Tax season is honestly a bit of a psychological rollercoaster for most people. We spend months ignoring that growing pile of 1099s and W-2s, only to panic when the calendar flips to March. For this year, the big day is standard. The IRS due date 2025 falls on Tuesday, April 15. It’s a return to normalcy after those weird years where holidays or weekends pushed the deadline around.

Don't let the simplicity of a Tuesday deadline fool you into complacency.

I’ve seen people lose thousands of dollars in "stupid tax"—penalties and interest—just because they thought they had more time than they actually did. The IRS isn't known for its sense of humor regarding late arrivals. If your paperwork isn't postmarked or e-filed by midnight on the 15th, the clock starts ticking on a failure-to-file penalty that is significantly more expensive than the failure-to-pay penalty.

The Reality of the IRS Due Date 2025

Most taxpayers are aiming for that April 15 target, but the tax year 2024 (which you are filing for in 2025) has some nuances. If you live in Maine or Massachusetts, you actually get a tiny bit of breathing room. Because of Patriots' Day and Emancipation Day observations, taxpayers in those specific states usually see their deadline shift to April 17.

It’s a quirk of the system.

For everyone else, the IRS due date 2025 remains firm. You should also keep in mind that "filing" and "paying" are two different beasts. You can file for an extension, which gives you until October 15, 2025, to get your paperwork in order. But—and this is a massive "but"—an extension to file is not an extension to pay. If you owe the government $5,000 and you file an extension without sending a check, the IRS will start charging you interest on that five grand starting April 16.

It’s basically a high-interest loan you never signed up for.

What if you're an expat or living abroad?

If you’re a U.S. citizen living outside the country on the regular deadline, you get an automatic two-month extension to June 16, 2025 (since the 15th is a Sunday). You don't even have to ask for it. However, interest still accrues from the April date on any unpaid tax. It’s kind of a trap if you aren't careful. You might feel like you have extra time, but your bank account will feel the sting of that accrued interest later.

📖 Related: Is Saturn Still in Business? What Actually Happened to the Different Brand

Estimated Payments and the Small Business Trap

If you're a freelancer, a side-hustler, or a small business owner, the IRS due date 2025 for your annual return is only part of the story. You’re likely tethered to the quarterly estimated payment cycle.

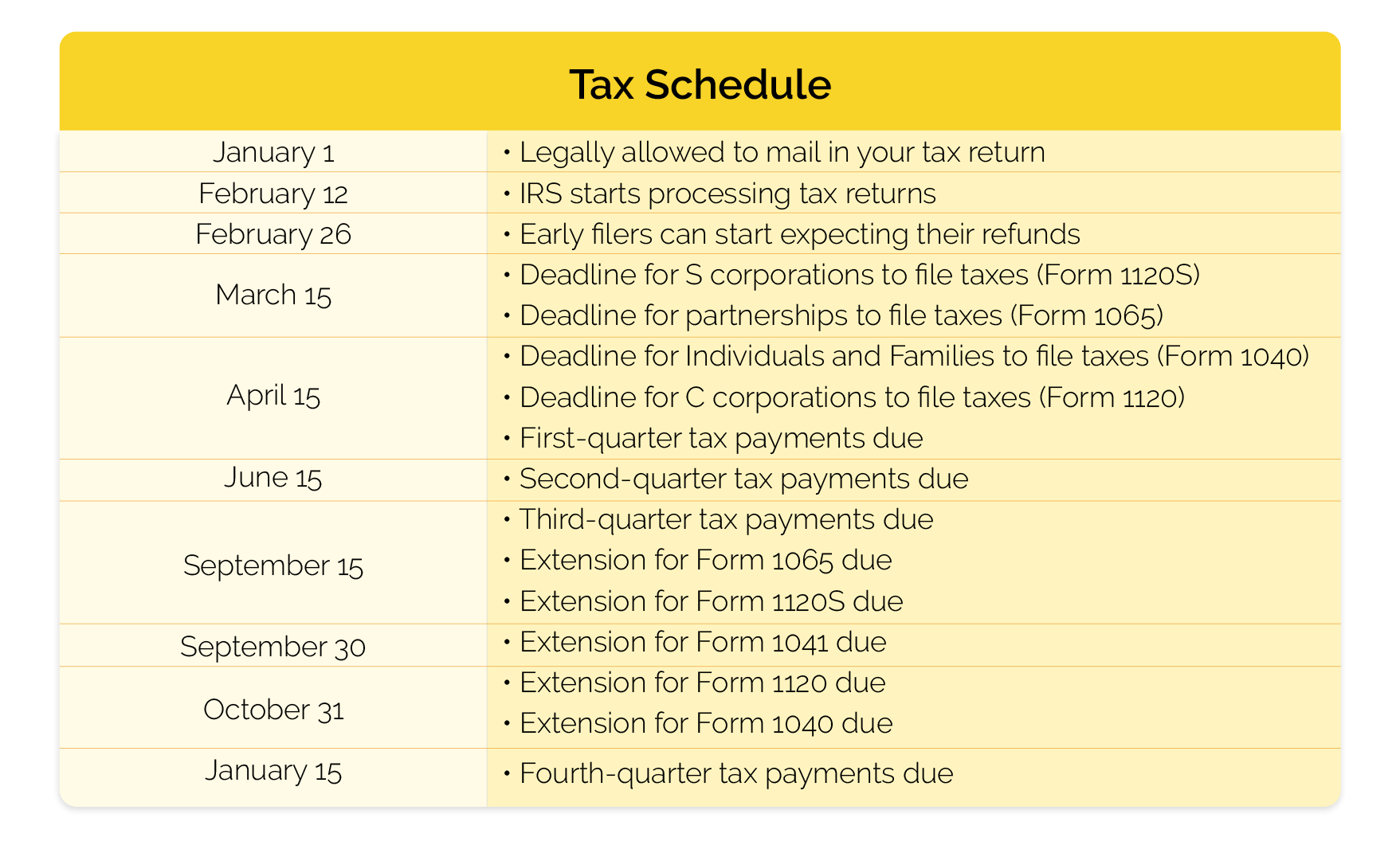

- Q1 (Jan-March) is due April 15, 2025.

- Q2 (April-May) is due June 16, 2025.

- Q3 (June-Aug) is due September 15, 2025.

- Q4 (Sept-Dec) is due January 15, 2026.

Wait, did you notice that? The first quarterly payment for 2025 is due the exact same day as your final return for 2024. This creates a massive cash-flow crunch for many self-employed people in mid-April. You’re trying to settle up for last year while simultaneously funding the current year. It’s brutal.

I once worked with a graphic designer who forgot this overlap. She had saved exactly enough to pay her 2024 tax bill, but she completely forgot she needed another $3,000 for her 2025 Q1 estimate. She ended up having to raid her emergency fund just to stay square with Uncle Sam.

The Extension Myth

"I'll just file an extension."

People say this like it's a magic wand. Form 4868 is great if your K-1s are late or your bookkeeping is a disaster, but it doesn't buy you time to find the money. Honestly, if you can't pay, you should still file on time. The penalty for not filing is roughly ten times higher than the penalty for not paying.

The IRS is surprisingly chill about payment plans if you've actually filed your return. They just hate being ghosted. If you file and don't pay, they’ll send you a bill. If you don't file and don't pay, they start wondering what else you’re hiding.

New Rules and Credits for 2025

Every year, the goalposts move slightly. For the 2024 tax year (the ones you're filing for by the IRS due date 2025), inflation adjustments have kicked in. The standard deduction has increased.

- Single filers: $14,600

- Married filing jointly: $29,200

- Head of household: $21,900

These numbers matter because they determine how much of your income is actually "taxable." If you made $50,000 as a single person, you’re only really taxed on $35,400 after the standard deduction.

We also have to talk about the Clean Vehicle Credits. If you bought an EV in 2024, the rules for the $7,500 credit changed to allow "point-of-sale" transfers. This means you might have already taken the credit as a discount at the dealership. If you did, you still have to report it on your 2025 filing. If it turns out you made too much money (over $150k for individuals or $300k for joint filers), you might actually have to pay that credit back.

That is a nasty surprise nobody wants on April 15.

Energy Credits are still huge

The Inflation Reduction Act is still pumping out benefits. If you put in solar panels, a heat pump, or even just some really fancy insulation in 2024, you’re looking at the Energy Efficient Home Improvement Credit. You can get back 30% of the cost, up to $3,200 depending on what you installed. Keep those receipts. The IRS loves receipts like a toddler loves a cardboard box.

How to Handle a Missing W-2

It happens every year. It’s late February, and your former employer—the one who went out of business or the one you left on bad terms—hasn't sent your W-2.

First, call them. If that doesn't work by the end of February, you call the IRS at 800-829-1040. They will send a letter to the employer. If you still don't have it as the IRS due date 2025 approaches, you use Form 4852, "Substitute for Form W-2." You basically estimate your earnings based on your final pay stub. It’s a hassle, but it keeps you from missing the deadline.

Avoid These Common Mistakes

Most people think the IRS is a giant supercomputer that knows everything. It’s not. It’s a giant supercomputer that knows some things and gets very confused when your math doesn't match its math.

- Wrong Social Security Numbers: You would be shocked how many people typo their own kid's SSN.

- Unsigned Forms: If you file by paper (why?) and don't sign it, the IRS considers it unfiled.

- Direct Deposit Errors: Double-check your routing number. If the refund goes to the wrong account, getting it back is a nightmare that can take months.

- Ignoring 1099-K: If you sold $600+ worth of stuff on eBay or took Venmo payments for a side gig, you're likely getting a 1099-K. The IRS gets a copy. If you don't report it, their system flags it automatically.

State Deadlines vs. Federal Deadlines

Don't assume your state follows the IRS due date 2025. While most states align with the federal April 15 deadline, some don't. Delaware, for example, often likes to be different (April 30). Iowa has also been known to wander. Always check your specific state's Department of Revenue website. Filing your federal taxes doesn't magically take care of your state obligations.

Actionable Steps to Take Right Now

Stop waiting for "the right time." The right time was January 1st, but the second-best time is today.

📖 Related: How Does Inflation Affect Purchasing Power Explained (Simply)

Gather your documents into one physical folder or one digital desktop folder. Create a "Tax 2024" folder. Every time you see a PDF with the word "Tax" or "1099" or "W-2," drop it in there.

Check your 2023 return. It’s the best map for your 2024 return. If you had a specific deduction last year, you probably have it this year too.

If you make less than $79,000, use the IRS Free File program. Don't pay a big-box tax software company $100 if you don't have to. The IRS partners with software providers to give you the same tech for free if you're under that income threshold.

Finally, if you know you're going to owe, start moving that money into a high-yield savings account now. Let it earn a little interest for you before you hand it over to the Treasury. By the time the IRS due date 2025 arrives, you want to be the person who just hits "send" and goes for a walk, not the person sweating over a calculator at 11:45 PM.

Verify your filing status. If you got divorced, married, or had a kid in 2024, your status changes. This is the foundation of your entire return. If you get the status wrong, everything else—from your tax bracket to your standard deduction—will be wrong. Take ten minutes to confirm you're filing the right way. It saves hours of headaches later.