You’re staring at a loan application or maybe a surprise IRS notice, and suddenly, you need a document from four years ago. It’s the classic "where did I put that" moment. Finding out how to get old w2 forms shouldn't feel like a heist, but if your old company went bankrupt or you've moved three times since 2021, it kinda does.

Panic isn't necessary. Honestly, the paperwork exists somewhere in the digital ether. Whether you need it for a mortgage, back taxes, or just to prove you actually worked that weird soul-crushing job in 2018, there are three or four distinct paths to take. Some are free. Some will cost you about the price of a fancy steak dinner.

Start With the Path of Least Resistance

Before you go calling the federal government, check your own digital footprint. Did you use TurboTax, H&R Block, or FreeTaxUSA three years ago? Log in. Most of these platforms store your data for up to seven years. If you imported your W-2 directly into the software, it’s likely still sitting there as a PDF. You've already paid for it, so you might as well use it.

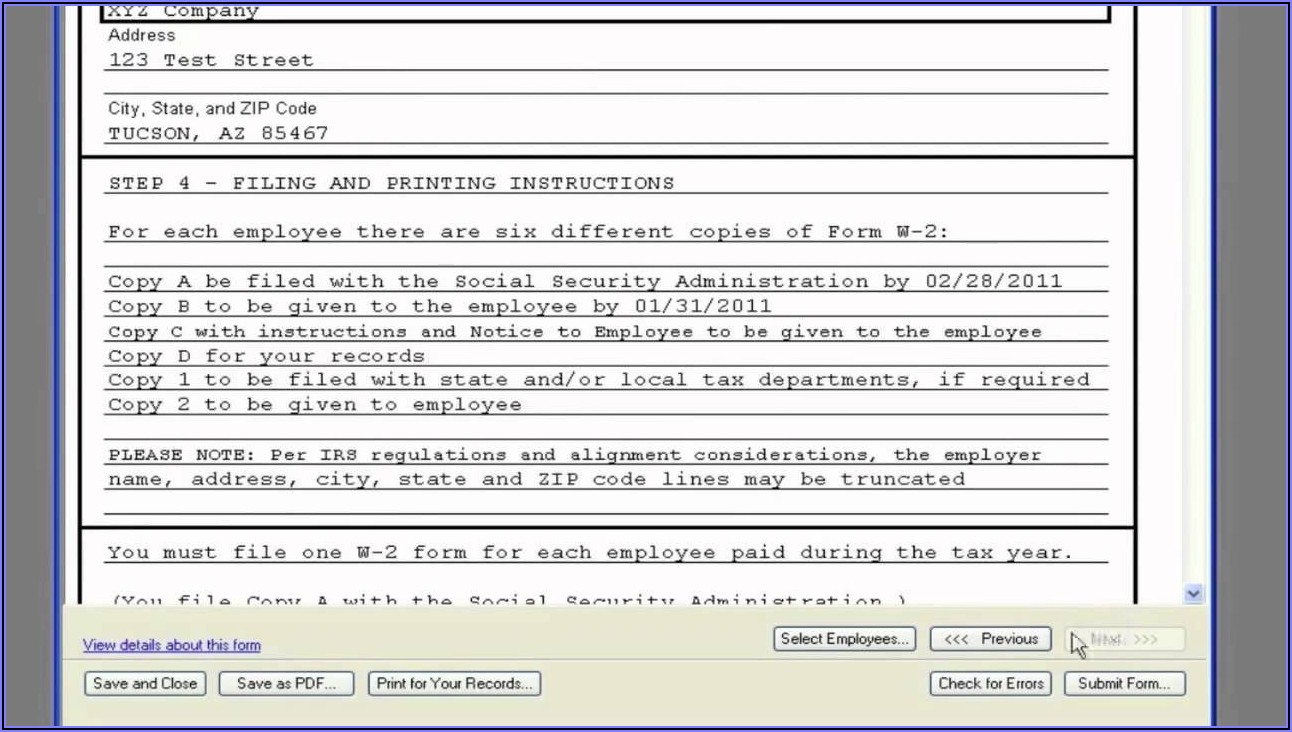

Reach out to your former employer's payroll department. Even if you left on bad terms, they are legally required to keep records. Specifically, the IRS requires employers to keep employment tax records for at least four years. If the company used a big-name payroll provider like ADP, Paychex, or Gusto, you might even still have access to your old employee portal. Try logging in with your personal email. You’d be surprised how often those accounts stay active long after you’ve turned in your badge.

When the Company is Gone: The Social Security Administration

What happens if the business folded? This is where it gets a bit more formal. Many people think the IRS is the first stop, but for a full copy of the actual W-2—including the state tax info—the Social Security Administration (SSA) is actually the keeper of the flame.

The SSA uses your W-2 to track your lifetime earnings and calculate your future benefits. If you need an actual copy of the Form W-2 for any year from 1978 to the present, they can provide it. But here’s the kicker: it isn't free unless it’s for a "Social Security related purpose." If you need it for taxes or a loan, be prepared to pay. Currently, the fee is $126 per request.

👉 See also: Questions to Ask for Job Reference: What Most Hiring Managers Get Wrong

To do this, you’ll need to fill out Form SSA-7050-F4. It’s a bit of a slog. You have to be specific about the years you need. It can take up to 120 days to process. That’s four months. If you’re in a hurry to close on a house, this is your "break glass in case of emergency" option.

Using the IRS Get Transcript Tool

The IRS won't usually give you a photo-perfect copy of the original W-2 like the SSA does, but they will give you the information on it. This is called a "Wage and Income Transcript."

It’s free. It’s fast.

You can go to the IRS website and use the "Get Your Tax Record" tool. If you can pass their identity verification—which is notoriously picky and requires things like a photo of your ID and a face scan via ID.me—you can download the transcript in minutes.

The transcript shows data from information returns the IRS receives, such as Forms W-2, 1099, 1098, and Form 5498.

Important Note: The IRS transcript only shows federal data. If you need your state and local tax withholding info to file a state return, the IRS transcript won't have it. In that case, you’d have to contact your state’s Department of Revenue.

The State Department of Revenue Shortcut

People often forget about the state level. If you worked in a state with income tax, like California or New York, their tax authorities have a copy of your W-2 data too. Often, their wait times are shorter than the federal government’s.

Search for "[State Name] Department of Revenue W-2 request." Some states allow you to log into a taxpayer portal and see every W-2 filed under your social security number for the last several years. It’s a great way to get old w2 forms information without the $126 price tag of the SSA or the identity verification headaches of the IRS.

Why You Might Need the Actual Paper Copy

Sometimes a transcript isn't enough. If you’re dealing with a very specific legal dispute or a highly scrutinized mortgage application, they might demand the "Form W-2 Copy B."

In these cases, the transcript—which is just a list of numbers—doesn't look "official" enough for some bureaucrats. If you find yourself in this spot, the SSA route is your only real choice.

But honestly, 90% of the time, the IRS Wage and Income Transcript is all you need to file back taxes or verify income. Don't pay for the SSA copy unless you've been explicitly told a transcript won't work.

👉 See also: MyBankingDirect High Yield Savings: Why It Actually Pays to Be Picky

Dealing With Missing Employers

Maybe the company didn't just close. Maybe they were "shady."

If you worked for someone who didn't send you a W-2 and now you’re trying to catch up on old taxes, you’ll need to use Form 4852, "Substitute for Form W-2, Wage and Tax Statement."

This is basically you telling the IRS, "Look, I tried to get my W-2, but the guy disappeared, so here is my best estimate of what I earned based on my pay stubs."

To use this, you really need your final pay stub from that year. It has your year-to-date (YTD) totals. If you don't have pay stubs and you don't have a W-2, you are in a tough spot. You might have to go through old bank statements and add up every deposit from that employer. It’s tedious. It’s annoying. But it’s the only way to satisfy the IRS that you’re making an honest effort.

Practical Steps to Take Right Now

If you're sitting there stressed about a deadline, here is exactly what to do in order of speed.

First, spend ten minutes searching your email for "ADP," "Paychex," "W-2," or "[Company Name] Payroll." You might find a link you forgot about.

Second, try the IRS "Get Transcript" tool online. It’s the fastest free way to see your data.

Third, if the IRS tool rejects your identity (it happens to the best of us), mail in IRS Form 4506-T. It’s the paper version of the transcript request. It takes about 10 business days.

Fourth, if you absolutely must have the original looking document for a court case or a very stubborn lender, download Form SSA-7050-F4, write the check for $126, and settle in for a long wait.

For the future, once you finally get old w2 forms, scan them. Toss them into a secure cloud drive or a physical fireproof box. The IRS can audit you up to three years back—and in some cases, six years—so keeping these records for seven years is the standard "safe" advice. Having a digital folder labeled "Tax Records" will save your future self a massive headache.

If you are currently trying to file a return for the most recent tax year and your employer simply hasn't sent the form yet, wait until February 15th. That is the date the IRS officially says you can start complaining. Before that, they'll just tell you to keep checking your mail. Once the 15th hits, you can call the IRS at 800-829-1040 and they will send a letter to the employer on your behalf. That usually gets people moving pretty quickly.

Check your state's specific requirements as well, as some states like Pennsylvania or Illinois have very specific portals for accessing historical wage data that are much more user-friendly than the federal options.