Honestly, if you’re still searching for the Idea Cellular Limited share price, you’ve probably noticed something weird on your portfolio. The name "Idea Cellular" basically doesn’t exist on the NSE or BSE anymore. It hasn’t for a few years. What you’re actually looking at now is Vodafone Idea Ltd (VIL), trading under the ticker IDEA.

As of right now—mid-January 2026—the stock is hovering around ₹10.82. It’s been a rough week for the telco. Just yesterday, January 16, the price slipped by about 2.35%. It opened at ₹11.10, teased a tiny high of ₹11.11, and then just sorta drifted down to a low of ₹10.77.

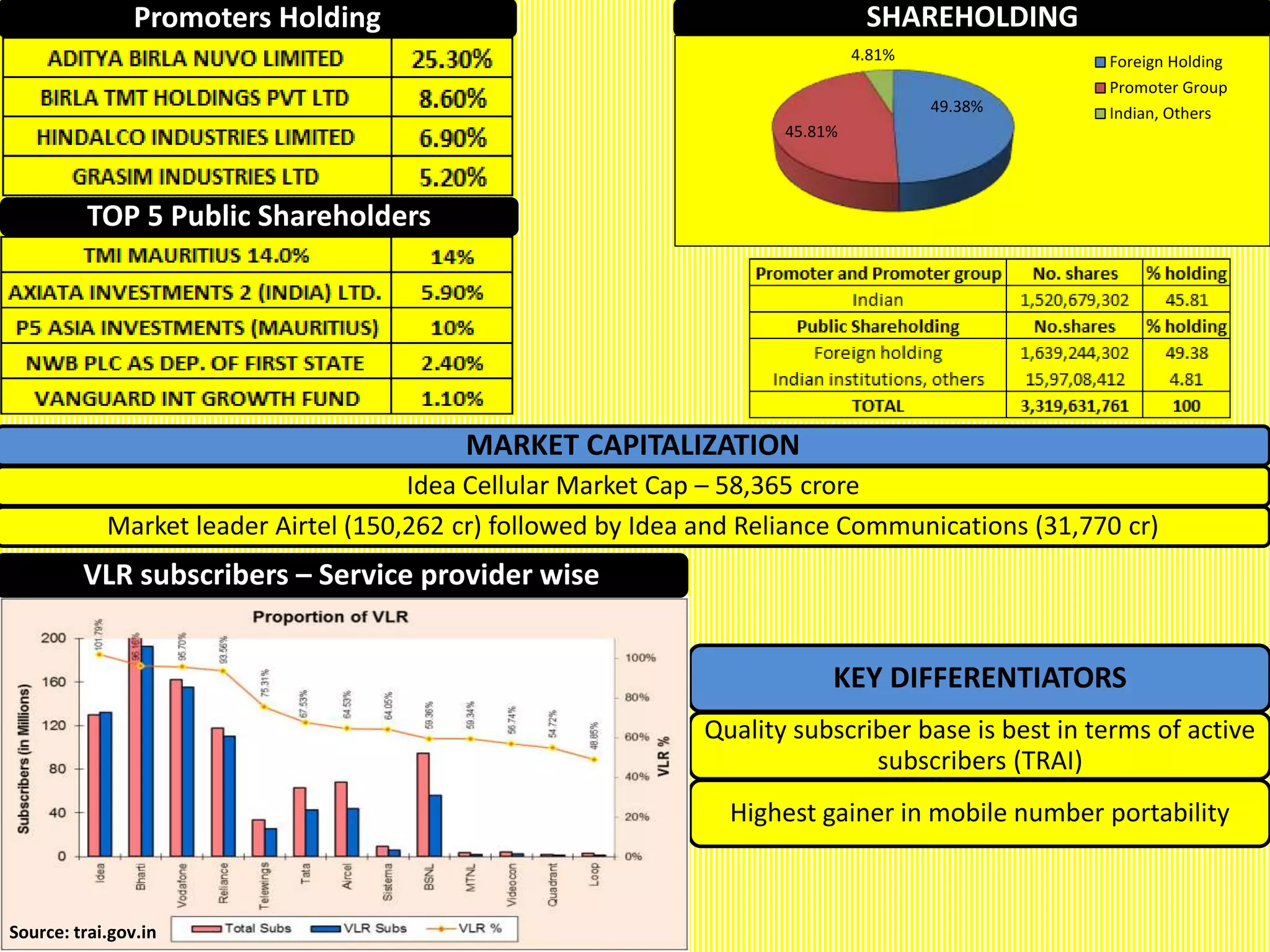

Why does this matter? Because for many retail investors, Idea was once a crown jewel of the Aditya Birla Group. Now, it’s a high-stakes survival story.

The Identity Crisis: Why the Name Changed

It’s easy to get confused. In 2018, Idea Cellular and Vodafone India decided they couldn't beat Reliance Jio individually, so they joined forces. They rebranded as Vi (pronounced "we") in 2020.

If you held old Idea shares, they automatically became Vodafone Idea shares. You didn't lose your money, but you definitely lost the stability the old brand used to have. Today, the Government of India is actually the largest shareholder, holding roughly 48.99% of the equity after converting the company's massive interest dues into shares back in 2023.

The Numbers Nobody Wants to Hear

Let's talk about the cold, hard cash. Or lack of it.

Vodafone Idea has been bleeding money. We're talking about a net loss of over ₹5,500 crore just in the last reported quarter of 2025. That is a massive number. The company is currently spending a staggering 56% of its operating revenue just to pay off interest on its debt.

- Market Cap: Somewhere around ₹1,17,227 crore.

- 52-Week High: ₹12.80.

- 52-Week Low: ₹6.12.

- Price-to-Book (PB) Ratio: -1.4. Yes, it’s negative because the company’s liabilities outweigh its assets.

Technically, the stock is in a bit of a "no man's land." For the coming week (Jan 19–23, 2026), analysts like those at Equitypandit are eyeing a support level at ₹10.80. If it breaks below that, we could see a sharp drop toward ₹10.34. On the flip side, it needs to cross ₹12.12 to show any real signs of life.

Is There a Recovery Plan?

The management is trying. They've planned a ₹27,000 crore investment to beef up their 4G and 5G infrastructure. They have to. If they don’t catch up to Airtel and Jio, their subscriber base—which currently sits at about 127 million—will keep shrinking.

✨ Don't miss: Indian Rupees to PKR: Why the Gap is Widening in 2026

There's a huge divide in what experts think. JM Financial recently put out a "Buy" rating with a target of ₹9 (which is odd given the current price is higher, suggesting they expect a dip first), while ICICI Securities is much more pessimistic with a "Hold" and a target of ₹7.

The Reality for Retail Investors

If you're holding this for the long term, you're essentially betting on a government bailout or a massive, miraculous turnaround in the telecom sector's Average Revenue Per User (ARPU).

Wait.

Think about that for a second. The stock has grown about 21% over the last year, which sounds great until you realize it’s still way below its pre-merger glory. It’s a "penny stock" with "large-cap" problems.

Actionable Insights for Your Portfolio

- Stop looking for "Idea Cellular": Update your watchlists to Vodafone Idea (IDEA) to get real-time data.

- Watch the Support: Keep a close eye on the ₹10.80 level. A sustained close below this could trigger a sell-off by institutional players.

- Check the Debt: The next quarterly result is crucial. Look specifically at whether the "Interest Coverage Ratio" is improving. If it isn't, the company is just running on a treadmill.

- Diversify: If this represents more than 5% of your portfolio, you are taking on massive "sectoral risk." The telecom industry in India is essentially a duopoly right now, with Vi fighting to stay as the third player.

The Idea Cellular Limited share price story isn't over, but the plot has shifted from growth to survival. Keeping a realistic view of these numbers is the only way to protect your capital.