Money is weird right now. If you look at your bank account, maybe things feel "okay," but if you peek at the global currency markets, there is a lot of chatter about the greenback losing its edge. Honestly, everyone wants a simple yes or no answer to the question: is the US dollar weakening?

The truth? It depends on who you ask and what day of the week it is.

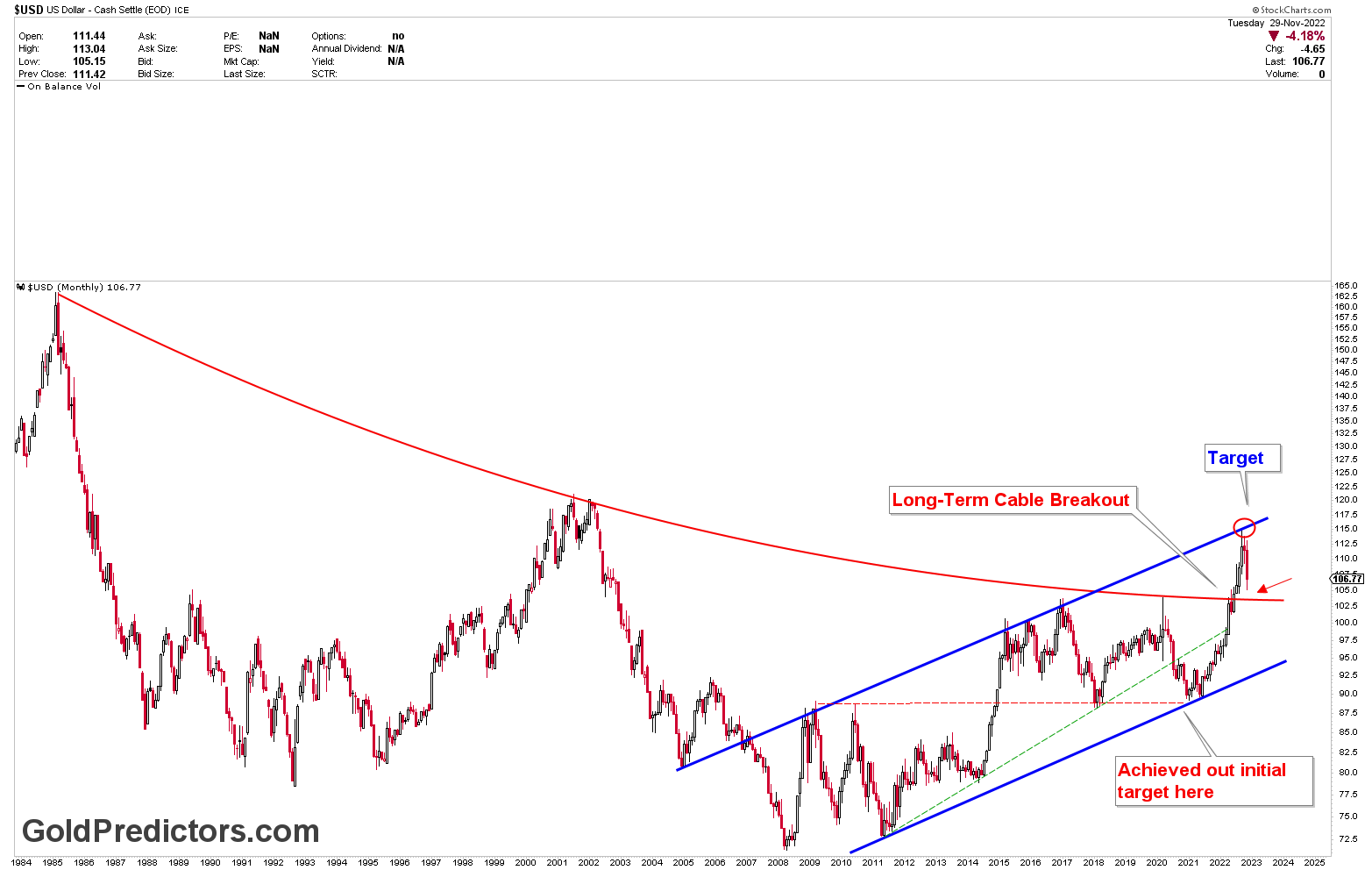

Right now, in early 2026, the US dollar is sitting in a strange spot. For most of last year, it was the king of the mountain, but lately, we’ve seen the US Dollar Index (DXY)—which measures the dollar against a basket of other big currencies like the Euro and Yen—slipping. It was trading way up near 109 not too long ago, but as of January 2026, it’s hovering around the 98-99 mark.

That’s a drop. A noticeable one.

Why the "Mighty Dollar" is catching a cold

The big reason for this shift is pretty basic: interest rates. You’ve probably noticed the Federal Reserve has been on a bit of a rollercoaster. After keeping things tight to fight inflation, they’ve started trimming rates. In fact, the Fed cut rates three times toward the end of 2025, bringing the federal-funds rate down to about 3.50%.

👉 See also: Walgreens on Halsted and Monroe: Why This Corner Stays Busy

When rates go down, the dollar usually follows. Think of it like this: investors want the best "rent" for their money. If US bonds pay less interest because the Fed is cutting, global investors move their cash to other places where they can get a better return.

Suddenly, the dollar isn't the only attractive girl at the dance.

But it’s not just about the Fed. We’re also seeing a "narrowing" of growth. For a while, the US was the only major economy that looked healthy. Now, other places are starting to wake up. When Europe or China show signs of life, the dollar loses its "safe haven" appeal. Experts like David Adams at Morgan Stanley have pointed out that while the dollar might be on a "choppy path," the first half of 2026 could see it dip even further—maybe down to 94 on the DXY.

Is the US Dollar Weakening for Good? The De-dollarization Myth

You can't talk about the dollar without someone bringing up the "death of the dollar" or BRICS. People love a good "empire falling" narrative. It makes for great headlines.

But let’s get real.

Yes, the BRICS nations (Brazil, Russia, India, China, South Africa, and the new members) are trying to use their own currencies more. Russia and India are trading oil in rupees. China and Brazil are settling deals in yuan. According to recent data, the dollar’s share of global foreign exchange reserves has slowly ticked down to about 58% or 59%. That's a decline, sure.

👉 See also: 1 usd to vnd rate: What Most People Get Wrong

But look at the other side.

The dollar is still used in nearly 90% of all foreign exchange transactions. Almost half of all SWIFT payments are in greenbacks. Even Vladimir Putin admitted recently that they aren't trying to "abandon" the dollar—they're just trying to avoid it being "weaponized" through sanctions.

And let’s not forget the "Trump factor." With the 2024 election behind us, the threat of 100% tariffs on countries that try to replace the dollar has acted like a massive psychological anchor. Nobody wants to be locked out of the US economy. It’s the ultimate "stick" that keeps the dollar as the global reserve currency, even if some countries are grumbling about it.

The AI Wildcard

There is something else keeping the dollar from falling off a cliff: Artificial Intelligence.

It sounds crazy, but the AI boom is a massive "Buy American" campaign. Companies like Microsoft, Google, and Nvidia are the engines of this $3 trillion spending wave. Global investors who want a piece of the AI future have to buy US stocks. To buy those stocks, they need dollars.

This creates a floor. Even if the Fed cuts rates and the economy slows down a bit, the sheer gravity of US tech keeps money flowing in rather than out.

What This Means for Your Wallet

So, if the dollar is "softening" but not "dying," what should you actually do?

If you're traveling to Europe or Japan this summer, you might find your money doesn't go quite as far as it did two years ago. The dollar is currently considered "overvalued" by many economists. Georgette Boele from Bethmann Bank noted that based on purchasing power, the dollar is about 40% too expensive compared to the Yen.

Basically, stuff abroad might start feeling a little pricier again.

✨ Don't miss: KULR Technology Stock Price: What Most People Get Wrong

For investors, a weaker dollar is actually a bit of a gift for certain sectors.

- Multinational Companies: When the dollar is weaker, companies like Apple or Nike make more money because their overseas sales convert back into more dollars at home.

- Emerging Markets: A softer dollar takes the pressure off developing nations that have debt priced in USD. It makes their stocks look a lot more attractive.

- Commodities: Gold and oil are priced in dollars. Usually (not always, but usually), when the dollar goes down, gold goes up.

Actionable Steps for the "Soft Dollar" Era

- Check your portfolio's "Home Bias": If you’re 100% in US stocks, you might be missing out. A weakening dollar is often the signal for international stocks (especially in Europe and Emerging Markets) to finally outperform.

- Hedge your travel: If you have a big international trip planned for late 2026, keep an eye on the exchange rates now. If the DXY hits that 94-95 range, it might be a good time to lock in some currency.

- Don't panic about "The Collapse": Don't sell your house and buy gold bars because of a TikTok video about BRICS. The structural advantages of the US—liquidity, legal transparency, and tech dominance—aren't going anywhere in 2026.

- Watch the Fed's June Meeting: Most analysts expect the rate-cutting cycle to pause or bottom out around mid-year. That’s likely when the dollar will find its footing and start a "V-shaped" recovery.

The dollar isn't "failing." It's just breathing. After years of being incredibly strong, a little bit of a pullback is normal, even healthy. It gives the rest of the global economy some room to grow, which—ironically—usually ends up helping the US in the long run anyway.

Keep an eye on the 10-year Treasury yield. If that starts creeping back up toward 4.5%, the "weakening" narrative will evaporate faster than a puddle in July. Until then, expect a bumpy, slightly cheaper ride for the greenback.