You're probably staring at a massive stack of Becker or Roger textbooks and feeling like the walls are closing in. It happens to everyone. Passing the CPA exam isn't really about being a genius at accounting—it's about managing your calendar without losing your mind. Honestly, most people fail not because they don't understand GAAP, but because their CPA exam study schedule was a total work of fiction from day one. They plan for twelve-hour days that never happen. They ignore the fact that they have a job, a life, or a need for sleep.

Let's be real. If you’re working at a Big Four firm or a mid-tier regional, your time isn't your own. Audit season will chew up your weekends. Tax deadlines will leave you fried. If you try to stick to a rigid, robotic schedule during those months, you’re going to crash. Hard.

Why Your Current CPA Exam Study Schedule Is Probably Failing You

The biggest mistake? Treating every section of the exam like it's the same. It's not. FAR (Financial Accounting and Reporting) is a different beast than Audit (AUD) or Regulation (REG). If you allocate 100 hours to each just because it sounds balanced, you’re setting yourself up for a nasty surprise when you realize how much content is actually in FAR.

Most candidates try to do "the marathon method." They study for six months for one section. Don't do that. You’ll forget everything you learned in month one by the time you sit for the exam. The brain has a funny way of dumping debits and credits if you don't use them. Instead, you need a condensed, high-intensity window. Think six to eight weeks per section.

You’ve got to account for the "Evolve" factor too. The AICPA updated the exam structure in 2024 with the CPA Evolution model. Now you have the Core (FAR, AUD, REG) and your Discipline (BAR, ISC, or TCP). Your CPA exam study schedule has to adapt to these specific niches. If you're taking Information Systems and Controls (ISC), your schedule should look very different than if you're tackling Business Analysis and Reporting (BAR).

The "Micro-Study" Myth and Reality

People tell you to "study in the gaps." Listen, reading a single page of a textbook while waiting for your Starbucks latte isn't studying. It's performative productivity. True learning requires deep work. You need at least 90-minute blocks where your phone is in another room.

However, there is a place for "gap" work. Flashcards on your phone during a commute? Great for memorizing the criteria for a capital lease. Doing a full simulation (TBS) while eating lunch? Terrible idea. You won't focus, you'll get frustrated, and you'll end up hating your lunch and the accounting profession simultaneously.

Breaking Down the Hours: What the Data Actually Says

NASBA and the AICPA don't give a "magic number" of hours, but the general consensus among successful candidates is somewhere between 300 and 400 total hours across all four sections.

💡 You might also like: 1 South Korean Won in Rupees Explained: Why the Rate is Shifting Right Now

- FAR: 100-120 hours. It’s huge. It’s dense. It’s the "Gatekeeper."

- REG: 90-110 hours. Tax law changes, and the sheer volume of rules for basis calculations can be overwhelming.

- AUD: 70-90 hours. It’s less about math and more about logic and "reading the question carefully."

- Disciplines: 60-80 hours, depending on your background.

If you’re working full-time, that means 15-20 hours a week. That’s two hours on weeknights and a heavy lift on Saturdays. Sunday? Take it off. Seriously. If you don't give your brain a rest day, your retention rates will plummet. You'll start reading the same sentence five times without it sinking in. We’ve all been there.

The Saturday Slog

Your Saturday is your secret weapon. But don't just sit there for eight hours. Use the Pomodoro technique, or something like it. Study for 50 minutes, walk around for 10. Every three hours, take a long break. Go outside. Talk to a human who doesn't know what a consolidated balance sheet is.

Tackling the "Core" Before the "Discipline"

Should you take FAR first? Most experts, including the folks at UWorld and Wiley, usually suggest it. Why? Because FAR provides the foundation for almost everything else. If you understand the financial reporting in FAR, AUD becomes significantly easier to conceptualize.

If you build your CPA exam study schedule with FAR at the end, you're going to be exhausted by the time you reach the hardest material. Get the big one out of the way while your motivation is still high. It’s a huge psychological win. Imagine walking into the rest of the year knowing you've already conquered the mountain.

👉 See also: Chadd Ritenbaugh Black Car Service: What’s Actually Going On?

What about the new Disciplines?

This is where it gets tricky. If you’re a tax person, take TCP (Tax Compliance and Planning) right after REG. The overlap is massive. It’s basically REG Part 2. Don’t wait six months and let that knowledge leak out of your brain.

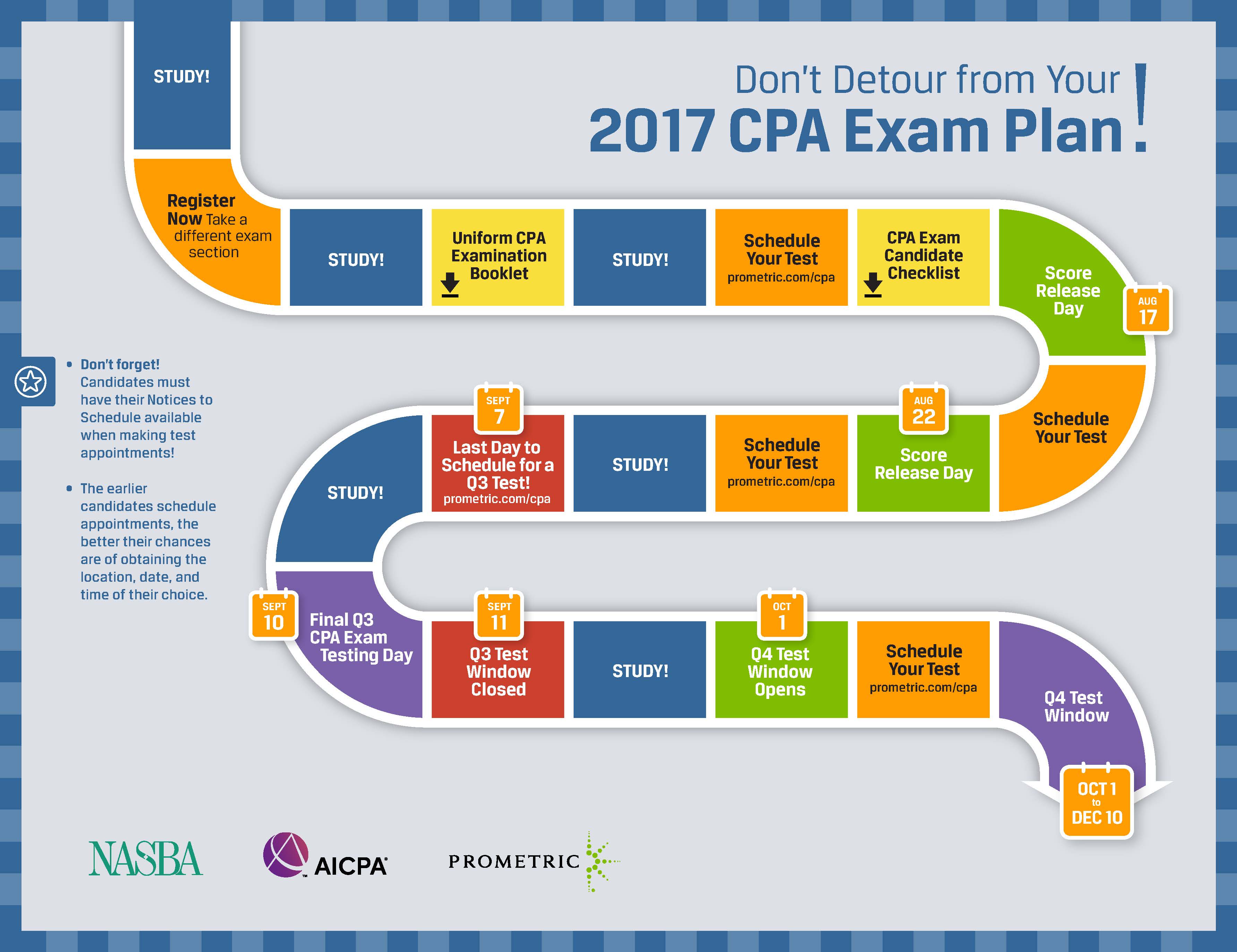

If you're more into data and tech, ISC is your best bet. But remember, the Disciplines are only offered in specific windows throughout the year. Your CPA exam study schedule must be built around the AICPA testing windows. You can't just decide to take an exam on a Tuesday in October if the window is closed. Check the NASBA website constantly. Dates change.

The Mental Game: Why Schedules Break

Life happens. Your car breaks down. Your boss dumps a last-minute project on your desk. Your kid gets sick.

When your schedule breaks, don't try to "catch up" by pulling an all-nighter. All-nighters are the enemy of memory consolidation. If you miss a Tuesday, just move Tuesday's tasks to Wednesday and accept that your exam date might slide by a few days. It's better to postpone an exam by a week than to fail it because you rushed the final review.

The "Final Review" phase is the most critical part of your CPA exam study schedule. This should be the last two weeks before your test. During this time, you aren't learning new material. You're doing cumulative sets of 30 multiple-choice questions (MCQs) and practicing Task-Based Simulations.

A Warning About MCQs

Do not memorize the answers. It’s a trap. You’ll start recognizing that "C" is the right answer for the question about the governmental fund. That doesn't mean you know the material. It means you have good pattern recognition. If you can't explain why the other three answers are wrong, you aren't ready.

Real-World Advice for the Busy Professional

If you’re in public accounting, talk to your manager. Most firms actually want you to pass. They might give you "study hours" or at least not schedule you for a 14-hour shift the day before your exam.

🔗 Read more: Gold Rate Today in Hyderabad India: Why Local Prices Just Hit a New Peak

Use your mornings. I know, it sucks. But your brain is freshest at 6:00 AM before the emails start rolling in. If you can knock out 90 minutes of study before work, you've already won the day. Even if the rest of your day goes to hell, you've made progress.

Actionable Steps to Build Your Plan Today

- Pick your first exam date. Don't "wait until you're ready." You'll never feel ready. Pick a date eight weeks out and pay the fees. Money is a great motivator.

- Audit your time. Track your actual activities for three days. You’ll be surprised how much time you waste scrolling on TikTok or watching Netflix. That’s your study time.

- Map out the "Big Rocks." Put your work deadlines, birthdays, and weddings on the calendar first. Then, fit the CPA exam study schedule around them.

- Buy a physical calendar. There’s something about crossing off a day with a red marker that feels immensely satisfying.

- Focus on "Weak Areas" early. Don't keep practicing the stuff you're good at just to feel smart. If you hate Pensions, spend more time on Pensions.

- Simulate the environment. At least twice during your study journey, take a full-length practice exam in a quiet room, without your notes, and with a timer. You need to build "sitting stamina."

The CPA exam is a test of endurance more than anything else. It's about showing up when you don't want to. It's about choosing the library over the bar. It's a short-term sacrifice for a long-term career boost that honestly changes your earning potential forever. Just take it one module at a time. Stop looking at the 400 hours and start looking at the next 60 minutes. That’s how you actually get those three letters after your name.