It is January 15, 2026. If you’ve been watching the Indian energy sector, you know it's a wild ride. Specifically, Jaiprakash Power Ventures, or JP Power as everyone calls it, is currently one of those stocks that creates a lot of noise but very little clarity. People are constantly checking the JP Power Ventures share price to see if it's finally going to moon or if it's just another "value trap."

Right now, the stock is hovering around ₹16.48 to ₹16.65.

It’s been a rough start to the year. In the last month alone, the price has dipped nearly 9%. If you’re holding, you’re probably feeling that slight pinch in your chest. But if you're looking to enter, you might be thinking this is the "dip" everyone talks about.

The Real Story Behind the Numbers

Honestly, looking at a stock price in isolation is like trying to guess the plot of a movie by looking at the poster. You need the context. JP Power is sitting on a market cap of roughly ₹11,300 crore.

✨ Don't miss: Vanguard US Growth Fund Admiral Shares: What Most People Get Wrong

Is it undervalued? Some metrics say yes. Its Price-to-Book (P/B) ratio is currently around 0.91 to 0.93. Basically, the market is valuing the company at less than what its assets are worth on paper. In a world where some green energy stocks are trading at 50x earnings, JP Power's Price-to-Earnings (P/E) ratio of 15.2 looks almost prehistoric.

But here is the catch.

The stock is currently trading below all its major moving averages. Whether it’s the 50-day or the 200-day, the momentum is undeniably bearish. Just a couple of weeks ago, MarketsMOJO even downgraded it to a "Sell."

Why? Because the financials are, well, flat.

In the September quarter of FY26, the company reported a net profit of ₹182.10 crore. That sounds like a lot of money, right? But it’s almost identical to what they made in the same quarter the previous year. When growth stalls, investors get bored. And when investors get bored, they sell.

Debt, Adani, and the "Jaypee" Baggage

You can't talk about the JP Power Ventures share price without mentioning the debt.

Historically, the Jaypee Group was buried under a mountain of loans. They’ve done a decent job of digging themselves out, though. The total debt has come down from over ₹5,200 crore in 2021 to around ₹3,700 crore today. That’s a massive improvement.

Still, there’s the "Adani factor."

In late 2025, news broke that Adani Enterprises received a Letter of Intent to acquire Jaiprakash Associates (JAL). This sent JP Power shares into a 30% rally in just two days. Why? Because the market loves a rescue story. When a giant like Adani enters the room, people assume the "bad days" are over.

But you've got to be careful. Manoj Gaur, the Non-Executive Chairman, had some legal trouble recently involving the ED and PMLA. While the company says it’s unrelated to JP Power specifically, the market hates uncertainty.

Is JP Power a Good Buy in 2026?

It depends on what kind of gambler you are.

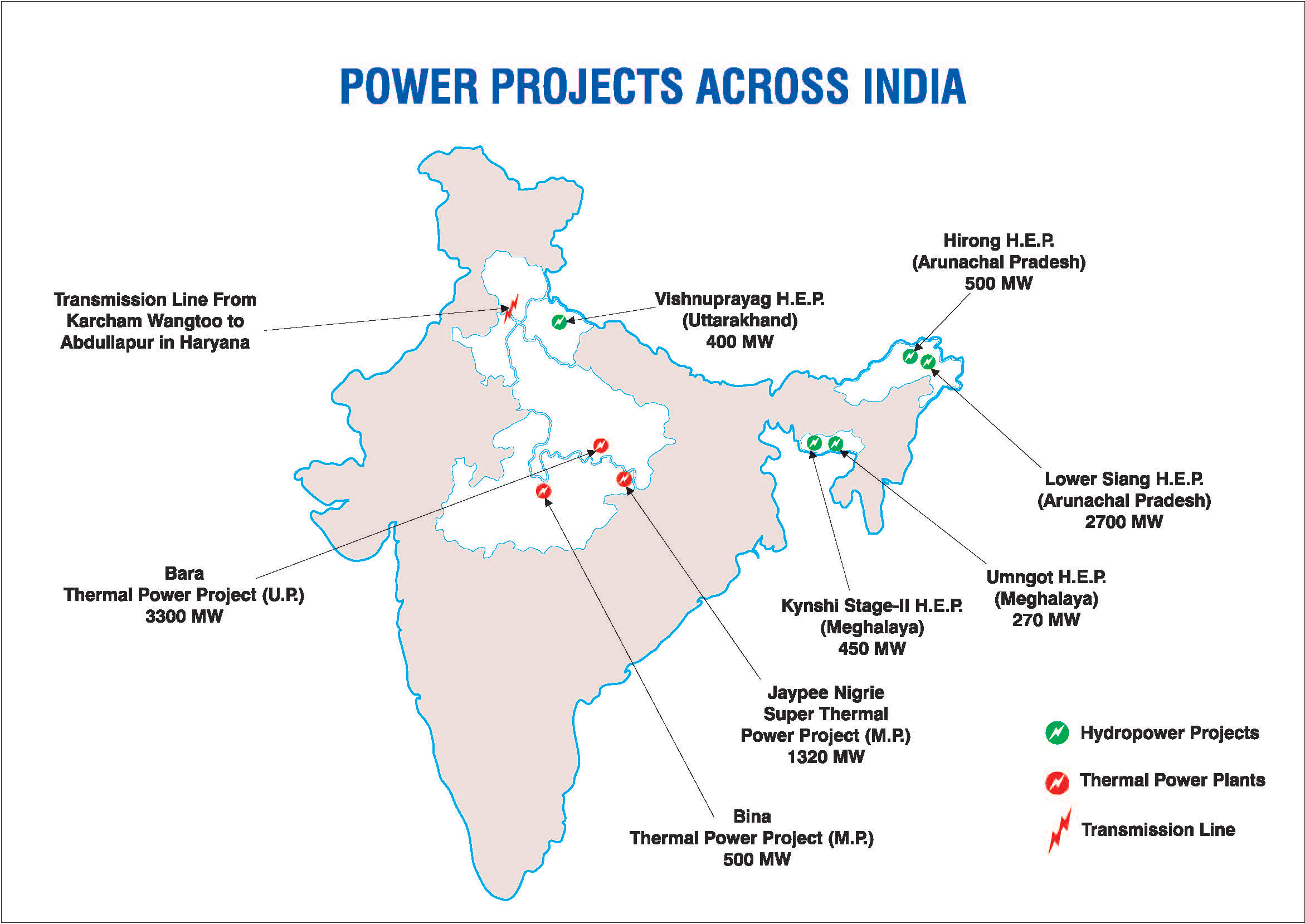

If you are a value investor, you see a company with massive hydroelectric and thermal assets trading at a discount. You see a debt-to-equity ratio that has fallen to 0.31, which is actually quite healthy for a power company.

On the other hand, if you’re a swing trader, the technicals look like a sinking ship. The delivery volumes have increased recently, which often suggests that big players are offloading their bags onto retail investors while the price is sliding.

Key Metrics to Watch (The Raw Data)

- 52-Week High: ₹27.70

- 52-Week Low: ₹12.35

- Current Price: ~₹16.50

- Promoter Pledging: A massive 79%. This is a huge red flag. When promoters pledge that much of their stake, it means they are using their shares as collateral for loans. If the price drops too far, lenders can sell those shares, causing a massive crash.

What You Should Actually Do

The JP Power Ventures share price is currently in a "wait and see" zone. It isn't quite at the bottom, and it certainly isn't in a breakout phase.

If you already own it, selling now might feel like losing a bet right before the final card is turned. But if you're thinking of "averaging down," be very cautious. The high promoter pledge and the flat profit growth are heavy anchors.

✨ Don't miss: Take Home Pay Calculator Washington State: Why Your Paycheck Probably Looks Smaller Than You Expected

Actionable Next Steps

- Monitor the ₹15.50 Support: If the stock breaks below ₹15.50, it could quickly slide toward the ₹12.50 range. Don't be a hero and try to catch a falling knife.

- Check the Q3 Results: The trading window closed on January 1, 2026, for the December quarter results. Wait for those numbers to come out. If there is a surprise jump in revenue (above ₹1,600 crore), the trend might reverse.

- Evaluate Peer Performance: Look at NTPC or NHPC. If the whole sector is down, it’s a macro issue. If only JP Power is down, it’s a company issue. Currently, JP Power is underperforming the broader Sensex, which is never a great sign.

- Watch the Adani-JAL Deal: Any further progress on the Adani acquisition of the parent group will likely cause speculative spikes. Use those spikes to exit if you're feeling overexposed.

Investing in penny-adjacent stocks like this requires a stomach for volatility. Don't put your rent money into JP Power. It's a speculative play on India's energy demand and the corporate restructuring of the Jaypee Group.