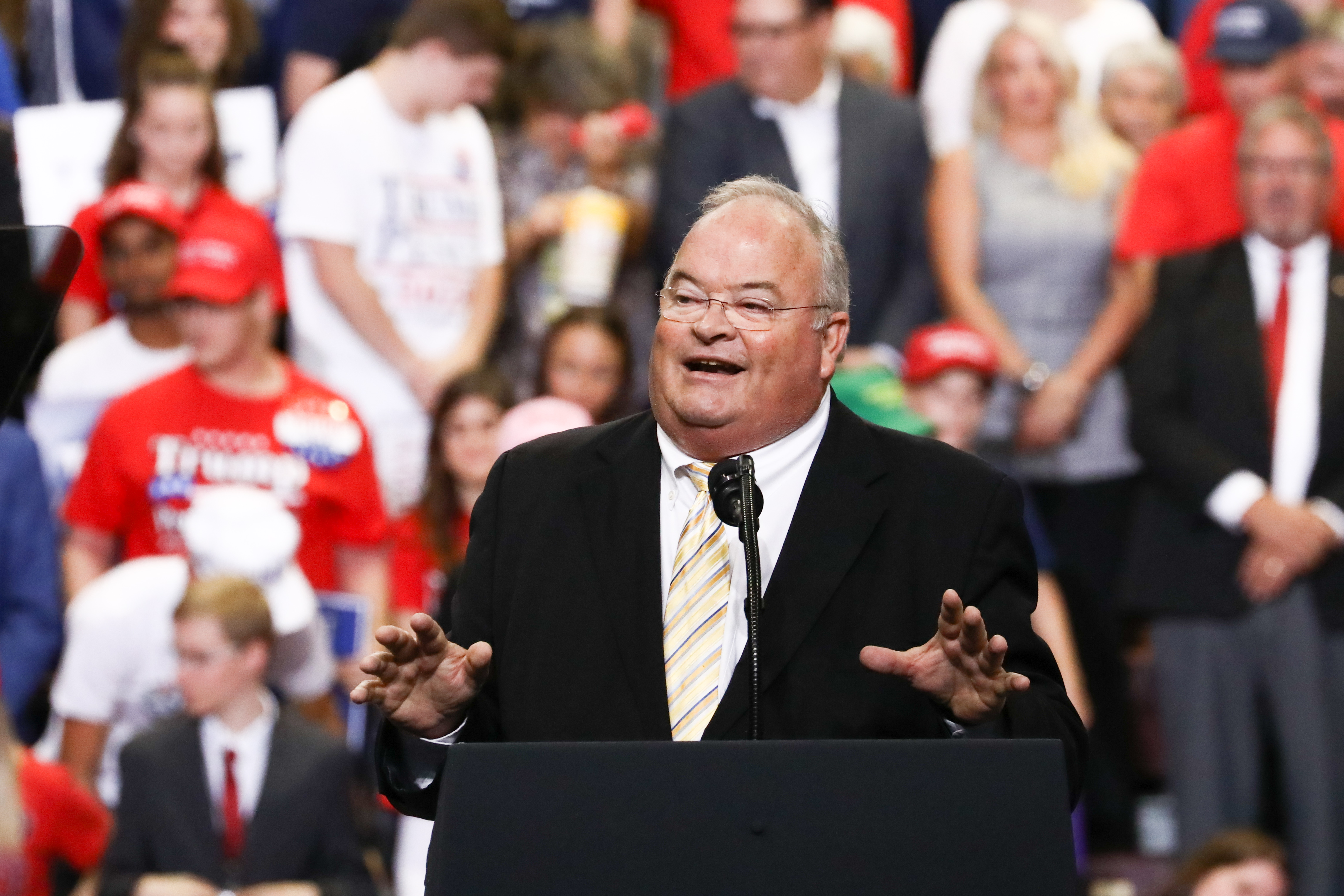

You probably remember the cowboy hats or maybe that auctioneer’s chant he did on the House floor once. But for a wild few weeks in 2025, Billy Long was actually the man running the IRS. It feels like a fever dream now, doesn’t it?

Honestly, the whole thing was a whirlwind. One minute he’s a former Missouri congressman with a penchant for flashy suits, and the next, he’s the 51st Commissioner of the Internal Revenue Service. It didn’t last. He was in the seat for less than two months before the administration pivoted, moving him over to a prospective ambassadorship in Iceland.

People are still scratching their heads over it. How does an auctioneer with a history of wanting to abolish the agency end up leading it, even for a summer?

The Rapid Rise of Billy Long at the IRS

When President Trump tapped Billy Long for the job, it wasn't exactly a traditional choice. Most IRS commissioners are tax lawyers or former high-level bureaucrats. Long was... well, he was Billy Long. He spent 12 years in the House representing Missouri’s 7th district and had a long career in real estate and auctioneering.

He was confirmed by the Senate on June 12, 2025, in a tight 53-44 vote. By June 16, he was sworn in.

He didn't waste much time. He brought this "culture-first" vibe to the agency. In his first message to employees, he basically told them he wanted to make their lives—and the lives of taxpayers—better. He was big on the idea of a "taxpayer-friendly" agency. For a guy who once cosponsored the Fair Tax Act (which would have effectively deleted the IRS), that was a pretty sharp turn in tone.

But the numbers didn't lie. While he was talking about culture, the agency was dealing with massive shifts. There were layoffs. There was a huge push to integrate AI into tax compliance. And then, there was the "FriYay" thing. Long famously sent out mass emails telling staffers they could head out 70 minutes early on Fridays. It was a hit with the rank-and-file, but it probably didn't sit well with the beltway types looking for rigid "efficiency."

Why the Tenure Was So Short

By August 8, 2025, it was over. Long announced on X (formerly Twitter) that he was stepping down to become the Ambassador to Iceland.

Why the sudden exit?

- Political Shuffles: The administration was moving fast. Replacing Long with Treasury Secretary Scott Bessent as an acting head allowed for a more direct line between Treasury policy and IRS execution.

- The ERTC Controversy: During his confirmation, Democrats hammered him on his post-Congress work advising businesses on the Employee Retention Tax Credit (ERTC). There were allegations about "peddling" credits that the IRS was already struggling to police for fraud.

- The Iceland Pivot: Honestly, sometimes the "ask" from the White House just changes. Long called it an honor to answer the call for the Iceland post, even if it meant leaving the IRS mid-stream.

The Legacy of the 51st Commissioner

You can’t talk about Billy Long's time at the IRS without mentioning the chaos. He was the sixth person to lead the agency in 2025 alone, counting the string of acting heads that followed Danny Werfel’s resignation. That kind of churn is brutal for any organization, let alone one that processes millions of tax returns.

Even though he was only there for about 50 days, he presided over a period of radical change. This was the summer the IRS began sharing certain taxpayer data with immigration officials—a move that sparked massive protests and legal challenges. It was also when the agency started pivoting toward the new GOP budget bill requirements, which included tax relief for tipped workers and changes to the child tax credit.

✨ Don't miss: Fidelity Contrafund Stock Price Today: Why This Giant Is Moving

Long wasn't a "tax geek." He was a communicator. He tried to run the IRS like a business—or maybe like an auction house—where enthusiasm and "vibe" mattered as much as the fine print.

What This Means for Your Taxes Now

Since Long left, the IRS hasn't exactly settled down. Scott Bessent took over the acting role, and the agency is now heavily focused on "OBBBA" (the 2025 budget act) implementation.

If you're looking at your 2026 filing season, the "Billy Long era" is mostly a footnote, but the policies that started under his brief watch are still in play. The IRS is smaller now. Thousands of auditors are gone. The agency is relying more on automated systems and less on human contact.

What you should do today:

- Audit-Proof Your Small Business: With the IRS shifting toward AI-driven audits, ensure your digital records are impeccable. The "hand-shake" era of tax resolution is fading.

- Check Your Credits: If you worked with any consultants on specialized credits (like the ERTC) during the 2024-2025 period, have a CPA double-check that paperwork. The IRS is still cleaning up those files.

- Watch the 1099-K Thresholds: The rules for third-party payments (Venmo, PayPal) are back to the $20,000/200 transaction threshold for 2026. Don't get caught by the old $600 rule rumors.

The Billy Long story is a reminder that the IRS is as much a political entity as a financial one. It changes with the wind. Stay sharp, keep your receipts, and don't expect those "FriYay" early dismissals to apply to your tax deadline.