You might remember the days of the "short form." It was that middle-ground tax document, not as bare-bones as the 1040EZ but nowhere near as terrifying as the standard 1040. If you’re looking for income tax form 1040a today, I’ve got some news that might be a bit of a shock: it doesn't exist anymore.

The IRS killed it.

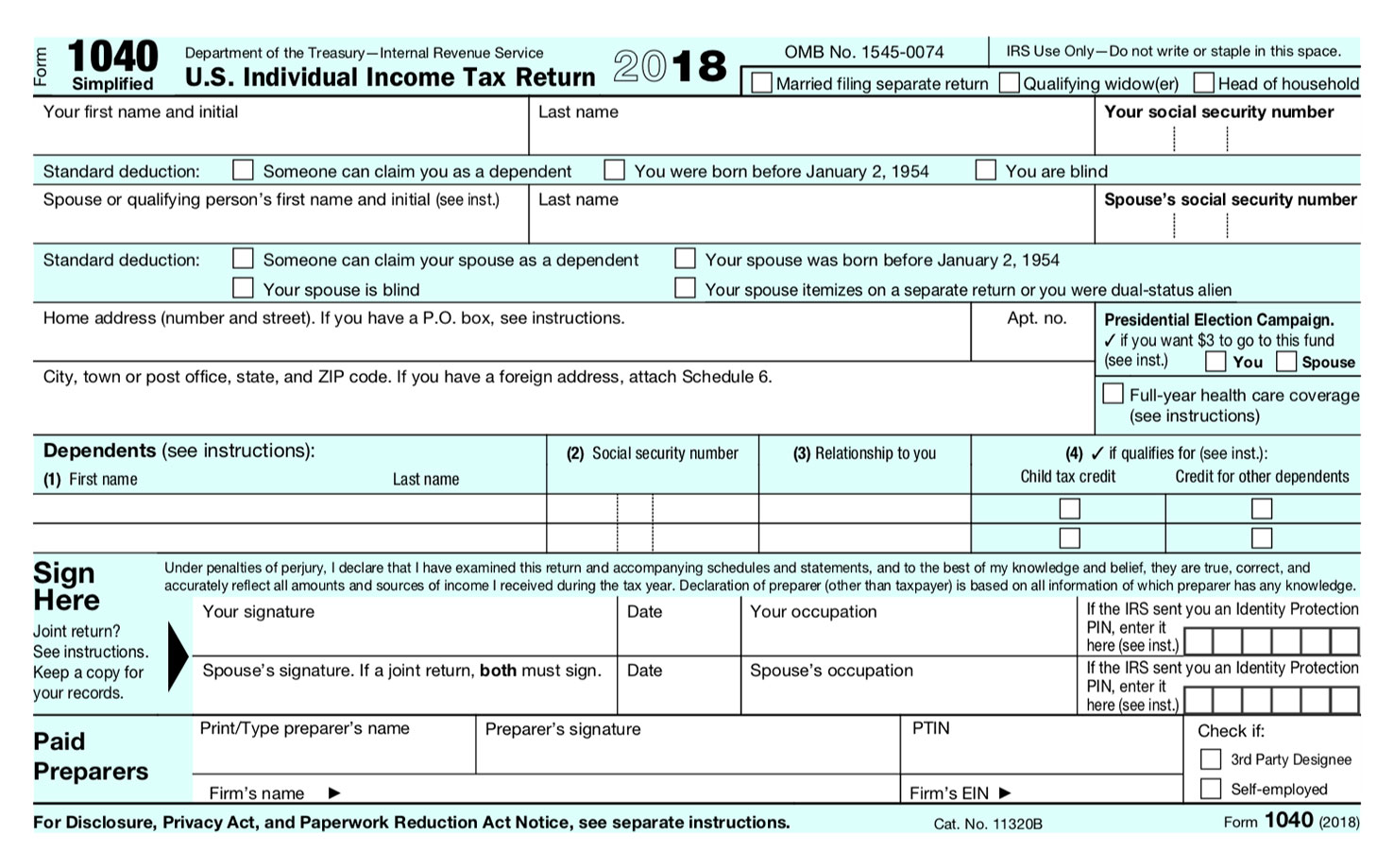

Back in 2018, the Tax Cuts and Jobs Act (TCJA) basically nuked the old way of filing. They moved to a "postcard" system that was supposed to make everything easier. Honestly, whether it actually became easier is up for debate, but the 1040A is officially a relic of tax history. If you're trying to file back taxes or just curious why your tax software looks different, you need to know what happened to this specific form.

The Life and Death of Income Tax Form 1040A

The 1040A was the go-to for millions. It was designed for people who had a bit more going on than a high schooler with a summer job, but who weren't exactly running a real estate empire. You could use it if you made less than $100,000 and didn't itemize deductions.

It was two pages long. Simple.

Then came the 2018 tax year. The Treasury Department decided that having three different versions of the 1040—the 1040EZ, the 1040A, and the long-form 1040—was redundant. They consolidated everything into one redesigned Form 1040. The idea was to have a single form that everyone used, supplemented by "schedules" if your financial life was complicated.

Most people who used to file income tax form 1040a now just file a standard 1040. But here’s the kicker: while the main form looks shorter, many of the lines that used to be right there on the 1040A have been moved to Schedule 1, Schedule 2, or Schedule 3. So, instead of a two-page form, you might end up with a one-page form and three extra sheets of paper. It’s a bit of a shell game.

Who Actually Used the 1040A?

It was a very specific niche. To qualify for the income tax form 1040a, you had to meet a laundry list of requirements. Your taxable income had to be below that $100,000 threshold. You couldn't own a business. You couldn't be a farm owner. Most importantly, you had to take the standard deduction.

If you wanted to deduct your mortgage interest or those heavy donations to charity? You were forced into the "big" 1040.

But for the average renter with a W-2 job, some interest from a savings account, and maybe a few dividends, the 1040A was perfect. It allowed for certain adjustments like IRA deductions or student loan interest. You could even claim the Child Tax Credit or the Earned Income Credit on it. It was the "Goldilocks" of tax forms. Not too big, not too small. Just right.

Why the Change Matters for You Today

If you’re hunting for this form because you missed a few years of filing, you can't just download a 2024 version of it. It doesn't exist. You have to use the form that corresponds to the specific year you missed. If you’re filing for 2017 or earlier, you can still use income tax form 1040a. But for anything 2018 and later, you’re stuck with the new consolidated 1040.

The biggest shift for former 1040A users is the "Standard Deduction."

The TCJA nearly doubled the standard deduction. For many people who used to sweat over whether they should use the 1040A or the long form, the choice was suddenly made for them. Most people found that the new, higher standard deduction was way better than itemizing anyway. This basically made the 1040A's original purpose—offering a middle path—completely obsolete.

The Myth of the Postcard

When the 1040A was retired, the government promised a tax return the size of a postcard. They actually printed a version that looked like one. It was a PR move.

In reality, if you had a student loan or a retirement account, that "postcard" suddenly required three different attachments. For the old 1040A crowd, this felt like a betrayal. You went from a self-contained two-page document to a fragmented mess of schedules.

Navigating the Current 1040 Landscape

So, you’re a former income tax form 1040a filer. What do you do now?

First, realize that the 1040 is now "modular."

Think of the current 1040 as the base of a Lego set. If your taxes are dead simple, you just build the base. If you have "above-the-line" deductions (the stuff that used to be on the 1040A, like student loan interest), you have to add Schedule 1.

Schedule 1 is where the old 1040A "adjustments to income" live now.

It’s divided into two parts:

💡 You might also like: Do They Make One Thousand Dollar Bills? The Real Story Behind America's Large Denominations

- Additional Income: This is for things like gambling winnings, jury duty pay, or prizes.

- Adjustments to Income: This is the stuff you likely care about—educator expenses, student loan interest, and health savings account (HSA) deductions.

Tax Credits and the Former 1040A Filer

One of the best parts of the 1040A was how it handled credits. You could claim the Child Tax Credit (CTC) or the Credit for the Elderly or the Disabled directly on the form.

Now? If you’re claiming non-refundable credits other than the Child Tax Credit or the Credit for Other Dependents, you’re likely headed to Schedule 3. This includes things like the Foreign Tax Credit or the Education Credits (American Opportunity Credit and Lifetime Learning Credit).

It’s more jumping around. It’s more clicking through tax software. It’s definitely more confusing for someone who liked the old-school paper filing method.

Common Misconceptions About Filing

People often think that because the income tax form 1040a is gone, they've lost their ability to claim certain deductions. That's just not true. Everything you could do on a 1040A, you can still do on a 1040. It just has a different name and a different location.

Another big one: "I have to use a professional now because it's too complex."

Honestly, probably not. If you were comfortable with the 1040A, you can handle the new system. Tax software like FreeTaxUSA, TurboTax, or H&R Block has basically automated the transition. They don't even ask you which form you want to use anymore; they just ask you questions about your life and fill out the background schedules for you.

Specific Details for Late Filers

If you are specifically looking for income tax form 1040a because you haven't filed in years, pay attention to the deadlines. The IRS generally only allows you to claim a refund for three years back. If you’re trying to file a 2017 return in 2026 to get money back, you’re likely out of luck on the refund, though you still owe any taxes due.

For those older years, you must use the original 1040A. You can find them in the "Prior Year Products" section of IRS.gov. Don't try to shove 2016 data onto a 2025 form. The IRS will reject it faster than a bad check.

Nuances of the 1040-SR

Wait, there’s one more thing. If you are a senior (65 or older), the IRS actually created a spiritual successor to the 1040A called the 1040-SR.

It’s almost identical to the standard 1040, but it has a larger font and a handy standard deduction table printed right on the form. It’s a nod to the fact that many seniors preferred the simplicity of the old income tax form 1040a. If you’re in that age bracket, it’s worth looking at, even if only to save your eyesight.

The Bottom Line on Form 1040A

The 1040A served us well from its introduction in the 1980s until its retirement in 2018. It was a symbol of a slightly less complicated tax era. While it’s gone, its spirit lives on in the schedules of the modern 1040.

Don't let the "Schedule" terminology scare you. If you were a 1040A filer, your tax situation is likely still considered "simple" by IRS standards. You just have to get used to the new layout.

Actionable Next Steps

If you need to get your taxes sorted and you're missing the 1040A, do this:

- Check your filing year. If it's 2018 or later, download the standard Form 1040. If it's 2017 or earlier, search the IRS archives specifically for "2017 Form 1040A."

- Gather your "Adjustments." If you used to claim student loan interest or IRA contributions on the 1040A, look at Schedule 1 of the current 1040. That's where that info goes now.

- Evaluate the Standard Deduction. Don't assume you need to itemize just because the 1040A is gone. The standard deduction is huge now ($15,000 for individuals in 2025). Most former 1040A users will find this is their best bet.

- Use IRS Free File. If your income is below $79,000, don't pay for software. Use the IRS Free File program. It handles all the schedules that replaced the 1040A for free.

- Look into the 1040-SR. If you're 65+, this is your new best friend. It’s the closest thing to the old "short form" experience we have left.