So, you hit "send" on your tax return and realized five minutes later that you forgot to report that $2,000 1099-NEC from your side gig. Or maybe you just found a dusty folder in the bottom of your desk containing receipts for a child care credit you completely overlooked. Your stomach drops. You think the IRS is going to kick down your door. Honestly? Relax. It happens to millions of people every single year. Dealing with an income tax amended return is a standard part of the tax cycle, though the rules have changed quite a bit lately, especially with how the IRS processes the 1040-X form.

Errors are human. The IRS knows this. In fact, their own Data Book usually shows millions of amended returns processed annually. But there is a specific way to handle this without triggering a "math error" notice or an agonizingly long delay. If you're sitting there wondering if you should just ignore the mistake and hope they don't notice, don't. The IRS's automated underreporter system (known as the CP2000 program) is remarkably good at matching the documents they have on file with what you actually reported. It’s better to fix it yourself before they send you a bill with interest tacked on.

Why You Might Actually Need an Income Tax Amended Return

Most people think you only amend if you're in trouble. That’s just not true. Sometimes, it's about getting back money you accidentally left on the table. If you suddenly realize you qualified for the Earned Income Tax Credit (EITC) or the American Opportunity Tax Credit (AOTC) after you already filed, you’re literally giving the government a free loan by not amending. You have rights under the Taxpayer Bill of Rights to pay no more than the correct amount of tax.

Wait. Don't amend for simple math errors. If you added $500 and $500 and got $1,100, the IRS computers will usually catch that and fix it for you automatically. They’ll send you a letter explaining the change. You also don't need an income tax amended return if you forgot to attach a specific W-2 or a schedule; typically, they'll just mail you a request for the missing paperwork. You amend when your filing status, your income, or your deductions change in a way that shifts the bottom line.

The Timing Trap

There is a ticking clock. You generally have three years from the date you filed your original return to file a 1040-X to claim a refund. Or, you have two years from the date you paid the tax, whichever is later. This is a hard deadline. If you’re filing for 2022 today, you’re likely fine, but if you’re trying to dig back into 2019 because you found a "lost" deduction, you might be out of luck unless you fall into very specific categories like combat zone service or physical impairment.

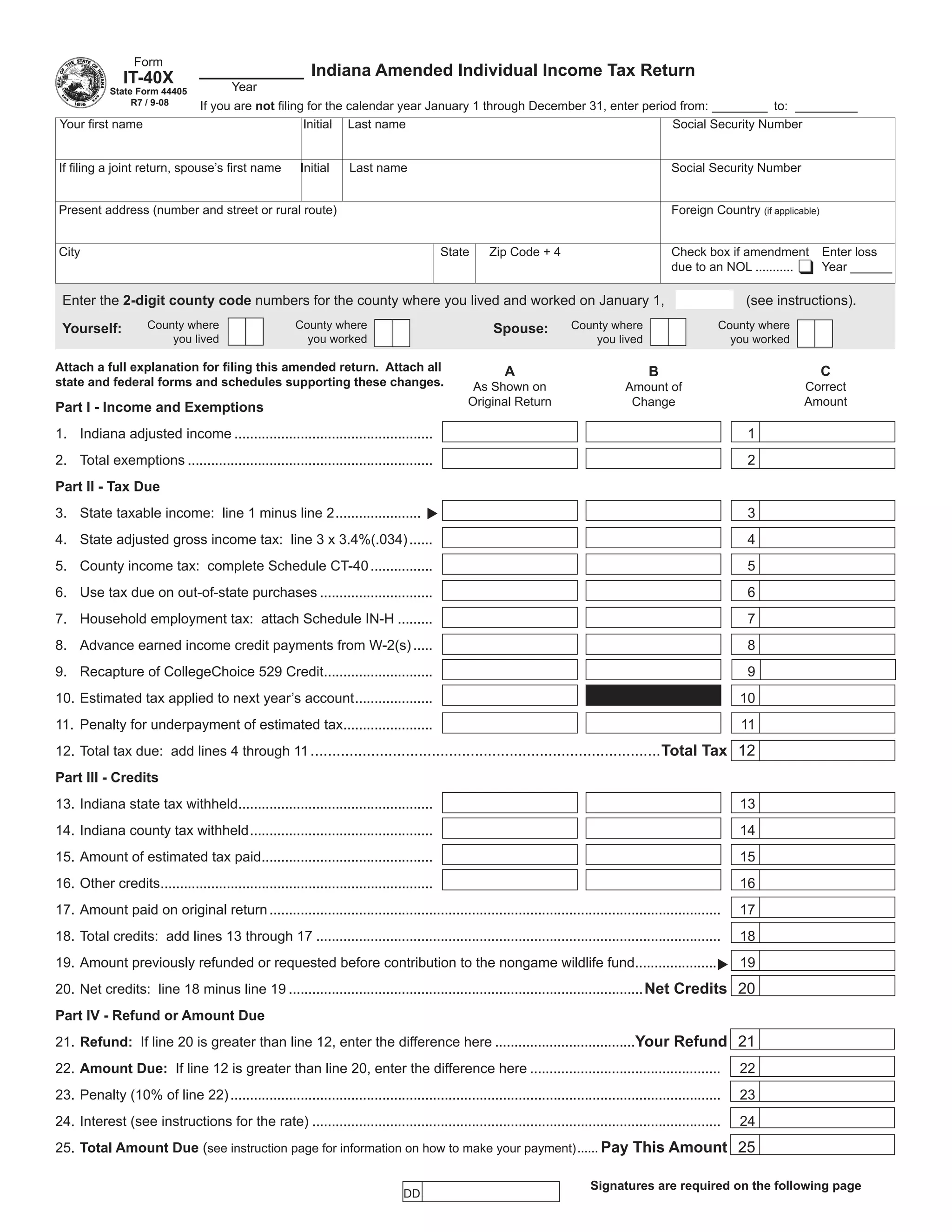

The Form 1040-X: It’s Not as Scary as It Looks

The 1040-X is the "Corrected U.S. Individual Income Tax Return." It’s basically a three-column document. One column shows the original numbers, one shows the change (increase or decrease), and the final column shows the corrected amount. It's surprisingly logical for a government form.

📖 Related: Cleveland Plywood Cleveland TN: Why Local Builders Still Swear By Them

You used to have to mail these in a paper envelope and wait months for a human in a processing center to open it. Now, for the tax years 2019, 2020, 2021, and 2022, you can actually e-file your income tax amended return. This is a massive win. E-filing reduces the "where is my refund" anxiety because the system acknowledges receipt almost instantly. However, if you are changing your filing status from "Married Filing Jointly" to "Married Filing Separately" after the deadline, you're usually stuck with the original choice—the IRS is weirdly strict about that specific switch.

The "Paper Trail" Requirement

Documentation is everything here. If you’re changing your charitable contributions, don't just write a new number on the 1040-X and hope for the best. You need to attach the new Schedule A. If you’re adding business expenses, you need the new Schedule C. The IRS won't just take your word for it; they need the supporting schedules that would have been there if you’d gotten it right the first time.

Common Mistakes That Trigger Delays

The biggest mistake? Filing the amended return too early. If you are expecting a refund from your original return, wait until you actually receive that money before you file the amendment. If you send the 1040-X while the first return is still being processed, it can create a massive "glitch" in the system where both returns get flagged for manual review, potentially freezing your money for months.

Another frequent blunder is forgetting to sign the form. It sounds stupidly simple, but if you're paper-filing, a missing signature is the number one reason forms get bounced. Also, don't forget your state taxes. If you change your federal return, that almost certainly changes your state tax liability too. Most states require you to notify them within 30 to 90 days of a federal change.

What About the "Where's My Amended Return" Tool?

The IRS has a dedicated tracking tool for this. It’s separate from the regular refund tracker. Usually, it takes about three weeks for your income tax amended return to show up in their system after you file it. Total processing time? Honestly, it’s rarely the "16 weeks" they claim on the website. Lately, it’s been taking anywhere from 20 weeks to six months. It’s a slow-motion process.

Special Situations: When Amending is Mandatory

If you receive a corrected 1099 or W-2 from your employer after you've filed, you kind of have to amend if the difference is substantial. The IRS gets a copy of those forms too. If their copy says you made $80,000 and your return says $70,000, their automated system will flag the discrepancy. It’s much cheaper to pay the difference now than to pay it later with three years of compounded interest.

Net Operating Losses (NOLs) are another big one. If you’re a small business owner and you had a rough year, you might be able to carry back those losses to previous years to get a refund of taxes you paid when you were profitable. This is a complex area of tax law—especially with the changes from the Tax Cuts and Jobs Act (TCJA) and the CARES Act—but it’s one of the few times an income tax amended return can result in a massive, unexpected windfall.

Actionable Steps to Fix Your Return

First, gather all your original documents and the new ones that arrived late. You need to see the "before and after" clearly. If you used software like TurboTax or H&R Block to file the original, use that same software to create the amendment; it usually handles the column-math for you automatically.

- Wait for your original refund. If you have a check or direct deposit hitting your account from the first filing, let that clear first.

- Download or open Form 1040-X. If you can e-file, do it. If you have to mail it, use Certified Mail with a Return Receipt. It costs a few bucks, but having proof that the IRS received your form is priceless if they lose it.

- Write a clear explanation. There is a section on the back of the 1040-X for "Explanation of Changes." Be concise. "Received corrected 1099-DIV from Vanguard on March 15th" is perfect. You don't need a life story.

- Pay what you owe immediately. If your amendment shows you owe more tax, pay it when you file. You can pay online via the IRS "Direct Pay" portal. This stops the interest clock from ticking.

- Track it but stay patient. Check the "Where's My Amended Return?" tool once a week. Don't call the IRS unless it’s been more than 20 weeks; the agents won't have any info for you until the form is actually assigned to a processor.

Amending a return isn't an admission of guilt; it's an exercise in accuracy. Whether you're hunting down a missed credit or correcting an honest oversight, the 1040-X is your tool for keeping your record clean. Just keep your receipts, stay organized, and remember that the tax code is designed to be fixed when things go sideways.