You've probably been there. It’s 11 PM on a Tuesday, you’re staring at your bank statement, and you have absolutely no idea where that $84.50 went. Was it a subscription? A grocery run that got out of hand? Or maybe that "one-time" treat that turned into a weekly habit. This is exactly why people go searching for an excel transaction tracker template. They want clarity. They want to stop the bleeding. But honestly, most of the templates you find online are either too bloated with macros that break or so simple they're basically a digital sticky note.

Money is stressful. Tracking it shouldn't be.

If you’re looking for a way to actually manage your cash flow without paying for a monthly SaaS subscription that—ironically—adds to your expenses, Excel is still the king. It’s private. It’s customizable. And unlike those "smart" apps, it doesn't sell your data to advertisers.

Why an Excel Transaction Tracker Template Beats Your Banking App

Most people think their banking app is enough. It’s not. Your bank shows you what happened, but it doesn't help you plan what will happen. A bank statement is a post-mortem; an Excel sheet is a strategy.

When you use an excel transaction tracker template, you’re forced to engage with your spending. There’s this psychological concept called "friction." When you manually enter a transaction—or even just categorize it yourself—you feel the weight of that purchase. It’s a reality check. Apps like Mint (rest in peace) or YNAB are great, but they often automate things so much that you stop paying attention. You just glance at a green bar and move on.

Excel lets you build a system that fits your brain. Maybe you don’t care about "utilities" as a broad category. Maybe you want to see exactly how much you’re spending on specific streaming services versus electricity. You can do that. You can't really do that in a rigid app interface.

The Anatomy of a Tracker That Actually Works

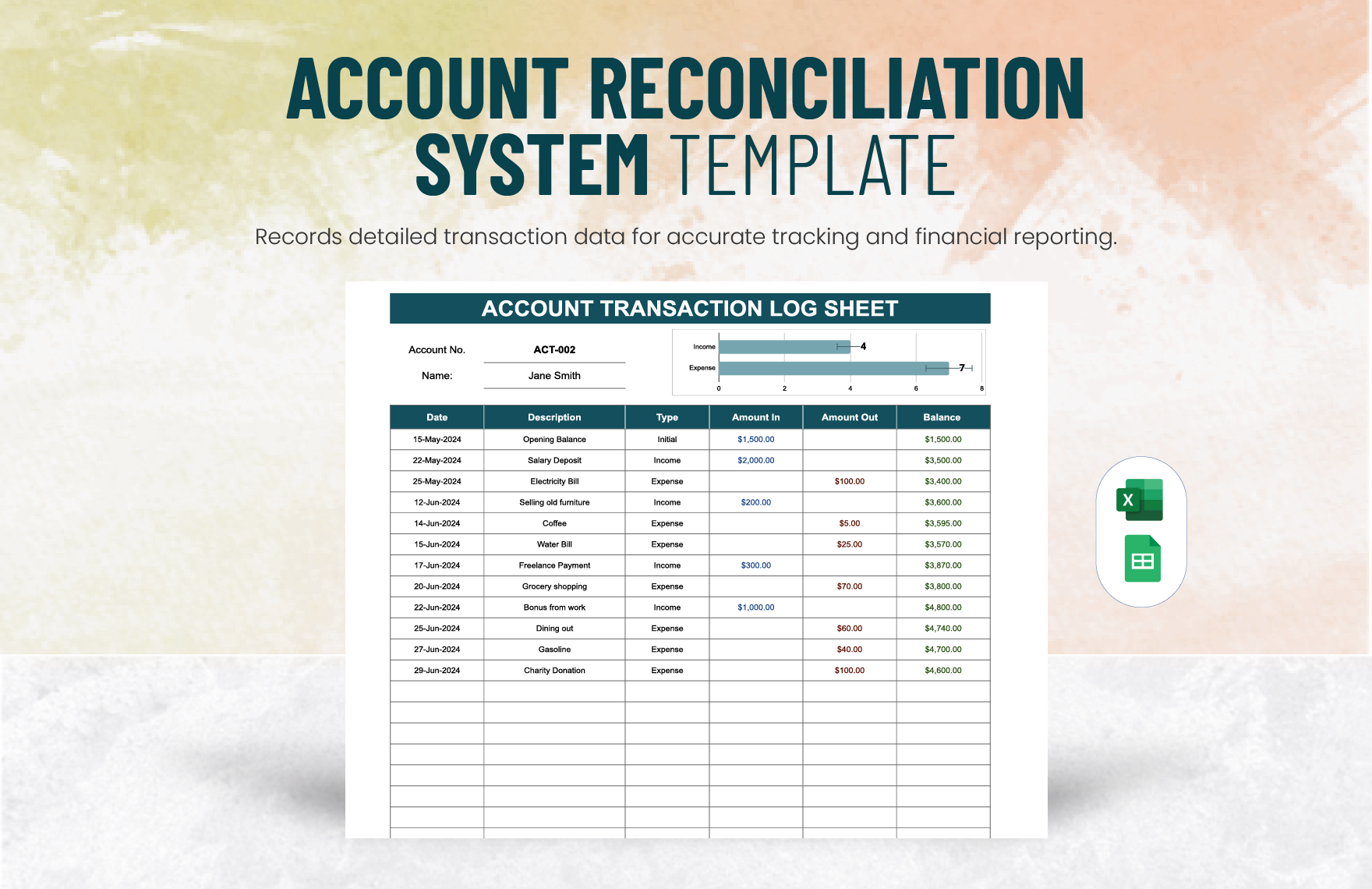

A good template isn't just a list of dates and amounts. It needs logic. If you're building one or looking for one to download, it has to have a few non-negotiable columns. You need the Date, obviously. Then the Description. But the real magic happens in the Category and Status columns.

The Status column is for reconciliation. This is where you mark whether a transaction has actually cleared your bank or if it's still "Pending." This is the secret to never bouncing a check or missing a bill. If you see $500 in your bank account but your Excel sheet says you have three pending transactions totaling $400, you know you only actually have $100. Your bank won't tell you that until it's too late.

Common Mistakes When Setting Up Your Sheet

People get over-ambitious. They download a complex excel transaction tracker template with 15 different tabs and 50 categories. Then they use it for three days and quit because it's too much work.

Keep it lean. You don't need a category for "Organic Kale" and another for "Regular Kale." Just use "Groceries."

Another huge mistake? Ignoring the "Fixed vs. Variable" distinction. Fixed expenses are your rent, your car insurance, your Netflix—things that don't change. Variable expenses are where the danger lies. That's your dining out, your impulsive Amazon buys, your gas. If your template doesn't separate these, you won't know where to cut when things get tight.

Tables Are Your Best Friend

Don't just type data into raw cells. Use the "Format as Table" feature (Ctrl+T). This is the single most important tip for Excel users. When you use a Table, your formulas auto-expand. If you add a new row at the bottom, your formatting and your dropdown menus carry over automatically. It prevents the sheet from breaking as it grows over the months.

Data Validation: The Secret to Clean Reporting

If you want to see a chart of your spending at the end of the month, your data has to be clean. If you type "Starbucks" as "Coffee" one day and "Dining Out" the next, your final report will be a mess.

This is where Data Validation comes in. In your excel transaction tracker template, set up a dropdown menu for your categories. This forces you to choose from a pre-set list. It sounds like a small thing, but it’s the difference between a professional-grade financial tool and a chaotic pile of numbers.

Real Talk About Macros

A lot of "pro" templates use VBA or Macros to automate things. Be careful here. Macros can be a security risk if you're downloading them from random sites, and they often break when Excel updates. Honestly, you don't need them. Standard formulas like SUMIFS and VLOOKUP (or the newer XLOOKUP) can handle 99% of what a normal person needs for transaction tracking.

How to Handle Different Currencies or Accounts

If you're freelancing or traveling, things get tricky. A basic excel transaction tracker template usually assumes one currency and one account. If you’re juggling a checking account, a savings account, and two credit cards, you need an "Account" column.

This allows you to filter your view. Want to see just your credit card debt? Filter by "Visa." Want to see your total liquidity? Unfilter everything.

For currencies, I usually suggest keeping a "Local Currency" column and a "USD" (or your home currency) column. Use a single exchange rate cell at the top of the sheet that you update once a week. It’s not perfectly precise to the minute, but for personal budgeting, it’s more than enough.

The Pivot Table: Where the Magic Happens

You’ve spent the whole month entering data. Now what?

You go to Insert > Pivot Table.

In about three clicks, you can see a breakdown of exactly how much you spent in every category. You can see which day of the week you spend the most money (usually Saturdays, let’s be real). You can see if your "Misc" category is becoming a junk drawer for bad habits.

Most people are terrified of Pivot Tables. Don't be. They are just a way to "squish" your long list of transactions into a summary. If you aren't using a Pivot Table with your excel transaction tracker template, you're just doing data entry for no reason.

Security and Privacy in 2026

We live in an era where every company wants to scrape your financial data to train AI or sell you loans. Using a local Excel file is a radical act of privacy.

But you have to protect it.

- Password Protect: Go to File > Info > Protect Workbook.

- Local Storage: Don't just leave it in an unencrypted cloud folder if you’re worried about it.

- Backup: Excel files can get corrupted. Keep a "Version A" and "Version B."

A Word on "Feature Creep"

It’s tempting to try and make your spreadsheet do everything. You want it to track your net worth, your stock portfolio, your grocery list, and your fitness goals.

Don't.

A specialized excel transaction tracker template works because it’s focused. If the file gets too heavy, it becomes slow to open. If it's slow to open, you won't use it. Use one workbook for your daily transactions and maybe a separate one for long-term investment tracking.

Steps to Get Your Tracker Running Today

- Define your categories. Limit yourself to 10-12. Anything more is overkill.

- Create your header row. Date, Description, Category, Amount, Account, and Status.

- Turn it into an official Table. Highlight the headers and press Ctrl+T.

- Set up Data Validation. Create a separate tab for your category list and link your "Category" column to it.

- Enter your last 7 days of transactions. Don't try to go back three years. Just start with the last week to get some momentum.

- Build a simple Summary. Use a Pivot Table on a new tab to see your totals.

- Reconcile weekly. Every Sunday, sit down for 10 minutes and make sure your Excel balance matches your bank balance.

If your balances don't match, don't panic. Check for those "pending" transactions. Check for small fees. Often, it's the $0.50 service charge or a small tip you forgot to add to the restaurant bill that throws things off.

Why People Fail

The reason people stop using an excel transaction tracker template isn't usually because the math is hard. It's because they miss a few days, feel guilty, and then avoid the file for a month.

📖 Related: Who is on the 100 dollar bill? The Real Story Behind the Blue Note

If you miss a week, just draw a line and start again today. You don't need a perfect history to have a successful future. The goal is awareness, not historical perfection.

Excel is a tool, not a cage. Use it to give yourself permission to spend on things you actually enjoy by cutting the fat elsewhere. Once you see the numbers in black and white, the anxiety of the "unknown" disappears. You'll finally know where that $84.50 went. And more importantly, you'll know where the next $84.50 is going.

Actionable Next Steps

- Audit your current categories: Open your bank app and look at your last 20 purchases. Group them into 5 broad buckets. This is the foundation of your new template.

- Set a "Reconciliation Day": Pick a recurring 15-minute slot—like Sunday morning over coffee—to update your sheet. Consistency is more important than complexity.

- Master the Ctrl+; shortcut: This instantly inserts today's date in Excel. It saves seconds, but those seconds make data entry feel like less of a chore.

- Download a baseline: If you aren't ready to build from scratch, use the built-in "Personal Budget" or "Transaction Logger" templates inside Excel’s "New" menu and then strip out the parts you don't need.