How much can one man actually take from a Ponzi scheme before the whole thing collapses? Most people look at Bernie Madoff as the architect of the greatest financial heist in history. But if you really want to understand the money trail, you have to look at Jeffry Picower. Honestly, he’s the guy who actually "won" the game—at least on paper.

When we talk about the Jeffry Picower net worth, we aren't just talking about a high bank balance. We're talking about a figure so massive it basically redefined what a "net winner" looks like in the world of white-collar crime. At the time of his sudden death in 2009, Forbes pegged him at about $1 billion.

But here is the kicker: that number was way off.

✨ Don't miss: Price Per Ounce For Gold: Why $4,600 Is The New Normal

Investigators later realized he had personally extracted over $7.2 billion from Madoff’s firm. That is more than Madoff himself likely ever had in his own pocket. It's a staggering sum that makes most hedge fund managers look like they're playing with pocket change.

The Secret Architect of a $7 Billion Fortune

Picower wasn't some flashy Wall Street guy with a podcast and a Twitter following. He was a lawyer and an accountant. A "tax shelter expert," as some called him. He liked the shadows. For decades, he moved through the elite circles of Palm Beach and New York, building a reputation as a philanthropist while his Madoff accounts were performing miracles.

And I mean miracles.

In the late 90s, some of Picower’s accounts were seeing annual returns of 120% to 550%. In one specific instance in 1999, an account of his reportedly earned 950%. You don't get those numbers by being good at picking stocks. You get those numbers when the guy running the books is literally typing in whatever profit you ask for.

Basically, Picower was Madoff’s biggest customer, and Madoff treated him like royalty. While other investors were happy with a steady 10%, Picower was pulling out hundreds of millions at a time.

✨ Don't miss: What Is The Stock Price For Ford: What Most People Get Wrong

Where did the money come from?

It didn't come from the market. It came from other people.

The $7.2 billion he withdrew over 30 years was comprised of the life savings of retirees, the endowments of charities, and the capital of smaller investors. He was the "net winner" because he took out $7.2 billion more than he ever actually put in.

The Tragic End in Palm Beach

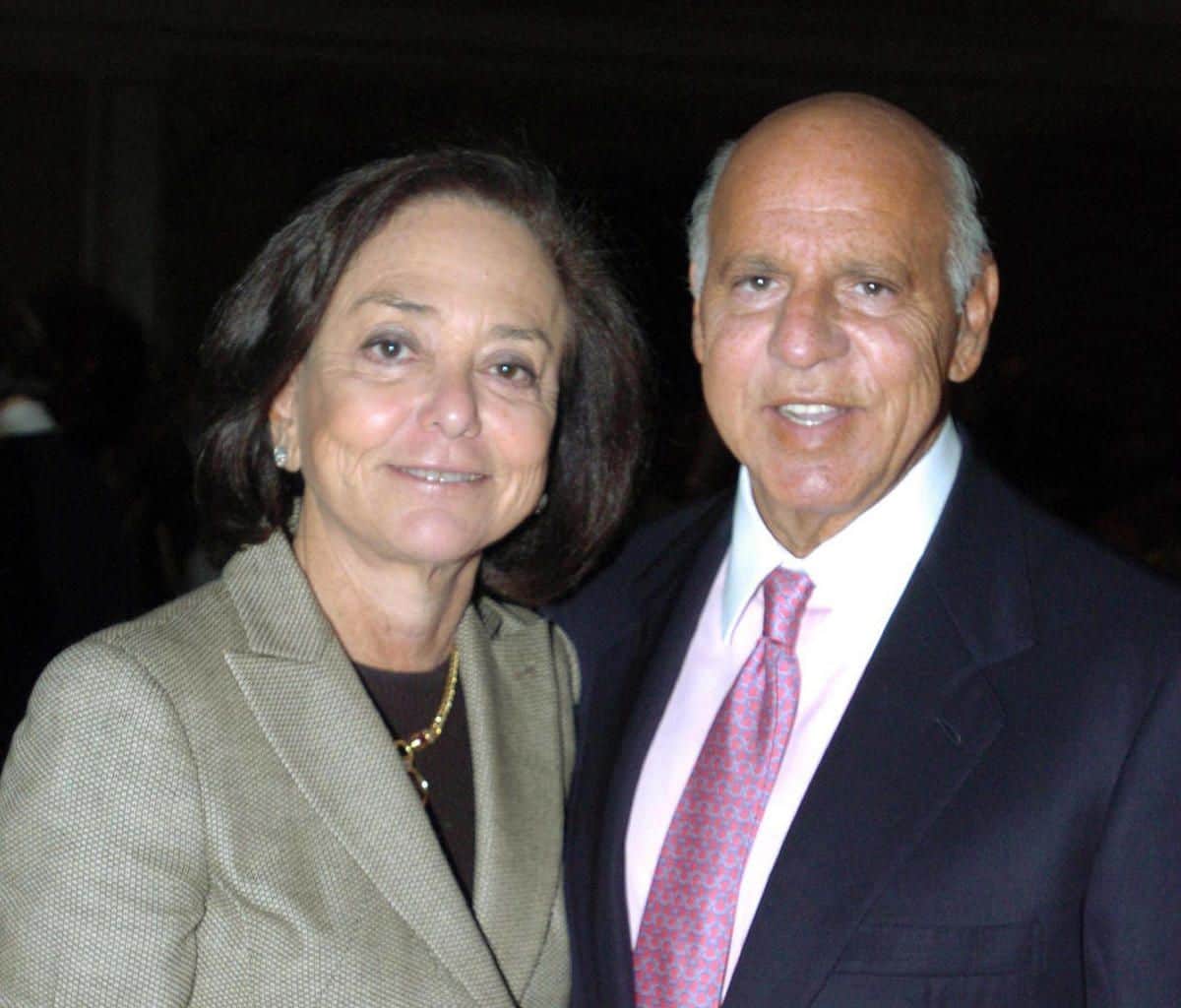

The story of the Jeffry Picower net worth took a dark, cinematic turn in October 2009. Picower was found at the bottom of his swimming pool at his $33 million mansion in Palm Beach. His wife, Barbara, found him. He was 67 years old.

At first, everyone thought it was suicide. The pressure of the Madoff investigation was mounting. Irving Picard, the trustee tasked with getting the money back, was breathing down his neck. But the medical examiner eventually ruled it an accidental drowning following a heart attack.

It was a strange, quiet end for a man who had successfully siphoned off a literal mountain of cash.

Giving It All Back: The $7.2 Billion Settlement

Usually, when someone dies with a bunch of questionable money, it takes decades for the courts to sort it out. Not here. In 2010, Barbara Picower did something almost unheard of in the history of American law.

She agreed to return every single cent of the $7.2 billion in "profits" her husband had taken from Madoff.

- The Forfeiture: It remains the largest single forfeiture in U.S. history.

- The Impact: This settlement alone was a game-changer for Madoff’s victims. It meant many of them would actually see a significant portion of their principal returned.

- The Motive: While some see it as an admission of guilt, Barbara Picower maintained that her husband didn't know about the fraud. She claimed she wanted to "do the right thing" and honor his legacy of philanthropy.

Regardless of the motive, that $7.2 billion was the cornerstone of the recovery effort. Without it, the Madoff recovery would have been a drop in the bucket compared to the total losses.

What Was Really Left Behind?

You might think that after giving back $7.2 billion, the Picower family would be broke.

Not even close.

Jeffry Picower was a savvy businessman outside of the Madoff sphere, too. He had huge wins in the healthcare sector, specifically with a company called Alaris Medical Systems, which was sold to Cardinal Health for $1.6 billion in 2004. He owned a massive chunk of that.

Even after the historic settlement, Barbara Picower was left with hundreds of millions. She used a significant portion of the remaining estate to fund the JPB Foundation. By 2018, that foundation had assets exceeding $3.7 billion. It’s one of the largest grant-making foundations in the United States today, focusing on poverty, the environment, and medical research.

It’s a weird paradox. The foundation does incredible work, but its seed money is inextricably linked to the most infamous financial scandal in history.

Why We Still Talk About Picower’s Net Worth

The Jeffry Picower net worth is a cautionary tale about "too good to be true."

When you see someone consistently beating the market by hundreds of percent, something is wrong. Picower was a sophisticated investor. He was a lawyer and an accountant. The central question that still haunts this case is: how could he not have known?

The Madoff trustee argued that Picower must have known because of the "impossible" returns and the backdated trades. Picower’s estate argued he was just a lucky investor who trusted a friend.

Ultimately, the money went back to the victims, but the mystery of what Jeffry Picower truly knew stayed at the bottom of that swimming pool in Palm Beach.

Actionable Takeaways from the Picower Legacy

If you're looking at your own investments or wondering how to avoid the next Madoff, keep these hard-won lessons in mind:

✨ Don't miss: US Dollar to Qatari Riyal: Why the 3.64 Rate Never Seems to Budge

- Audit the Returns: If your investment is returning 20% or more every single year regardless of what the S&P 500 is doing, you aren't a genius. You're likely in a Ponzi scheme or a high-risk bubble.

- Understand the Custodian: Madoff’s firm was his own custodian. This meant there was no independent third party verifying that the trades actually happened. Always ensure your broker uses a reputable, independent custodian.

- The "Net Winner" Risk: In a legal sense, being a "winner" in a fraud can be just as bad as being a loser. If you withdraw "profits" from a fraudulent scheme, even unknowingly, the law can (and will) claw that money back.

- Diversification is Safety: Picower had other "real" businesses, which is why his family stayed wealthy even after the $7.2 billion settlement. Never put all your capital in one person's hands.

The story of Jeffry Picower is a reminder that in the world of high finance, the biggest winners are often the ones you've never heard of—until the lights come on.

To better protect your own assets, start by reviewing your current brokerage statements for third-party custodian verification. Ensure your investments are held by an entity separate from the person making the trades. This single step is the most effective way to prevent falling victim to a Madoff-style fraud.