Honestly, the Health Savings Account (HSA) might be the most misunderstood tool in the entire American tax code. People call it a "health account," but if you're over 55, it's basically a stealth IRA on steroids.

If you're hitting that 55-plus milestone, the IRS starts getting a little more generous. You've probably heard about the "catch-up contribution," but there is a massive amount of confusion regarding how it actually works—especially for married couples. It isn't just a simple box you check.

The Basic Math for 2024

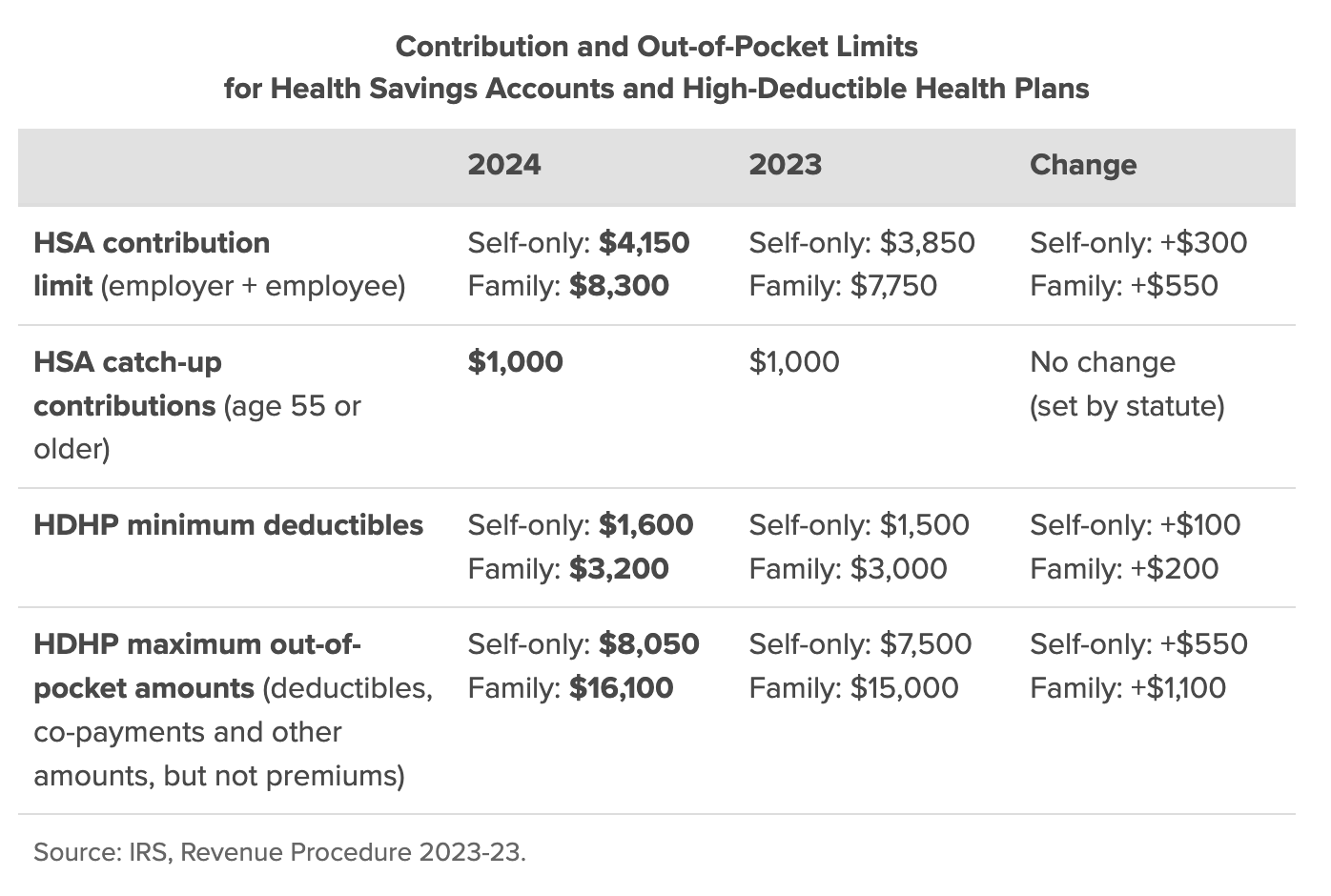

Let's look at the raw numbers first. For the 2024 tax year, the IRS bumped the standard limits up quite a bit from the previous year.

📖 Related: How to cancel a buyers bid on eBay without ruining your seller rating

If you have a self-only high-deductible health plan (HDHP), your base limit is $4,150. If you're on a family plan, that number jumps to $8,300.

Now, here is where the hsa contribution limits 2024 over 55 rules kick in. Once you hit 55, you can add an extra $1,000 to those totals.

- Self-only (55+): $5,150

- Family (55+): $9,300

Simple, right? Not exactly.

The "55" rule is very flexible. You don't actually have to be 55 when you make the contribution. As long as you blow out 55 candles on your cake by December 31, 2024, you are eligible for that full $1,000 catch-up for the entire year. You could turn 55 on New Year's Eve and still put in the full extra grand on January 2nd.

The "Two HSA" Trap for Married Couples

This is the part that honestly trips up almost everyone. If you and your spouse are both over 55 and covered under the same family HDHP, you might think you can just dump $10,300 (Family $8,300 + two $1,000 catch-ups) into one account.

You can't.

The IRS is very weird about this. While the "family" limit of $8,300 can live in one person's HSA, the catch-up contributions are tied to the individual.

If you want to maximize your savings, you essentially need two separate HSA accounts. Spouse A puts the family $8,300 + their $1,000 catch-up into Account A. Spouse B must open Account B to put their own $1,000 catch-up in. If you put both catch-ups into one account, you’ve technically made an excess contribution, and the IRS will come knocking with a 6% excise tax penalty every single year that money sits there.

Why the "Over 55" Window is a Goldmine

Most people use their HSA like a checking account. They put money in, get the tax break, and then immediately spend it on a $50 copay or a box of Band-Aids.

👉 See also: Target Corporation Worth: Why the 50 Billion Dollar Giant is at a Crossroads

That’s a mistake.

If you are 55, you are likely in your peak earning years. You’re also roughly 10 years away from Medicare. If you can afford to pay your medical bills out of pocket now and let that HSA money sit, you are building a tax-free mountain of cash.

Unlike a 401(k) or a Traditional IRA, where you pay taxes when you take the money out, HSA money is "triple tax-advantaged."

- No tax on the way in.

- No tax on the growth.

- No tax on the way out (for medical stuff).

And here is the "secret" nuance: After you turn 65, the HSA loses its "penalty" for non-medical withdrawals. While you’ll still pay income tax on the money if you spend it on a boat or a vacation, the 20% penalty disappears. It literally turns into a Traditional IRA, but better, because you can still take it out tax-free for healthcare.

Watch Out for the Medicare Cliff

There is one major "gotcha" that can ruin your 2024 plans.

HSA eligibility stops the second you enroll in Medicare. Most people sign up for Medicare at 65. If you are 65 and still working, but you decide to take Social Security, you are automatically enrolled in Medicare Part A.

Once that happens, your ability to contribute to an HSA drops to zero.

If you’re 64 and planning your 2024 contributions, you have to be careful. If you enroll in Medicare mid-year, you have to prorate your contribution. You can only contribute for the months you weren't on Medicare.

The "Last-Month Rule" Gamble

If you just got a high-deductible plan in December 2024, you might think you can only contribute 1/12th of the limit.

Nope.

The IRS has a "Last-Month Rule." If you are eligible on December 1, 2024, you can contribute the entire amount for the year, including the full $1,000 catch-up.

But there’s a catch. You have to stay eligible for a "testing period" which lasts through December 31, 2025. If you lose your HDHP coverage during 2025, that extra money you put in for 2024 becomes taxable, and you'll get hit with a 10% penalty. It's a bit of a gamble if you think your job situation might change.

Actionable Next Steps

Don't just read this and move on. If you're over 55, you should probably do these three things right now:

🔗 Read more: 8 unit apartment building plans: What developers usually get wrong about the missing middle

- Audit your accounts: If you're married, make sure your spouse has their own HSA account for their $1,000 catch-up. Do not co-mingle catch-up funds.

- Max it out by April: You actually have until the tax filing deadline (usually April 15, 2025) to make your 2024 contributions. You don't have to scramble before December 31.

- Switch to Investing: If you have more than $2,000 in your HSA, stop leaving it in the cash settlement fund making 0.01% interest. Most providers allow you to buy low-cost index funds. Since you're over 55, that 10-year growth curve before retirement is huge.

The hsa contribution limits 2024 over 55 aren't just about healthcare; they're about aggressive wealth preservation. If you're eligible, leaving that $1,000 catch-up on the table is basically throwing away a free tax break.