Checks feel like relics. Honestly, in a world dominated by Apple Pay and instant Zelle transfers, pulling out a paper checkbook feels a bit like using a typewriter. But here is the thing: landlords still love them, the IRS demands them, and sometimes your grandma won’t accept anything else. Knowing how to write a proper check isn't just about getting the money from point A to point B. It’s about making sure some random person doesn't change your $10 into $100 or that the bank doesn't reject it because your handwriting looks like a doctor's scrawl.

You've probably been there. You're standing at a counter, pen in hand, suddenly realizing you haven't done this in three years. Your hand shakes a little. You wonder if you should use "and" in the dollar amount. This isn't just a piece of paper; it’s a legal contract.

The Anatomy of the Paper: Why the Details Matter

Look at your check. It’s busy. You have the routing number and account number at the bottom, which is basically the GPS for the banking system. Banks use MICR (Magnetic Ink Character Recognition) to read those numbers. If you smudge them or spill coffee on them, the machine might kick it back.

The top right corner is where the check number lives. It helps you track your spending, but it doesn't actually affect the validity of the payment. If you're paying a big bill, like a security deposit, write down that check number in your notes. You'll thank yourself later when you're trying to prove you actually paid the guy.

Getting the Date Right

It seems simple. It isn't always. Most people just write today’s date, which is standard. But post-dating is a thing. You write a future date because you don't want the person to cash it until Friday. Here is the kicker: banks often don't care. According to the Consumer Financial Protection Bureau, banks can often cash a post-dated check early unless you specifically notify them in writing about the restriction. So, don't rely on the date to save your bank balance from an overdraft.

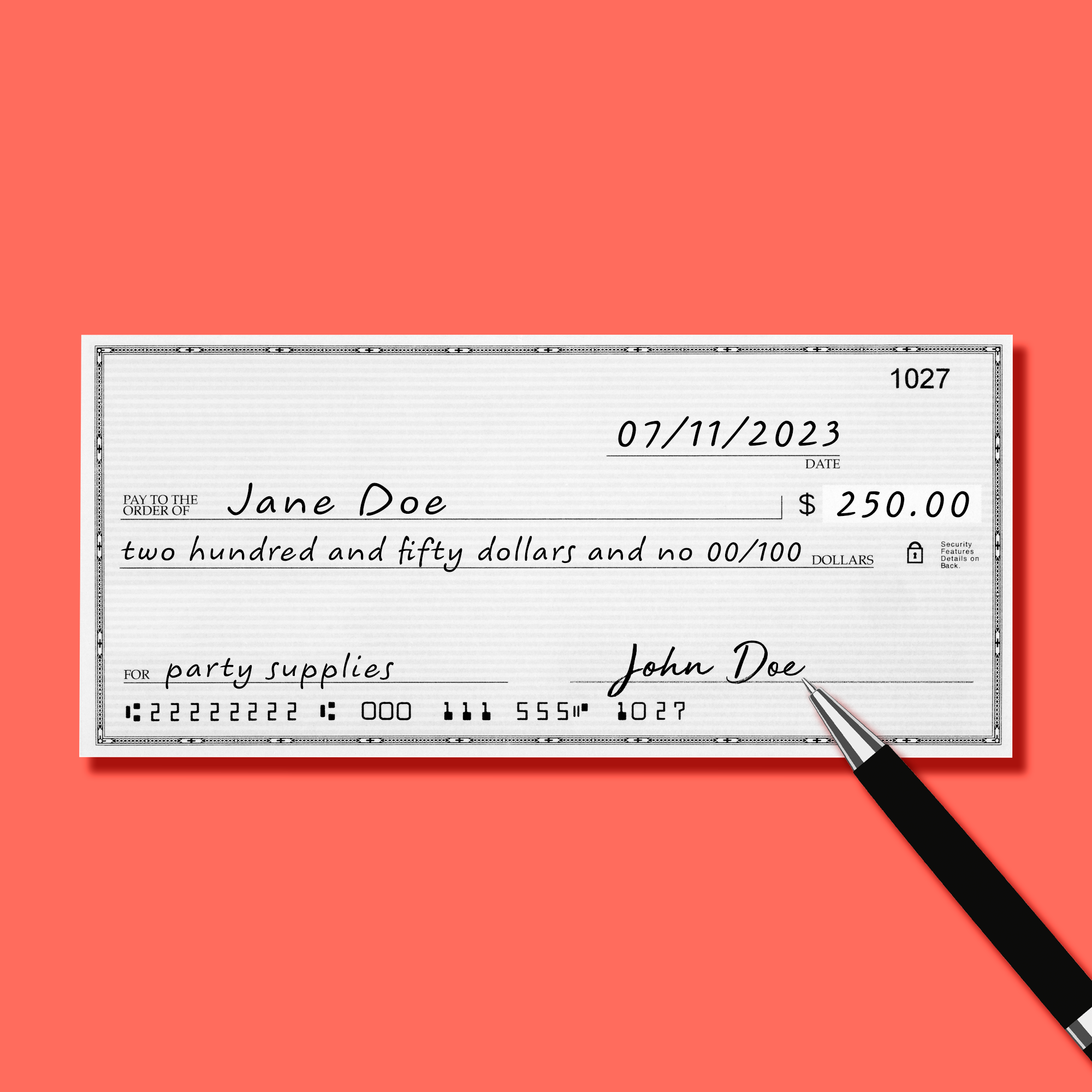

How to Write a Proper Check So It Actually Clears

Let’s walk through the actual ink-on-paper part. Use a blue or black pen. Never use a pencil. That sounds obvious, but you’d be surprised how many people grab whatever is rolling around in their glove box. Pencils can be erased. Gel pens that bleed through the paper are also a nightmare for bank scanners.

📖 Related: Current exchange rate dollar to naira in nigeria: What Most People Get Wrong

First, the Pay to the Order of line. This is where you write the name of the person or company receiving the money. Write the full name. If it’s for a business, use their legal name, not a nickname. If you’re paying "John Smith," don't just write "John."

Next to that is the little box for the numerical amount. This is where most people mess up. Write the numbers clearly. Start as far to the left as possible. If you leave a gap, someone could easily turn a $50.00 into $950.00. Use a decimal point and write the cents clearly. Even if it’s an even dollar amount, write ".00" just to be safe. It leaves no room for "creative" editing by a dishonest recipient.

The Word Line: The Legal Heavyweight

This is the long line below the recipient's name. This is actually the most important part of the check. Why? Because if there is a discrepancy between the numbers in the box and the words on the line, the words technically win under the Uniform Commercial Code (UCC).

Write it out: "One hundred twenty-five and 50/100."

See that fraction? That’s the professional way to handle cents. Draw a line from the end of your writing to the word "Dollars" printed on the check. This "fill-in" line prevents anyone from adding extra words. It’s a classic fraud prevention tactic that old-school bankers still swear by.

The Memo Line and Why You Shouldn't Skip It

The memo line is technically optional. The bank doesn't care what you write there. They won't even look at it. However, you should care.

If you’re paying rent, write "January 2026 Rent." If you’re paying a utility bill, write your account number. If this check ends up as evidence in a small claims court or an IRS audit, that memo line is your best friend. It’s the context that turns a random payment into a specific record.

The Signature: Your Financial Thumbprint

Don't overthink this, but don't be sloppy either. Your signature should match the one the bank has on file. If you’ve changed your name or your handwriting has evolved significantly since you opened the account at age 16, you might want to update your signature card at the branch.

A check isn't money until you sign it. Never, ever sign a check before filling out the other fields. A signed blank check is basically a "steal my money" coupon. If you lose it, anyone can write in any amount they want.

Common Mistakes That Get Checks Rejected

- Illegible Handwriting: If the bank's AI scanner can't read your "Seven," it might flag the check for manual review, delaying the payment.

- Mismatched Amounts: Writing $100 in the box but "One Thousand" on the line is a recipe for a phone call from your bank’s fraud department.

- Using the Wrong Year: Every January, millions of people write the previous year. Banks are usually lenient for a few weeks, but eventually, they’ll stop accepting them.

- Scribbles and White-Out: If you make a mistake, don't try to fix it. Do not use White-Out. Banks see corrections as potential signs of tampering.

If you mess up, write "VOID" in big letters across the check and start a new one. It feels wasteful, but a $15 returned check fee feels worse.

Security Practices You Kinda Need to Know

Fraud is real. It’s not just for movies. Check washing is a technique where criminals use chemicals to erase the ink on a check and rewrite it to themselves for a higher amount.

To prevent this, use a Uni-ball Signo 207 or a similar pen with pigmented ink that traps itself in the paper fibers. It makes it nearly impossible to "wash" the check without destroying the paper itself.

Also, when you're mailing a check, don't leave it in an outgoing mailbox with the red flag up. That's a signal to thieves that there might be money inside. Drop it off inside the post office or use a secure blue USPS box.

🔗 Read more: Global Liquidity: Why Your Portfolio Might Be Hitting a Ceiling

The Modern Reality of Personal Checks

Are checks dying? Sorta. But they are still foundational to the US financial system. Businesses use them for B2B transactions because it creates a clear paper trail that digital systems sometimes lack.

If you're worried about your check being stolen, you can always use a "Cashier’s Check" or a "Money Order" for large transactions. These are guaranteed by the bank's own funds, which makes the recipient feel a lot better when they’re handing over the keys to a car or a house.

Practical Next Steps for Better Banking

- Check your balance first. Writing a check without the funds is "kiting," and it can lead to heavy fines or your account being closed.

- Keep a check register. Every time you write a check, record the number, the date, and the amount in the little booklet that comes with your checkbook.

- Monitor your statements. Log into your banking app every few days to make sure the checks that cleared match the amounts you actually wrote.

- Buy high-security checks. If you order checks from third-party sites, look for those with holograms or chemically sensitive paper.

Taking two extra minutes to ensure you've followed the steps of how to write a proper check saves hours of headache later. It’s about precision. Start at the left, use permanent ink, and always fill the memo line. Your future self will appreciate the lack of "insufficient funds" notices.