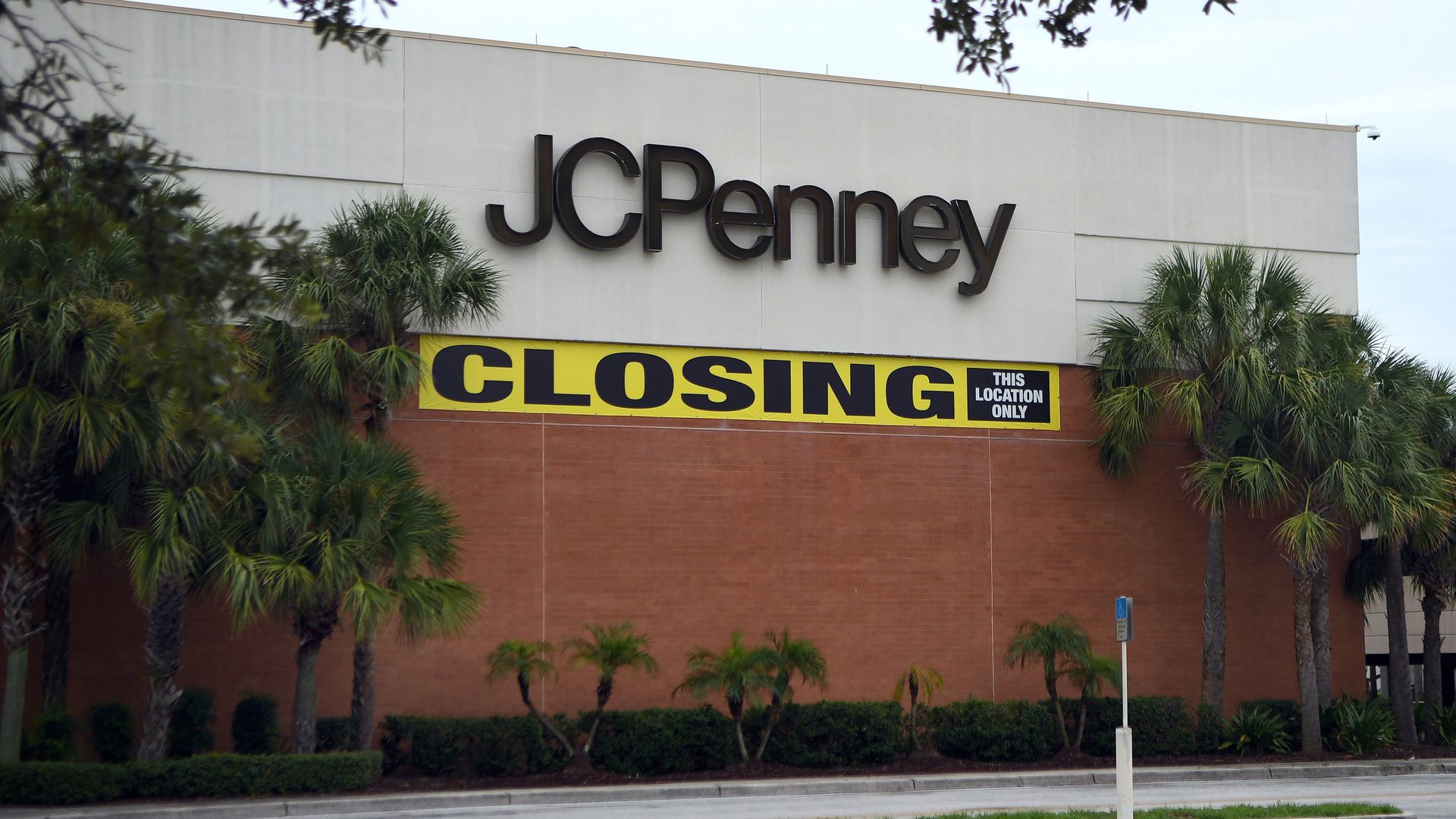

You’ve probably seen the headlines or heard a neighbor mention that the JCPenney at your local mall is finally throwing in the towel. It feels like we've been hearing about the "death of the department store" for a decade now, yet JCPenney always seems to hang on by a thread. But as we move through 2026, looking back at the jcpenney closing 2025 cycle reveals a story that isn't just about a brand dying.

Honestly, it’s more about a massive, billion-dollar surgery.

The year 2025 was supposed to be the "reset" year. While people were panic-searching for lists of store closures, the company was actually trying to merge its way out of a hole while quietly trimming the fat. If you're wondering why your favorite location vanished or why the one in the next town over suddenly looks like a high-end boutique, it all comes down to a very specific set of moves made by their owners, Simon Property Group and Brookfield.

The 2025 Store Closure Reality Check

Let’s clear the air first. There wasn't a "mass liquidation" in 2025 like the one we saw during the 2020 bankruptcy. Instead, the company confirmed a "handful" of isolated closures. Specifically, eight stores were put on the chopping block by mid-year.

👉 See also: INR to USD Chart: Why the Rupee Hit 90 and What Happens Next

Why only eight?

Well, JCPenney has been stuck in this weird limbo where they can't afford to close too many stores because their landlords are their owners. If Simon and Brookfield close a Penney’s, they lose a massive anchor tenant in their own malls. It’s like moving money from your left pocket to your right pocket, only to find a hole in the right one.

The locations that did get the axe in 2025 included:

- The Shops at Northfield in Denver, CO

- Charleston Towne Center in West Virginia

- The Shops at Tanforan in San Bruno, CA

- Asheville Mall in North Carolina

- West Ridge Mall in Topeka, KS

- Pine Ridge Mall in Pocatello, ID

- Mall at Fox Run in Newington, NH

- Annapolis Mall in Maryland (though this one had some lease-extension drama)

These weren't random. Most of these shutdowns were blamed on expiring leases or "market changes," which is corporate-speak for "nobody is walking through these doors anymore."

The Catalyst Brands Merger Nobody Noticed

While everyone was focused on the jcpenney closing 2025 list, something much bigger happened in the boardroom. In January 2025, JCPenney basically joined forces with SPARC Group to create a new entity called Catalyst Brands.

Think of it as a retail Avengers, but for brands that have seen better days.

This move put JCPenney in the same family as Aeropostale, Eddie Bauer, and Brooks Brothers. The goal was simple: synergies. They wanted to use the same warehouses, the same tech, and the same shipping routes to save cash. For the average shopper, this meant seeing more "name brands" inside JCPenney, trying to lure back the families that had migrated to Target or TJ Maxx.

Did the $1 Billion Plan Actually Work?

Back in 2023, the company announced they were dumping $1 billion into a turnaround. By the end of fiscal 2025, that money was mostly spent. If you walked into a "refreshed" store last year, you saw the results: brighter lights, faster checkout tech, and a heavy emphasis on the JCPenney Beauty section (their answer to losing Sephora to Kohl's).

The results were... mixed.

By Q2 of 2025, JCPenney actually swung to a profit of $110 million. That was huge. People were buying shoes and home goods again. But by Q3, the wheels started wobbling. They posted a $100 million loss as the "working family" demographic they target started feeling the pinch of inflation and high credit card interest.

"There is still softness in the numbers, but it seems like the sales declines might be starting to level off," noted Neil Saunders of GlobalData.

Basically, they aren't sinking as fast, but they aren't exactly doing a victory lap yet either.

The Real Estate Shell Game

Here is the part most people get wrong about jcpenney closing 2025. There was a massive deal involving 119 store properties that was supposed to sell for nearly $950 million to a firm called Onyx Partners.

It fell through.

This created a lot of uncertainty. When a billion-dollar real estate deal collapses, people assume the stores are closing. In reality, JCPenney just continues to rent those spaces from a property trust. It’s messy, it’s complicated, and it’s why you might see "For Sale" signs on the land even though the store inside is having a "Back to School" sale.

Why 2026 Looks Different

We are now seeing the "Make It Count" strategy in full swing. JCPenney has stopped trying to be everything to everyone. They’ve pivoted hard toward "diverse, working families." They are leaning into private labels like Arizona and Liz Claiborne because the profit margins are better than selling Adidas or Nike.

The strategy now is "Frequency over Foot Traffic."

They don't care if a million people walk past the store in the mall; they care if their loyal credit card holders come back 18 times a year. In late 2025, they reported that trip frequency was actually up. People who shop at Penney's are shopping there more often, even if the total number of shoppers is shrinking.

What You Should Do If Your Local Store Is Still Open

If your local JCPenney survived the 2025 cuts, it’s likely considered a "core" location. But don't expect the old-school department store experience.

First, check your rewards. The company revamped their loyalty program in 2024-2025 to be way more aggressive. If you aren't using the app, you're basically throwing money away. They are desperate to keep you in their ecosystem.

Second, watch the brands. With the Catalyst Brands merger, you’re going to see a lot more cross-pollination. If you like Eddie Bauer or Lucky Brand, you might find "mini-shops" inside Penney’s that offer better prices than the standalone boutiques.

Third, don't ignore the "Liminal" feel. Some stores still feel like a time capsule from 1994. If your local store hasn't received part of that $1 billion refresh yet, it might be on a future closure list. The company is prioritizing "A" malls—the high-traffic, fancy ones. If you’re in a "B" or "C" mall that looks like a ghost town, your JCPenney is likely on borrowed time.

Actionable Steps for the Savvy Shopper:

🔗 Read more: How Much for a Newspaper: Why the Price of Print is Skyrocketing

- Verify Your Store Status: Use the official JCPenney Store Locator rather than relying on social media rumors. Many "closing" lists online are outdated or include stores that were saved at the last minute.

- Maximize the "Cash": JCPenney Rewards (JCPenney Beauty especially) has become one of the most generous in retail because they need the data. Link your phone number and actually use the $10 coupons.

- Shop the Private Labels: Brands like Xersion and St. John's Bay are where the company is investing its quality control. They are often better made than the name brands they carry because JCPenney owns the entire supply chain now.

- Monitor the "PropCo" News: If you see news about the JCPenney Property Trust selling more locations, don't panic. Usually, it's just a change in landlord, not a store closure.

The era of JCPenney being a "mall giant" is over. What’s left is a leaner, slightly more focused retailer that is trying to prove it can survive in a world dominated by Amazon and Shein. Whether they can actually pull off a total comeback depends entirely on whether those "working families" keep showing up when the economy gets bumpy.