You've probably seen the word "issuance" buried in a boring quarterly report or a dense news snippet about the Federal Reserve. It sounds like one of those dry, "Wall Street only" terms that regular people can ignore. Honestly? It’s basically just a fancy word for making something new and putting it out into the world. But in the world of money, what issuance means determines who has power, who has debt, and whether your bank account is actually growing or just treading water.

Think of it as the "birth certificate" for a financial asset. Whether it’s a tech startup creating new shares or the U.S. Treasury printing T-bills to fund a highway, they are "issuing" something. It’s the bridge between an idea or a need and the actual capital required to make it happen. Without it, the gears of global capitalism would basically grind to a halt.

The Core Concept: What Does Issuance Mean in Plain English?

At its simplest level, issuance is the legal process of offering securities, or other investment instruments, to the public or private investors. It’s the moment a company or government says, "We need cash, so we’re creating this piece of paper (or digital entry) that represents a deal."

You aren't just giving them money for nothing.

When an issuance happens, the issuer—the entity needing the funds—creates a liability or an equity stake. If Apple issues a bond, they are issuing debt. They’re promising to pay you back with interest. If a small biotech firm issues stock, they are selling a piece of their soul (or at least their future profits).

There’s a huge difference between the two. Debt issuance is a loan. Equity issuance is a marriage.

Investors often track issuance levels to see how "hot" a market is. If you see a massive wave of new stock issuance (like we saw during the SPAC craze of 2020 and 2021), it often signals that companies think their valuations are high and it's a great time to sell. On the flip side, when issuance dries up, it usually means everyone is scared, or interest rates are so high that borrowing money feels like a trap.

Debt Issuance: The World Runs on IOUs

Most people think of the stock market when they hear about finance, but the debt issuance market is actually way bigger. It’s massive. Governments, municipalities, and corporations all issue debt.

Take the U.S. Treasury. They are the kings of issuance. When the government spends more than it takes in through taxes—which happens pretty much every year—they have to bridge the gap. They do this through the issuance of Treasury bonds, notes, and bills. This isn't just "printing money" in the way people talk about it at bars; it’s a formal process of selling debt to investors, who then hold that debt as a safe asset.

Why corporations love issuing debt

A company like Amazon might have billions in the bank, but they still issue bonds. Why? Because sometimes it’s cheaper to borrow money at a 4% interest rate and keep their own cash invested in something that returns 10%.

- Public Issuance: This is when a company sells bonds to anyone who wants them. It requires a lot of paperwork with the SEC.

- Private Placement: This is a "quiet" issuance. The company goes to a few big insurance companies or pension funds and says, "Hey, we need $500 million. Want to buy our debt?" It's faster and has fewer rules.

It’s not just about getting cash, though. It's about timing. Smart CFOs watch the Federal Reserve like hawks. If they think rates are going up next month, they’ll rush an issuance through today to lock in a lower rate. You've probably seen news headlines like "Corporate Issuance Hits Record Highs." That's usually a sign that companies are terrified rates are about to spike, so they're grabbing all the cheap money they can while the getting is good.

Equity Issuance: Selling the Dream

Then there’s equity. This is what people usually mean when they talk about "going public" or an IPO (Initial Public Offering).

An IPO is the most famous type of issuance. It's the first time a private company creates shares and offers them to the general public. It's a huge milestone. But issuance doesn't stop after the IPO. Companies can do a "secondary issuance" or a "follow-on offering."

This is often a red flag for existing shareholders.

Imagine you own a pizza that’s cut into 8 slices. You own one slice. If the pizza shop decides to "issue" more pizza and suddenly cuts that same pie into 16 slices, your one slice is now much smaller. This is called dilution. In the world of stock issuance, dilution is a dirty word. If a company issues new shares without a really good reason—like a massive acquisition that will make the company way more profitable—the stock price usually drops because each existing share is now worth a smaller percentage of the company.

The Role of Underwriters

Issuance doesn't happen in a vacuum. A CEO doesn't just wake up and post "New Shares for Sale!" on Twitter (well, unless they're Elon Musk, and even then, there's a formal process).

Enter the investment banks.

Goldman Sachs, Morgan Stanley, JP Morgan—these guys are the gatekeepers. They are the "underwriters." Their job is to manage the issuance. They look at the company, decide what the shares or bonds are worth, and find the buyers. They also take a massive fee for the privilege.

The underwriter essentially guarantees the issuance. In a "firm commitment" underwriting, the bank actually buys all the new shares from the company themselves and then tries to sell them to the public. If nobody wants them? The bank is stuck with them. This is why they do so much "roadshow" work, traveling around to convince big hedge funds that this new issuance is the best thing since sliced bread.

🔗 Read more: No Tax on Overtime: What Most People Get Wrong About the New Rules

The Dark Side: Over-Issuance and Market Crashes

There is such a thing as too much.

When the market is flooded with new issuance, it can lead to a "liquidity drain." There’s only so much investment capital to go around. If every tech company in Silicon Valley decides to issue new stock in the same month, there might not be enough buyers to keep prices up.

Historically, massive spikes in issuance have preceded market corrections. Look at the dot-com bubble. Look at the lead-up to 2008. When the quality of what is being issued starts to drop—when even companies with no revenue are successfully issuing stock—you know things are getting weird.

It’s sort of like inflation. If a government issues too much currency (a form of issuance), the value of each dollar drops. If a company issues too much stock, the value of each share drops. The principle is the same across the board.

Beyond Finance: Issuance in Daily Life

We use the term "issuance" for more than just stocks and bonds.

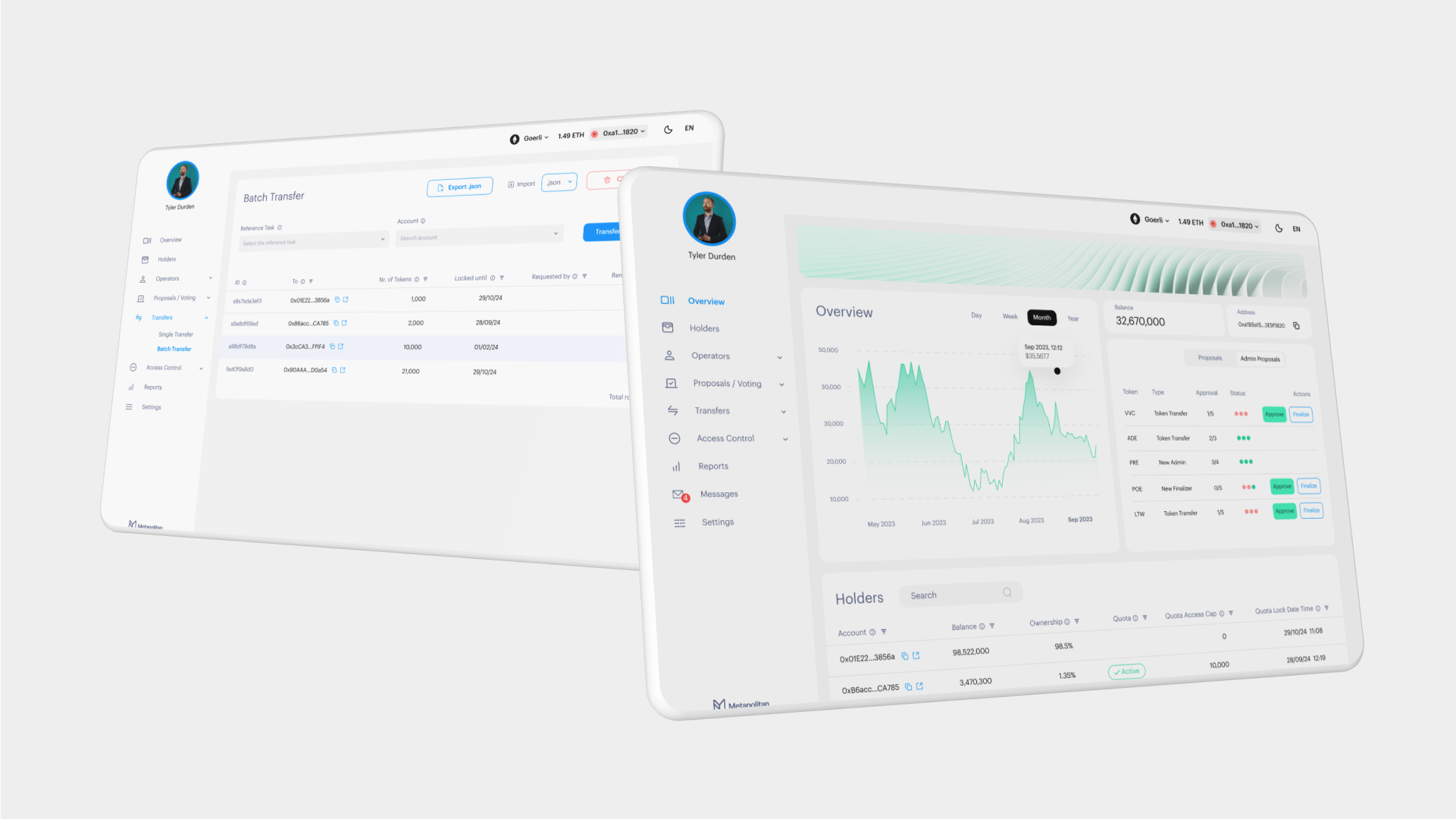

Think about your driver's license. The DMV "issues" it. It’s an official grant of authority. In the world of technology, we talk about "credential issuance" or "token issuance" in blockchain.

In a crypto context, issuance refers to how new coins are created. For Bitcoin, issuance is hard-coded. It happens every 10 minutes through mining. For other coins, a central foundation might "issue" a billion tokens all at once. Understanding the "issuance schedule" is the first thing any smart crypto investor looks at, because if the developers can just issue a million new tokens whenever they want, your investment is basically a donation to their vacation fund.

Key Differences: Primary vs. Secondary Markets

One of the biggest points of confusion is where the issuance actually happens.

The issuance itself happens in the primary market. This is the only time the company actually gets the money. When you buy a stock on Robinhood or E*TRADE, you aren't participating in an issuance. You’re buying a "used" share from another investor in the secondary market.

- Primary Market: Company sells to Investor. Company gets cash. (Issuance)

- Secondary Market: Investor A sells to Investor B. Company gets nothing. (Trading)

This distinction is huge. If you want to support a company's growth directly, you participate in an issuance. If you just want to bet on their stock price, you use the secondary market.

How to Analyze a New Issuance

If you’re looking at a company and they announce a new issuance, don’t panic. But don't celebrate either. You need to look at the "Use of Proceeds."

Companies are legally required to tell you what they’re going to do with the money. If the filing says "general corporate purposes," that's often code for "we’re running out of cash and need to pay the electric bill." That's bad.

However, if they say the issuance is to "fund the construction of a new manufacturing plant in Texas" or to "acquire a competitor," that could be a great sign. It means they see an opportunity to grow that is so big, it’s worth the cost of issuing new debt or equity.

Check the "Ratings"

For debt issuance, always check the credit rating. Moody’s or S&P will give a new bond issuance a grade like AAA or B-.

A "junk bond" issuance (anything below BBB-) means the company has a high risk of defaulting. They have to pay a much higher interest rate to convince people to take the risk. If you see a company issuing debt at 12% interest when the rest of the market is at 5%, you have to ask yourself: how desperate are they?

Actionable Steps for Navigating Issuance

Understanding issuance helps you see the "why" behind market moves. It’s the difference between being a gambler and being a strategist. Here is how you can actually use this knowledge:

- Monitor the Calendar: Keep an eye on the "IPO Calendar" and "Earnings Calendars." Companies often announce secondary issuances right after a good earnings report when their stock price is high.

- Watch the Yield Curve: Debt issuance is heavily influenced by interest rates. When the yield curve flattens or inverts, issuance patterns shift dramatically. If you see companies stopping debt issuance and switching to equity, they might think a recession is coming.

- Read the Prospectus: It’s a 200-page document that everyone ignores. Don't ignore it. Look at the "Risk Factors" section. This is where the company is legally forced to admit all the ways the issuance could go wrong.

- Calculate the Dilution: If a company you own announces a new stock issuance, do the math. Divide the number of new shares by the total existing shares. If they are increasing the share count by 20%, your ownership just took a 20% hit. Is the reason they're raising money worth that 20% loss in power?

- Follow Federal Reserve Policy: Since the Fed controls the "price" of money (interest rates), they essentially control the volume of issuance globally. When the Fed pivots, the issuance floodgates either open or slam shut.

At the end of the day, issuance is just the mechanism by which resources are reallocated in an economy. It's the lifeblood of expansion. Whether it's a government building a bridge or a startup building an AI, issuance is the spark that turns a plan into a reality. Just make sure you aren't the one left holding the bag when an issuance is poorly timed or desperately executed.