You’re staring at a one-page document that looks exactly like the one you signed three years ago. It isn't. IRS Form W-9 might be the most boring piece of paper in the American financial system, but it’s the gatekeeper to your income. If you're a freelancer, a contractor, or someone dabbling in the crypto markets, the latest version of Form W-9 (Rev. January 2026) is something you cannot afford to sleep on.

Tax forms change. Usually, it's just a font update or a moved margin. This time? It’s different. The IRS is finally catching up to how people actually make money in the 21st century.

What’s New in the January 2026 Revision?

Honestly, the biggest shocker is the digital asset section. If you’re a digital asset broker—or even if you just deal with one—there is a brand-new checkbox in Part II. This isn't just "extra credit" for crypto nerds. It's a mandatory certification for U.S. digital asset brokers to claim they are exempt from certain information reporting under Regulations section 1.6045-1.

Wait, there's more.

The IRS finally got fed up with people using the wrong Taxpayer Identification Numbers (TINs). If you are a sole proprietor, listen closely: You must use your Social Security Number (SSN). For years, many sole proprietors used their Employer Identification Number (EIN) on the W-9 because it felt more "professional" or they wanted to keep their SSN private. The latest version of Form W-9 makes it crystal clear: do not enter the EIN of a sole proprietorship or a disregarded entity in the TIN box if you are the owner. You need to provide the TIN of the "regarded" owner. If that’s you, an individual, that means your SSN.

The $2,000 Threshold: A Massive 2026 Shift

Historically, the magic number was $600. If you paid a contractor $601, you needed a W-9 to file a 1099.

Starting in 2026, things have shifted significantly due to recent legislative updates. The aggregate reportable payment threshold has jumped from $600 to $2,000. This is huge. It basically means a lot of small, one-off gigs won't trigger the massive administrative headache of a 1099-NEC.

But don't get lazy. Just because the threshold is higher doesn't mean you don't need the form. Most businesses will still ask for a W-9 before they send you a single dime. Why? Because they don't want to be the ones left holding the bag if the IRS audits them three years from now and asks why they didn't have your info on file.

Why You Can’t Just Reuse Your 2024 Form

You might think, "I have a PDF of my 2024 W-9 saved, I'll just send that."

Bad idea.

The 2026 version includes Exempt Payee Code 14. This is a specific code for payees in digital asset transactions who are exempt from backup withholding. If you use an old form, you don't have a place to put that code.

The Backup Withholding Trap

If you mess up your W-9, or if the name on the form doesn't perfectly match what the IRS has in its database, the payer is legally required to take 24% of your check right off the top. This is called backup withholding.

📖 Related: Unemployment Rates by Year in US: What the Headlines Kinda Miss

Imagine landing a $10,000 contract and only seeing $7,600 in your bank account because you forgot to check a box or used an outdated version of the form. It’s a nightmare to get that money back. You usually have to wait until you file your tax return the following year to see a cent of it.

How to Fill Out the Latest W-9 Without Losing Your Mind

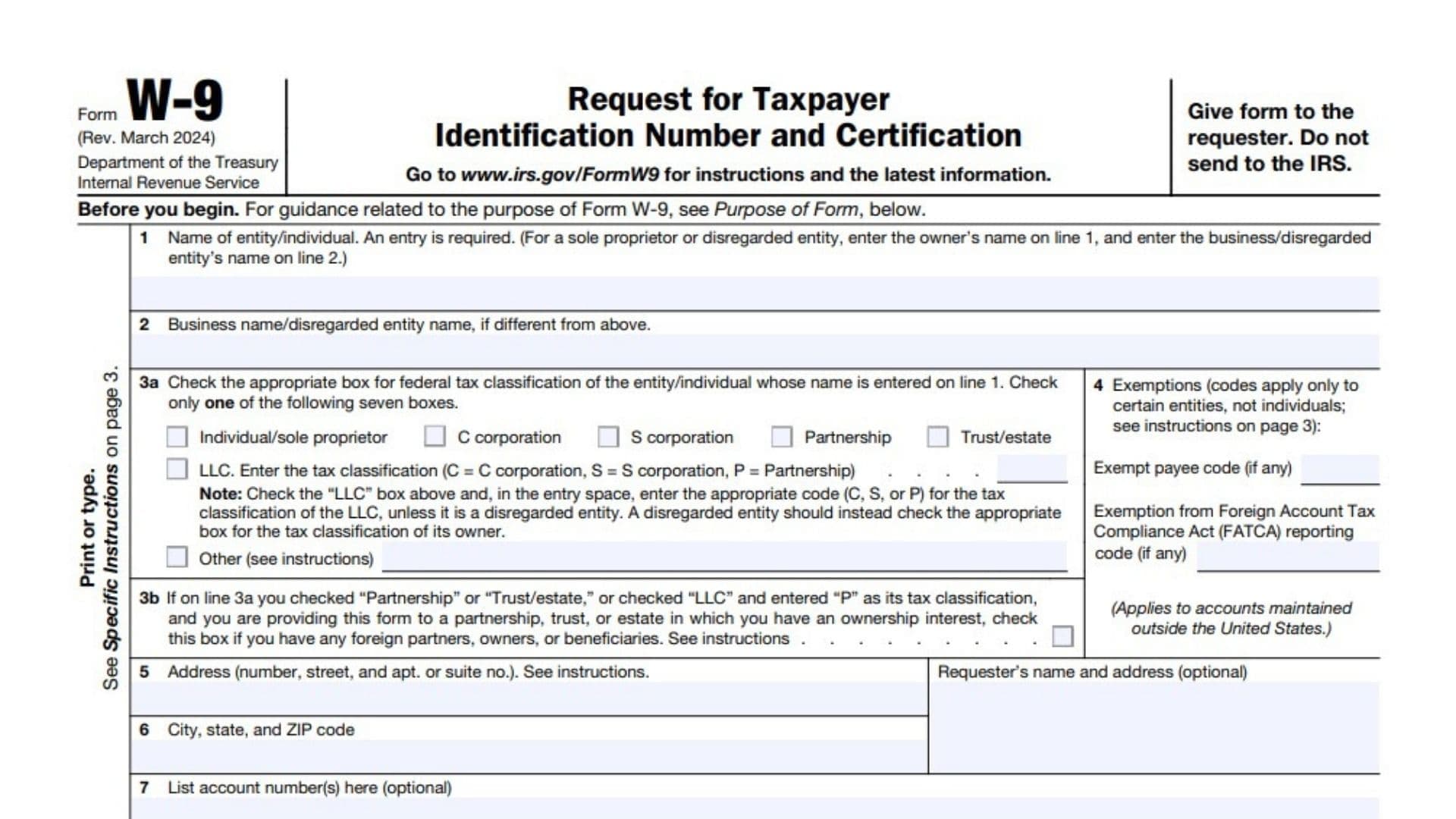

- Line 1 is for your name. This must be the name that appears on your tax return. If you're a single-member LLC, put your personal name here, not the business name.

- Line 2 is for the business name. This is where your LLC or "Doing Business As" (DBA) name goes.

- Check the box. Most freelancers will check "Individual/sole proprietor or single-member LLC." If you’re a partnership or corporation, pick the right one. Don't guess.

- The Digital Asset Checkbox. Only check this if you are a qualified broker. If you're just a person getting paid in Bitcoin for web design, this isn't for you.

- Part I (TIN). Sole proprietors, remember: SSN is the gold standard now.

- Part II (Certification). You are signing under penalty of perjury. Read it once before you ink it.

The Disregarded Entity Confusion

This is where everyone gets stuck. A single-member LLC is usually a "disregarded entity" for tax purposes. This means the IRS treats you and the business as one and the same.

On the latest version of Form W-9, you must provide the name and TIN of the owner. If you are an LLC owned by another LLC, you have to keep going up the chain until you find a person or a corporation that isn't "disregarded." It’s like a family tree of tax liability.

Practical Next Steps for 2026

- Audit your files. If you’re a business owner, send out a request for the updated January 2026 version of Form W-9 to any new vendors you've onboarded this year.

- Update your "Standard" W-9. If you're a freelancer, download the latest PDF from IRS.gov, fill it out, and save it as your master copy. Trash the old ones.

- Check your SSN vs EIN. If you’ve been using an EIN as a sole proprietor, it’s time to switch back to your SSN on the form to avoid a "B-Notice" (that's the scary letter the IRS sends when names and numbers don't match).

- Watch the Digital Assets. If you are moving money in the crypto space, verify if you qualify for the new Code 14 exemption. It could save you 24% in upfront withholding.

- Secure your data. Never, ever email a W-9 as a plain attachment. It has your SSN on it. Use a secure portal or an encrypted file-sharing service.

The IRS is getting much faster at "TIN matching." They have automated systems that flag discrepancies within weeks, not years. Using the correct, latest form is the simplest way to keep your payments flowing and the tax man off your porch.