprised how many people forget their PIN when they’re in a rush.

The Step-by-Step Reality of Using the Machine

Every machine is a bit different. Some have a single slot for everything. Others have a specific slot for checks and another for cash.

- Slide your card in and enter your PIN. Do not let the person behind you see your fingers moving.

- Look for the "Deposit" or "ATM Check Cashing" option.

- Choose the account. Usually, this is your primary checking.

- Insert the check. Most modern machines don't need envelopes. Just slide the check in flat. If it’s wrinkled, flatten it out on your leg first. The scanner is sensitive.

- Confirm the amount. The screen will usually show a digital image of your check and ask, "Is this $152.50?" If the OCR misread a "7" as a "1," fix it now.

- Decide if you want cash back. This is the crucial moment. If the bank allows it, the screen will ask if you want a portion of the check in cash.

Wait for the receipt. Always. Get the one with the image of the check printed on it. If the machine eats your check and loses the data, that receipt is your only weapon in the fight with customer service.

Why Your Check Might Get Rejected

It happens. You try to cash a check at an ATM and the machine makes a grinding noise and spits it back at you like it’s offended.

Why? Maybe the corners are folded. Maybe your signature is too light. Sometimes, the check is just too old. Most checks have a "void after 90 days" or "six months" rule. If you’ve been keeping a birthday check from your grandma in your visor for half a year, the ATM is going to reject it. Also, third-party checks—where Bob signs a check over to you—are almost never accepted at an ATM. You’ll have to see a human for that.

Limits and Holds: The Fine Print Nobody Reads

According to the Electronic Fund Transfer Act (Reg E) and the Expedited Funds Availability Act (Reg CC), banks have specific timelines they have to follow. But they have "exceptions."

If you deposit a $5,000 check at an ATM, don't expect to withdraw $5,000 five minutes later. The bank is going to place a hold on that. Large deposits are risky for them. They want to make sure the person who wrote the check actually has the money.

- Standard Holds: Usually 1-2 business days for the first chunk.

- Extended Holds: Can be up to 7 business days for large amounts or accounts that are frequently overdrawn.

If you’re using a "foreign" ATM—meaning an ATM that doesn't belong to your bank—expect even longer delays. In fact, many out-of-network ATMs won't let you deposit checks at all. They only want to give you cash (and charge you a $4.00 fee for the privilege).

Check Cashing at Retail ATMs

You might see ATMs at 7-Eleven or CVS that claim they can cash checks. These are often operated by companies like FCTI or are part of the MoneyPass network. Some of these utilize specialized software to verify checks on the spot. They usually charge a flat fee or a percentage. It’s expensive. You might pay $5 just to get your own money, but if the bank is closed and you’re desperate, it’s an option.

🔗 Read more: Logos Ethos Pathos Advertising Examples: Why Most Marketing Fails to Move the Needle

Real-World Tips for Success

I've seen people lose their minds because an ATM "stole" their check. To avoid being that person, do this:

Check the screen for a "No Deposits" message. Sometimes the machine is full. If the "Deposit" button is grayed out, don't try to force it.

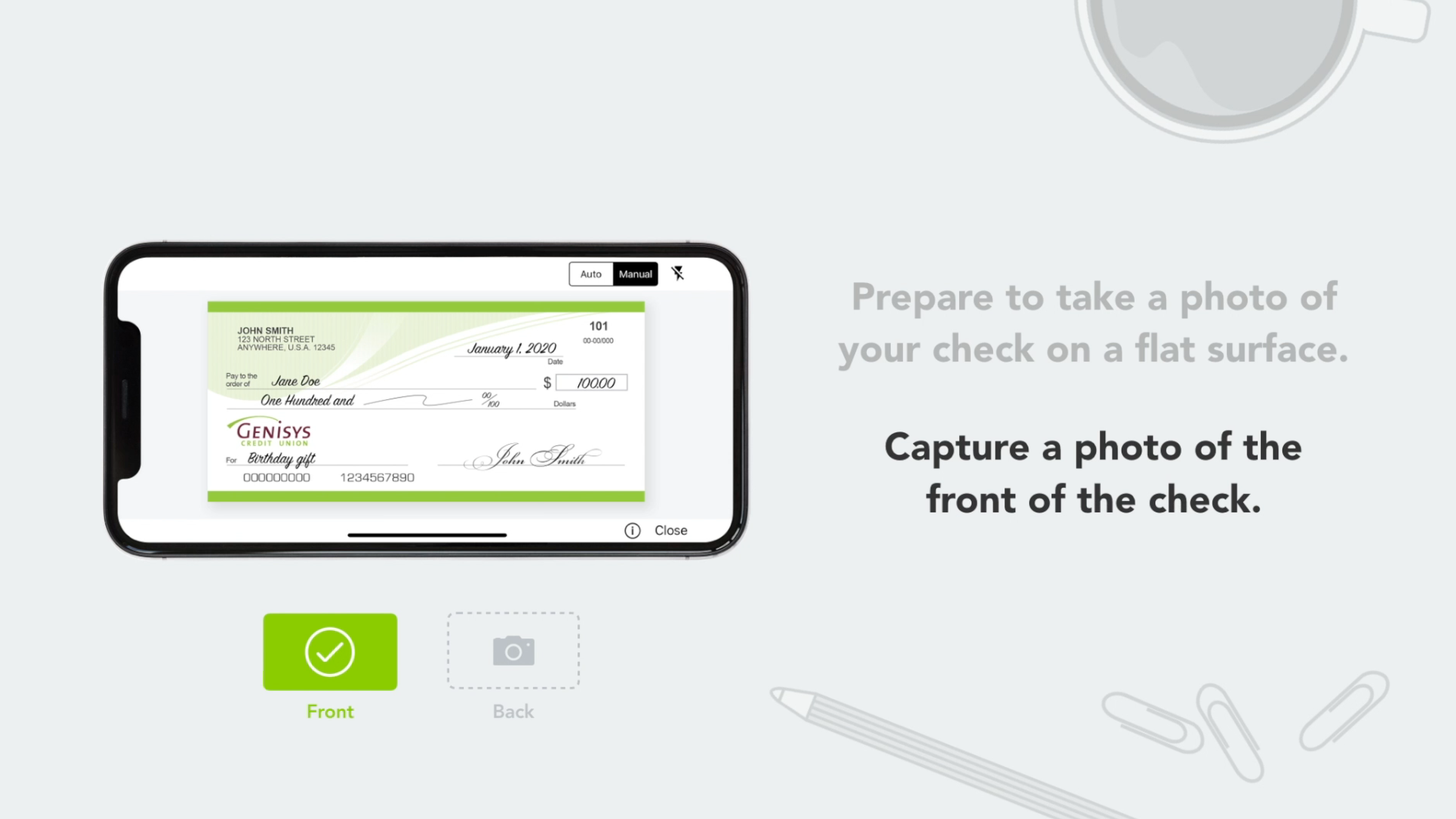

Use the app first. Honestly, most big banks (Chase, Capital One, etc.) have mobile apps that let you take a photo of the check. If the app accepts it, you don't even have to leave your couch. Then, once the funds are "available," you can go to the ATM and just withdraw the cash normally. This is way safer than feeding a physical check into a machine that might jam.

Watch out for the "Business Day" trap. A "business day" ends way earlier than you think. At many banks, if you deposit after 2:00 PM or 3:00 PM on a Friday, that check doesn't even start its journey until Monday morning. You won't see that money until Tuesday or Wednesday.

Actionable Next Steps

If you need to cash a check at an ATM right now, here is your checklist:

- Verify the ATM belongs to your bank. This ensures the fastest possible processing time and avoids extra fees.

- Inspect the check. Look for tears, stains, or very light ink. If the check looks like it went through a washing machine, don't put it in the ATM. Go to a teller.

- Sign and endorse correctly. Use blue or black ink. Pencil will not work; the scanner can't see it well.

- Check your "Available Balance" after the transaction. Don't just assume the money is there. Log into your banking app and see how much is actually "available" versus "pending."

- Keep your receipt until the money is fully cleared. Don't throw it in the trash can next to the ATM. Take it home.

If the ATM refuses the check, your next best bet is a grocery store service desk (like Kroger or Walmart) or a dedicated check-cashing store, though they will charge you a fee. Otherwise, wait for morning and talk to a teller. It’s annoying, but it’s better than having a check stuck in a broken machine over the weekend.