When the news first broke that James C. Collins Jr. was stepping down from Corteva Agriscience, it felt like a bit of a shock to the system for the global ag community. Honestly, you've got to look at the timing. It was mid-2021. The world was still wobbling from the pandemic, supply chains were a total mess, and Corteva—this massive pure-play agriculture giant—was only a couple of years into its life as a standalone company.

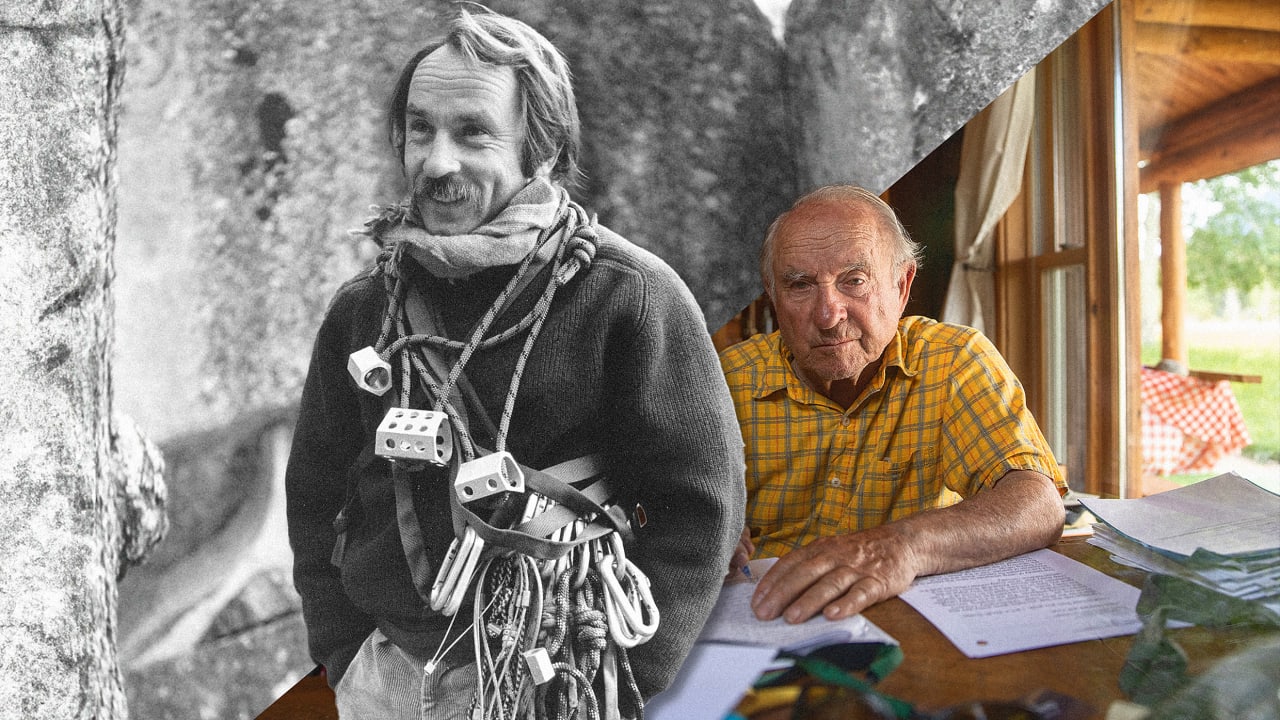

Collins wasn't just some guy in a suit. He was the "architect" of the whole thing. He'd been with DuPont for over 30 years. He basically lived and breathed the Dow-DuPont merger, the subsequent three-way split, and the birth of Corteva. Then, on June 21, 2021, the company dropped the 8-K filing: Collins and the board had "mutually agreed" he would retire at the end of the year.

Why did Jim Collins leave Corteva?

People love a good conspiracy, but the reality here was mostly about "mission accomplished" and a little bit of pressure from the sidelines.

By the time he announced his exit, Collins had successfully spun Corteva out. He’d navigated the brutal "Day 1" on the NYSE and kept 21,000 employees focused while they were literally working from their kitchen tables during COVID. In his own words, he felt the company was on "solid ground."

📖 Related: Geography Lessons 5 Biz: Why Most Companies Fail at Location Intelligence

But there’s always a but.

At the time, Corteva was facing some heat from activist investors, specifically Starboard Value. They were pushing for better margins and higher returns. While the official line was a mutual agreement for retirement, the corporate world knows that when an activist investor starts knocking, the board starts looking for a "growth-stage" leader. Collins was the builder. The board wanted a runner.

Enter Chuck Magro: The Succession

The transition wasn't an overnight disappearance. Collins stayed on as a special advisor through December 31, 2021, to make sure the handoff to Chuck Magro didn't trip any wires. Magro, who had previously been the boss at Nutrien, officially took the CEO chair on November 1, 2021.

📖 Related: Car Insurance Cost by State: What Most People Get Wrong

It was a classic pivot. You move from the guy who understands the internal chemistry and the "merger divorce" to a guy who knows the retail and fertilizer side of the business inside out.

What most people get wrong about the Collins era

It’s easy to look back and just see a CEO who left after two years. That’s a shallow take. Jim Collins spent three decades building the pieces that became Corteva.

- The "Divorce" Strategy: He famously said, "Immediately upon marriage, we started planning the divorce." He was referring to the DowDuPont merger. It was a $130 billion marriage designed solely to be broken apart into three better companies.

- The Human Element: Running a Fortune 200 company from a kitchen table via self-shot videos isn't exactly in the CEO handbook. He leaned heavily into sincerity over polished scripts.

- The Portfolio: He inherited a messy overlap of Dow and DuPont seeds and chemicals. He had to prune that list without losing the trust of farmers who had used Pioneer seeds for generations.

The KEYWORD: Jim Collins stepped down Corteva legacy

When Jim Collins stepped down Corteva was already a different beast than the one he inherited. He left behind a "pure-play" company. That’s a fancy way of saying they don't do paints or plastics—they only do food and farming.

Since he left, he hasn't exactly been sitting on a porch. By August 2022, he popped up on the board of ADM (Archer-Daniels-Midland). It makes sense. You don't spend 30 years in ag and then just go play golf. He’s now helping oversee one of the biggest grain traders in the world.

Lessons from the transition

If you're looking at this from a business or leadership perspective, there are a few things to chew on.

📖 Related: Where to File Form 7004 Without Losing Your Mind

- Timing is everything. Collins left when the foundation was set but before the "growth expectations" of the next five years could pin him down.

- Activist pressure works. Even if it's not the primary reason, the presence of Starboard Value accelerated the conversation about what the "next phase" of leadership looked like.

- The "Founder" CEO vs. the "Scaler." Even though Corteva was 100 years old via its parents, as a standalone entity, it was a startup. Collins was the founder-equivalent. Magro was brought in to scale the margins.

What’s next for Corteva?

Under Magro, the company has stayed the course on high-tech seed traits and "green" crop protection. The groundwork Collins laid—especially in digital agriculture and the USMCA trade advocacy—still dictates how the company operates in 2026.

Honestly, the move was probably the right one for both parties. Collins got to walk away with a successful "launch" on his resume, and Corteva got to bring in a leader with a different set of eyes for the retail side of the business.

Next steps to consider:

- Review Corteva’s recent quarterly earnings to see if the "margin expansion" promised during the leadership change has actually materialized.

- Follow Jim Collins’ current work with the ADM board to see how his "sincerity-first" communication style is influencing their ESG reporting.