You’re standing there with a piece of paper that says it’s worth five thousand dollars. Maybe you just sold a used car on Facebook Marketplace, or perhaps you're renting out your vacation home. The buyer looks legit. They handed you a cashier's check because, hey, that’s "as good as gold," right? Honestly, that’s the first mistake most people make. Thinking a cashier's check is foolproof is exactly how people end up losing their shirts.

The truth is, learning how to verify a cashiers check is the only thing standing between you and a massive bank fee—or worse, a total loss of your assets.

In the old days, these checks were the gold standard. They are drawn against the bank’s own funds, not the individual’s personal account. That means the money is already there. But today? Scanners are too good. High-end printers are too cheap. A teenager with a basic understanding of Photoshop can create a "check" from a major bank like Chase or Wells Fargo that looks better than the real thing. If you deposit a fake, your bank might give you "provisional credit" the next day. You think you’re safe. You spend the money. Then, ten days later, the check bounces. The bank claws that money back out of your account, and if you've already handed over your car or mailed back "excess funds" to the scammer, you are completely out of luck.

Why "Wait for it to Clear" is Dangerous Advice

Most people think "clearing" happens in 24 hours. It doesn't. Federal law requires banks to make funds from cashier's checks available quickly—usually by the next business day. This is the "availability" rule, not the "verification" rule. Just because the money shows up in your balance doesn't mean the check is real.

The actual process of the check traveling from your bank back to the issuing bank can take a week or more. If the check is a high-quality counterfeit, it might take the issuing bank days to realize the account number is slightly off or the signature is forged. By the time the notification of the fraud hits your bank, the scammer is long gone. You need to know how to verify a cashiers check before you ever walk into your bank branch.

The Physical Red Flags You Can See Right Now

Before you even call a bank, look at the paper. Real cashier's checks are printed on heavy, high-quality security paper. If it feels like the same paper you put in your home inkjet printer, it’s a fake. Period.

Look for the edges. Are they perforated? Real checks are almost always pulled from a book or a sheet, leaving at least one rough, perforated edge. If all four sides are perfectly smooth, it might have been printed on a standard paper cutter.

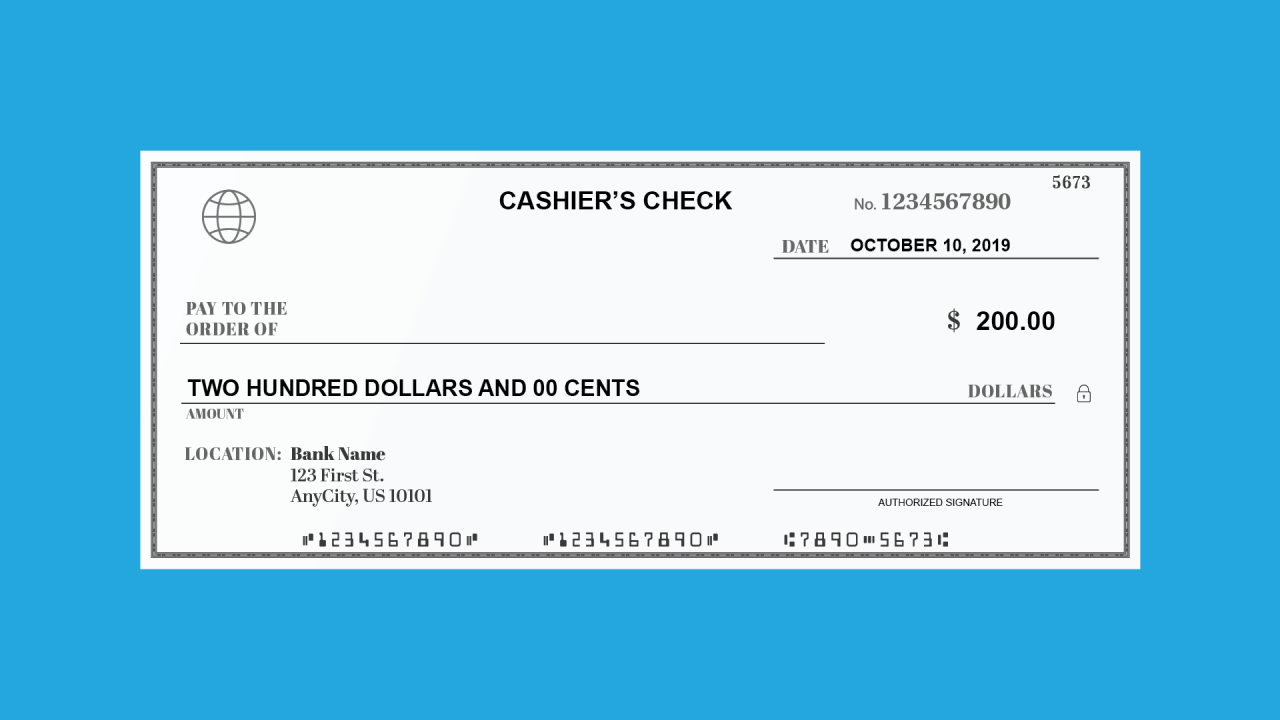

Then there’s the MICR line. That’s the string of numbers at the bottom. On a real check, this is printed with special magnetic ink. It should feel slightly raised or at least have a distinct matte look compared to the rest of the text. If the numbers look blurry or "fuzzy" around the edges, that’s a sign of a low-quality digital print.

Check the bank's address. Scammers are notoriously lazy. Sometimes they'll list a real bank name but put an address that doesn't exist, or an address for a branch that closed three years ago. Use your phone. Google the address. Does it match a real branch? If the check says "First National Bank of Nowhere" but lists a random office park in a different state, walk away.

The Only Reliable Way to Verify a Cashiers Check

You have to call the issuing bank. This sounds simple, but there is a massive trap here. Never use the phone number printed on the check.

If a scammer is smart enough to forge a $10,000 check, they are smart enough to print a phone number that leads directly to their buddy sitting in a basement. That "bank representative" will answer the phone professionally, ask for the check number, and tell you, "Yes, that's a valid instrument."

Instead, do this:

- Find the name of the bank on the check.

- Go to your browser and find the official website for that bank.

- Look for their "Verified Check" department or their general customer service line.

- Call that official number and ask to speak with the department that handles check verification.

When you get a real person, give them the check number, the date, and the exact amount. Ask them specifically if the check was issued to you (or whoever the payee is). Some banks won't give out details over the phone due to privacy laws, but many will at least confirm if a check with that specific number and amount exists in their system.

What if the bank won't help?

Some banks, like Bank of America or Chase, have become more restrictive about over-the-phone verification. If they won't tell you anything, take the check to a local branch of that bank if one exists nearby. A teller there can scan it into their system and tell you immediately if it's a ghost.

🔗 Read more: First Source Debt Collection: Why They’re Calling You and What to Do Next

The "Overpayment" Scam: A Classic Red Flag

If you’re trying to learn how to verify a cashiers check, you’re probably already suspicious. Trust that gut feeling. The most common scam involves a buyer "accidentally" sending you a check for more than the agreed price.

"Oh, I accidentally told my assistant to write the check for $5,000 instead of $4,000. Just deposit it and Zelle me the $1,000 difference back."

This is a 100% guaranteed scam. The $5,000 check is fake. It will show up in your account tomorrow. You will send the "real" $1,000 via Zelle (which is like sending cash). A week later, the $5,000 vanishes from your account. You are now out $1,000 of your own money, and you’ve likely given the scammer whatever item you were selling.

Digital Alternatives are Safer

Honestly, in 2026, cashier's checks are becoming an outdated way to do business between strangers. If you're selling something expensive, there are better ways.

- Wire Transfers: Unlike checks, a domestic wire transfer is generally "final" once it hits your account. It doesn't rely on the physical transport of paper. It’s bank-to-bank.

- Escrow Services: For high-value items like cars or jewelry, use a reputable escrow service. They hold the buyer’s money until you prove the item was delivered.

- Meeting at the Bank: This is my favorite. If someone wants to pay with a cashier's check, tell them you'll meet them at their bank. Watch the teller print the check and hand it to you. That is the only way to be 100% sure the funds are real.

Dealing with the Aftermath of a Fake

If you realize you’ve been handed a fake check, don't just throw it away. You need to report it. Start with the Internet Crime Complaint Center (IC3), which is run by the FBI. You should also contact your local police.

If you already deposited it, call your bank immediately. Don't wait for them to find out. If you go to them first and explain that you think you were the victim of a scam, they are much less likely to close your account for "suspicious activity." Banks hate risk. If they think you are intentionally depositing bad checks, they will blackhole your name in the ChexSystems database, and you won't be able to open a bank account anywhere for years.

Immediate Action Steps

If you have a check in your hand right now, do these three things:

- Check the Date: Cashier’s checks are often void after 60, 90, or 180 days. If it's old, it's a problem even if it's real.

- Verify the Bank Name: Is it a real bank? A quick search for the "FDIC BankFind" tool can tell you if the institution actually exists.

- Hold the Item: Do not ship your goods or hand over your car title until your bank's fraud department—not just the teller—confirms the funds have moved from the issuing bank to yours. This usually takes 5 to 7 business days.

Verification is about patience. Scammers rely on your desire to finish the deal quickly. They use "urgency" as a weapon. By slowing down and following the verification steps above, you take that weapon away from them.

The most important thing to remember: A bank's "availability of funds" is not a confirmation of a check's validity. Don't spend a dime of that money until you've done the legwork to prove the paper is real.