Waiting is the worst part. You hit "submit" on that Sapphire Preferred or Freedom Flex application, the screen spins for three seconds, and then... nothing. Instead of an instant "Approved," you get the dreaded message saying they need more time to review your request. Now you're stuck wondering if you messed up your income stated on the form or if your credit score took a random dip. Honestly, most people just sit and wait for a letter in the mail, but that’s a waste of time. You can actually check on Chase credit card application status yourself, and usually, you can find out the decision way before the postal service shows up at your door.

Chase is a bit of a black box. They have these internal rules—like the famous 5/24 rule—that can trip up even the most seasoned churners. If you aren't familiar, 5/24 basically means Chase won't approve you for a new card if you’ve opened five or more personal credit cards from any issuer in the last 24 months. It doesn't matter if your score is 850. If you’re over that limit, it's a "no."

The Fastest Ways to Get Your Answer

Don't just stare at your email inbox. Chase isn't always quick with the digital notifications. The most reliable way to check on Chase credit card application status is actually the automated phone line. It’s boring, yes. It's a robot voice, absolutely. But it is updated frequently—often more frequently than the online portal.

💡 You might also like: Kuwaiti Dinar to Pakistani Rs: Why the Rate Is More Than Just a Number

You can reach the automated status line at 1-800-432-3117. You'll need to provide your Social Security number. Once you're in, the machine will tell you one of a few things. If it says you'll receive a decision in "two weeks," that is generally a very good sign. It usually means you’re on the verge of an approval. If it says "7 to 10 days," brace yourself. That’s the classic code for a rejection, though it sometimes just means they need to verify your identity or address. If it says "30 days," they’re still processing it. It's neutral territory.

Using the Chase Mobile App or Website

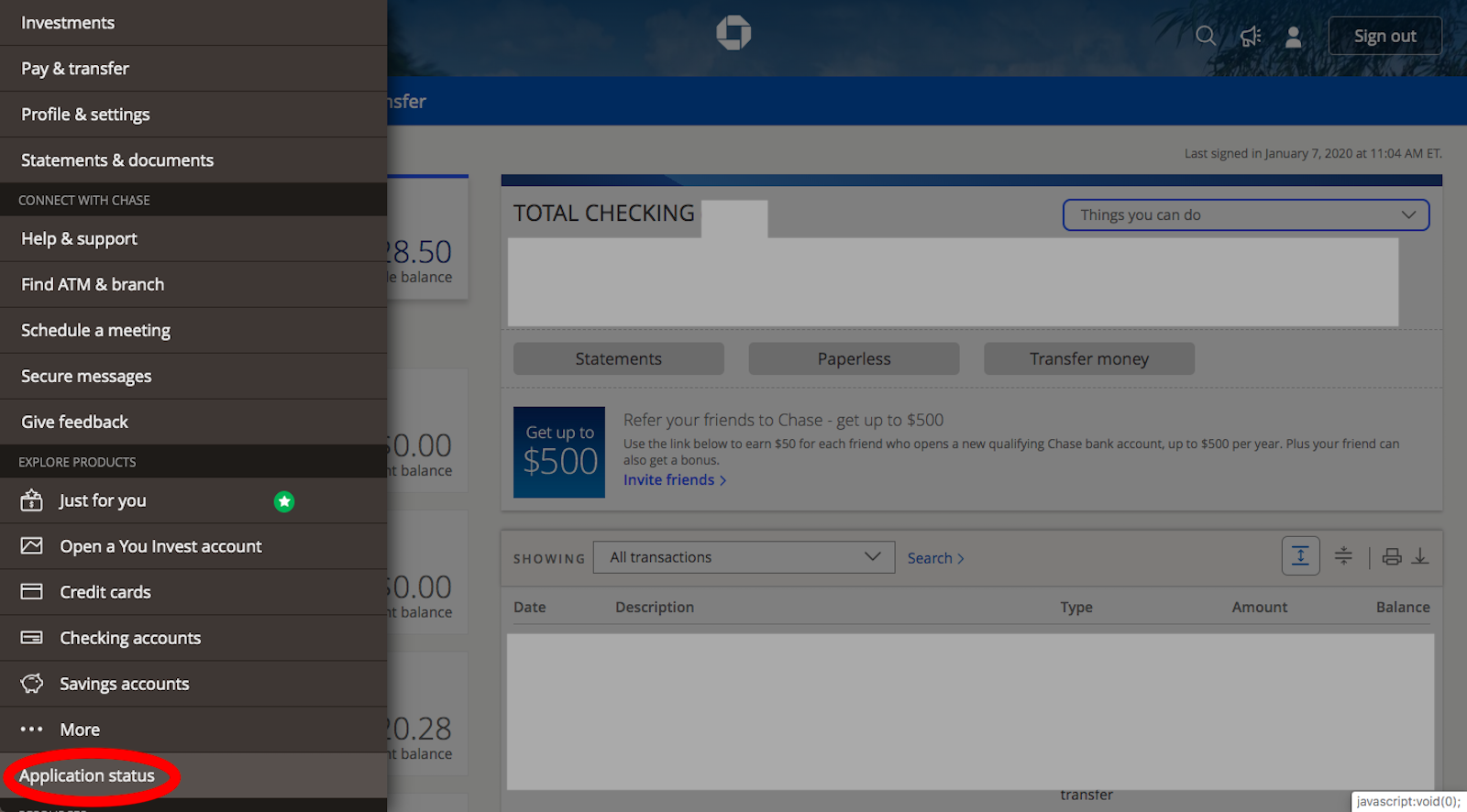

If you already have a Chase account for checking or another credit card, things are easier. Log in. Go to the "Main Menu" (those three little lines). Look for "Credit Card Programs" and then "Application Status." It’s right there. Sometimes the app updates before the phone line, but in my experience, the phone line is the "source of truth" for the backend system.

What if you aren't a Chase customer yet? You're sort of flying blind on the digital front unless you received a specific application ID. This is why the phone line is the universal equalizer. It works for everyone.

Understanding the "7 to 10 Days" Message

Let's talk about the "7 to 10 days" thing because it scares everyone. Rightfully so. In the world of Chase, that timeline usually implies a denial letter is being drafted and mailed. But don't panic yet.

Sometimes, Chase just needs to make sure you are who you say you are. With identity theft being so rampant, banks are twitchy. They might just want you to upload a photo of your Social Security card or a utility bill to prove your residence. If you hear "7 to 10 days" on the automated line, you might want to bypass the robot and talk to a human in the reconsideration department.

The Reconsideration Line: Your Secret Weapon

This is where the real "pro" move happens. If you find out you were denied, or if your application is stuck in "7 to 10 day" limbo, you can call the Chase Reconsideration Line.

- Personal Cards: 1-888-270-2127

- Business Cards: 1-800-453-9719

When you call, you aren't calling to complain. You're calling to provide "additional information." Maybe they denied you for "too much credit" with Chase. You can offer to move some of the credit limit from your existing Freedom card to the new Sapphire card. They love that. It takes the risk off them because they aren't giving you new credit; they're just shifting it around.

Be prepared. They might ask why you want the card. Don't say "for the 60,000-point bonus." Say you like the travel protections or the specific category multipliers. Be a person, not a bot. I’ve seen people turn a "no" into a "yes" in five minutes just by being polite on this line.

Why Your Application Might Be "Pending"

Chase is weirdly conservative for being one of the biggest banks in the world. Even if you have a high income, they might pause an application for the smallest reasons.

- The 5/24 Rule: As mentioned, this is the big one. If you've opened 5 cards in 24 months, the system auto-rejects.

- Recent Inquiries: If you just applied for three other cards last week, Chase sees that as a "bust-out" risk. They think you're desperate for cash.

- Credit Report Freeze: This happens all the time. You forgot you froze your Experian report, Chase tried to pull it, and they got a big fat "Access Denied." If this is the case, you need to thaw your credit and then call them to re-run the application.

- Inconsistent Data: If the address on your application doesn't match what Experian has on file, the system flags it for manual review.

Decoding the Timeline

Timing is everything. If you check on your application and it's been more than two weeks, something is likely wrong. Chase usually moves faster than that.

The "two-week" message on the phone line is the holy grail. I’ve checked my status before and heard "you will be notified of our decision in two weeks," and literally two hours later, the card showed up in my mobile app as "Active."

Business cards are a different beast. If you're applying for an Ink Business Cash or Preferred, the review process is often manual. They might want to know about your "business." Pro tip: Even a side hustle selling stuff on eBay counts as a sole proprietorship. If they call to ask about your business revenue, be honest but prepared with your numbers.

Actionable Steps for a Quick Decision

If you’re sitting there right now wondering what to do, follow this exact sequence to check on Chase credit card application status efficiently:

- Check your email first. Look for a "Welcome" email or a "Thank you for applying" email. Sometimes the approval is buried in there.

- Call the automated line at 1-800-432-3117. Do this once a day. No more, no less. Over-calling doesn't help.

- Log into your Chase Portal. If you see a new card account that you didn't have yesterday, congratulations. You're approved.

- If you hear "7-10 days," call Reconsideration immediately. Don't wait for the letter. By the time the letter arrives, the "window" for an easy override might have closed.

- Have your documents ready. If they ask for proof of income, have your recent W2 or 1099 as a PDF ready to upload to their secure message center.

Checking your status doesn't have to be a stressful experience. Most of the time, the delay is just a human at a desk in Ohio or Delaware needing to click "OK" on a screen. If your credit is in good shape and you haven't gone overboard with new accounts lately, you’re likely fine. Just stay on top of the communication and don't be afraid to talk to a real person if the robot gives you bad news.

Once you get that "Approved" notification, keep an eye out for the card. Chase usually sends them via USPS, which takes 3-5 days, but for premium cards like the Sapphire Reserve, they often overnight it via UPS or FedEx for free. If you're in a hurry to meet a spending requirement, you can even ask them to expedite shipping on a lower-tier card once you’re approved—they'll often do it if you ask nicely.

Stay proactive. Use the tools they provide. Most importantly, don't let a "pending" status ruin your week. It's just a part of the game.