Let’s be real for a second. If you own Apple stock, you've probably grown used to the "Apple is doomed" narrative that pops up every single year like clockwork. But when a heavy hitter like Jefferies moves the needle, people actually stop and look.

Jefferies downgrades Apple to underperform from hold, and honestly, the timing couldn't be more awkward for the tech giant.

🔗 Read more: Sam Brinton Net Worth: What Really Happened to the Nuclear Guru's Fortune

While most of Wall Street is busy high-fiving over the "AI supercycle," analyst Edison Lee and his team at Jefferies are essentially pouring a bucket of ice water on the party. They aren't just saying Apple is a bit pricey; they’re saying the market's math on the iPhone 17 and the rumored "iPhone 18 Fold" is basically a fantasy.

The AI Reality Check Nobody Wanted

The big hook for the latest iPhones was supposed to be Apple Intelligence. You know, the "Siri is finally smart" and "I can erase my ex from this photo" features. But according to Jefferies, this isn't enough to make someone drop $1,000 on a new phone.

Edison Lee pointed out something pretty blunt: smartphone hardware needs a massive "rework" before it can handle serious, high-level AI. We’re talking about a timeline that stretches into 2026 or 2027.

Most people think AI is a software update. Jefferies thinks it’s a hardware problem. If the hardware isn't ready, the "supercycle" is just a normal cycle with a fancy marketing name.

Why the iPhone 17 is looking "lukewarm"

You've likely heard the hype about the iPhone 17 "Air" or the "Slim" model. It’s supposed to be this ultra-thin, sexy device that revives the lineup. Jefferies' tracking shows it's actually the least popular model in terms of early interest.

- Lead times are falling: In major markets like the UK and Germany, lead times for the Pro models have dropped to zero.

- The "Base" model is carrying the weight: Surprisingly, the standard iPhone 17 is doing well, but only because Apple effectively cut the price in places like China.

- Resale values are weird: While some Pro Max models are holding value, the mid-tier is struggling.

When the base model—the one with the lowest profit margin—is your best seller, that's not exactly a "win" for a company valued at nearly $4 trillion.

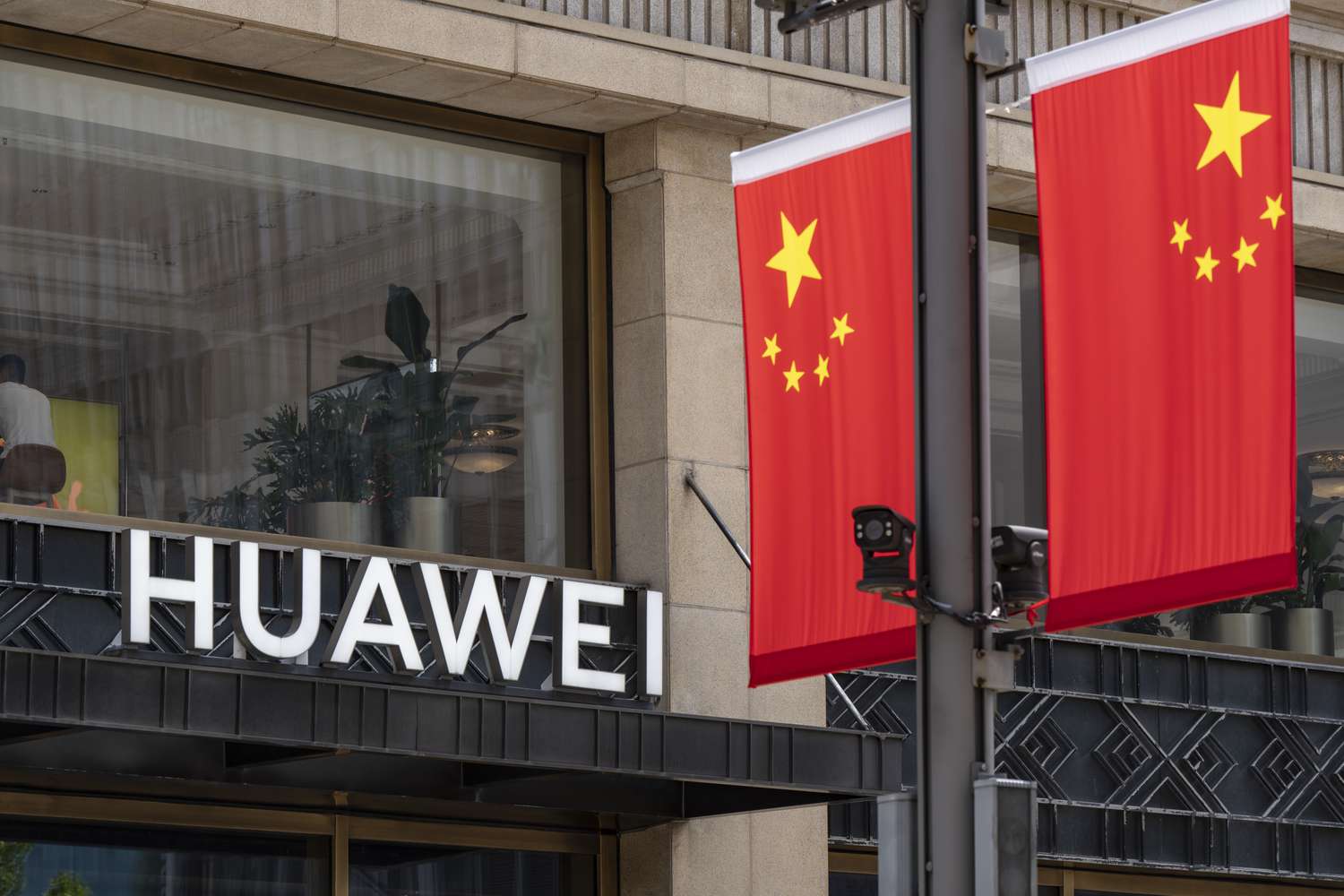

The China Headache and the Tariff Ghost

China is still the dragon Apple can't quite tame. Jefferies notes that Apple is losing its grip as the top seller there. To keep units moving, they’ve had to lean into deep discounts and government subsidies.

📖 Related: Is the In the Money Podcast Still the Best Way to Trade the Open?

And then there's the tariff situation.

Lee’s team brought up a scary number: a potential 5% hit to earnings per share (EPS) if the US starts taxing iPhones imported from China. Apple is trying to move production to India, but they can't meet 100% of US demand from there yet. If those tariffs hit, Apple has two choices: eat the cost (hurting margins) or raise prices (hurting sales). Neither is great.

What's the deal with the $2,000 Foldable?

The market is already pricing in a "foldable iPhone" as the next big thing. Jefferies thinks this is "excessive."

They’re forecasting about 12.5 million units for the first year of a foldable. The market? It’s pricing in double that. Plus, there's the price tag. If Samsung’s Fold is $2,000 and barely moves the needle for their bottom line, why would Apple's be any different?

"Without innovative features, a price-driven replacement cycle may not be sustainable." — Edison Lee, Jefferies.

🔗 Read more: Holiday in Share Market: Why Your Trading App Is Randomly Quiet Today

Basically, if the only reason people are buying new phones is because the old ones are cheap or the new ones are slightly thinner, the growth isn't real. It's just a placeholder.

A Rare "Underperform" in a Sea of Buys

It's important to put this in context. Most analysts—like the folks at Evercore ISI—are still very bullish, with price targets as high as $330. They think the spring 2026 Siri overhaul will be the "magic moment."

Jefferies is the outlier. They’ve cut their price target down to roughly $203. That’s a huge gap from the current trading price.

| Analyst Firm | Rating | Price Target | Rationale |

|---|---|---|---|

| Jefferies | Underperform | $203.07 | Weak AI hardware, margin risks, China slowdown. |

| Evercore ISI | Outperform | $330.00 | Strong iPhone 17 demand, Siri AI overhaul. |

| JPMorgan | Overweight | $260.00 | Cautious on China but likes the overall ecosystem. |

What You Should Actually Do

So, should you dump your shares because one analyst is grumpy? Probably not. Apple has a way of proving people wrong. But you can't ignore the math on margins.

If you're looking for "actionable" steps, here’s how to play this:

1. Watch the Service Revenue, not just the hardware.

If iPhone sales flatline, Apple needs Services (iCloud, Music, App Store) to grow even faster. If Services growth slows down while hardware is struggling, that’s when you actually worry.

2. Keep an eye on the "Siri Overhaul" in 2026.

If the AI features launching in early 2026 are actually "wow" factors, Jefferies might have to eat their words. If it’s just a slightly better voice assistant, the downgrade was justified.

3. Monitor the China pricing wars.

Check if Apple continues to offer deep discounts in Asia. If they do, they’re buying market share at the expense of their "premium" brand image.

Ultimately, Jefferies downgrades Apple to underperform from hold because they don't believe in the "AI fairy tale" just yet. They see a company that is hitting a hardware ceiling at the exact moment global trade is getting more expensive. It’s a bold call, and in a market that usually only goes up, it’s a perspective worth at least considering before you go "all in" on the next upgrade cycle.

To stay ahead, keep a close watch on the quarterly "Gross Margin" figures in the next earnings report. That's where the truth about those China discounts and component costs will finally show up.