Taxes are a nightmare. Honestly, there’s no other way to put it when you’re staring at a stack of W-2s and 1099s while trying to figure out if the IRS is going to send you a refund or a bill. Most of us just want to get it over with, but the instructions for Form 1040 have become so dense over the last few years that even seasoned pros get a headache. The IRS 1040 booklet is basically a novel now. It’s over 100 pages of fine print that determines how much of your hard-earned money you actually get to keep.

You’ve probably heard people say filing is easier now because of the "postcard" sized form that debuted a few years back. That was a bit of a marketing gimmick. The form itself looks shorter, sure, but it relies on a web of "Schedules" that make the actual process just as complex as it ever was. If you have a side hustle, a house, or kids, you aren't just filing a 1040; you're navigating a labyrinth.

The Standard Deduction vs. Itemizing: The $14,600 Question

Most people take the easy route. For the 2024 tax year (the ones you're likely filing in 2025), the standard deduction jumped to $14,600 for individuals and $29,200 for married couples filing jointly. It’s huge. Because of this, nearly 90% of taxpayers don't bother itemizing anymore. Why track every single Goodwill donation or medical bill when the government gives you a massive "freebie" deduction?

But here is where the instructions for Form 1040 get tricky.

If you live in a high-tax state like New Jersey or California, or if you had massive out-of-pocket medical expenses that exceeded 7.5% of your adjusted gross income (AGI), you might be leaving money on the table by taking the easy way out. You have to run the numbers both ways. It’s tedious. You’ll need Schedule A for this. I’ve seen people miss out on thousands because they assumed the standard deduction was "good enough" without actually checking their property tax and mortgage interest totals.

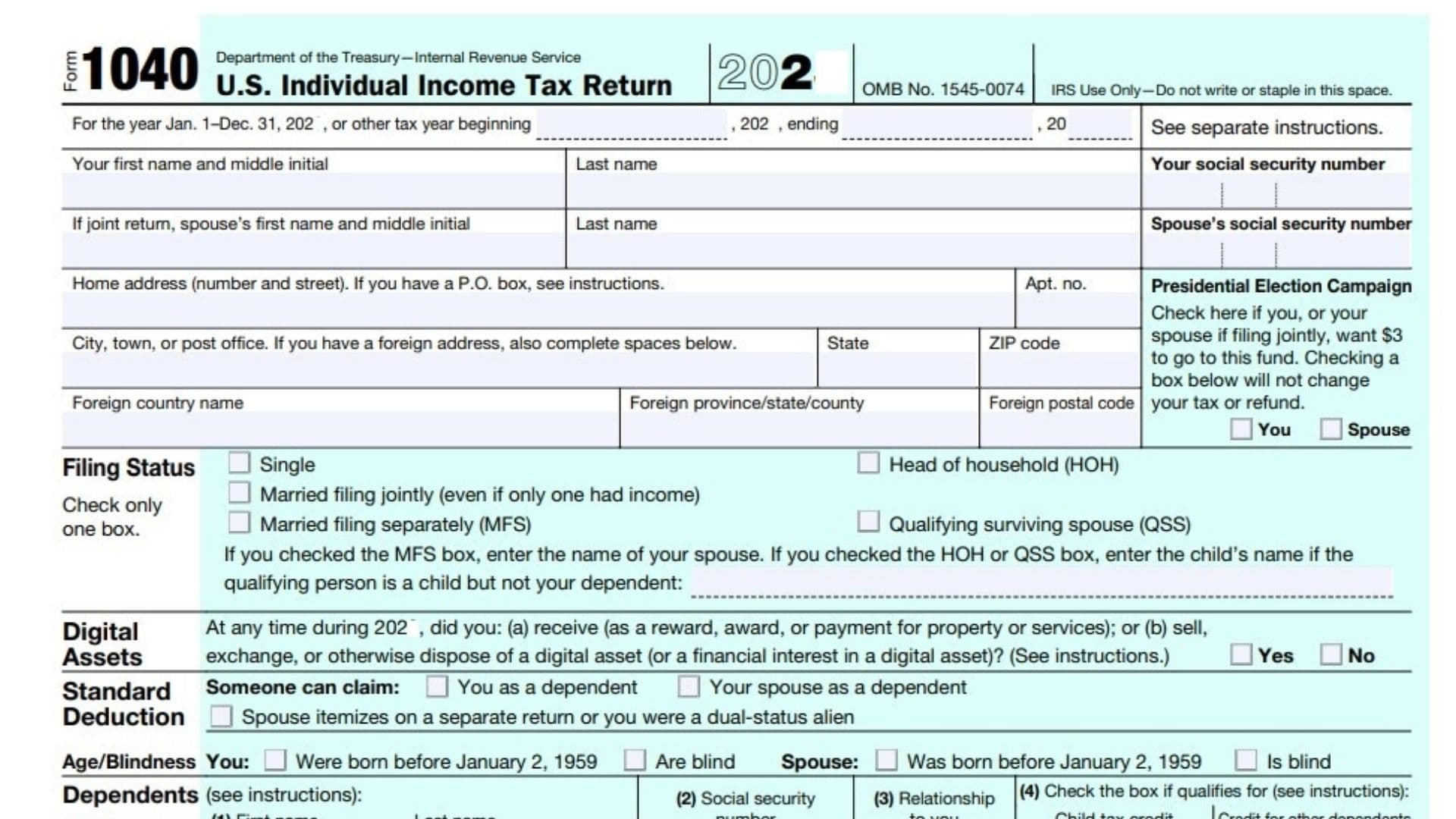

That Weird Question About Crypto

Look at the very top of Form 1040. Right under your name and address, there’s a question about digital assets. The IRS is obsessed with this. If you received, sold, exchanged, or otherwise disposed of any digital asset (like Bitcoin, Ethereum, or even certain NFTs), you have to check "Yes."

If you just bought crypto with US dollars and held it in a wallet? You can usually check "No." But if you traded one coin for another, that’s a taxable event. The instructions for Form 1040 are very clear about this: they are looking for capital gains. Don't lie here. The IRS has been winning court cases to get user records from major exchanges like Coinbase and Kraken. They already know.

Understanding the "Schedules" Architecture

Think of Form 1040 as the hub of a wheel. The Schedules are the spokes.

✨ Don't miss: Cuándo pagan en McDonald's: Lo que realmente necesitas saber sobre sus ciclos de nómina

- Schedule 1 is for additional income. Did you win money gambling? Do you have a "standard" job but also drive for Uber? That goes here. It also covers "adjustments to income," which are the holy grail of tax filing because they lower your AGI directly.

- Schedule 2 deals with "Additional Taxes." This is where the Alternative Minimum Tax (AMT) lives, along with self-employment tax. If you're a freelancer, this is your primary headache.

- Schedule 3 is for non-refundable credits. This is the good stuff—foreign tax credits, education credits, and the like.

One thing the instructions for Form 1040 emphasize is that your AGI (Line 11) is the most important number on the whole return. It determines your eligibility for almost every credit and deduction in the book. If your AGI is too high, you get "phased out" of the Child Tax Credit or the ability to deduct student loan interest. It’s a cliff.

The Self-Employment Trap

If you’re part of the gig economy, the instructions for Form 1040 are a different beast. You aren't just a taxpayer; you're a business. You have to fill out Schedule C to report your profit or loss.

The biggest mistake? Forgetting that you owe both the employer and employee share of Social Security and Medicare taxes. That’s roughly 15.3%. You get to deduct half of that on Schedule 1, but it’s still a gut punch when you see the final number. Also, keep your receipts. The IRS doesn't care if you "estimate" your mileage; they want a log.

Credits You Shouldn't Ignore

Tax credits are better than deductions. A deduction lowers the income you’re taxed on, but a credit is a dollar-for-dollar reduction of the tax you owe.

✨ Don't miss: What Does Bullish and Bearish Mean in Stocks? The Truth Behind the Jargon

The Earned Income Tax Credit (EITC) is one of the most substantial, yet the IRS estimates that about 20% of eligible taxpayers don't claim it. Why? Because the instructions for Form 1040 regarding the EITC are notoriously confusing. It’s designed for low-to-moderate-income working individuals and families. If you have three or more kids, the credit can be worth over $7,000. That’s life-changing money for some.

Then there’s the Child Tax Credit. For 2024, it's generally $2,000 per qualifying child under age 17. Only a portion of it ($1,700) is refundable, meaning if you owe zero taxes, you can still get up to $1,700 back as a check.

Why Your Filing Status Matters More Than You Think

Don't just default to "Single" or "Married Filing Jointly" without thinking. "Head of Household" is a goldmine if you’re unmarried but pay more than half the cost of keeping up a home for a qualifying person. It gives you a higher standard deduction and more favorable tax brackets than filing single.

However, if you’re going through a rough divorce, "Married Filing Separately" might feel safer, but it’s usually the most expensive way to file. You lose out on the Earned Income Credit, most education credits, and the ability to take the student loan interest deduction. It’s a steep price for privacy.

Common Blunders in the 1040 Process

Errors lead to delays. Delays lead to stress.

- Wrong Social Security Numbers: If you mistype a kid's SSN, the IRS computers will automatically kick back the return and disallow the Child Tax Credit. It happens all the time.

- Mailing a Paper Return: Just don't. The instructions for Form 1040 still explain how to do it, but unless you have a very specific legal reason, file electronically. Paper returns take months to process. E-filed returns with direct deposit usually result in a refund within 21 days.

- Forgetting Line 1h: This is relatively new. It’s for "other earned income," like household employee wages or certain types of disability payments. People miss it constantly.

- Math. If you're doing this by hand, you're almost guaranteed to make a mistake. The IRS has a "math error authority" that allows them to correct your return and send you a bill for the difference without even going through a full audit.

Dealing with the 1099-K Mess

There has been a lot of back-and-forth about the $600 threshold for 1099-K forms (the ones Venmo and PayPal send). For the most recent tax year, the IRS delayed the $600 rule again, moving toward a $5,000 "transition" threshold.

👉 See also: Andy Elliott Explained: The Man Who Made Six-Pack Abs a Sales Requirement

Regardless of whether you get a form, you are legally required to report the income. If you sold an old couch on Facebook Marketplace for less than you paid for it, that's not taxable income. But if you sold concert tickets for a profit? The instructions for Form 1040 say that's a capital gain. Report it.

When to Hire a Professional

If you just have a W-2 and no kids, you can probably do this yourself using the IRS Free File program. It’s literally free software for anyone earning under $79,000.

But if you own rental property, have foreign bank accounts (FBAR requirements are no joke), or have complex stock options (RSUs or ISOs) from your job, the instructions for Form 1040 won't be enough. You need a CPA or an Enrolled Agent. A mistake on a foreign asset disclosure can carry a penalty of $10,000 or more. That’s not a typo. Ten grand.

Actionable Steps for a Painless Filing

- Gather Your "Information Returns" First: Do not start your 1040 until you have every W-2, 1099-INT, 1099-DIV, and 1099-B. If you file and then a stray 1099 shows up in the mail in March, you’ll have to file an amended return (Form 1040-X), which is a massive pain.

- Check Your Withholding: If you ended up owing a lot of money this year, go to your HR department and update your W-4. The goal isn't necessarily a huge refund (that’s just an interest-free loan to the government), but you definitely don't want a surprise $5,000 bill in April.

- Contribute to an IRA: You have until the April filing deadline to put money into a Traditional IRA and potentially deduct it from your 2024 taxes. This is one of the few ways to lower your tax bill after the year has already ended.

- Review the PDF: Before you hit "submit" on your tax software, actually look at the 1040 PDF. Check Line 1 (wages), Line 11 (AGI), and Line 24 (total tax). If those numbers look crazy compared to last year, investigate why before you send it.

- Save a Copy: Keep your returns for at least three years. The IRS generally has three years to audit you, but if they suspect you "substantially" understated your income, they can go back six.

Filing taxes is a legal obligation, but you don't have to pay more than you owe. The instructions for Form 1040 are your map, but you have to be the one to actually read the signs. Take it slow, double-check your identity info, and remember that the "Standard Deduction" is your baseline, not necessarily your best friend. Get your documents organized now so you aren't rushing when the deadline hits. Once you’ve submitted and received your confirmation number, you can breathe easy for another 365 days.