You probably think you know the Bernie Madoff story. Greedy old guy, $65 billion vanished, lives ruined. It's a standard true-crime narrative, right? Well, not exactly. Most of what we think we know is actually just the surface-level debris from a much deeper, more disturbing wreck.

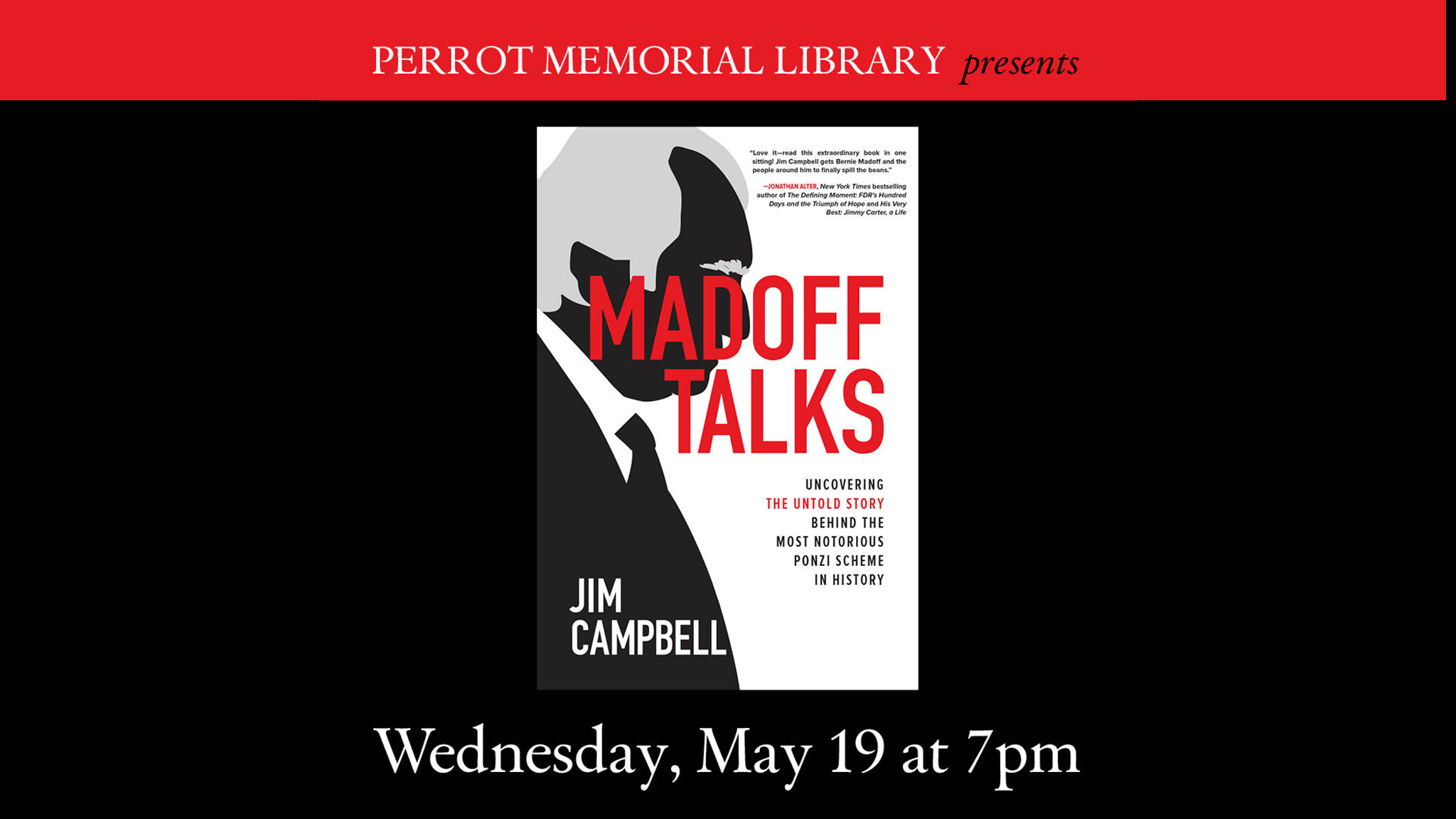

When Jim Campbell released Madoff Talks, he didn't just write another finance book. He basically spent a decade inside the head of a monster.

📖 Related: Georgia Sales Tax Number: What Most People Get Wrong About Registering Your Business

Jim Campbell didn't just interview people; he got Bernie to open up. He exchanged over 400 pages of correspondence with Madoff while the fraudster was rotting in a North Carolina prison. That's a lot of ink. It’s also a lot of lies, justifications, and weirdly enough, some brutal truths that Wall Street would rather you forget.

Why Madoff Talks Still Matters Today

People always ask: "Why bother?" Bernie is dead. The money is mostly gone. But the "why" matters because the system that let him do it hasn't actually changed as much as you'd hope.

In Jim Campbell Madoff Talks, the author makes a chilling point. Madoff wasn't just some wizard hiding behind a curtain. He was a product of a culture. Bernie told Jim, "I was a product of the corrupt nature of Wall Street." Now, maybe that’s just a narcissist shifting blame. But when you look at how the SEC ignored whistleblowers for forty years, you start to wonder if he had a point.

Jim spent years talking to Ruth Madoff too. And Andrew. He got the family to talk when no one else could. That’s the "talks" part of the title. It’s not just Bernie blathering; it’s the whole ecosystem of silence finally breaking.

The Five-Minute Fraud

Here is the kicker. Frank Casey, one of the guys who first smelled a rat, told Jim it took him about four minutes to realize Madoff was a fake. Four minutes.

Contrast that with the regulators. They spent decades looking at Bernie. They even "investigated" him multiple times. Every single time, they missed it. Why? Because they were looking for the wrong crime. They thought he was "front-running"—basically stealing a few cents off the top of trades. They never imagined he just wasn't trading at all.

He was just a guy with a bank account. A big one.

What Really Happened Inside the Lipstick Building

Madoff’s office in the Lipstick Building was split. The 18th and 19th floors were legitimate. They were a real, profitable market-making business worth maybe $3 billion. That’s the part people forget—Bernie didn't need to be a crook to be rich. He was already a titan. He was the chairman of NASDAQ, for heaven's sake.

But the 17th floor? That was the ghost zone.

That’s where the "investment advisory" business lived. It was basically two or three people and an ancient IBM AS400 computer. In Jim Campbell Madoff Talks, we learn that those "trades" everyone saw on their statements were completely fabricated. They weren't even good fakes. If any regulator had just called a clearinghouse to verify a single trade, the whole thing would have collapsed in 1992. Or 1982.

But nobody called.

The Myth of the $65 Billion

Let's clear something up. Bernie didn't actually steal $65 billion in cash. That number was "paper wealth." It was the total value of all the fake profits he’d told people they had.

The actual "cash-in, cash-out" loss was closer to $19 billion. Still a staggering, life-destroying amount, but the $65 billion figure is what Madoff wanted the world to believe. It fed his ego. In his letters to Jim, you can see this weird pride. He wanted to be the biggest, even if it was the biggest failure.

👉 See also: The Planet Fitness Founder Story: How Michael Grondahl Built a Gym for People Who Hate Gyms

The Human Cost Jim Campbell Uncovered

The most haunting part of the book isn't the math. It’s the families.

Jim Campbell spent a lot of time with Ruth Madoff. People love to hate her. They assume she knew. But Jim’s take is more nuanced—and honestly, more tragic. He describes her as someone who didn't even know what a Ponzi scheme was when Bernie finally confessed. She was living in a bubble of "Bernie handles it."

And then there are the sons. Mark and Andrew.

- Mark committed suicide on the second anniversary of his father’s arrest.

- Andrew died of cancer a few years later, blaming the stress of the scandal for his relapse.

Andrew told Jim, "He killed Mark quickly, he’s killing me slowly." That’s a heavy line. It shows that Madoff wasn't just a financial predator; he was a familial one. He used his sons’ names to lend legitimacy to his firm while keeping them completely in the dark about the 17th floor.

How He Kept the Lie Alive

You’d think a Ponzi scheme would be hard to maintain for forty years. It is. Usually, they collapse in three or four. Madoff had a "Big Four"—a group of massive investors like Jeffry Picower who kept the engine running.

When Bernie had a cash crisis, these guys would "invest" more. Picower alone took out over $7 billion in "profits." Madoff actually grew to hate these guys. He felt they were extorting him. In his mind, he was the victim of his own biggest clients. Classic narcissism.

The "Anti-Con" Conman

Jim calls Bernie the "anti-con conman." Most scammers try to sell you something. Bernie did the opposite. He’d tell people, "I don't want your money," or "I'm closed to new investors."

That’s the ultimate psychological play.

By making it hard to get in, he made people desperate to hand him their life savings. It was an "affinity" scam. He targeted the Jewish community, charities, and country clubs. He used trust as a weapon.

✨ Don't miss: What is MrBeast's Net Worth: Why He Claims to Have Negative Money

Actionable Lessons from the Madoff Saga

If you’re reading this because you want to protect your own money, there are real takeaways from Jim Campbell Madoff Talks that go beyond just "don't trust guys named Bernie."

- Check the Custodian. Madoff acted as his own custodian. That means he managed the money and reported on how it was doing. Never, ever invest in a fund where the "reporting" and the "holding" of the money happen under the same roof. You want a third-party bank (like State Street or BNY Mellon) to verify that the assets actually exist.

- Audit the Auditor. Madoff’s auditor was a tiny shop in a strip mall with one active accountant. A multi-billion dollar fund being audited by a guy in a suburban office is a red flag big enough to cover a stadium.

- Understand the "How." If an investment strategy is so complex that the manager says "you wouldn't understand it," walk away. Madoff claimed to use a "split-strike conversion" strategy. It sounds fancy. In reality, the math didn't work.

- Watch the Returns. Madoff didn't promise 50% returns. He promised 10-12% every single year, regardless of the market. That’s actually more suspicious. Real markets go up and down. A straight line is always a lie.

The Final Word on Bernie

Jim Campbell’s work is the definitive account because it doesn't try to make Bernie a cartoon villain. It shows him as a flawed, narcissistic, and deeply mediocre man who found a hole in the system and lived in it until it collapsed.

Madoff's final "investment" was his attempt to use Jim to fix his legacy. He thought Jim would write a book that cleared his name or showed he wasn't a "monster."

He was wrong.

The book ended up being a roadmap of his crimes and the systemic failures that allowed them. Bernie's letters, in the end, became the evidence that sealed his place in history as exactly what he was: a man who traded his family and his soul for a lie that lasted forty years.

If you want to understand the actual mechanics of how the biggest fraud in history happened, you have to look at the intersection of ego and institutional incompetence. Jim Campbell didn't just write a book about a crime; he wrote a book about how easy it is to be fooled when you want to believe.

Next Steps for Investors:

Verify your current investment holdings by checking who the independent custodian is. Ensure your financial advisor uses a third-party auditor that is registered with the PCAOB. Review your latest statements for "consistent" returns that don't match market volatility—this is often the first sign of trouble.