Honestly, if you were sitting in front of the TV on February 1st waiting for Nirmala Sitharaman to drop a bombshell on your wallet, you probably walked away feeling a weird mix of relief and confusion. The India Budget 2025 income tax announcements weren't just a minor tweak. They were basically a "join the new regime or get left behind" signal from the government.

Money is personal. So when the Finance Minister stands up and starts rattling off figures like ₹12.75 lakh and Section 87A, your brain naturally tries to calculate: "Am I richer or poorer today?"

Here is the real talk: If you earn ₹12 lakh a year, you basically just got a 100% tax waiver. No strings attached. Well, almost no strings.

The Zero-Tax Club: Is it Actually Real?

You’ve likely seen the headlines screaming that income up to ₹12 lakh is now tax-free. It sounds like a gimmick, but it’s actually a clever combination of a higher rebate and wider tax slabs.

In the 2025-26 financial year, the government hiked the rebate under Section 87A to ₹60,000. Under the New Tax Regime—which is now the default, by the way—if your taxable income is ₹12,00,000, your calculated tax would have been exactly ₹60,000. Since the rebate matches the tax, you owe the IT Department zero. Zip. Nada.

But wait. There’s a catch for the salaried folks.

Because you get a standard deduction of ₹75,000 (which was also bumped up from ₹50,000), your "gross" salary can actually be ₹12,75,000. After you take out that standard deduction, you land at exactly ₹12 lakh. And boom—no tax.

The New Slabs (2025-26)

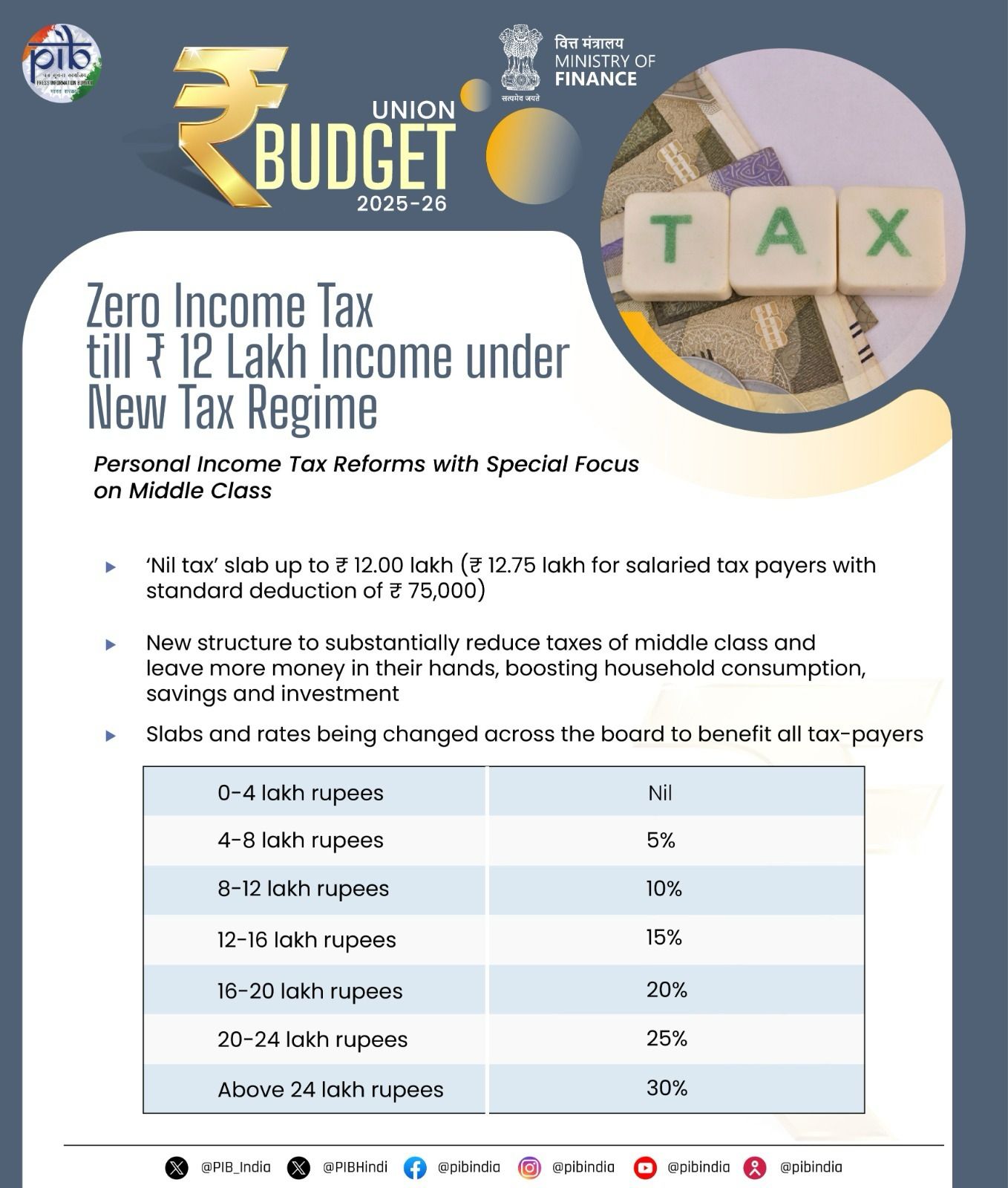

If you're wondering where you fit, here is the breakdown for the New Regime. It's a lot smoother than it used to be:

- ₹0 to ₹4 Lakh: 0% (The baseline is up from ₹3 lakh)

- ₹4 Lakh to ₹8 Lakh: 5%

- ₹8 Lakh to ₹12 Lakh: 10%

- ₹12 Lakh to ₹16 Lakh: 15%

- ₹16 Lakh to ₹20 Lakh: 20%

- ₹20 Lakh to ₹24 Lakh: 25%

- Above ₹24 Lakh: 30%

Notice something? That 30% bracket used to hit way earlier. Now, it only kicks in after you cross the ₹24 lakh mark. If you’re a high-earner, say someone making ₹25 lakh, you’re looking at a tax saving of roughly ₹1,10,000 compared to the previous year's structure. That’s a vacation or a very nice piece of jewelry.

The Old Regime is a Ghost Town

Let’s be blunt. The government is ghosting the Old Tax Regime.

✨ Don't miss: Pinterest Does Not Work: Why Your Strategy is Crashing and How to Fix It

There were zero—and I mean zero—changes to the old system in the 2025 budget. If you are still sticking to it because of your LIC, PPF, and home loan interest, you might want to run the numbers again. The "benefit gap" is closing fast. For most people without massive home loans, the New Regime is now the clear winner.

Experts like Surabhi Marwah from EY have noted that while the old regime still exists, it's essentially for those with very specific, heavy investment commitments. For everyone else, the simplicity of the New Regime—no receipts to save, no CA to haunt—is the intended path.

Why the "Cliff" Doesn't Kill You Anymore

There used to be this terrifying thing called the "tax cliff." Imagine you earn ₹12,00,001. Just one rupee over the limit. Suddenly, you'd owe thousands in tax. It was a nightmare.

Budget 2025 fixed this with Marginal Relief.

Basically, the law now ensures that the tax you pay on that extra income won't exceed the extra income itself. If you earn ₹12.1 lakh, you aren't going to suddenly have less take-home pay than someone earning exactly ₹12 lakh. It’s a bit of complex math behind the scenes, but the gist is: don't panic if you get a tiny year-end bonus that pushes you over the limit.

Capital Gains: The Silent Part of the Budget

While everyone was cheering about the slab rates, the capital gains section was a bit more of a "mixed bag."

The 2025 budget solidified the 12.5% rate for Long-Term Capital Gains (LTCG) across the board. Whether it's listed stocks, gold, or even those high-premium ULIPs (Unit Linked Insurance Plans) you bought, the taxman wants 12.5%.

The ULIP Reality Check

This is one area where people often get tripped up. If your ULIP has an annual premium of more than ₹2.5 lakh, it's no longer a "magic tax-free bucket." Budget 2025 made it clear: these are now capital assets. If you hold them for over a year, you pay 12.5% on the gains. If you ditch them earlier, they are taxed at your slab rate.

💡 You might also like: Rivian After Hours Stock Price: Why Everyone Is Watching the R2 Reveal So Closely

Compliance: Giving You More Time (Sorta)

There was a pretty significant change for anyone who is... let’s say "forgetful."

The deadline for filing an Updated Income Tax Return (ITR-U) was extended from 2 years to 4 years. This is huge. If you realized you forgot to report some interest from a random savings account back in 2023, you now have a much longer window to fix it without getting a scary notice.

But don't get too excited—you still have to pay additional tax (25% to 50% extra) for the privilege of filing late. It's an "oops" fee, but at least the door is open longer.

What Most People Miss: The Small Stuff

- NPS Vatsalya: You can now open these for minors and get the same tax perks as a regular NPS. It's basically a way to start your kid's retirement fund while they're still in diapers.

- TDS Thresholds: If you have money in the bank, the TDS limit on interest was bumped from ₹40,000 to ₹50,000. It’s a small win for senior citizens and middle-class savers.

- Rent Payments: The TDS threshold for rent was hiked from ₹2.4 lakh to ₹6 lakh, which is a massive relief for small business owners who were drowning in paperwork.

Actionable Next Steps

Don't just read this and go back to your coffee. Taxes are active, not passive.

📖 Related: Finding 230 Peachtree St NW Suite 1000 Atlanta GA 30303: What You Need to Know

- Run the Calculator: Use the official Income Tax Department calculator for the FY 2025-26. Plug in your current salary and see the difference between the Old and New regimes. Most people will find the New Regime saves them between ₹50,000 and ₹1.1 lakh.

- Review your ULIPs: If you have high-value insurance policies, check the premium amounts. Anything over ₹2.5 lakh annually needs a new tax strategy because those gains aren't "free" anymore.

- Clean up the past: Since the ITR-U window is now 4 years, look back at your 2022 and 2023 filings. If there was a mistake, fix it now before the "faceless assessment" AI flags it.

- Salary Restructuring: Talk to your HR. Since the standard deduction is now ₹75,000 and slabs have shifted, you might want to re-evaluate how your allowances are balanced if you're still on the Old Regime.

The India Budget 2025 income tax changes are clearly designed to put more cash in your pocket today, rather than making you wait for a refund tomorrow. It’s a shift from "save to save tax" to "earn and spend (or invest) freely."