So, you’ve got $300,000 sitting there. Maybe it’s from a house sale, a grueling decade of saving, or a lucky inheritance. It feels like a lot of money until you realize how quickly inflation or one bad "tip" from a neighbor can eat it alive. Most people think they need a secret door to a private hedge fund to manage this kind of cash. They don't. Honestly, how to invest 300k isn't about finding a "hidden" stock; it's about not being the person who buys into a bubble at the exact moment it's about to pop.

Three hundred grand is a weird amount. It’s too much to leave in a savings account earning pennies, but it’s often just shy of what you need for "accredited investor" status for the really high-end private equity deals. You're in the middle. It’s a powerful position if you're smart, but a dangerous one if you're greedy.

The boring truth about the S&P 500 and why it works

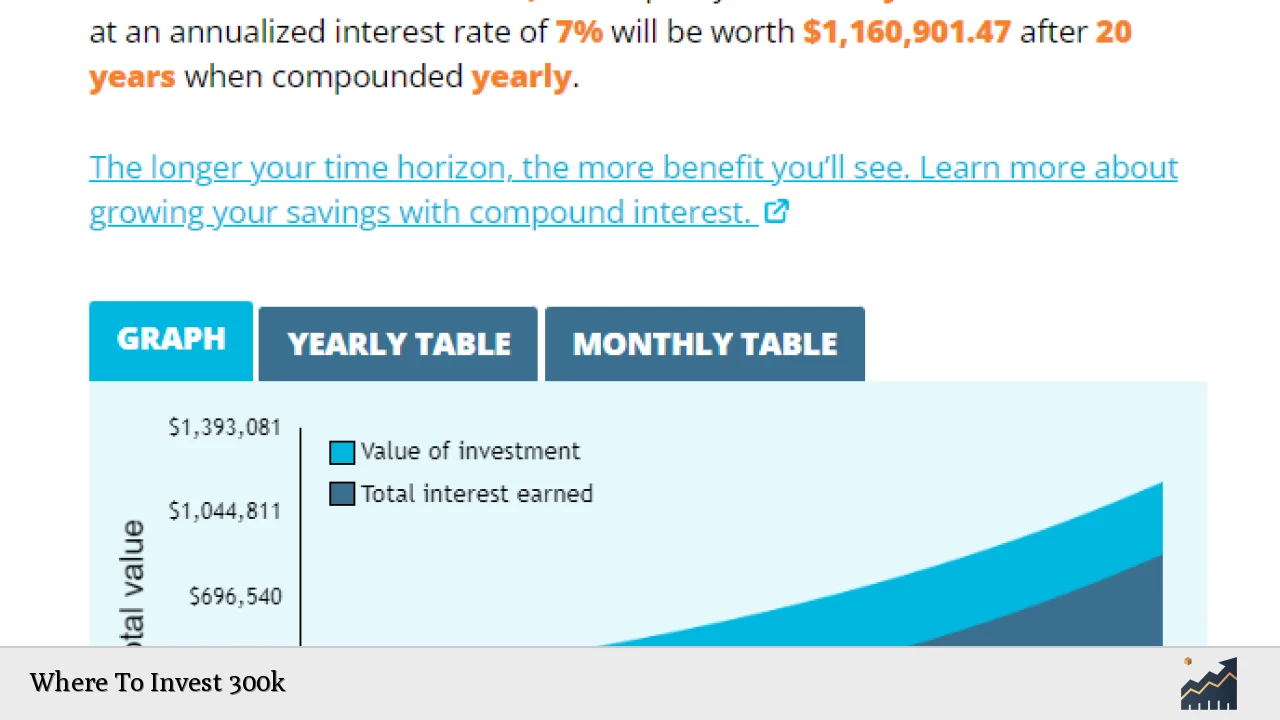

Let’s be real. If you put that $300,000 into a low-cost S&P 500 index fund like VOO or SPY and literally did nothing for twenty years, you’d likely end up with over $1.2 million, assuming a historical average return of around 7% to 8%. Most people can't do that. They get itchy fingers. They see a tech stock "mooning" on TikTok and want a piece of it.

The S&P 500 is basically a bet on American capitalism. It’s the 500 biggest companies. When one fails, it gets kicked out, and a winner replaces it. You don't have to do the work. The index does it for you. Vanguard’s founder, Jack Bogle, spent his whole life preaching this, and yet people still try to outsmart the system. Why? Because boring doesn't feel like "investing." It feels like waiting. But in the world of high-net-worth growth, waiting is the most profitable skill you can own.

Don't dump it all in on Tuesday

There is this thing called Dollar Cost Averaging (DCA). Imagine you put all $300,000 into the market on a Monday, and on Tuesday, the Fed announces a surprise interest rate hike. You've just lost 4% of your net worth in twenty-four hours. That hurts.

Instead, many advisors suggest breaking that 300k into chunks. Maybe $25,000 a month for a year. You might miss some gains if the market rips upward, but you’re protected if it craters. It’s psychological insurance. You sleep better. And when you're managing six figures, sleep is a luxury you can actually afford.

Real estate is great until the toilet breaks

A lot of people think how to invest 300k automatically means buying a rental property. It can be a massive wealth builder. According to the U.S. Census Bureau, home prices have historically outpaced inflation over the long haul, and you get the benefit of someone else paying your mortgage.

But let's be honest about being a landlord.

It's a job. It is not passive income. If you spend $300,000 cash on a turnkey rental in a mid-sized market like Indianapolis or Kansas City, you might clear $1,500 a month after taxes and insurance. That sounds great. Then the HVAC dies. Suddenly, three months of profit are gone.

If you want the real estate exposure without the 2 a.m. phone calls about a leaky faucet, look into REITs (Real Estate Investment Trusts) or syndications. Platforms like Fundrise or CrowdStreet let you get into commercial deals with smaller amounts. Just watch the fees. Fees are the silent killers of a $300k portfolio. A 2% management fee on 300k is $6,000 a year. Over ten years, that’s $60,000 plus lost compounding. That’s a Porsche. Don't give a stranger your Porsche.

The 60/40 split is "dead" every year, yet it survives

Every year, some "expert" on CNBC says the 60% stocks and 40% bonds split is dead. Then the market gets volatile, and suddenly everyone loves bonds again.

With $300,000, you have enough to actually utilize a "barbell strategy." This is a concept popularized by Nassim Taleb. You keep a huge chunk—say 80%—in ultra-safe stuff like Treasury bills or high-yield savings accounts. Then, you take the remaining 20% and put it into high-risk, high-reward plays.

- The Safe Side: $240,000 in a HYSA or TBills. In 2024 and 2025, we've seen rates hover around 4% to 5%. That's $12,000 a year just for existing.

- The Aggressive Side: $60,000 in individual growth stocks, crypto, or a small business venture.

If the 20% goes to zero, you're still okay. If the 20% triples, you've significantly boosted your total net worth. This beats the hell out of putting the whole $300k into "medium risk" assets that all crash at the same time during a recession.

Tax-loss harvesting is your new best friend

When you're figuring out how to invest 300k, you have to think about the IRS. They are your silent, uninvited partner. If you have $300,000 in a taxable brokerage account, you should be looking at tax-loss harvesting.

This basically means selling losing positions to offset the gains from your winners. If you made $10,000 on Nvidia but lost $10,000 on a speculative biotech stock, you can sell both and owe $0 in capital gains taxes. It’s a way to keep your money working for you instead of sending it to Washington. Wealthy people don't necessarily make more money than you; they just keep more of it.

The "Human Capital" factor

Sometimes the best way to invest $300k isn't in the ticker symbols. It's in you.

If you're 30 years old and you spend $50,000 on an advanced degree or a specialized certification that jumps your salary from $80k to $150k, that is a better ROI than any stock will ever give you. The math is simple. That $70,000 annual raise, compounded over 30 years, is worth millions.

Don't be so obsessed with "the market" that you forget you are your own most productive asset.

Common mistakes to avoid when you're flush with cash

People get weird when they have 300k. They start thinking they are "investors" and start "doing deals." Here is what usually goes wrong:

- Lending to family: Just don't. If you give a cousin $20k for a restaurant, consider it a gift. If they pay you back, cool. If not, don't let it ruin Thanksgiving.

- Chasing Yield: If an investment promises 15% guaranteed returns, it's a lie or a Ponzi scheme. Bernie Madoff promised consistent 10-12% returns. We know how that ended.

- Over-diversification: You don't need 40 different mutual funds. You'll end up owning everything, which means you'll perform exactly like the market but pay way more in fees.

- Ignoring Liquidity: Don't lock all $300k into a five-year private equity lockup. Life happens. You might need a new roof or a surgery. Keep at least $30k-$50k in something you can exit in 24 hours.

Your 300k Action Plan

Stop overthinking. Here is a practical way to actually move that money in the next 30 days.

First, check your high-interest debt. If you have a credit card at 22% or a personal loan at 12%, pay it off today. That is a "guaranteed" return on your money that no bank can match.

Second, max out your tax-advantaged accounts. If you have a 401k or an IRA, use some of the 300k to cover your living expenses so you can shove as much of your actual salary as possible into those tax-sheltered buckets.

📖 Related: Why the Gold Rate INR Chart Is Moving So Fast Right Now

Third, decide on your "Risk Number." If the market dropped 20% tomorrow, would you vomit? If yes, you shouldn't be 100% in stocks. A simple 70/30 split between a total stock market fund (VTI) and a total bond market fund (BND) is enough for 90% of people.

Fourth, set up an automatic transfer. Don't try to time the bottom of the market. You won't. Nobody does. Just get the money working. Money is like a bar of soap; the more you handle it, the less you have. Set your strategy, automate the buys, and go live your life.

Check back in a year. You'll likely find that the less you messed with it, the more it grew. That’s the real secret to managing a windfall. It’s not about being a genius; it’s about having the discipline to stay out of your own way.