So, you just got a text message. It says you’re eligible for a fresh IRS economic impact payment 2025 text notification, and there’s a link right there waiting for you. Maybe it looks official. Maybe it even has the IRS logo or some fancy government-sounding jargon about the "Recovery Rebate Credit."

Don't touch it. Seriously.

The IRS is not texting you about a new stimulus check. They just aren't. While the government did pass the "One, Big, Beautiful Bill" in 2025 which introduced things like Trump Accounts for newborns and some specific tax deductions for car loan interest, there is no fourth round of "free money" checks being blasted out via SMS. If you’re seeing a text about an economic impact payment in 2026, you’re looking at a scammer trying to bait you into handing over your Social Security number or your bank login.

The Truth About the IRS Economic Impact Payment 2025 Text

Here’s the deal: scammers are incredibly good at timing. They know people are still hearing echoes of the 2021 stimulus era. They also know that in 2025, the IRS actually did start a push to help people claim old, "missing" money from years ago.

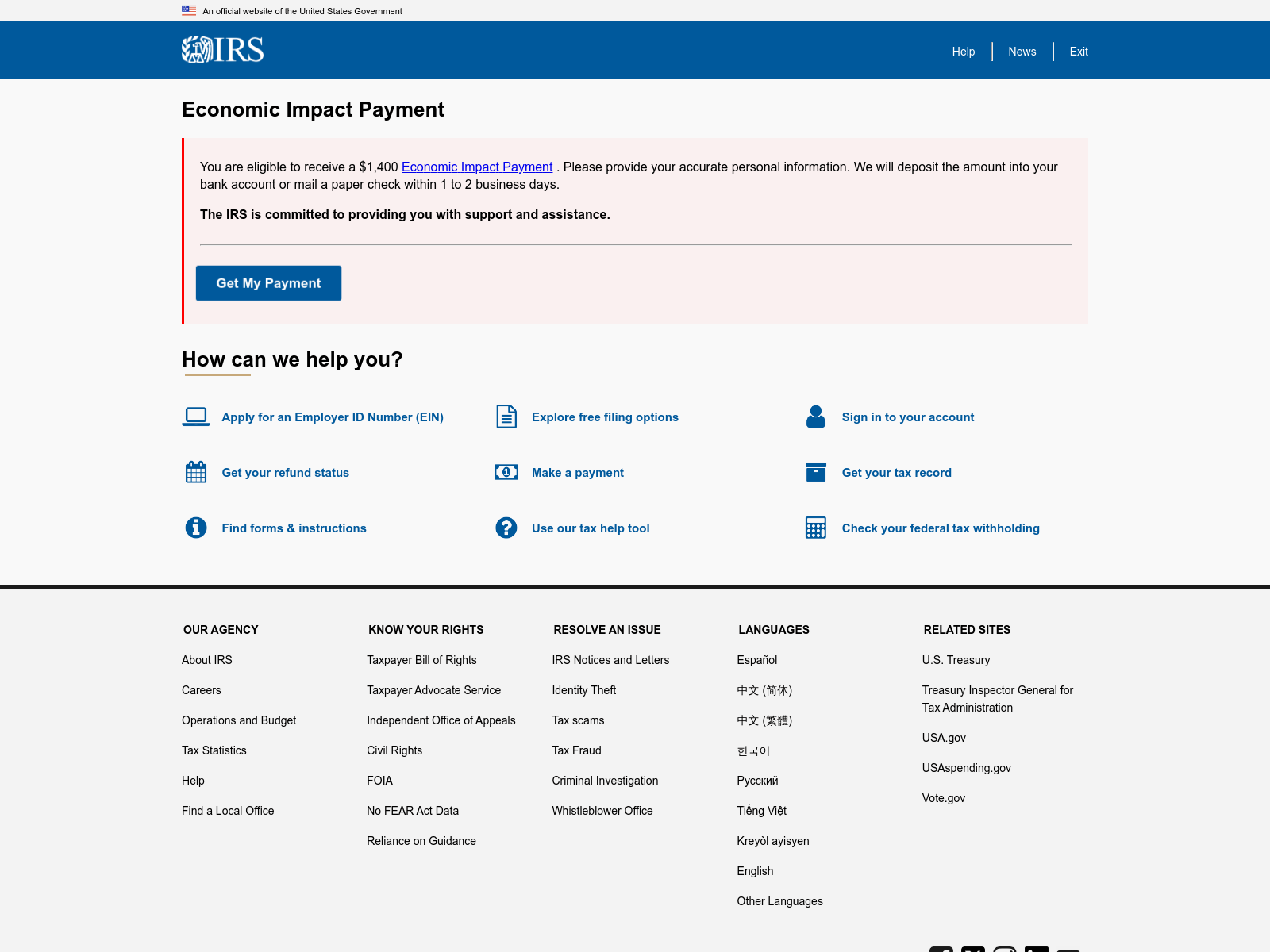

Specifically, the Treasury Inspector General for Tax Administration (TIGTA) warned about a wave of "smishing"—that’s just a nerd word for SMS phishing—targeting taxpayers during the 2025 filing season. These fake messages claim you have an unclaimed IRS economic impact payment 2025 text waiting for you. They’re piggybacking on a real (but very specific) IRS effort to issue automatic payments to people who were eligible for the 2021 Recovery Rebate Credit but never claimed it.

The catch? The IRS does that stuff through the mail or direct deposit. They don’t send a text with a link to "Verify Your Identity."

Honestly, it’s a mess. People get confused because states like New York actually sent out "inflation refund checks" late in 2025. When people hear "refund" and "payment" in the news, they become way more likely to click a suspicious link.

How to Tell It's a Fake

If you’re staring at a message on your phone right now, look for these red flags. Scammers are smart, but they’re also lazy.

- The Link Ends in .com or .net. Real government sites end in .gov. If the link is "https://www.google.com/search?q=irs-tax-payment-portal.com," it’s a trap.

- The Vibe is Urgent. "Act now or lose your payment!" or "Final notice for your 2025 rebate!" The IRS moves at the speed of a tired turtle. They aren't going to rush you via text.

- They Ask for Your Mother’s Maiden Name. Or your bank PIN. Or your favorite childhood pet. The IRS already knows who you are; they don't need a text message to figure it out.

Wait, Is There Any Real 2025 Money?

Kinda. But it's not what the scammers are selling.

Under the newer tax laws, there are some specific benefits that people are confusing with "stimulus checks." For example, if you had a kid in 2025, you might be looking at the new $1,000 pilot program contribution for "Trump Accounts." But that doesn't start until mid-2026 for most people.

📖 Related: M\&T Bank Corp Stock Price: Why the Buffalo Giant is Surprising Wall Street

Then there’s the 2021 back-pay. If you missed out on the $1,400 per person payments from years ago, you had until April 15, 2025, to file a return and claim that money. If you missed that deadline, you’re mostly out of luck for the federal stuff, though some tax pros might still be able to help with amended returns depending on your specific situation.

The Paper Check Phase-Out

One reason people are falling for the IRS economic impact payment 2025 text is because the IRS is changing how it pays people. Starting September 30, 2025, the agency began a massive shift away from mailing paper checks. They want to move everyone to "Direct Pay" or electronic transfers.

Because of this transition, people are expecting "digital notifications." Scammers know this. They send a text saying, "Since we no longer mail checks, click here to set up your digital payment." It sounds plausible! But again, the IRS will notify you of these changes through official mail (the kind that comes in a paper envelope) or through your secure account on IRS.gov.

What to Do If You Got the Text

First off, don't reply. Even texting "STOP" lets the scammer know your phone number is active and held by a real person. That just gets you added to more lists.

- Take a Screenshot. If you want to be a good citizen, grab a shot of the message.

- Report It. Forward the text to 7726 (SPAM). This helps carriers block the sender. You can also report it to the IRS by forwarding a screenshot or the details to

phishing@irs.gov. - Check Your Real Status. If you’re genuinely worried you’re missing money, go to the source. Log in to your official account at IRS.gov. If there is a payment waiting for you, it will be listed in your "Tax Records" or "Payment History" section.

- Delete and Block. Once you've reported it, get it off your phone.

The reality is that "Economic Impact Payments" as we knew them in 2020 and 2021 are over. The terminology has shifted to "Recovery Rebate Credits" or specific state-level inflation relief. Anyone still using the phrase "IRS economic impact payment 2025 text" in an unsolicited message is almost certainly trying to rob you.

Keep your guard up. The IRS doesn't have your cell number on speed dial, and they definitely aren't sending you emojis with links to "claim your cash."

Actionable Next Steps:

- Check your IRS Online Account: Verify your actual payment status only through the official IRS.gov portal.

- Update your security: If you did click a link, change your banking passwords immediately and consider putting a credit freeze on your files with Experian, Equifax, and TransUnion.

- Report the sender: Forward any suspicious IRS-themed texts to 7726 and then email the details to

phishing@irs.gov.