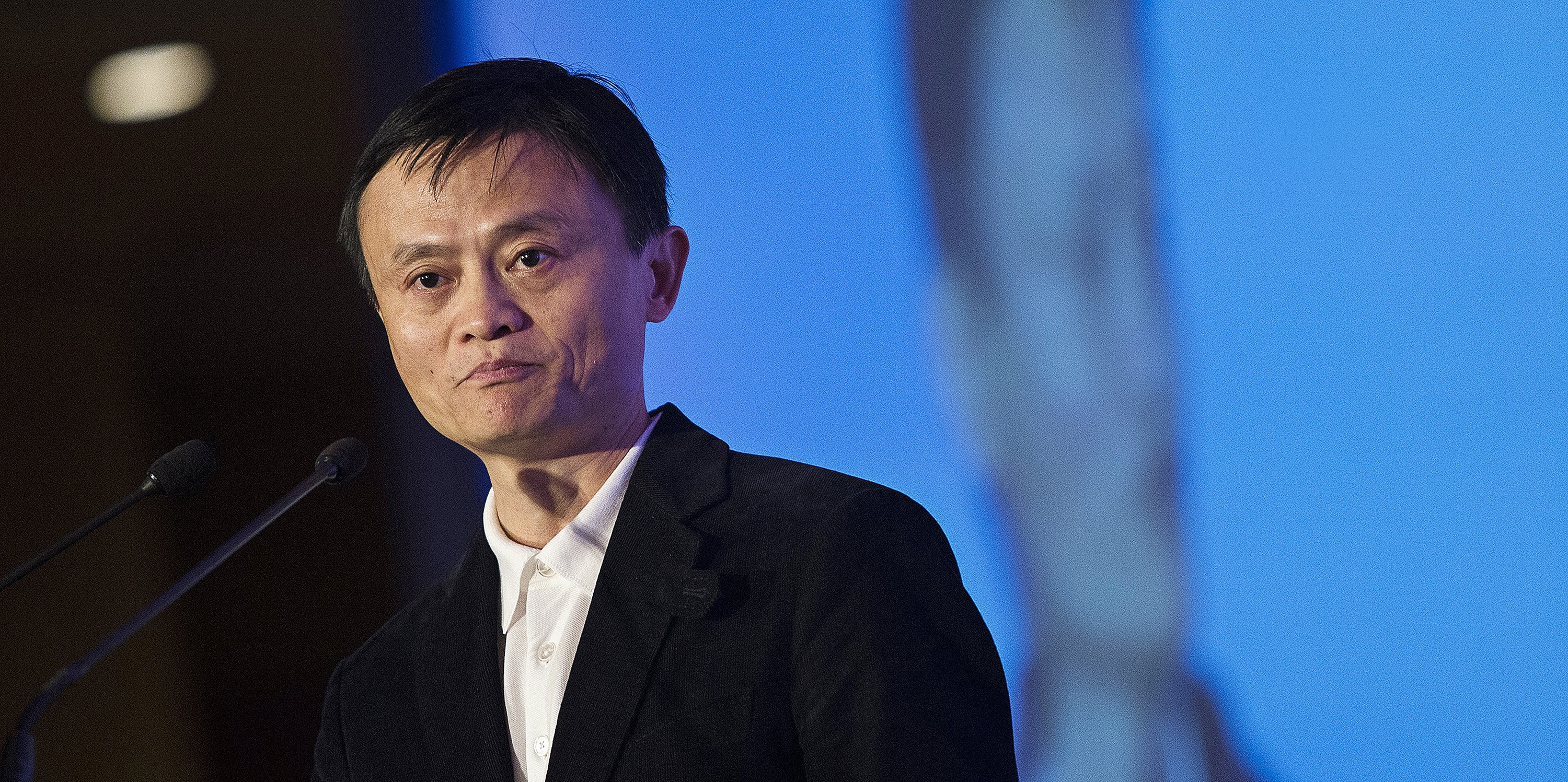

It is a weird thing to watch a man lose $30 billion and still be one of the richest people on the planet. Honestly, if you haven't been following the saga of Jack Ma over the last few years, you've missed one of the most dramatic shifts in modern business history.

Once the undisputed face of the Chinese tech boom, Ma's trajectory changed in a heartbeat after a single speech in October 2020. Since then, the numbers have been sliding, shifting, and—lately—recovering in ways that most people aren't talking about.

The Current Reality of Jack Ma Net Worth

As of early 2026, Jack Ma net worth is hovering around $31 billion.

To some, that sounds like an impossible win. To those who remember the peak of his influence, it’s a shadow of what once was. Back in 2020, just before the Ant Group IPO was pulled from under his feet, he was worth roughly $61 billion. He was the wealthiest person in China and a global icon.

The drop wasn't a slow leak; it was a structural demolition. Between the massive fines levied against Alibaba and the forced restructuring of Ant Group, the value of his primary assets took a massive hit. But here is the kicker: he’s still here. He hasn't faded into the background as much as the headlines would have you believe.

💡 You might also like: Sri Lankan Rupee to USD: What Most People Get Wrong About the Exchange Rate

Where the Money is Actually Housed

Most of Ma's wealth is still tied to his 3.9% stake in Alibaba. While he has been divesting shares for years—he famously sold about $8.2 billion worth in 2020 alone—the performance of the "BABA" ticker on the New York Stock Exchange and its Hong Kong counterpart is what moves his needle daily.

Then you have Ant Group. This is the fintech giant behind Alipay. It was once valued at a staggering $280 billion. Today? Most analysts, including those from Bloomberg, peg its valuation closer to $78 billion or $80 billion. Ma used to have the controlling interest here, but in a series of "corporate governance optimizations" (that's corporate-speak for "giving up power"), his voting rights were slashed from over 50% to roughly 6.2%.

The Quiet Return and the AI Pivot

For a while, the only news we got about Jack Ma was "spotted in a Japanese ski resort" or "studying agriculture in the Netherlands." It felt like a forced retirement. But 2025 and 2026 have seen a massive change in his public and private involvement.

📖 Related: Indian INR to Canadian Dollar: The Real Reason Your Transfers Are Getting Pranked

He’s back at the Alibaba campus in Hangzhou more frequently now. He isn't the CEO, and he isn't the Chairman, but he’s basically the spiritual architect of their new "AI-first" strategy. Alibaba recently committed about $53 billion to AI and cloud infrastructure over the next three years.

You can see his fingerprints all over this. He’s always been a "big picture" guy, and right now, the big picture for him is Qwen—Alibaba’s answer to GPT.

It’s Not Just Tech Anymore

What most people get wrong is thinking Ma is just a "tech guy." He’s been diversifying like crazy.

- Agriculture: He spent a significant amount of time in Thailand and Europe learning about sustainable food production. He even launched a small startup called "1.8 Meters Marine Technology" in 2023.

- Education: This is his true passion. He refers to himself as "Teacher Ma." Through the Jack Ma Foundation, he’s poured millions into rural education initiatives in China and the Africa Netpreneur Prize.

- Singapore Real Estate: His family recently made headlines for a $37 million property purchase in Singapore. It’s a classic move—diversifying assets away from the volatile mainland market.

Why the Numbers Keep Changing

If you look at the Forbes Real-Time Billionaires list, you’ll see Ma’s rank jumping around constantly. Why? Because the Chinese tech sector is currently a rollercoaster.

One day, Beijing announces a new stimulus for the digital economy, and Alibaba’s stock jumps 10%, adding $2 billion to his net worth. The next day, export curbs on AI chips from the US hit the news, and the value drops again.

Honestly, the Jack Ma net worth story is no longer about him trying to be the richest man in the world. He’s already been there. It’s about "soft power." He’s transitioning from a mogul to a mentor. He’s teaching at the University of Tokyo and the University of Hong Kong. He’s becoming an elder statesman of the internet era.

The Misconception of "Losing Control"

There is this narrative that Ma is "broken" or that his wealth is "gone." That’s just not true. He still sits on a pile of cash and equity that makes him more powerful than most small nations.

The real shift is that he is no longer the "control person." In the past, what Jack said, happened. Now, Alibaba is run by a more pragmatic team led by the likes of Eddie Wu and Joe Tsai. This actually helps his net worth in the long run. It reduces the "key man risk" that once made the stock so volatile.

When the market stops worrying about whether Jack Ma will say something to upset regulators, the stock stabilizes. And when the stock stabilizes, his billions are safer.

Actionable Insights for Investors and Observers

If you are tracking wealth trends or looking at the Chinese market, there are a few things to keep in mind regarding this saga:

- Watch the Ant Group IPO (again): There are persistent rumors that a reorganized, smaller version of Ant Group might finally go public in 2026. If that happens, expect Ma’s net worth to see its first major upward surge in half a decade.

- The AI Multiplier: Alibaba is currently trading at a P/E ratio that is much lower than its US peers like Amazon or Microsoft. If their AI pivot succeeds, that "China discount" might shrink, leading to a massive wealth recovery for its founders.

- Philanthropy as a Shield: Ma is using his foundation to align with "Common Prosperity" goals. This isn't just charity; it’s a strategic move to ensure his remaining wealth is viewed as a benefit to society rather than a threat to the state.

- Diversification is King: Follow the trail of his private investments in Southeast Asia and agriculture. These are the "quiet" billions that don't show up as clearly on the Bloomberg index but provide his long-term financial floor.

The era of the "Rockstar Billionaire" Jack Ma is over. The era of the "Strategic Investor and Educator" Jack Ma is just beginning. While his net worth might never hit $60 billion again, the $31 billion he has left is being deployed with a lot more caution—and perhaps a lot more long-term wisdom.