Writing a check feels like a relic from a bygone era, right? Most of us just tap a phone or Venmo someone when we need to move money around. But then life happens. Maybe your landlord is old school, or you’re paying a contractor for a $700 repair, and suddenly you’re staring at that little rectangular piece of paper wondering if you’re about to mess it up. Honestly, it's easier than it looks, but the stakes feel higher when it’s a significant chunk of change like seven hundred bucks.

Mistakes lead to bounced checks. Or worse, someone could alter the amount if you leave too much white space.

When you sit down to figure out how to write a check for 700, you aren't just filling in boxes. You're creating a legal document that tells your bank exactly how to handle your hard-earned cash. If the numbers don't match the words, the bank might reject it. That’s a headache nobody needs.

📖 Related: Laos Currency to USD: Why the Kip is Finally Settling Down in 2026

The Step-by-Step Breakdown for a $700 Check

First things first. Grab a blue or black pen. Never use a pencil or a gel pen that can be easily washed or erased. Fraud is real, and $700 is enough to make a thief’s day.

Start at the top right. Write the date. You can use the standard format like January 18, 2026, or just go with 01/18/2026. Just make sure it’s legible. If you post-date it—meaning you put a future date on it—the person you're giving it to might not be able to cash it until that day, though some banks are pretty lax about this, so don't rely on post-dating as a safety net if your balance is low.

Next is the "Pay to the Order of" line. This is where you put the name of the person or company getting the money. Write it clearly. If you’re paying a person, use their full legal name. Avoid nicknames. If it’s a business, make sure you have the exact name. "Landlord" isn't a legal name; "Oak Ridge Properties LLC" is.

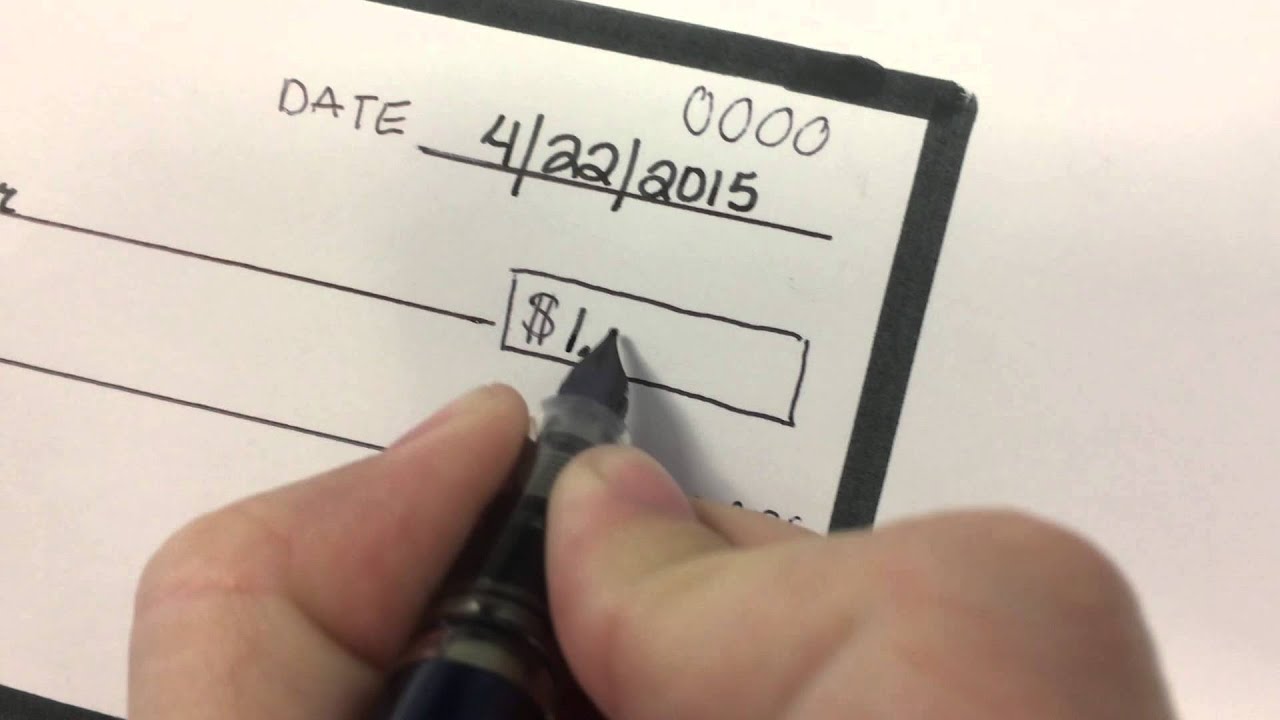

Now, look for the small box with the dollar sign. This is where you write the numerical amount. Put 700.00 here. Write it close to the dollar sign so no one can squeeze an extra digit in there. Some people like to write "700--" or "700.xx" to ensure the decimal is accounted for.

Why the Written Words Matter Most

This is the part that trips people up when they're learning how to write a check for 700. Below the recipient’s name, there’s a long line ending in "Dollars." You need to write out the amount in words.

Write: Seven hundred and 00/100.

Why the fraction? It represents the cents. Even if there are zero cents, you need to show that you didn't just forget them. If you’re feeling fancy, you can draw a long straight line from the end of your writing to the word "Dollars." This prevents anyone from adding more words to change the value. According to the Uniform Commercial Code (UCC) § 3-114, if the numbers and the words on a check conflict, the words actually take precedence. So, if you write "700" in the box but "Seven thousand" on the line, the bank is legally obligated to treat it as a seven-thousand-dollar check. That’s a terrifying mistake to make.

The Memo Line: Your Future Best Friend

The memo line in the bottom left corner is optional, but you're doing yourself a disservice if you leave it blank. Trust me. Six months from now, when you're looking at your bank statement and see a $700 withdrawal, you won't remember what it was for.

Was it for rent?

A security deposit?

That vintage espresso machine you bought off Craigslist?

Write it down. "January Rent" or "Invoice #4452" helps both you and the recipient keep their records straight. If you're paying a bill to a large company, they often require you to write your account number in this space.

Security and the Final Signature

None of this matters if you don't sign the bottom right line. Your signature is the "key" that unlocks the vault. It should match the signature the bank has on file for you. If you’ve changed your name or your handwriting has evolved significantly since you opened the account, you might want to update your signature card at the branch.

Don't sign the check until everything else is filled out. A signed blank check is essentially cash. If you lose it, anyone can find it, write in their name, and drain $700 (or more) from your account.

Common Pitfalls and How to Avoid Them

People get nervous. They overthink it.

One big mistake is using "and" in the wrong place. Don't write "Seven hundred and dollars." The "and" should only come before the cents. "Seven hundred and 00/100" is the gold standard.

Another issue? Writing too small. If the bank teller or the mobile deposit scanner can’t read your writing, the check will get flagged. Use bold, clear strokes. If you mess up, don't try to scribble over it. Write "VOID" in big letters across the check and start a new one. It sucks to waste a check, but a messy, corrected check looks suspicious to fraud departments.

Is a $700 Check Always the Best Choice?

Sometimes, a personal check isn't enough. If you’re buying a car or paying a large deposit, the recipient might ask for a cashier’s check or a money order. A personal check for $700 is only as good as the money in your account. The recipient has to trust that the money is actually there.

💡 You might also like: Another Word for Goods: What Most People Get Wrong About Business Vocabulary

With a cashier's check, the bank takes the money from your account immediately and issues a check from their own funds. It’s guaranteed. If someone is skeptical about your personal check, you might have to head to a branch and pay a small fee (usually $5 to $15) for a cashier's check.

Also, keep an eye on your balance. Writing a check for 700 when you only have $650 in the bank is a recipe for disaster. You’ll get hit with an NSF (Non-Sufficient Funds) fee from your bank, which is usually around $35. Plus, the person you tried to pay might charge you their own "returned check" fee. Suddenly, that $700 payment costs you nearly $800.

Mobile Deposits and the $700 Limit

In 2026, most people deposit checks by taking a photo on their phone. This is incredibly convenient, but be aware that many banks have daily or monthly limits for mobile deposits. A $700 check is usually well within those limits, but if you have a brand-new account, your limit might be lower.

When you receive a check, make sure to endorse the back. Write your name exactly as it appears on the front. Some banks also require you to write "For Mobile Deposit Only" under your signature. If you forget that, the app might reject the photo, and you'll have to wait for a human to review it.

Quick Checklist for Writing Your $700 Check

- Date: Current date in the top right.

- Payee: Full name of the person or business.

- Numeric Box: 700.00 written clearly.

- Written Line: Seven hundred and 00/100 (plus a line to the end).

- Memo: What it’s for (optional but smart).

- Signature: Your official signature on the bottom right.

Always double-check your work before handing the paper over. It takes five seconds to verify, but hours to fix a banking error. Once the check is gone, it's out of your hands.

If you're mailing the check, don't just drop it in a blue USPS box if you're worried about "check washing." Thieves have been known to fish checks out of those boxes and use chemicals to erase your ink. Mailing it from inside a post office is much safer for larger amounts.

💡 You might also like: CEO Bob Iger DEI Explained: What’s Actually Changing at Disney

Moving Forward with Your Finances

Now that you know exactly how to write a check for 700, you might want to look into other ways to track your spending. Using checks can actually be a great way to slow down and be intentional with your money, unlike the mindless "tap-to-pay" culture.

Keep your checkbook in a safe place. Record every check you write in your check register—that little booklet that comes with your checks. If you don't, you might forget that $700 is "spoken for" and spend it elsewhere before the check clears.

To stay on top of your banking:

- Log into your mobile app and see if the check has cleared.

- Compare your check register to your bank statement monthly.

- If a check hasn't cleared after 30 days, reach out to the recipient. They might have lost it.

- If you lose a check you've already written, call your bank immediately to place a "stop payment" order. There is usually a fee for this, but it's cheaper than losing $700.

By following these steps, you ensure your payment is professional, secure, and accurate. It’s a basic financial skill, but doing it right saves you from a world of unnecessary stress.