Tax season usually feels like a giant puzzle designed by someone who hates you. You’re looking at piles of forms, weird acronyms, and numbers that seem to shift every time you blink. Honestly, it’s a lot. But the irs 2024 tax rates aren't actually some dark secret once you peel back the legalese.

The big story for 2024 was inflation. Since prices for everything from eggs to electricity went through the roof, the IRS bumped up the income thresholds for the tax brackets. They do this so you don’t get "bracket creep," which is just a fancy way of saying you shouldn't pay higher taxes just because your boss gave you a tiny raise to keep up with the price of milk.

How the Brackets Actually Work

Most people think if they land in the 22% bracket, the IRS takes 22% of everything they make. That’s a total myth. We have a progressive tax system. Think of it like a series of buckets. Your first chunk of money fills the 10% bucket. Once that’s full, the next chunk spills into the 12% bucket, and so on.

✨ Don't miss: GE Vernova Stock Price: What Most People Get Wrong

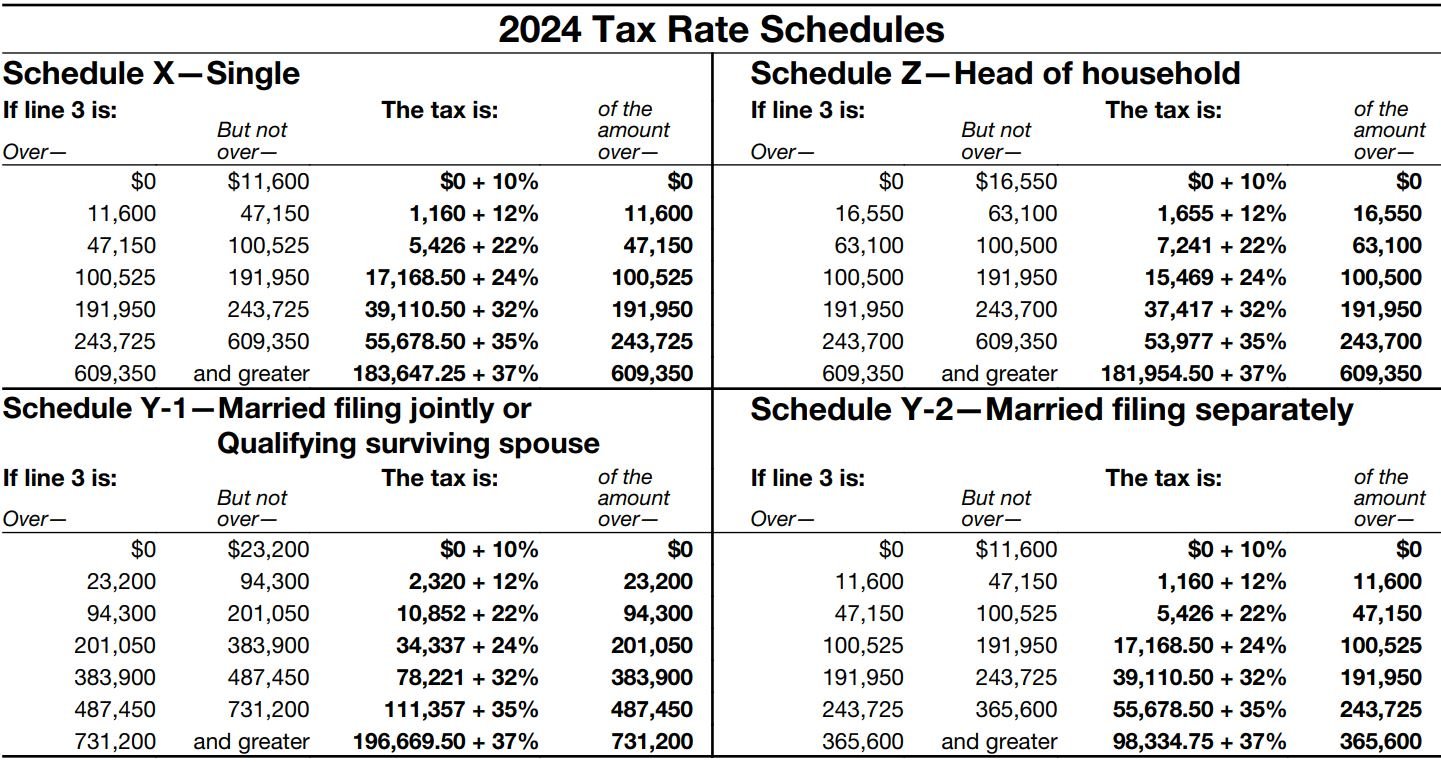

For 2024, the seven rates stayed the same: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. What changed was how much you can earn before moving to the next bucket.

If you’re filing as a single person, that 10% rate applies to your first $11,600 of taxable income. If you make $11,601, only that one extra dollar gets taxed at 12%. It’s a common mistake to think a raise will "lower" your take-home pay by pushing you into a higher bracket. In reality, you always make more money when you earn a raise, even if the government takes a bigger bite of the top portion.

Single Filers

For those flying solo, the thresholds for 2024 are pretty clear. The 22% rate starts once you hit $47,150. If you’re a high earner, you don’t hit that top 37% rate until your taxable income clears $609,350.

Married Filing Jointly

Couples get much wider buckets. You can earn up to $23,200 and stay in the 10% zone. The 22% bracket for married folks starts at $94,300. Basically, the IRS doubles the single thresholds for most of these tiers to account for two people living on the same pool of money.

The Standard Deduction: Your First Big Win

Before you even look at those brackets, you have to talk about the standard deduction. This is the amount of money the IRS just lets you keep, no questions asked. Most people take this instead of itemizing because, frankly, keeping every single receipt for three years is a nightmare.

For the 2024 tax year, the standard deduction jumped up significantly:

- Single filers and Married Filing Separately: $14,600

- Married Filing Jointly: $29,200

- Head of Household: $21,900

If you are 65 or older or blind, you get an extra "bump" on top of these numbers. For a single person over 65, that’s an extra $1,950. This is huge because it lowers your "taxable income." If you earned $50,000 as a single person, you subtract that $14,600 immediately. Now you’re only being taxed on $35,400. That moves you down into a lower bracket than your gross salary would suggest.

Head of Household: The Middle Ground

There's a lot of confusion around the Head of Household status. It’s for people who are unmarried but pay for more than half the cost of keeping up a home for a "qualifying person," like a child or an aging parent.

The irs 2024 tax rates for this group are more favorable than the single rates but not quite as generous as the married ones. For instance, the 12% bracket for a Head of Household goes up to $63,100, whereas for a single person it stops at $47,150. If you qualify for this, use it. It’s a massive leg up.

Capital Gains and the "Hidden" Taxes

We can't just talk about your paycheck. If you sold some stock or a piece of property, you're looking at capital gains rates. These are generally lower than ordinary income rates, which is why investors often pay less in taxes than people who work a 9-to-5.

In 2024, if you're single and your taxable income is under $47,025, your long-term capital gains rate is actually 0%. Yeah, zero. For most people, you'll fall into the 15% rate, which kicks in above that $47,025 mark. The top 20% rate doesn't even touch you until you're making over $518,900.

Then there’s the Alternative Minimum Tax (AMT). This was originally designed to make sure the ultra-wealthy couldn't use loopholes to pay nothing, but it sometimes catches middle-class families in high-tax states. For 2024, the AMT exemption amount is $85,700 for singles and $133,300 for married couples filing jointly.

Credits That Actually Put Money Back

A deduction lowers how much income you’re taxed on. A credit is better. A credit is a dollar-for-dollar reduction of the tax you actually owe.

The Child Tax Credit remains a big deal. For 2024, it’s $2,000 per qualifying child. The refundable portion—the part you get back even if you don't owe any tax—increased to $1,700 due to inflation adjustments.

Then you have the Earned Income Tax Credit (EITC). This is aimed at low-to-moderate-income working individuals and families. For 2024, the maximum credit for someone with three or more children is $7,830. That is a significant chunk of change that can change a family's entire financial year.

Why This Matters for Your Paycheck

If you noticed your take-home pay went up slightly at the start of 2024 without you getting a raise, this is why. Employers adjust their withholding based on these new irs 2024 tax rates. Because the brackets shifted "up," less of your money was held in those higher-percentage buckets.

It’s also why you should check your W-4 form. If you’ve had a kid, got married, or bought a house, your withholding might be all wrong. Nobody wants to give the government an interest-free loan all year, but you also don't want a massive bill come April.

Actionable Steps for 2024 Filers

Stop looking at your total salary and start looking at your taxable income. That’s the only number the IRS cares about.

- Maximize your 401(k) or IRA: These contributions come off the top of your gross income. If you're on the edge of the 22% bracket, a few thousand dollars into a retirement account could drop that portion of your income back down to the 12% tier.

- Check your filing status: If you’re a single parent, make sure you aren't accidentally filing as "Single" when you could be "Head of Household."

- Look at the 2024 standard deduction: If your total itemized deductions (mortgage interest, state taxes, etc.) don’t add up to more than $14,600 (single) or $29,200 (married), just take the standard. It’s easier and usually saves you more money anyway.

- Adjust your 2025 withholding now: Use the IRS Tax Withholding Estimator tool. Since we're already into the next cycle, seeing how the 2024 numbers affected you is the best way to avoid surprises next year.

The tax code is thousands of pages of boredom, but these core rates are the foundation. Knowing where you land helps you make smarter moves with your money before the clock runs out.