The stock market loves a good breakup. Especially when it involves a giant like ITC. For years, investors complained that the hotel business was a "drag" on the cigarette-to-biscuit conglomerate’s valuation. Then 2025 happened, the demerger became reality, and now we’re staring at the ticker for ITC Hotels share price on our screens every morning.

But here’s the thing. Most people are looking at the price action all wrong. They see the daily fluctuations—like the recent dip toward ₹187—and think it’s just another hotel stock moving with the travel season. It’s not. It’s a specialized play on luxury consumption in India, and it’s finally decoupled from the parent company's cash flow.

Why the ITC Hotels Share Price is Trading Where It Is

Right now, the market is essentially trying to figure out what a pure-play ITC luxury hotel business is worth without the "safety net" of the tobacco business. On January 16, 2026, the stock closed around ₹186.90. Some are calling it a "death cross" because it’s down from those mid-2025 highs of ₹261. Honestly, that sounds more dramatic than it actually is.

If you look at the fundamentals, the company is basically debt-free. That’s rare in the hotel world. Most hospitality chains are buried under interest payments for the massive buildings they own. ITC Hotels has a mix, but they’ve been leaning hard into the "asset-right" strategy—managing properties rather than just building them from scratch with their own cash.

👉 See also: Paul Tatum and Donald Trump: The 1996 Moscow Mystery That Still Sparks Rumors

You’ve got a market cap sitting near ₹39,000 crore. Is that expensive? Well, the P/E ratio is north of 50. In a vacuum, that looks pricey. But when you compare it to Indian Hotels (IHCL), which often trades at even higher multiples, you start to see why the big brokerages like Nomura are still putting "Buy" ratings on this with targets near ₹230.

The Demerger Math You Probably Forgot

Let's refresh the memory because the math was a bit funky. For every 10 shares of ITC Ltd you held back in early 2025, you got 1 share of ITC Hotels.

ITC (the parent) still keeps a 40% stake. The rest is with us, the public. This matters because it means the parent company isn't just dumping the child; they have every incentive to make sure the ITC Hotels share price reflects the actual value of those 120+ properties.

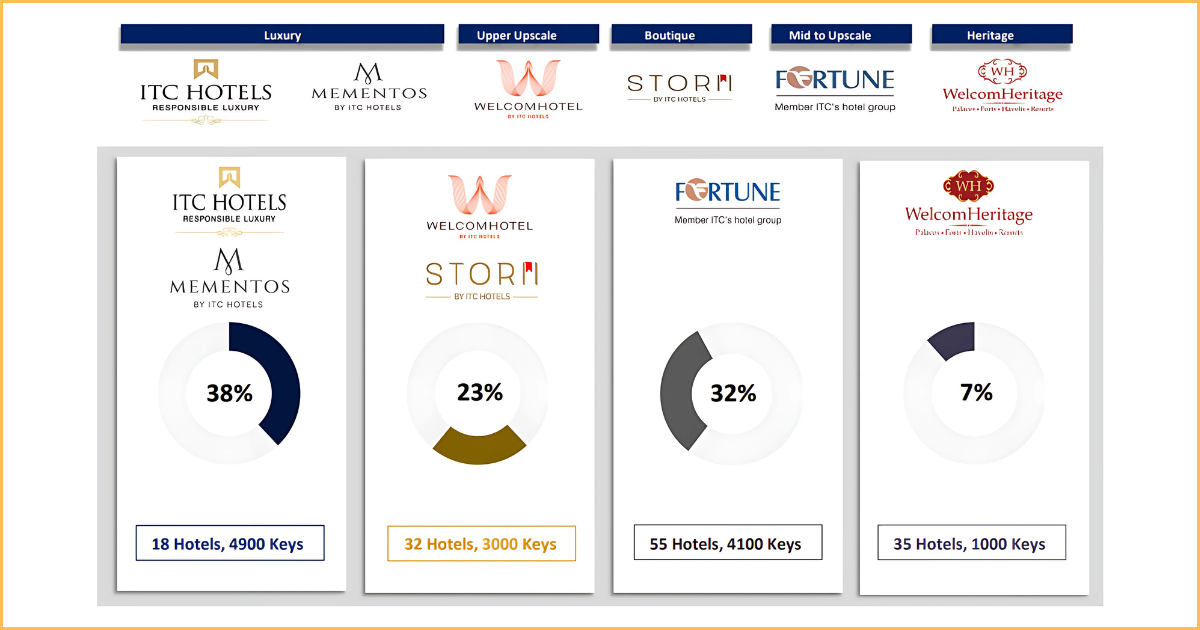

- Marquee Brands: We're talking ITC Hotels, Mementos, Welcomhotel, and the budget-friendly Fortune.

- The Sri Lanka Factor: ITC Ratnadipa in Colombo is finally gaining traction.

- Recent Allotments: They just got land at Yashobhoomi in Dwarka. That’s a massive win for the MICE (Meetings, Incentives, Conferences, and Exhibitions) segment.

What's Driving the Volatility Lately?

The first half of January 2026 hasn't been kind to the broader Indian market. Global tensions—specifically the US-Iran situation—have pushed investors toward gold and away from "discretionary" spending stocks like luxury hotels.

FII (Foreign Institutional Investor) selling has been a constant theme. When the big money leaves, the mid-cap stocks usually feel the pinch first. But don't let the red candles on the chart fool you into thinking the business is struggling. In Q2 of FY26, the company reported a net profit growth of about 72% year-on-year, hitting ₹133 crore. Revenue is up too.

Basically, the business is making more money, but the stock price is adjusting because the initial "demerger hype" has cooled off. It’s a classic "sell the news" scenario that has stretched out over a year.

The Real Support Levels

If you’re the kind of person who stares at charts, the 52-week low is around ₹155. We’re still a fair bit above that. Most analysts see a strong support zone between ₹180 and ₹185. If it breaks below that, we might see some panic, but as long as RevPAR (Revenue Per Available Room) keeps growing in the high single digits, the long-term story stays intact.

The "Asset-Light" Pivot and Your Portfolio

For a long time, ITC was criticized for being too capital-intensive. They’d spend hundreds of crores building a single hotel. Now, they’re signing management contracts left and right.

This shift is crucial for the ITC Hotels share price because it improves the Return on Invested Capital (ROIC). When you don’t have to own the bricks and mortar, your margins look a lot sexier. Nomura expects the company to generate annual cash of ₹800–1,000 crore. That’s a lot of firepower for small acquisitions or just beefing up the dividend once they get into a steady rhythm.

Actionable Insights for Investors

If you're holding these shares or thinking about jumping in, keep your eyes on the January 20 board meeting. They’ll be announcing the Q3 results for the period ending December 31, 2025.

- Watch the RevPAR: If revenue per room is growing, the stock will eventually follow.

- Ignore the "Death Cross" Noise: Technical signals like that are often lagging indicators in a sector that is fundamentally recovering from a decade-long slump.

- Check the FII Data: Once the foreign selling stops, ITC Hotels is exactly the kind of "India Growth" story that sees a quick rebound.

- Tax Considerations: Remember that your holding period for capital gains usually dates back to when you bought the original ITC shares, not just when the new ones were credited.

The market is currently in a "wait and watch" mode. The listing hype is dead, and the real work of being a standalone company has begun. It’s a boring phase for traders, but for long-term investors, this is usually where the actual value is found.

Pay attention to the occupancy rates in the upcoming quarterly report. If they can maintain 70%+ occupancy during the peak winter season, the current dip might look like a massive missed opportunity by this time next year. Just don't expect it to double overnight; luxury is a slow, steady game.