You’re standing there with a piece of paper that says it's worth five thousand dollars. Or maybe fifty thousand. It looks official. It has the watermarks, the bank logo, and that heavy, expensive-feeling bond paper that makes you want to believe it’s as good as gold. But honestly? It might just be a very high-quality photocopy.

Knowing how to verify a cashiers check is basically the only thing standing between you and a massive bank fee—or worse, a police report. People assume these checks are "guaranteed" because the bank draws the funds from its own account rather than the buyer's personal stash. That’s true in a perfect world. In the real world, scammers have gotten terrifyingly good at Photoshop.

If you deposit a fake check, your bank might actually make the funds available the next day. This is the trap. You see the balance go up, you think you're safe, and you ship the car or the jewelry. A week later? The check bounces. The bank takes the money back out of your account, and you’re left staring at a negative balance.

Why You Can't Trust Your Eyes Alone

Don't rely on the look of the paper. I've seen fakes that look more "real" than the actual documents issued by local credit unions.

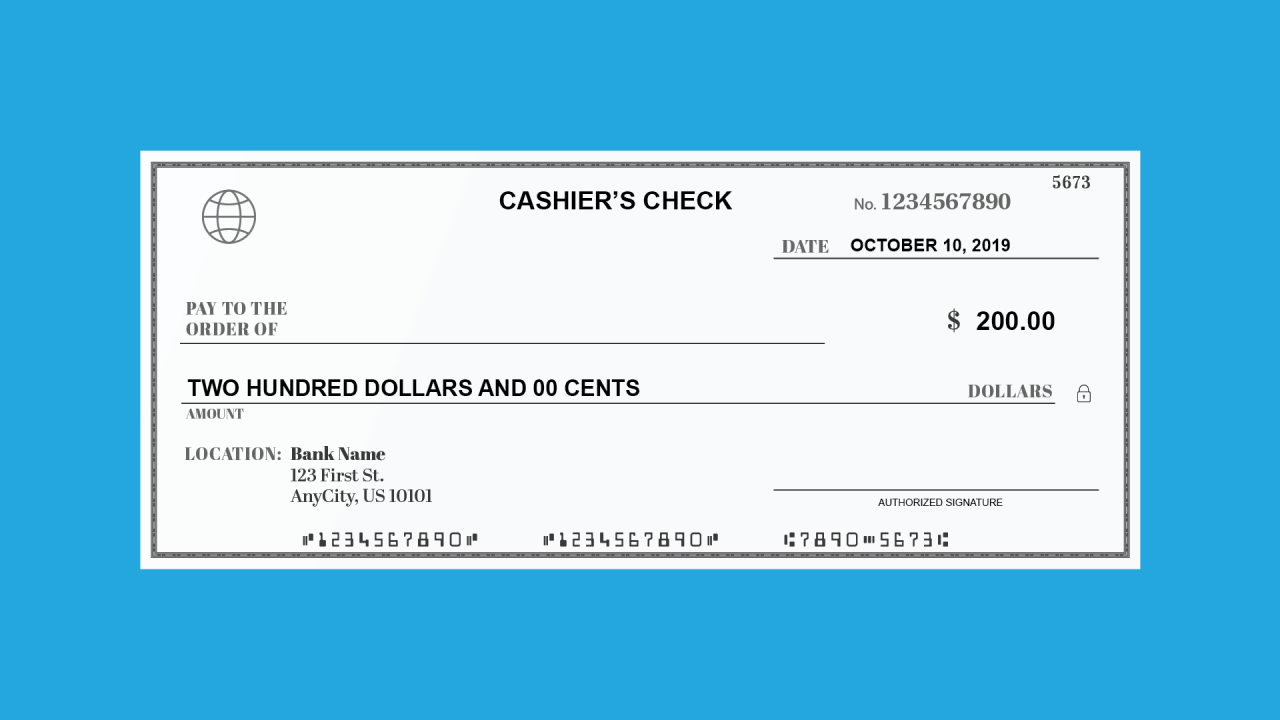

Modern printers are incredible. A fraudster can replicate the MICR line—those funny-looking numbers at the bottom—with ease. They can even buy security paper that has "VOID" appear when copied. So, if you're trying to figure out how to verify a cashiers check, you have to look past the aesthetics. You need to look at the routing number.

Every legitimate bank in the United States has a specific nine-digit routing number. You can look these up on the American Bankers Association website. If the routing number on the check belongs to a bank in New York, but the address printed on the top left is for a branch in California, you’ve got a problem. A big one.

The Phone Call That Saves Your Bank Account

The absolute, non-negotiable step is calling the issuing bank. But wait. Do not—under any circumstances—call the phone number printed on the check itself.

Scammers aren't stupid. They will print a fake customer service number on the check that leads directly to their buddy sitting in an apartment with a burner phone. When you call, he’ll answer with a professional-sounding "Thank you for calling Chase Bank, how can I help you?" He’ll "verify" the check, and you’ll hang up feeling safe while he laughs his way to the pawn shop.

✨ Don't miss: Tata Power Ltd Share Price: Why Most Investors Get the Timing Wrong

Go to Google. Type in the name of the bank. Find their official corporate website. Look for their "Verify a Cashier's Check" department or just their general fraud line. When you get a human on the phone, tell them you have a check in front of you and you need to verify its authenticity.

They are going to ask for a few specific things:

- The check number (usually in the top right corner).

- The exact amount of the check.

- The date it was issued.

- The name of the remitter (the person who bought it).

Sometimes, banks won't give you a "yes" or "no" because of privacy laws, but they will tell you if the check number matches an outstanding item in their system. If they tell you that check number 10293 was already cashed three months ago, or that it was issued for $5 instead of $5,000, you just saved yourself a nightmare.

Red Flags That Should Make You Walk Away

There are some social cues that are just as important as the physical check. If someone is overpaying you and asking you to wire back the "extra" money, it’s a scam. Every time. No exceptions. No one accidentally sends a cashiers check for $2,000 more than the asking price because of a "shipping error."

🔗 Read more: South African Rand to USD Converter: Why Your Bank Is Probably Ripping You Off

Check the ink. Real cashiers checks are printed with magnetic ink. If you run your finger over the numbers at the bottom and they feel completely flat or look like they were printed by a standard home inkjet (which often leaves tiny splatters of color), be suspicious.

Legitimate checks also usually have at least one signature from a bank official. If there's no signature, or if the signature looks like it was printed as part of the background image rather than signed or stamped on top, it's likely a fake.

The Clearing Process vs. Availability

This is the part that trips up even smart people. Federal law (Regulation CC) requires banks to make funds from "guaranteed" checks available quickly—often by the next business day.

Available does not mean cleared.

When you're learning how to verify a cashiers check, you have to understand the lag. Your bank is basically giving you a short-term loan based on the promise that the other bank will pay. It can take five to ten business days for a check to actually clear the Federal Reserve system. If you spend that money or give away your property before the check truly clears, you are the one responsible for the loss. Not the bank.

I once talked to a guy who sold a vintage motorcycle for $12,000. He took a cashiers check, saw the money hit his Chase account the next morning, and let the buyer haul the bike away. Six days later, the check was flagged as a counterfeit. The $12,000 vanished from his account. Since he had already spent some of it, his account went into the red, and he had to pay the bank back. The bike was gone. The "buyer" was gone.

Go to the Bank Together

If you’re selling something expensive, like a car, tell the buyer you’ll meet them at their bank.

Watch the teller print the check. This is the only 100% foolproof way to handle this. If they refuse to meet at a branch, or claim they already have the check printed and "don't have time" to go back, walk away from the deal. There is no legitimate reason for a buyer to refuse to let you watch the check being issued if they are using real funds.

If they have a check from a bank that doesn't have a local branch, tell them you'll wait for the check to fully clear—meaning 10 full business days—before you release the goods. A legitimate buyer will understand. A scammer will disappear.

Immediate Action Steps

- Verify the Bank’s Existence: Make sure the bank is FDIC insured. You can check this on the FDIC BankFind tool.

- Independent Research: Find the bank's phone number yourself. Never use the one on the check.

- Specific Check Details: Ask the bank teller if the check has "cleared" or is "issued and outstanding."

- Wait it Out: Do not spend the money for 10 business days, even if the bank says the "funds are available."

- Check for Typos: Surprisingly, many fake checks have spelling errors in the bank's name or the fine print.

Knowing how to verify a cashiers check isn't about being cynical; it's about being professional. In 2026, with the tools available to counterfeiters, a little bit of healthy skepticism is the only thing that keeps your finances intact. If a deal feels too fast or too easy, it usually is. Trust your gut, but verify the routing number first.